New timing and strategy in options trading

Author: The Little Dream, Created: 2017-02-16 13:33:43, Updated: 2017-02-16 13:34:58New timing and strategy in options trading

Time is the enemy of option buyers

-

One, time is money.

Everyone has heard this saying and has their own interpretation of it in their minds, so let's explain why time is money in the field of options trading.

Options traders trade options in order to make money, and how much money they make is measured in terms of time. A return of 1% in one year is very different from a return of 1% in January. So, in the process of trading options, traders will naturally consider the question of time efficiency, if they do not pursue an annual return of more than 5%, then they do not need to trade options, as long as they can deposit money in the balance.

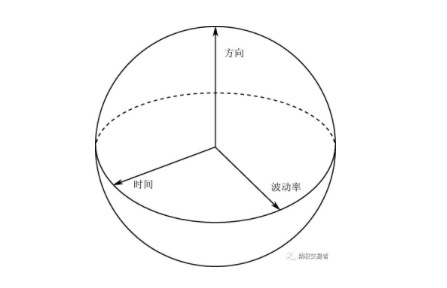

There are six main factors that influence the price of an option, namely the market price of the underlying asset, the contract price of the option, the expiry date of the option, the volatility rate of the underlying asset, the risk-free interest rate and the yield on the underlying asset, which affect the price of the option by affecting the implied value and the time value of the option. These six factors can be divided into three dimensions of direction, time and volatility.

An option is not exercisable and expires invalid. For the American option, it can be executed at any time during the term, and the longer the term, the greater the opportunity for multiple profits, and the longer-term option contains all the execution opportunities of the shorter-term option. Therefore, the longer the term, the higher the option price.

In the case of a European option, it can only be executed at the end of the term, and the long-term option does not necessarily include all the execution opportunities of the short-term option, which makes the relationship between the term of the European option and the price of the option seem more complex. However, in general (i.e. the special case where the asset that is excluded from the index pays a large profit), the longer the term, the greater the risk of the indexed asset and the greater the risk of short-term loss.

In addition, we should note that the time value of the option increases decreases over time, which is the law of decreasing marginal time value of the option.

Since time is money, how do we make money from this dimension of time in options trading? It's simple, to profit from the flow of time value, we can choose to sell a bullish/bullish option naked, or to sell a cross option more aggressively.

In addition to the above-mentioned radical strategies, there are other strategies that can be employed. The so-called time difference strategy is an investment strategy that combines options of the same denomination, the same execution price and the same type of option, but with different expiration dates, in order to profit from the loss of time value.

-

(1) Reduce or eliminate the collateral holdings. If we are to sell a naked option closer to the expiration month, we will need a lot of collateral. If we buy another option later in the expiration month (other conditions are the same), we can offset the holdings of some of the recent month's options.

-

(2) Limiting risk. All bare put options face potentially unlimited risk, and you will lose a lot if the price goes against your expectations. If you buy another option later in the expiration month, this option will put a cap on the above risk.

-

(3) Profiting from volatility. When you have a time difference strategy, you can always flatten the option blank position, leaving only directional options to profit from directional fluctuations in the underlying asset.

-

-

Second, time is the enemy of the option buyer.

If you are an option buyer, the passage of time will undoubtedly be your enemy.

Time is a very important variable among the many factors that influence the price of options, as time implies the possibility of volatility in the price of the underlying asset.

If I personally buy a bullish option on a 50 ETF, then after buying the option, I will always hope for some big good news, hoping that the Chinese government will launch an economic stimulus program to promote the rise of the 50 ETF. In fact, the government may not have introduced the policy as I expected, and even worse, it may not have introduced the policy until after the option I bought expires.

The price of the option (the principal) consists of the implicit value and the time value. The implicit value refers to the total profit that can be obtained immediately after the option is purchased, the option price removes the implicit value, the remaining part is the time value.

The time value reflects the possibility for the option buyer that the option's intrinsic value will increase in the future. In fact, as the price of the underlying commodity changes over time, it can cause the option to increase in value, so the buyer is willing to pay an option fee that is higher than the intrinsic value.

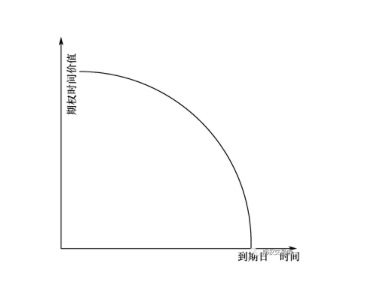

Generally, the longer the term of an option, the greater the time value. As the option approaches its expiration date, its time value gradually decreases, until the time value becomes zero by the time the option expires.

We can understand that time value describes the time risk hedge and the time appreciation potential hedge, as the option distance to the expiration date gets closer, the time appreciation risk hedge that the seller faces due to the price fluctuation of the underlying will become smaller and the time appreciation that the buyer expects to see becomes smaller. Thus, as the option approaches the expiration date, its time value will gradually decrease until it decreases to zero, as shown in the figure below.

