He is the key step to open systematization and short line high frequency trading.

Author: The Little Dream, Created: 2017-01-23 09:49:41, Updated: 2017-01-23 09:56:01He is the key step to open systematization and short line high frequency trading.

Trading is self-awareness, investing is life changing.

Mende Staal: Director of Investment at Shanghai Jinjiang Investment Management Ltd. He has been involved in quantitative trading for a long time. He started focusing on the futures market in 2008 and developed a variety of trading strategies, eventually forming a multi-strategy, multi-variety, multi-cycle programmatic combination strategy system, pursuing stable returns with low retracement, long-term annual returns with a maximum withdrawal ratio of 4:1. After 2010, annual stable profits at the ten-million level.

-

This is the first time I have seen this video.

Today I'm going to share a simple piece of information with you in three parts: the first part is to share some of my understanding of programming; the second part is to give you a brief introduction to high-frequency trading; and the third part is to give you some tips by introducing some of our company's asset types and investment combinations. We see the first part, programmatic trading. I don't know how much you know about programmatic trading, so I'll start with the simplest part. First, I'll ask a question, why most people trade at a loss? Because statistics say that almost 90% of people in the futures market are at a loss, 80% of people have a life cycle of more than three months, 70% have a life cycle of more than half a year, 60% have a life cycle of more than a year. There are very few outcomes that actually make money in the market. Why do you lose? We do a very simple intraday trading system, and we perfected the trading system mentioned above, the previous aspects I mentioned are to determine the direction, cut-in points, stop-loss, stop-loss, money management, now do the simplest one, what is the direction?

(Financial curve 1)

