Subjective and quantitative, synthetic and comparative

Author: The Little Dream, Created: 2017-04-07 17:03:28, Updated: 2017-04-07 17:04:38Subjective and quantitative, synthetic and comparative

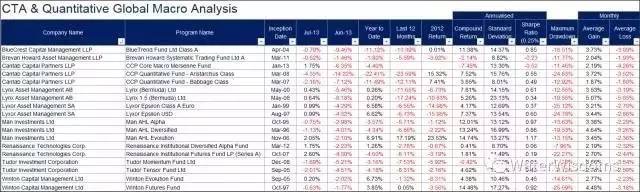

Quantitative investments are only tools, we can't over-exaggerate or blindly worship them. Once strategies are homogenized to a certain extent, it's not so easy to keep quantitative returns stable. Abroad, quantitative neutral strategies are notorious for losing more than 10% a year; especially in the financial crisis or the Black Swan, where quantitative performance is generally not subjective. In the 2007-2008 debt crisis, the largest losses of hedge funds were 60-70% purity.

下图是几个国内媒体崇尚的量化“大神”的前几年业绩表现(这里没有批评同行的意思,

只是为了阐述事实举一些反例。我们认为做投资,亏损不是丢人的,怕的是掩耳盗铃或神化;

从不犯错以至于不知道错误在哪里也是危险的):

-

There are many ways to invest, and investors who are not good at fundamental analysis (and I am not good at it either) can choose the path of technical analysis or quantitative management. Although black cats are white cats, catching a mouse is a good cat; but we can not completely deny basic analysis or subjective investing. Otherwise, there is no skin and hair attached to quantitative and passive investing, in fact, tracking, researching or replicating the behavior of investors in the field (including themselves). They themselves do not play a decisive role in mining and asset pricing in general.

The so-called alpha strategy, which now refers to the majority of the market buying small-scale stocks / empty-scale stocks, is not only not really alpha at all in the investment logic, but also in essence is a monopoly liquidity to get a similar payoff, or a Ponzi scheme, not to withstand the test of liquidity risk, and the initial intention of the alpha of stocks that are quoted is also 180,000.

It is more important to establish an open and fair market/system that enables investors to supervise listed companies, achieve optimum resource allocation, and serve the real economy. Well, then investments have a real alpha. I have always believed that without a stock vacancy mechanism, without an investor against a listed company collective action mechanism, no exit mechanism, it is difficult for the A stock market to perform the function of superiority, so it is difficult for stocks to have a real alpha.

At a time when 90% of listed companies are faking their books, when institutional investors are still powerless to fight back, and even when the manipulation of prices by listed companies has actually led to the failure of the functioning of the entire capital market, investors in the secondary market are still arguing whether it is subjective or quantitative to get a more stable alpha from stocks.

I personally admire fund managers who stick to principles, stay away from scams, actually extract value, and control systemic risk.

It's not unique, it's not ridiculous, but for a long time, before quantification became obsolete, the usual media article was about the deified Buffett, the short-line satirist or the technical analyst.

Buffett is not a full-fledged value investor, he is more like an investment bank or PE model, as he makes extensive use of leverage, mergers and acquisitions, influencing board of directors of public companies, selling options, lending high-interest loans, and other tricks that are difficult for the average individual investor to replicate across the primary and secondary markets.

Buffett hasn't won the S&P 500 in nearly a decade.

Buffett does more than long lines, he also does short lines: he did a lot of event-driven/merger/acquisition arbitrage deals early on.

Buffett's statistical performance criteria are also problematic. Because the reference is to the stock price of his investment vehicle Berkshire, not net worth. If Berkshire is viewed as a fund, its price has a 50% premium on net assets from investors' expectations.

-

Soros's reflective theory and technical analysis have a lot to offer. Stanley Druckenmiller, the chief fund manager of his Quantum Fund, even says that technical analysis accounts for 80% of his trading system. Druckenmiller was the main designer and implementer of helping Soros target the pound, forcing the Bank of England. During his tenure as Quantum Fund Manager from 1988 to 2000, he had an annualized performance of 37% far above the annualized level of 20% of Quantum Funds (Soros to Close His Fund to Outsiders, By Azam Ahmed July 26, NY Times).

In addition, most people who don't read financial alchemy overlook one of the most important messages. The title of the financial alchemy is given to Liu by Paul Tudor Liu, a tech-savvy macro hedge fund manager whose firm, Tudor Investments, manages nearly $17 billion and is a leader in the hedge fund industry. He even personally went to the University of Virginia to teach technical analysis to students.

