Money and credit in monetary banking

Author: The Little Dream, Created: 2017-03-04 14:09:28, Updated: 2017-03-04 14:36:00Money and credit in monetary banking

He dreams of one day becoming a top trader, and a qualified trader should also have some macro skills. Every weekend, he will join you in learning the macro trading 101 series, hoping to bring you some inspiration beyond specific strategies.

-

Macro traders

The term macro trader refers to a trader who searches for opportunities between assets such as bonds, foreign exchange, stocks, commodities, etc. based on a macro view of economic growth, inflation, monetary policy, and fiscal policy. They tend to bet on the over/undervaluation of one asset class relative to another asset class, rather than the decline of one asset class itself. It should be noted in particular that in general we do not think that macro traders need to do stock selection strategies, such as stock selection strategies in stock investments or issuer credit research in bond investments.

Contrary to popular belief, I believe that Macro Trader is not Macroeconomics, much less Macroeconomic Prediction. Macroeconomics covers many extremely broad and far-reaching fields, but for Trader, we are only concerned with who will take the money to buy my hands and how to predict each other's prices. So the first step at this point is to understand how money moves through the entire monetary system.

-

1. Commercial bank money lending system Flow Chart

The most basic concept of the monetary banking system is credit. In a market without a credit mechanism, such as the residential housing market, the number of houses can only be calculated by how many houses can be bought and sold. In a market with a credit mechanism, such as the monetary banking sector, the bank can promise a large sum of money to the bank's deposit customers even if there is now only a relatively small amount of cash. If liquidity is well managed, the amount of deposits can be ten hundred times or even a thousand times greater than the amount of cash we have.

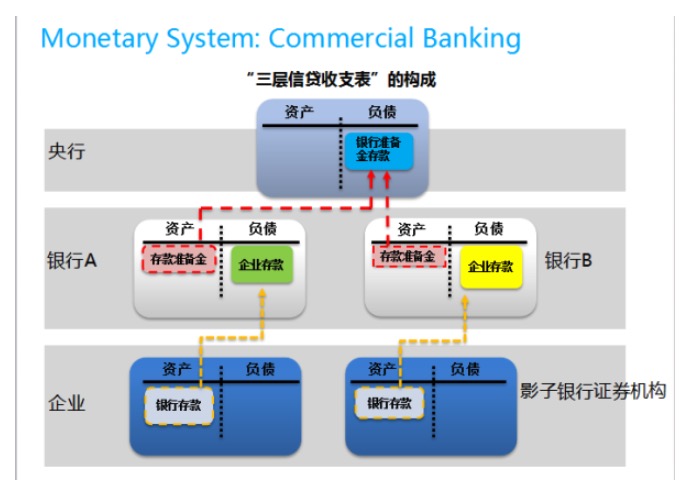

This chart is the Panda's favorite chart, written by Mr. Wang Zhuo of the Bank of China, describing how to understand the credit liquidity mechanism of Fiat Money based on the credit balance sheet. In the Fiat Money system, all underlying currencies are central bank liabilities. When the central bank believes there is a risk of deflation, liquidity panic, or liquidity tightening, or "whatever the reason", the central bank chooses to expand its own liabilities to create more underlying currencies. The more the concept of Debt and Credit is synonymous with expansion, the more the central bank's balance sheet needs to expand its assets.

The liquidity of the underlying currency, rather than the size of the overall credit, is the key to the liquidity of the underlying currency. Since banks bear the responsibility for creating liquidity through the credit mechanism, the liquidity of the underlying currency is generally caused by the banking system. We refer to the fact that businesses own credit money created by banks, Credit, rather than the underlying currency Money (unless they open bank accounts and only collect cash under the mattress), but corporate settlements, especially with accounts opened with other banks and other businesses, are made through the underlying currency.