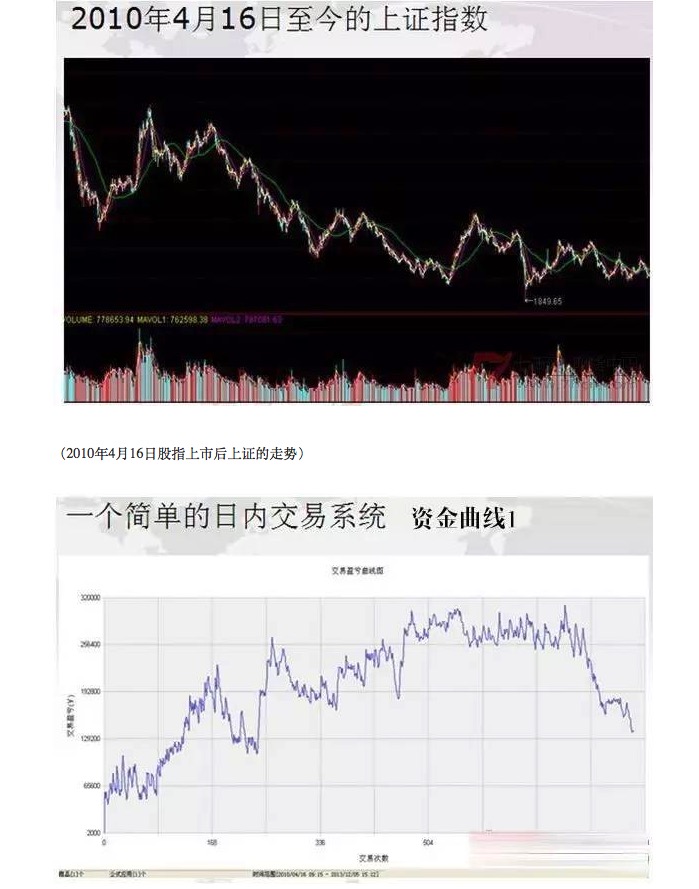

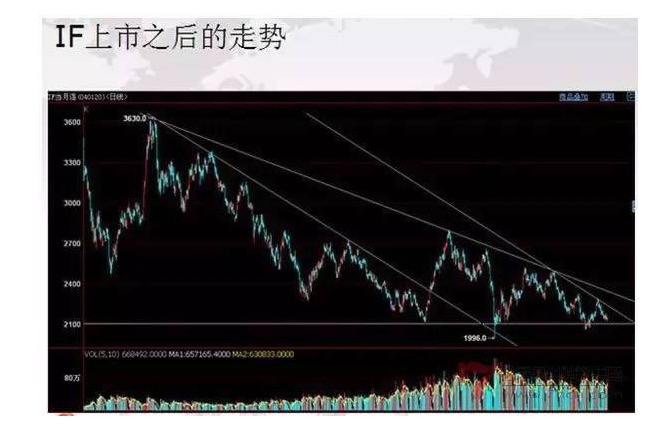

We can see that with such a simple trading system, we can see that the index is very good when the stock was just listed in 2009 and 2010 and we can see that with such a simple trading system, we can see that the stock is from April 16th of the year when it started to be listed until the most recent year at the end of 2013, the capital curve 1. This is the trend after the stock was listed on April 16th, which is a downward trend, this is just what we have a simple day trading system, it only started to recover rapidly in the second half of 2013. But I want to ask a question, how much of the profit on the stock is still positive now, I believe most people are negative.

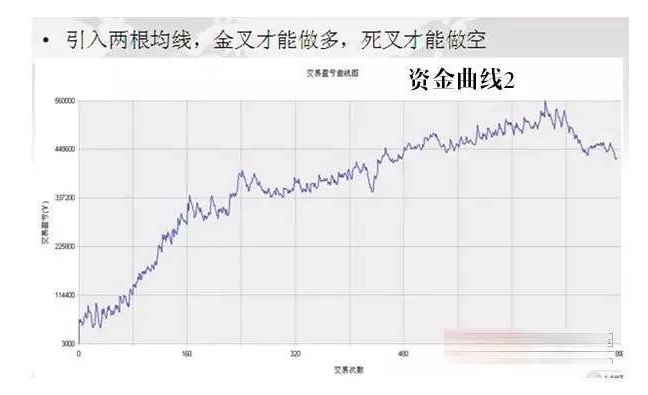

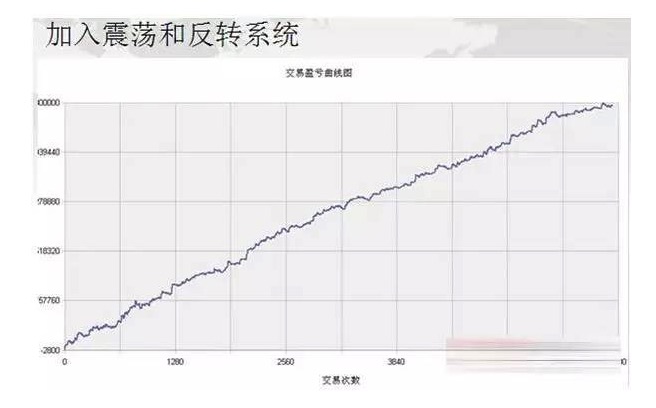

(Funding curve 2) We've made an improvement to the day trading system now, it's too simple, there's no way to adapt to this increasingly complex market situation, that's why we just couldn't stick to it, the long-term profit concept is not to lose too much when you lose, because if we do it with such a simple trading strategy, although it's ultimately profitable, but few people can stick to it, why? Because the mid-retracement is too big, the moment we don't wait for the dawn, we die in the dark.