From this we can see that the time value of the option will decrease as the expiry date approaches, and the decrease will be greater and greater, until the expiry date, the time value of the option will become zero.

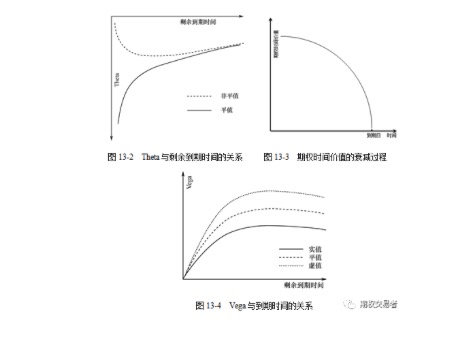

Theta is used to measure the effect of time changes on the theoretical value of an option. It indicates how much the option value will be lost per day over time. Theta = change in the option price ÷ change in the expiration time. The longer the expiration time, the higher the value of the option, regardless of other factors.

The investor faces a loss of time value after buying the option. Under the same conditions, the longer the expiration time, the higher the value of the option. As long as it does not expire, the option has time value, and the buyer has hope that there may be a favorable change. But for options contracts, the expiration time will only decrease by one day from the first day of trading on the market, so the option is a loss-making asset, the buyer has the right, but the right is not unlimited.

In the practice of options trading, how should the option buyer try to minimize the adverse effects of the time value flow? It is best to choose options with more than three months before the expiration date before buying, and not to buy options with less than a month before the expiration date. After buying, try not to hold the option until the last month.

-

3 Use the horizontal price difference strategy

Time-differential strategies not only benefit from short-term fluctuations in time value, but also retain the possibility of profiting from large price fluctuations in the underlying asset over the long term.

I mentioned in the previous post that the passage of time is the enemy of the option buyer, but the friend of the option seller. We can profit from the passage of time through time-differentiation strategies in addition to selling options separately.

A time differential, also called a horizontal price differential or a calendar price differential, is an investment strategy that combines options of the same denomination, the same execution price, and the same type of option, but with different expiration dates, in order to profit from the loss of time value. It is called a time differential because the value of the portfolio of positions increases over time. In particular, it should be noted that the time differential strategy is not only able to profit from the short-term passage of time value, but also retains the possibility of profits in the long term, depending on the large fluctuations in the price of the indicated asset.

In the following, we will illustrate the profit mechanism of the time difference strategy, talking about the mechanism of the time difference, it is necessary to mention the two Greek letters theta and vega. Theta indicates the change in the value of the option caused by the passage of unit time, in the absence of other factors. If we buy the option, theta is our enemy, the smaller the better. If we sell the option, theta is our friend, the larger the better.

The time difference strategy can also benefit from the increase in the implied volatility rate. Vega indicates the change in the value of the option caused by a change in the volatility rate of the underlying asset when other factors remain unchanged. Figure 13-4 shows the relationship between Vega and the expiration time. Generally speaking, the longer the expiration time, the larger the Vega, which shows that if the implied volatility rate increases, the value of the long-term option increases faster than the value of the near-term option increases.

The most common time difference pricing tactics are as follows:

-

The time difference in the price of a put option is the time difference in the price of a put option constructed with the same execution price.

-

A time difference in the price of a put option is a time difference in the price of a put option constructed with the same execution price.

-

The difference between the price of the calendar and the price of the long-term options is the difference between the price of the long-term options and the price of the short-term options.

-

A calendar-wide spread is used to buy the long-term bear and bear options, and sell the short-term bear and bear options.

The main advantages of the time difference strategy are: no collateral required or very little collateral occupied, limited risk, and the strategy can be conveniently converted into a multi-head option.

The disadvantage of the time difference strategy is that it reduces the likelihood of profit relative to the naked put option.

-

Translated by Options Traders

- Real and formal trading systems

- Three short stories about understanding real estate, stocks and money

- Six branches of Quant uncovered

- Dynamic time series based pattern recognition strategies

- Thinking about an analog exchange

- Eight well-known crypto hedge EA's review of strategy

- Reduce worthless trades and cherish familiar opportunities!

- The 10th currency war in history!

- Experience with futures trading

- What does support vector machine (SVM) mean?

- High-frequency strategy: exchange of applications for cabbage harvesters

- Leaving school for a low level of hard work is a trap

- Talk about network trading law

- It's incredible how easy it is to make a profit on futures.

- 2.10.2 Variable values in the API documentation

- Your biggest enemy is inertial thinking.

- Foolish trading: the power of rules

- 2.7.1 Windows 32-bit system Python 2.7 environment Install the talib index library

- Details of futures options

- Why are many commodity futures contracts primarily traded in January, May and September each year?