但是否这种无序银根紧缩现象是否已经被彻底消灭,不需要我们关注了?答案是不仅没有,而且还在央行够不着的地方越玩越High。例如离岸货币体系其实就没有旨在调控流动性和货币利率的中央银行(此处默默黑某央行),所以离岸体系比在岸体系脆弱的多。离岸货币体系的基础货币,往往是由在岸银行搬运的,其主要目的是套利(即使是离岸美元,套利因素也很重)。可以想象,当离岸市场的商业银行出于信心坍塌而收缩信贷的时候,仅仅只用在岸离岸之间的息差吸引同样的商业银行多搬运些在岸货币来抚平离岸市场的银根紧缩,效果将有多差。2008年离岸美元市场的流动性坍缩,其实严重程度远大于美国本土,联储应对的方式是向ECB/BoE/BOJ/SNB/BoC等央行发放大规模的Swap,向离岸供应天文数字一样的美元,再加之各家央行的主要目的是金融稳定而不是套利,才压制住Eurodollar市场的恐慌。有心人士可以对照FED的H4.1表,看看当时投放的USD流动性有多大量。

(The part of the offshore currency continues to shrink, Macro 101 is afraid of not being able to keep it, so the offshore market, or the part of the monetary banking system that lacks central bank regulation, came first, anyway this topic is actually common, the following 2a-7 case is more wonderful) (I can't help myself, come back again, now many people miss the gold standard, do you Macro Traders want to know how to trade under the gold standard?

In the monetary banking system, the structure of the banking system is the focus of the macro trader's observation of Flow, especially as banks assume the responsibility for the liquidity of the underlying currency, and in particular the link that affects the dissemination of liquidity to the credit balance sheets of enterprises. The first is that we are very concerned about reserves, because the impact of the reserve on the total base currency available for settlement directly affects the liquidity of the entire monetary system. It should be noted that all these factors affecting the excess debt repayment reserve, in addition to the position of the reserve in the deposit, are comparable in this respect.

Once the liquidity of credit reaches the corporate level, the flow will be more diverse, and assets such as stocks and commodities often need to be obtained from this. This is where confusion is most likely to arise, and my suggestion here is not to simply look at changes in macroeconomic numbers, but to infer from the microeconomic level of corporate expansion decisions. For example, the fallacy that the so-called Fed QE printed money flowing into the stock market to push up the stock index is not going away, but if combined with the microeconomic analysis of liquidity in Money and Credit, we realize that QE is in fact extremely efficient, and the underlying monetary valuation of the expansion of the reserve is often located on the over-expenditure of commercial banks, which has led to the low willingness of the monetary credit system to underwrite the over-expenditure of the over-expenditure of the United States from $50 billion in 2007 to over $200 billion in 2013 and has the potential to provide unintended returns.

In a normally growing economy, companies see investment returns that outweigh opportunity costs, are motivated to increase financing and put capital into operation, and corporate CAPEX generates demand for labor and commodities, thus driving high inflation. What a wonderful story, unfortunately now full of abnormal economies, normal economies seem to be in conflict. The most famous is the Japanese-style balance sheet recession, in which Japanese companies do not dare to expand CAPEX, but use the retained earnings earned to fill the hole left when the bubble burst.

The second example is the US corporations after the QE debacle. According to textbooks, corporations should be encouraged by low interest rates, and some seemingly unprofitable CAPEX projects should be encouraged to drive inflation (see Bernanke VS Summers (2015)). But the bulls don't drink the water, let alone the smart masses.

第三个例子更有意思。仍然考虑企业对主营业务没有信心的情形,如果投机成本低、企业有钱但又不愿意发给股东,他会干什么?说不定我们可以考虑干些投机。投机讲究快进快出,所以显然不能做重资产的,这时候金融资产就显得有得天独厚的优势了。在这种情况下,金融资产尤其是企业最熟悉的商品领域会出现大幅的波动,甚至超过宏观的趋势。另一个投机现象是别家地里比自家肥,制造业想做房地产,房地产进军金融业,金融业搞直投…这种Mislocate现象不仅中国有,欧美市场也有,不过欧美市场更多是投资组合资产配置方面的Mislocate.

(And the more the merrier. Simply put, Macro Trader needs to combine information at the Micro level to do Flow analysis, and only look at macro data blindly as an absolute deadbeat.