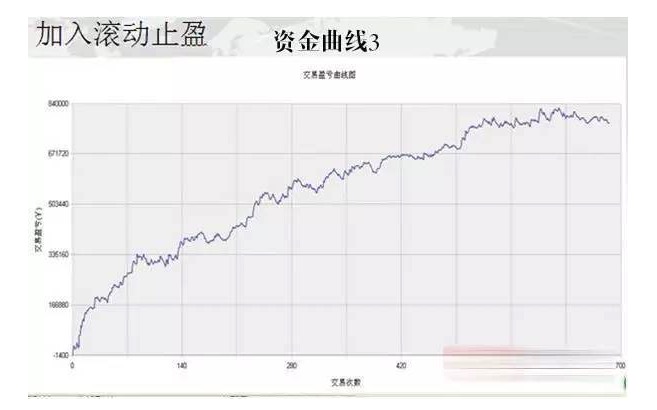

(Financial curve 3) We don't need to say that we need to get a close, many markets are up 80 points in the morning and turn into a loss of 20 points in the afternoon. Then you may not get 80 points, and the result is a stop of 20 points. This is not reasonable, then we join the rolling stop, it is very simple, that is, we win more than 50 points, as soon as we withdraw 40% or 30% I stop.

(Financial data result chart)

Then it's a strategy comparison, the first one is our simplest one, the rate of profit, the number of hands, what is the maximum asset withdrawal? 200,000. The second, adding two even line optimizations, the maximum drawback became 160,000, but it was still large, the hit rate was slightly increased, and the number of dealers decreased because of partial filtering. Third, the rollback after the addition of the rollback stops is very small, 60,000, at least this is what I was able to stick with. Its curve smoothness starts to improve, its risk-reward ratio gradually changes from less than 1 to 3, and the maximum rollback value also changes. This is the continuous evolution of the individual strategies in your programming.

(Funding curve 4)

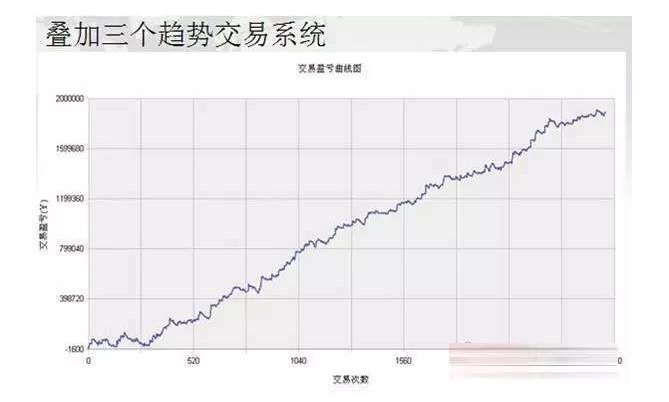

We do a simple trend system, and then we do another trend tracking system that starts at a different starting point, and maybe that's on the 3-minute line, and we now overlay the 15-minute line and the hourly line, or give us another trend strategy thinking, and put different trend strategies together on the capital curve, and the curve will get better. Why is that? Because different strategies are all trends, but they start at different starting points, and some strategies are as long as the trend is just starting, it goes in, it goes in more, the strategy confirms that it needs to go in, and then we run three strategies at the same time, and if it's a small wave, it just triggers those trend-sensitive trading strategies, and when the market-sensitive trading strategy doesn't trigger the first wave, this is not the way to solve the specific trend, and you're talking about a strategy where you're just going to slide into the second one, and then you're going to have to make a big jump, so I'm not afraid to do that. We then add a completely different logic, a system of shocks and reversals, and its curve is very good for the capital curve 5. What's the biggest difference? It's the whole 2013 cross-curve stage, it starts to rise, of course it's not as up slope as it was earlier, right? It plays a smooth role.

(Financial curve 5)

Let's see how it works, it has a reversal strategy, it has a shock strategy, it has a trend strategy with different cycles, it has a capital curve made on the same stock finger, and we can see that it has a profit ratio of 46%, it has a maximum drawdown of more than 138,000, but notice, although it is more than 60,000, but everyone needs to understand how many hands it is? 1, 2, 3, 4, 5, 6, 7, 7 strategies, that is, the maximum position it will reach 7 hands.

