Why are many commodity futures contracts primarily traded in January, May and September each year?

Author: The Little Dream, Created: 2017-02-09 14:15:54, Updated:Why are many commodity futures contracts primarily traded in January, May and September each year?

For example, polyethylene etc. ‒ is it for historical reasons? ‒ was once thought to be due to the demand cycle of the spot commodity, for example polyethylene for agricultural films, has a certain seasonality, but later it was discovered that many completely different futures are also the main focus of September 15 ‒ please tell us the good guys, specific reasons, historical facts.

-

The answer comes from a Bibliophilist who knows:

I'll try to answer, using my more familiar natural rubber futures as an example, and talk about my personal opinion, welcome applause.

In conclusion, there are several factors that people consider to be important: supply and demand relationships, exchange rules, trading habits.

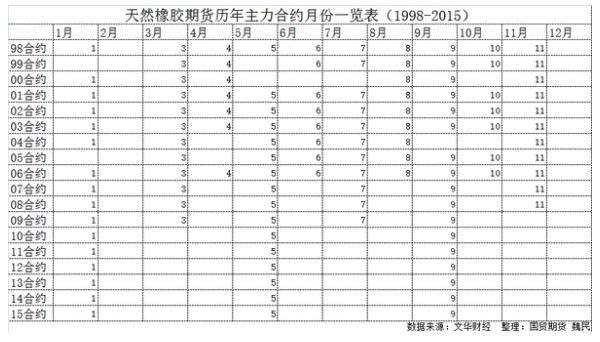

Posting a chart of the distribution of the main contracts over the past year, sorted out overnight ~ (It's like the trend map of the big lottery with wood = _ = crop)

Start reading the diagram below

It is obvious that February, December have never been the main contract, why?

It's February, because it's Spring Festival! Whether it's the farmers, the processing plants (supply) or the traders, the tire factories (demand) or the traders (trade habits), they all have to go home after the holidays! A picture is worth a thousand words...

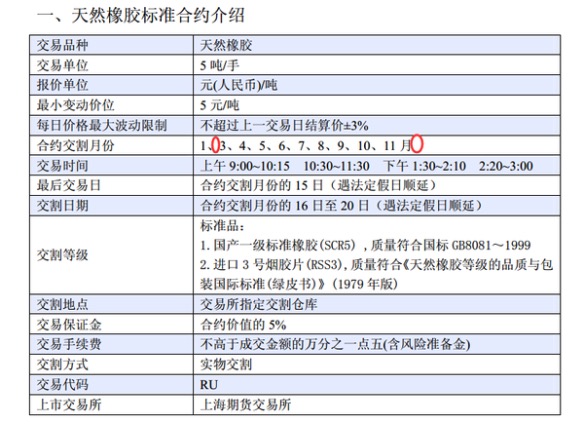

In addition, there is no main contract in February, and another factor is that there are no contracts in February, December, what kind of deals... I'm going to post it again.

The exchange also has a rule that the December contract cannot be the main contract: Article 69 of the Shanghai Futures Exchange Delivery Rules states explicitly that:

(i) Domestic natural rubber (SCR WF) shall be delivered to the warehouse in the last delivery month of the second year of the production year and shall exceed the deadline for the conversion of the goods into cash. Domestic natural rubber (SCR WF) produced in that year shall not be used for physical delivery until the end of the storage period in June of the following year (excluding June) at the latest and shall not exceed the deadline for delivery.

2, from the monthly overview of the main contract of the calendar year of natural rubber futures (1998-2015) the table can be seen that the monthly balance of the main contract was basically balanced between 1998-2003, while the number of main contracts continued to thin between 2004-2015 until only 1, 5, and September are left today.

The reason for the above is that the main factor, according to the individual, is market speculation, which forms the so-called trading habits.

Prior to 2003, the domestic futures market was in a state of stagnation due to the 1995 S&P 327 stock market crash and a series of subsequent corrections, which led to the collapse of the domestic futures market (the futures exchanges were reduced from 50 to 3), and the first generation of futures traders during this period were worried about which day the country would take over the futures market. It was not until 2003 and 2004 that a series of national regulations and guidelines were introduced, which relaxed the first generation of futures traders, and investment funds opened their wings to play a big game.