Paul Tudor

Druckenmiller & Soros

-

I understand quantitative and subjective, active investment/passive investment, long/short/high-frequency relationships, we are all in fact one ecosystem, in different ecosystems, relationships that coexist and even learn from each other, without necessarily biasing, excluding or belittling each other.

High-frequency and short lines (including subjective and quantitative) provide liquidity to markets, as if microbes make nutrients or oxygen for all living things. They may be short-sighted, they may make mistakes often, but without them, the ecosystem would be in chaos.

High-frequency programs also have short life cycles, and now regular performance declines every 6 months, more like microbes.

Long lines, low frequencies or values are giant animals such as lions, tigers, elephants and humans.

Low-frequency, value investors are organisms at the top of the food chain that persist, evolve, and adapt to different environments. They may succeed, they may fail, they may be paranoid like fools, they may be sad like Prometheus, but without them persistence, life will not reproduce, society will not evolve.

But if you destroy the microbe, which is the food that destroys the high-end organisms, the latter cannot survive on its own. Without high-frequency and short-term investors, the market prices will be extremely illiquid, which brings transaction risks (the inability to build or withdraw) and pricing errors to long-term investors. Recently, an investigation was conducted, holding billions of dollars in a company, complaining that they did not actively acquire a Hong Kong listed bank, but only because of the debt relationship.

The ecosystem is diverse, and I cannot imagine animals or plants growing the same way in nature... GM technology is actually a quantification of the biosphere. The voice of the domestic blind cult of GM, ignoring one of the most important control measures abroad, the Convention on Biological Diversity, the Food and Agriculture Organization of the United Nations (FAO) has imposed strict restrictions on the use, cultivation and protection of GMOs to protect biodiversity.

Similarly, Harry Markowitz's modern group rationalization, while controversial, is generally consistent with diversification. In fact, quantitative procedures are the most easily replicated technique because of the movement of employees. It is easy to homogenize the strategy in the market in a short time. In this case, non-quantitative funds are unlikely to get excessive returns, as FOFs in the upper asset allocation also introduce centralized investment or liquidity risk.

Passive investment ETFs have also been deified in recent years. The average active investor cannot exceed the index, but have the boasters considered: What if the market is empty of active investors and the market is inactive? What if the market is full of passive investors, who will provide liquidity in the event of a downside risk release?

In summary, quantitative/subjective, long/short, active/passive investing are actually interrelated, so from a gambler's point of view, or even from a selfish point of view, they should actually be praying for the upside, praying for each other's longevity to be blessed with something for... regardless of whether the market is occupied by any of the factions, it will lead to the destruction of the investment ecosystem or the market itself.

I personally believe that the most important quality in investing is honesty, followed by:

The ability to think independently: investing is an exercise. We must learn from others, learn from our peers, learn from success, and also learn from failure, but we should not be afraid to question any investment treasure. Otherwise, being a slave to someone else's ideas is not suitable for you, but for you.

Humility: Any idea, including the idea of investing, once exclusive and deified, comes close to religion, limiting the mindset of people or procedures. Investing must be modest, fearful of other investors, fear of the market. The meaning of the name of the Soros quantum fund is to assume that you will make mistakes too.

I think that the reason why he is adorable is not only because he has crossed the ideological boundaries of the sword and the spirit, he has crossed the borders of the nobility, but also because he is independent, humble, pursues freedom, and mocks the incarnation of the Sun and Moon Godhood, which is closer to the quantitative system, the idea of slavery... perfect.

- Sharp is 0.6, should we throw it out?

- How to make money with options strategies, someone finally told us!

- Voting is not a matter of time and strategy.

- Can you give an explanation of the parameters of the retest results?

- In the future, the rings will be fixed.

- The various strategies for stopping losses are detailed

- What does a more complete trading system include?

- From exploiting the vulnerabilities of the delivery system to the combination of cross-term leverage, this is how the good guys play copper.

- Meaning and simple application of futures holdings

- Holdings of futures

- Swing trading and swing trading

- How to use a template for drawing two Y-axes

- Exchange API Special Issue Summary (Unfinished...)

- 7 issues to consider when dealing in virtual currency

- We hope to support the Bitmex platform

- Support for Coinbase and itbit

- MacD, please look at this.

- Indicator of the performance of trading algorithms -- Sharpe ratio

- A new kind of grid trading law

- I feel like you guys cut the cabbage, and I'm still holding the coin.