(Financial data graph)

The largest one-day profit and loss can reach 120,130,000, with a capital of one million, the largest one-day loss is only 34,000. This is a reasonable ratio. We often say trend trading, wave trading should be 3: 1, this is a reasonable ratio. You can see most of the losses, the loss in a day is controlled within 15,000. That is, the maximum withdrawal of most of the day is within 1.5%, which is completely acceptable, and the maximum profit of the day can be 10%. The German philosopher Schopenhauer once said that a person is inevitably going to make the same mistakes in the same time conditions, which is the inferiority of humans. Simply put, there are two things: first, it is very powerful in execution, and second, it is very fast in trading. Let's say first, subjective trading means that we are trading with the market, but also that we are constantly struggling with our own psychological tendencies. The German philosopher Schopenhauer once said that a person is inevitable to make the same mistakes in the same time conditions, which is the inferiority of humans. You make this mistake again and again, and again.

There's a graph here that I'm just going to say, this is a graph of the overall trend after the stock goes public. You can see that the volatility is not constantly converging, and that's why the simple trend trading system makes money when the volatility is high, makes money when the trend is clear, and loses constantly when the volatility is high, because the reverse is the case, because the reverse is the case, so the simple approach is no longer adaptable to the market. So you don't just have to superimpose different forms of trend trading systems, which fluctuate in different cycles, but also to introduce volatility and inversion strategies. Programmatization is not as simple as I just said it should be. In fact, it has a lot of work to do, why? Because there are more and more programmatic bottlenecks. In several respects, the first is that there are too few trends, so the market structure is more and more complex, the composition of investors is more and more complex, the institutional investors are more and more, and the trend will become less and less broken. We will use a number of methods, through the symmetry of time, trends and some features of the evolution of the oscillation of the nodes to judge whether the current volatility is to evolve from one volatility to another. But one thing is clear, once a volatility is formed, it is consistent, and after the formation of one volatility it will continue for several days until something special breaks this volatility, it will move into another.

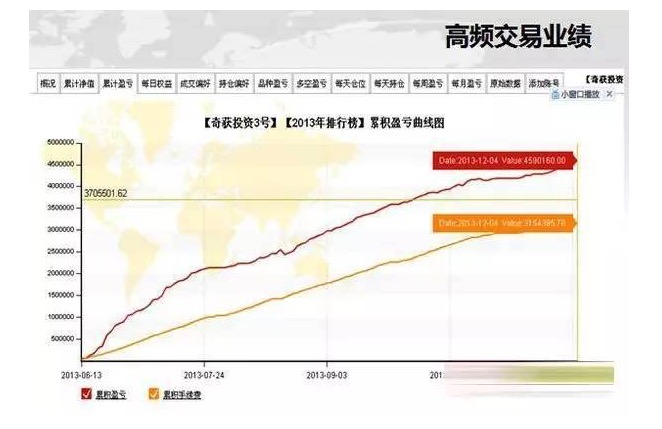

The strengthening and unification of many varieties, have you noticed a characteristic that when the market pulls all the major contracts of all varieties into one interface, at a glance there is red and green, then today's market is hard to form one-sided, that is, the falling varieties probably won't fall anywhere, and the rising varieties probably won't go anywhere. Because different varieties are its weakness is divided, at this time it doesn't form a cohesive force, and the market sentiment will not try to play out to the extreme, then at this time you don't have too high expectations for the volatility rate. If we feel that the change in the characteristics of the volatility may be relatively small, then we will only make parametric adjustments, and the parametric adjustments will cause the strategy to be sensitive to change or to become volatile. If the change in the volatility is a dramatic evolution, we will adjust the matching ratio of different strategies, appropriately increase the ratio of reversal and volatility strategies, reduce the ratio of some strategies, and at the same time we will do a study of those characteristics, which varieties are not really suitable for this phase. In short, programming, although it has many advantages over subjective human trading, its disadvantages are also obvious, although it can execute very well without emotion, but it is poorly adaptable, it is poorly resilient, it cannot keep up with changes when the market changes, human can, so to do human-computer combination. Now let's get to know about high-frequency trading. The high-frequency traders in our team have been in the group since 2009 and I brought them with me, so I'm very aware of the fact that I also did a lot of high-frequency trading myself in the beginning, and I'm very aware of the current state of domestic high-frequency trading. High-frequency trading is very profitable, and in 2010 we were able to do a record of probably not losing more than 10 days a year. There are probably three categories of high frequency, one is the artificial high frequency, which is what we are focusing on right now, and I'm going to talk about it today; another is the high frequency, which is the statistical high frequency, which is some of the trading profits; and another is the foreign predatory algorithm, the liquidity algorithm, which is this high frequency trading done by machines, but you can't do it at home now, why? Because we have a frequency of 500 milliseconds, and the foreign frequency is measured in a few seconds, we're not on a quantitative level, so we're now doing the law of high frequency or short-term volatility, which is the high frequency or short-term volatility law, which is the human frequency or short-term volatility law, which is the high frequency or short-term volatility law, which is the quality requirement for traders. I'll show you the transaction records of our traders and share our transaction records with you so you can understand what a high frequency is.

