Can deep learning be used to quantify transactions?

Author: The Little Dream, Created: 2017-07-11 13:38:28, Updated: 2017-07-11 13:39:18Can deep learning be used to quantify transactions?

-

Yes, but don't play predictions (except high-frequency trading)

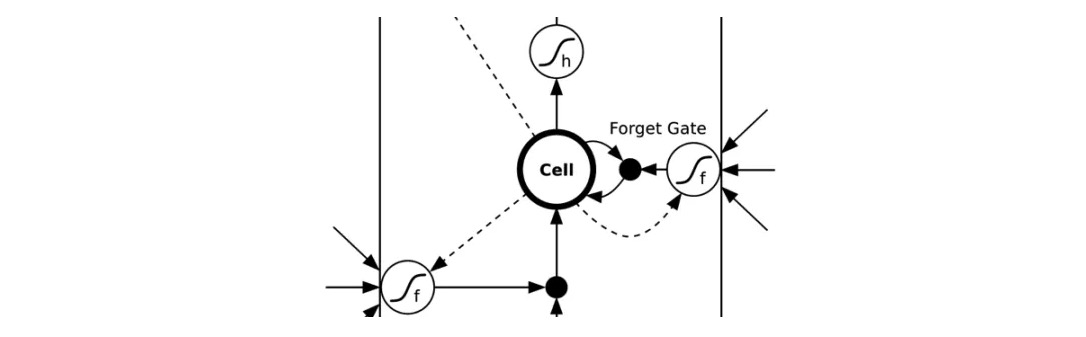

I've seen a lot of articles, publications, or brokers write about deep learning as input based on historical indicators, using networks like LSTM to predict future stock and futures returns and match them into trading strategies. This method I've basically tried, either through the classification method or the regression method to predict, and the results are bad.

This is not to say that new technology is unreliable in predicting the price of assets such as stocks, but first let's think about why you can predict the future with just a few inputs. This hypothesis of predicting the future based on historical data is strong, and under a strong hypothesis, using a black box to run out of a narrow winning rate is somewhat unimpressive.

The key is that there is a stable data-dimensional correspondence between the image and the name, which is more complex, but the relationship is stable. And the financial sequence is different, and the logic of historical data predicting the future is itself unstable, which will only make the results more confusing with such a complex tool. But in fact, deep learning has a particularly suitable application in secondary market quantitative trading, specifically what I am not convenient to say, the characteristic of this application is definitely stable correspondence.

Translated from Quantified Transactions by Zenino

- The K line is the car, the straight line is the road!

- Repeated balancing issues on some exchanges

- In a scientific and philosophical sense, how can we believe in a strategy that doesn't have logic?

- The multi-headed trend is backtracking strategy

- The root cause of the decentralization of the market to the extreme is found!

- A sustainable and efficient trading model

- Indices: Please ask about the market for OKEX contracts, is there an index?

- Multi-platform hedge stability of the leverage V2.1 (note)

- Bitcoin is open for ETC trading, inventors quantify, when will ETC support?

- Don't miss out on the advances and breakthroughs in technology!

- The depth of the OKEX futures Why only get 5?

- Pandora's Box: How financial traders eat risk-free fat

- Newcomer's Question. GetRecords obtained K-line data and the chart of the retest and the actual data are inconsistent.

- Hot summer, tokens and inventors quantify join hands, 5 discount invites you to start quantified trading

- TableTemplate from Python

- Dongjian Tunnel (formerly known as the Turtle System)

- Maximizing trading: Theoretical boundaries and trading systems

- How to customize the set of currencies not shown on the exchange label when creating a digital currency trading robot

- The LogStatus function shown in the Python interface

- The LogStatus function shown in the Python interface