Because there is a lot of material in this area, so I will not go into detail, just to say a little bit. PM/Trader in the FICC field in China tend to observe these phenomena of money banks more deeply than in the mature markets of Europe and America, which should be said to be an advantage of the relatively mature market when learning Macro Trading. I have been in the dollar and yuan markets for a long time.

As mentioned above, the credit balance of central banks and commercial banks is the most important observation point of the Macro Trader. The information in this regard is in fact very rich, because the main central banks regularly publish statistics of central banks and commercial banks. Reading the data of central banks and commercial banks is a basic function of the Macro Trader. It is recommended that all readers read the financial data published by the main central banks carefully, at least read the Fed and PBoC. When reading the Fed data, it is recommended to compare the Fed Z1 Flow of Funds data, which is more conducive to establishing an understanding of the monetary system in the central bank / bank / enterprise.

In the above analysis, I deliberately bypassed the traditional monetary banking analysis methods such as M0/M1/M2 analysis etc. This is partly because the content is rich enough for the reader to find on their own, without the need for me to come to Bibi without any training in Kobani (in fact, little or no deep analysis, a lot of misstatement, comparing the Flow Chart to find a lot of material on the market completely confuses the concept of monetary banking). On the other hand, Macro Trader must be able to transform the model or data obtained to paint a more accurate picture.

-

2. Shadow banking money credit system Flow Chart

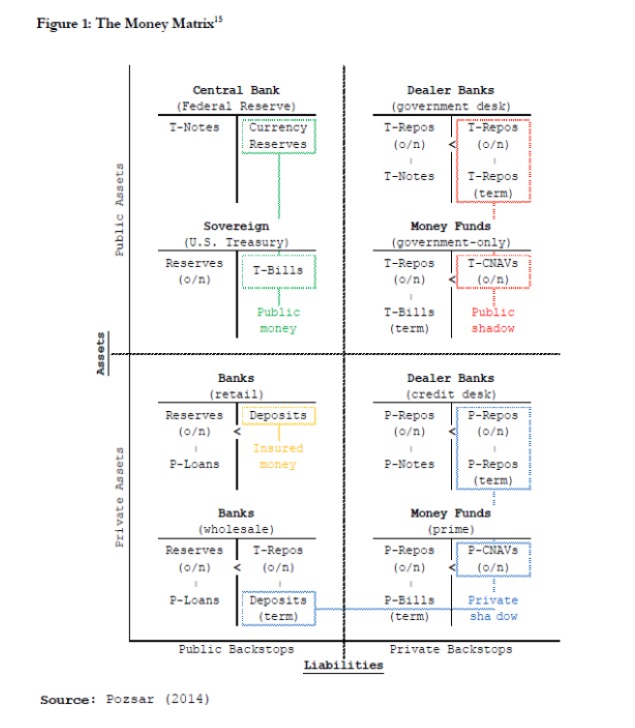

In the modern financial system, an equally important role is played by the securities system, or the shadow banking credit system. It is characterized by the fact that securities assume a part of the function of creating credit. The most detailed paper on this aspect is Possar ((2014), which is so comprehensive that it is no longer necessary to describe it, just a simple reference diagram, recording a few points.

This is because in all modern monetary banking systems, sovereign bonds have the same risk capital as cash, and, in the main monetary banking system, the liquidity and liquidation efficiency of sovereign debt transactions and repurchases is extremely high, so sovereign bonds can also serve as a base currency, taking on a part of the role of a credit derivative. Hence, there is a hypothesis that a price-controlled and highly efficient monetary system, with a policy interest rate equal to the overnight sovereign bond repurchase rate.

Secondly, shadow banks, or non-bank financial institutions, whose transaction settlements also require physical currency, and although shadow banks can derive credit, they often cannot obtain credit directly from the central bank (with very rare exceptions), so their role in the above-mentioned commercial banking money flow chart can be considered to be at the corporate level.

Third, shadow banks participate in the monetary credit system, but the statistics and operating mechanisms of the shadow banking system are far less mature than those of commercial banks.