We have to do post-trade analysis every day. Every day to statistically record our transactions, we can see from the transaction records that this holding time is 6, 5, 4, 8 seconds, profit and loss three prices, two prices, three prices, more times 1.6. Stop loss up to 5 price levels; generally cut within 3 price levels If you get 50 points, that's your prize. I don't recommend, for example, fast 7 now has 5 prices, or how many automatic stop losses, I don't recommend. The problem will be a lot. It slips very badly, we made 300, if we stop 100, automatic stop losses 50 of them, each one slips one price, I lose 3000. Artificial high-frequency trading has many requirements if you want to be successful, good trading habits, discipline is very strong, it is a prerequisite for stable profitability. Forming a thoroughly detailed trading system and a very hard technical base, everyone looks at the thorough details, it must be a thoroughly detailed trading system, why do you need to be thorough? Because thorough execution is necessary to execute, if there is no standard execution, there will be problems, the most important thing in high-frequency trading is execution, a skilled basis of keen reflection, you can only be able to do it with a skilled natural reflection, we often stop losses, are consciously stopped losses, not I see losses. The most important thing is the listing, the importance of the listing from the beginning to the end is the first, even in 2009-2010, we only look at the listing to do. At that time I do not remember looking at the K line chart, it was easy to draw four rows of numbers: sell, buy, sell, buy, look at these four numbers and you can do a day's time, I do not look at it, just look at the numbers, draw a picture in my mind.