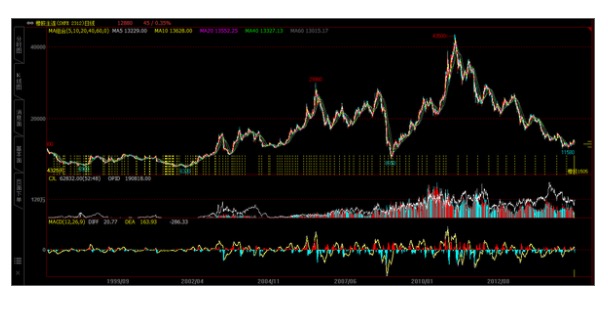

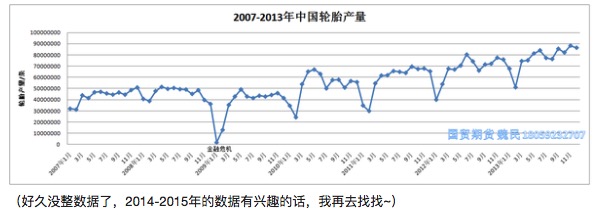

After 2004, as the speculative atmosphere grew more volatile, the market was dominated by speculative capital (expressed as an amplification of the volume of transactions, as shown below) rather than by industrial capital, creating only 1, 5, and 9 main contracts.

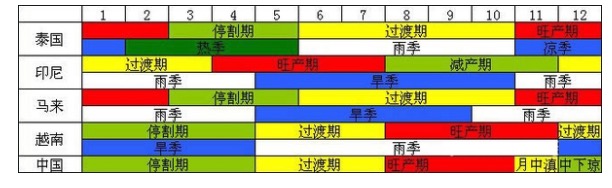

In fact, similar to 1998-2003, the distribution is more favorable to service companies, and Tokyo's rubber has been maintaining a basic monthly dominant position. After all, the futures market is focused on the service real economy, and rubber processing plants can not only process 1, 5, 9 (as shown below), but also the supply of rubber.

It is also unlikely that tire factories will only produce tires on the 1st, 5th, or 9th of September (see below) and the wrong period of insurance will definitely affect the normal operation of the company.

In summary, individuals believe that the main reason for the main contract structure on the 1st, 5th, and 9th is due to the habit of trading speculative capital, the supply of the industrial supply of aluminum, iron ore, soybean oil is not only 18,000 km, its main structure is still 1, 5, and September. If February is not the Spring Festival, October is not the National Day, the structure of speculative capital is not possible to make 2, 6, and 10.

I guess that's the way it is, the answer to the question of how to sleep at night is also very complicated... Go to sleep first

Additional updates: The contract for the agricultural products has always been for one month, 159 and there may be a reason why. Commodity exchange variety development positions, analyze from the perspective of the exchange. The domestic commodity futures are derived from agricultural futures, agricultural products are naturally active in the 159th quarter due to their seasonality of sowing. After being familiar with the rhythm of this main contract, it is natural for market mainstream funds to bring the seasonality of agricultural products into the later industrial and energy varieties, so most non-spin varieties are also active in the 159th contract.

-

Known to Users

It should be more influenced by the effect of collateral and holding volume, stock index futures are only the difference between the current and next month's contracts obviously, while for commodity futures there are more cumbersome regulations. For example, the current month, next month, the next month's fees and the provisions of the holding volume are different, you can clear up the reasons, in short, this causes the current month and the next month's contracts are generally not traded, for six contracts a year is the same month and the next month, such as January 15, the general trade 1505 contract, which is the order of the procedure fee and the holding decides.

-

I know the user Oliver.

The main metal is not necessarily the main one in March, the main contract is determined by the stock and the volume of transactions, and sometimes the contract goes to February and April.

-

Known user Nobody

I don't know if the metal is the main force of the moon, but I don't see the 159 law.

- New timing and strategy in options trading

- High-frequency strategy: exchange of applications for cabbage harvesters

- Leaving school for a low level of hard work is a trap

- Talk about network trading law

- It's incredible how easy it is to make a profit on futures.

- 2.10.2 Variable values in the API documentation

- Your biggest enemy is inertial thinking.

- Foolish trading: the power of rules

- 2.7.1 Windows 32-bit system Python 2.7 environment Install the talib index library

- Details of futures options

- China's four largest futures exchanges exposed

- 1.4 Futures Basics of knowledge

- Not support market order error

- Inventors describe the mechanism of quantitative analogue level retesting

- The K-Line is not compatible with mainstream channels.

- Quantitative trading "reverse investment from the mean to the return"

- I've been reading a lot about equity, counter-equity, the profit formula, the gambler's loss theorem (very inspiring).

- The Deutsche Bank study notes several common mistakes in the quantification strategy

- Bitcoin contracts for okcoin: the dollar-renminbi exchange rate problem

- The more complex the method, the more it deviates from the essence of the transaction.