These concepts are boring. Boring to learn! Because ignoring this system would seriously miss the flow chart. Now, when we look back at the June 2013 money shortage, the word in the audience is that the central bank tightened monetary policy to leverage and cause liquidity collapse. But if you study the financial data for the second quarter of 2013, and then read important central bank documents such as the Monetary Policy Report, you will find that credit and liquidity still seemed to grow significantly, but only slightly decreased. If you look at the shadow banking scenario completed at the time, my feeling is that the direction of the central bank's monetary policy did not change.

In mature markets, the shadow banking system has more freedom, more functionality, and therefore more impact, and Macro Trader needs to watch more closely. When the Fed launched QE in 2009, many participants lamented that unprecedented malign inflation was coming, and gold was pushed to a high of 1900. However, today, six years later, US inflation has suffered many setbacks and is only struggling towards 2%. The reasons for this are varied, but from the perspective of a Macro Trader, if the efficiency of the commercial banking system and the monetary banking system is ignored, talking about inflation only in accordance with the basic currency is definitely a problem.

Whether it is the commercial banking system or the shadow banking system, liquidity is the most sensitive point of the Macro Trader. This process is not a simple sale of risky assets, the sale is not the result, and will stop when the liquidity of the risk compensation rises to a reasonable level. Again, Debit and Credit is a form of simultaneous expansion of the bank holding that precious deposit, rather than an expansion to create deposits for loans, in the shadow bank, it is the Dealer holding the liquidity of the country not to release, the pressure even refuses to accept the liquidity of the country that can consume the valuable liquidity of the company in their hands.

In mature markets such as the European and American markets, where the transmission mechanism is flexible and self-regulating, the flight to quality is a series of reactions that are simplified by traders into Risk On/Risk Off, and then both the cash flow and asset price reactions are explained by changes in Risk Appetite. The advantage of this practice is that it greatly simplifies the analysis process, but also skips the in-depth analysis of the market structure. We have previously mentioned that if the market mechanism is too smooth, a black box may form, which may eventually affect the trader's intuition, resulting in a loss of perception of the market infrastructure.

In spite of the impact of events such as Lehman, the impact of liquidity risk in the modern monetary banking system is increasingly, and even greater than that of traditional credit risk, even in the case of Lehman. This is due to the increasingly stringent regulation of the commercial banking system, and measures such as regulatory capital, centralized liquidation and orderly bankruptcy have greatly reduced the impact of the credit risk system. On the other hand, governments and central banks' aversion to investing in systemic risk has led to a growing number of participants believing that credit risk once it rises to systemic risk is a potential need for central bank rescue.

In other words, traders should be more sensitive to changes in the monetary credit system than sharks are to the smell of blood. Every change in the monetary credit structure means that a bunch of funds will have to find new paths, if they can identify the transmission paths of monetary credit changes, and grab the money before the market. On the contrary, if the new monetary credit system is forced to change but the action is too clumsy and slow, it means paying tribute to sharks.

Translated from the Moneycode column

- Playing JavaScript with the old man - creating a buyer/seller partner and developing the tool code used by the robot

- High-frequency trading strategies talk - do the market versus the reverse option

- Becoming a probabilist - a random strolling idiot who reads books

- Positive expectations for probabilities, odds and long-term trades

- Playing JavaScript with the old man - creating a buyer/seller partner (5)

- Playing JavaScript with the old man - creating a partner who will do the buying and selling (4) teaching him a little simple knowledge (even-line applications)

- Playing JavaScript with the old man - creating a buyer/seller partner (3) A lively little guy who likes fresh things around

- I'm going to ask the gods about my doubts about future functions!

- Playing JavaScript with the old man - creating a partner who buys and sells - born in a sandbox

- Playing JavaScript with the old man - creating a partner who will buy and sell 1) The boring life of a front-end middle-aged farmer

- Futures trading: The pursuit of perfect certainty is a toxin in the trading system!

- Trading strategies of gamblers

- HttpQuery is not used in Python

- What does it mean to be a "dispossessed" hedge fund?

- Details: Shares subject to size restrictions (Shares Trading Rules)

- Talking about the odds of winning and losing

- This is probably the biggest lie in investing!

- How to Survive in a Random World

- Discover trends and follow trends

- Disclosure of the Big Data Fund