Why is it important to look at a lot of things, why is it important to say research? Because this market is largely time-saving, time-saving, one thing moves and then something else moves, and when no one else reflects, we can reflect, and we can seize the opportunity of time-saving, analysis of key points, form and time point combinations, quantitative analysis, overlapping of technical indicators, our trading system must have a process from simple and complicated to complicated; we start to add things slowly, and finally these things rise and disappear, and eventually everything will be mastered to a certain degree, becoming an automatic reflection in your brain. In fact, for the novice trader, we require that he must build up a good trading discipline and trading habits, a lot of practice, and gradually form his own trading system. For the intermediate trader, we generally try to find ways to build his confidence in the market, because he has gone through it, knows the dangers of the market, and often has a fear of the market, but not too much, so we want to help him build confidence. But for the truly mature trader, we just need to do emotional management. This is the core, that is, skills. I had a fight with a trainee, I said today you have to overvalue, you have to get your whole body naked, but he still didn't hold on to one more, and in the afternoon he took off his clothes, and he took off to show that this person had a game, he didn't take off because he was running away from himself. Not afraid to face himself. How do you face the market? In general, we will do a lot of practice on the basis of persistence, the goal is to practice frequently, the low goal is to zero everything you originally had, why do you like a blank paper when recruiting a trader? It is because he does not know anything, everything is done according to my discipline, my rules, he is easy to form good trading habits, and habits then determine the height of your trade. Stop loss, to train this pushback to practice stop loss, train the trend thinking, form good trading habits. This is the first stage, the second stage you have to expand, train your self-control, increase the hit rate, increase the profit ratio, reduce losses. The first stage is certainly a daily loss, the simulation board can basically lose 20,000 to 30,000 per day, by the second stage I may make a loss, but my daily loss will not exceed 3,000, which has been from the downward trend. What do you mean? First of all, you have to pick it up, you have to pick it up, don't go to the next head, don't go to intercept the rocket, when to pick, this is a phrase I saw from Larry Williams' short-line trading technique, don't go to the next head, when to pick it up, until it falls to the ground and fires twice without moving, pick it up again, that is, when it is convenient to do it. The word convenience is important, but the word convenience, can be reversed on the plate, we basically make turns and stops on the plate on a regular cycle. Stop, stop loss without discussion, the concept of stop loss is not only a stop loss, but a continuous phased stop, a day's stop, a month's stop loss, a week's stop loss, that is, a single stop loss is a single stop loss, there is no room for any discussion, if you miss a few consecutive money, you also understand to stop, this is also a stop loss, you lost this morning, one hand lost 2000 bucks, you do not lose that is not a stop loss, you think you will lose tomorrow again that is also a loss, stop this concept is forever and ever. Less, now you have to start doing the penny market, not like before, you have to filter the market, the wavelength of the market is very small, you do it, you do 10 pennies, maybe against 8 pennies, but sorry you lost 2 pennies, the whole may be losing money, why? Quick, the process must be quick, isn't there a word in Kung Fu? Kung Fu is not broken, the same logic, as long as you are fast enough, you won't get hurt in the market, how much money do you need to adjust yourself, but the premise is fast. Well, I'm talking about the precision of the cut-in point, some people say I'm doing the bandwidth, my profit target is 30 points, I definitely have to take 10 points of risk, right? At least 10 points of risk, no, we high-frequency traders do it late, he can take a one-point risk to make a profit of 30 to 50 points, because he does the cut-in point well enough. The prospects and transformations of high-frequency trading. The decline in transaction fees is a long-term trend, because the transaction fees are indeed too expensive domestically and abroad, and higher volume of transactions will bring more trading opportunities, more variety of options, and high-frequency trading is often more successful than other trading methods. I often use high-frequency trading as a stepping stone in the creation of transactions. You're in a good mood, you're doing well in the wave, you're doing well in the trend, you're doing well in the leverage, you're stronger than everyone else. The most important thing is that we have always thought that risk is the first, only stability is profitable. So we have configured from the beginning to be multi-trading, multi-strategy, multi-variety, multi-cycle, multi-market, profits can be overlaid risk can be hedged, since the beginning and end we are all a team to do this, stability is profitable. Because I do not need much every day, I only need 0.05%, the next year I have to make a profit, 365 times the 1.01 is 37 times.

Translated fromSearch for Finance

- Quantitative trading "reverse investment from the mean to the return"

- I've been reading a lot about equity, counter-equity, the profit formula, the gambler's loss theorem (very inspiring).

- The Deutsche Bank study notes several common mistakes in the quantification strategy

- Bitcoin contracts for okcoin: the dollar-renminbi exchange rate problem

- The more complex the method, the more it deviates from the essence of the transaction.

- Quantified trading strategies for the CCI indicator

- Commodity futures reassessment price changes are not continuous

- About data storage

- Summary of fees related to digital currency exchanges ((updated on 02/13/2017))

- English comparison of common quantitative terms, trading terms, and terms

- Ask for help: How to get the opening and closing prices of a k-line

- Synthesis of 4-hour K-string function ((First throw the cube, later give the code for synthesis of arbitrary cycle)

- Bitcoin trading platforms cancel funding of the coin

- The 10 most puzzling economics myths

- What are the basic functions a qualified trader should have? (comprehensive, complete)

- How does the Bitcoin protocol work?

- How the Bitcoin protocol works

- 3.5 Strategy framework templates

- Quantified trading strategies for the KDJ indicator

- Bayesian classifier based on KNN algorithm

Drunk picked up a lamp and looked at a swordI'm not sure what you mean by that.