The story of a post-95 coin collector

Author: Orc quantified, Created: 2020-01-21 20:32:33, Updated: 2023-10-18 19:57:04

Other information

Hello, I'm the only founder of Liu Oak Quantum Coins (actually I'm the only one in the whole team / manual dog head), you can call me Krater called Beast (why Krater called Beast, the context has an explanation). I'm a 95-year-old programmer, currently working on development for a father company in Hangzhou. I'm happy to share my coin history.

First, the initial transaction, the resignation of the coin.

The first contact with Bitcoin was at the end of 17 years, through a colleague who introduced him to the digital currency market. The first exchange to be contacted was ZB, and remembers that at that time the newly charged 100 QCs carrying a nickel, opened the way for transactions with only charging and no withdrawal.

With the familiarity of the market, I found that I seemed to have a talent for trading, and with the 3000 pieces I borrowed, I quickly earned the 1000 pieces. Coupled with the guidance of my older brother, who had 20 years of stock trading experience and taught me a lot of Wall Street dry goods, I soon decided to quit the coin.

My friends and relatives raised $100,000 to start a full-time coin. That spring, I spent $3.00 on ZB, but I didn't sell 10 of them, and it dropped to $8.8.

At that time, a public analytics market called the Pit Coin Market was opened, and there was also a fee group, which called itself the Pit Coin Market or the Beast Market (professor did not dare, barely being called a beast / manual dog head).

(He resigned from the Mint at the time)

To this day, I still consider that time as the most precious experience of my life.

Second, contact contracts, development systems

In the first half of the year, the market started to deteriorate and there was no profit. The net worth of the fund also started to turn negative, and every day was anxious to face the loss of investors' money.

I finally got in touch with a hundredfold contract trading platform through a friend's introduction. I was just starting to trade contracts, making a lot of money, and it felt like making free money could be as easy as breathing. Later, the exchange invited me to their headquarters for an interview.

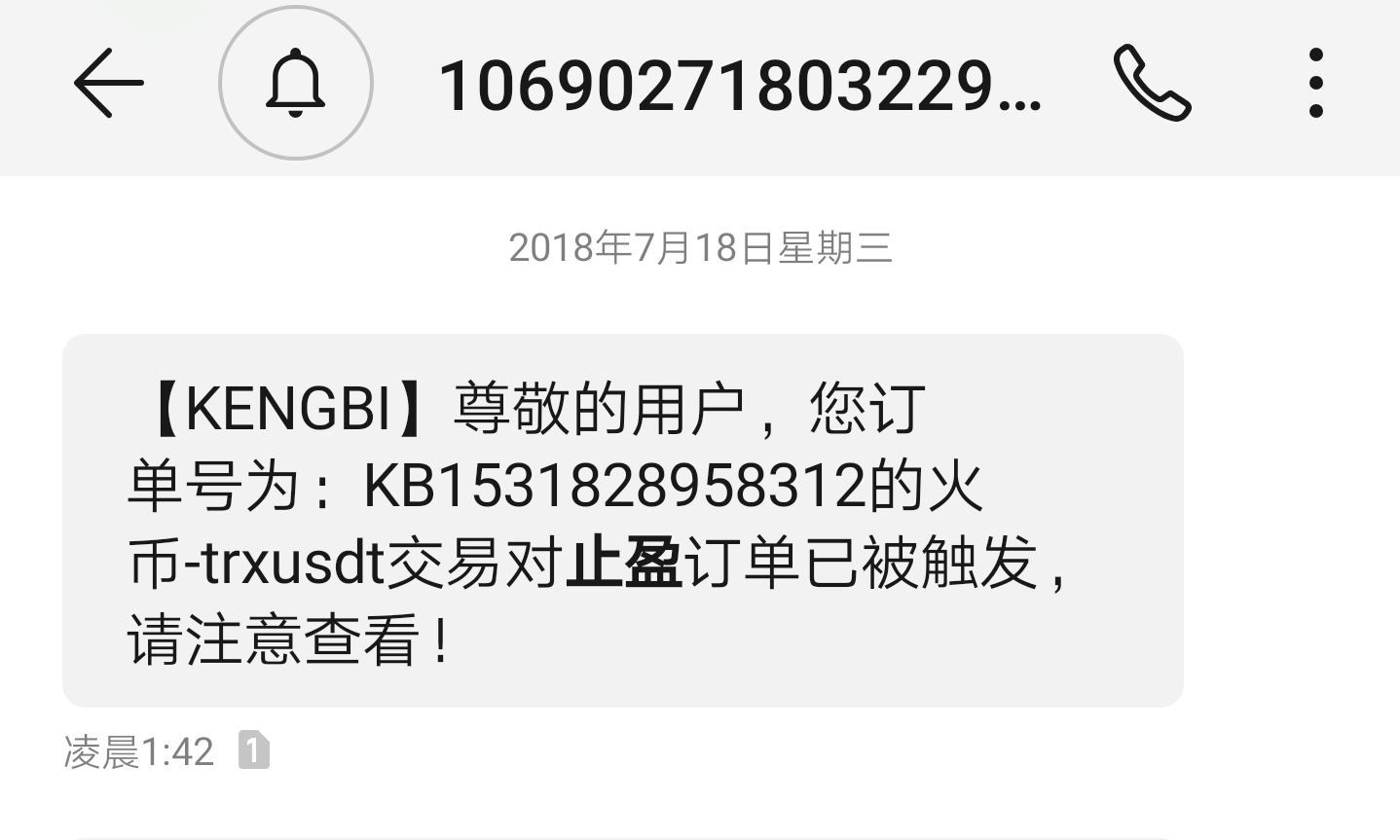

At the same time, the market was often in the late-night plug-in situation, and the trading on the market did not have a stop-loss function. So I wrote a set of two-way stop-loss platforms for pairing the APIs of the major exchanges, and pairing the WeChat service number, called the Pit Pro Coin Platform (now renamed as the OOQ Quantum Coin), developed for the market, and was very popular with users.

(This was done to promote the platform)

(SMS alerts to users after morning stop orders are triggered)

The contract deal made me rise faster and made me fall worse.

Three, the end of the road, meeting the inventor

Later, when I hit 6,000, I was devastated, and I was too stupid to do anything else. The net worth of the fund had been severely damaged, and although my family and friends did not blame me for losing money, I was still very guilty.

After that, I stayed at home every day playing games and didn't even think about trading. The frustration of so many big deals took a toll on my self-confidence, and that was three months ago.

At that time, the job market in Beijing was not particularly good, and my wife saw me as a day-to-day scumbag and not a way out (yes, you're right, she's not a girlfriend), she called her friend in Hangzhou and said there were many opportunities here, so she suggested that I go to Hangzhou to try. I agreed a little reluctantly, and she helped me buy a bus ticket and get a good place to stay. So I came to Hangzhou alone, and after almost a month, I finally entered a company of my father.

In my spare time, I happened to see a coin lover in the group boasting about quantizing robots. Because I am from the development field, I have a natural interest in quantization. So I met the inventor of the platform. I thought I was at the end of my trading career, but I found out that the second half of my trading had just begun.

Four, stable losses, stable profits

Because there was some JS functionality, and the inventor's integration was so well done, users didn't have to perceive the underlying application calls, just focus on the design and execution of the algorithm's strategy.

However, at the beginning, regardless of the design, the results of the reassessment are often very good, and the real market starts to lose. The strategy is changed and modified and modified, as if it is always being caught by the market.

I later remembered an article that said that the stock market is like a living rabbit, the more you observe it and predict it, the more it changes in the opposite direction of what you predict.

So I started to abandon the algorithm of predictive indicators and started experimenting with strategies such as cross-platform leverage, cross-term leverage, hedging, etc. After developing these strategies, my quantitative losses no longer became uncontrolled, and the losses became gradually stable. The appearance of stable losses made me feel that I was not far from the goal of stable profits.

After more than a year of sluggishness, I have written a dozen or so strategies, with gains ranging from total losses to losses to steady profits. Although I thought about giving up in the process, because it is easy and easy to give up, the process of coding and exploring the unknown made me stick to it. The current strategy, although it sometimes backtracks, has been stable and profitable under normal circumstances.

Finally, thank you to the inventors of this platform, who are really working hard to make it very convenient for us traders.

The fifth and final sentence

Looking at a line of code that you type in your hand, and thinking about how the money in your account will feed back into the market through these codes, you have a little bit of expectation. Just like the strategy is the body, the custodian is the blood, the parameters are the soul, my strategy is like an organic life machine that interacts with the whole market. The future market movements are changing because of the participation of us traders, and even more so the participation of you, the reader.

- Quantifying Fundamental Analysis in the Cryptocurrency Market: Let Data Speak for Itself!

- Quantified research on the basics of coin circles - stop believing in all kinds of crazy professors, data is objective!

- The inventor of the Quantitative Data Exploration Module, an essential tool in the field of quantitative trading.

- Mastering Everything - Introduction to FMZ New Version of Trading Terminal (with TRB Arbitrage Source Code)

- Get all the details about the new FMZ trading terminal (with the TRB suite source code)

- FMZ Quant: An Analysis of Common Requirements Design Examples in the Cryptocurrency Market (II)

- How to Exploit Brainless Selling Bots with a High-Frequency Strategy in 80 Lines of Code

- FMZ quantification: common demands on the cryptocurrency market design example analysis (II)

- How to exploit brainless robots for sale with high-frequency strategies of 80 lines of code

- FMZ Quant: An Analysis of Common Requirements Design Examples in the Cryptocurrency Market (I)

- FMZ quantification: common demands of the cryptocurrency market design instance analysis (1)

- The old farmer's journey to the pit

- Hands-on teaches you how to convert a Python single-variety policy into a multi-variety policy.

- My automation loss and FMZ shore trip

sssmmmxPlaying cards

Hashish does things.Applause encourages you to learn more with support