The risk is controlled by adding to the damage... So, Gurdjan, what is the cost?

Author: Cousins, Created: 2020-11-15 16:25:22, Updated: 2023-09-26 20:54:31

(This article was originally published on FMZ)

In the quantitative trade, every head-numbing migrant farmer faces a tough decision.

(This article was originally published on FMZ)

In the quantitative trade, every head-numbing migrant farmer faces a tough decision.

Stop-loss logic or not?

Without a stop-loss-stop-loss logic, it is often possible to continue to eat the benefits and thus increase the yield. But it is also often the risk of going back to the night before liberation under a fluctuation, after years of hard work. The addition of stop-loss logic can improve the utilization of funds and reduce the risk per transaction, but often leads to reduced returns.

to be or not to be this is a question

After a series of explosions, the elderly boss finally added a stop loss in each tactic.

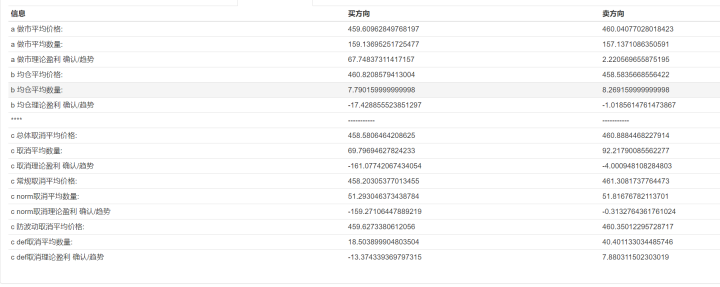

But what is the price, Gurdhan? I'm going to use one of my accounts as an example: The profit resulting from cancellation of orders is theoretically pocketed, the loss resulting from cancellation of orders is theoretically empty (because the cancelled transaction information will not be reflected in the account, but if the cancellation of the order resulting from the transaction is not reflected in the account. This is easy to understand, right?) In other words, the formula for calculating the gain is:

'Wow. hand_price Submitted price now_price Current price hand_amount The number of transactions, positive or negative depending on your bid, ask direction 'Wow. (hand_price - now_price) *hand_amount

Stop loss is a way to cancel the corresponding transaction after the discovery of a fall. For example, after the discovery of a fall, in the trading logic, the probability of executing a buy order decreases and the probability of executing a sell order increases.

Stop loss is a way to cancel the corresponding transaction after the discovery of a fall. For example, after the discovery of a fall, in the trading logic, the probability of executing a buy order decreases and the probability of executing a sell order increases.

In addition to eliminating the corresponding downward trend in probability, some pending buy or sell orders are recorded in statistical information.

Due to the frequency of trading, cancellation of one-way orders can have a direct impact on positions.

Compared to doing stop loss trading, this way of predicting the market stop loss, due to the cancellation without trading, because it can save due to the procedure fees, has a huge advantage. If you are following the teacher, he does not even teach you this way, he suggests that you repay this person, and then go to the B-station to search the monkey's mouth to talk about quantification, learn how to quantify digital currency trading, does it smell?)

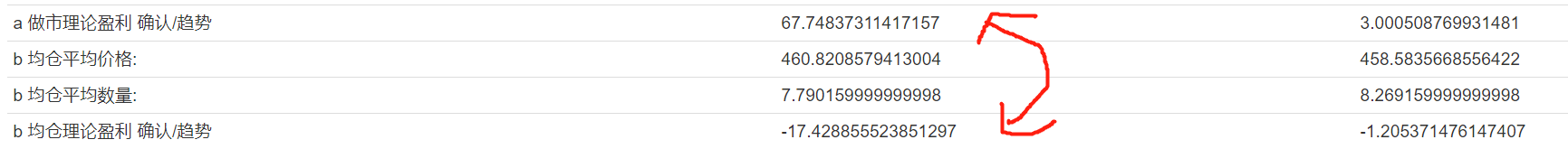

So knowing this, let's look at the transaction information in the graph next. Currently, the profit on the drop in the market is 67.4 and the average stock is 17.4, which means the theoretical profit now is 50.

Currently, the profit on the drop in the market is 67.4 and the average stock is 17.4, which means the theoretical profit now is 50. See the actual earnings calculated at the current discounted market value, 48, almost equal.

See the actual earnings calculated at the current discounted market value, 48, almost equal.

The theoretical value and the actual value are very similar, which means that our calculations are correct, at least within the error range.

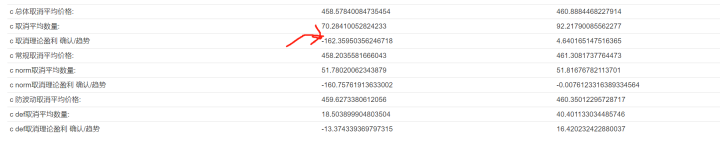

So we can use the same method to calculate how much the cancellation of the order will cost: -162

-162

In other words, stop-loss/stop-loss, let's say we have a loss of about 162 income.

This is almost three times the actual profit so far.

So is it fair to say that if we don't stop the losses, we could have four times the profits?

Of course not.

As for why, the first point is because the utilization of the money is high.

When trading on an exchange, the spot requires you to have a commodity bin to place the order, so the stop loss cancellation order, in fact, if he completes the transaction, will inevitably lead to the fact that the funds have been occupied, the next new order cannot be completed.

That is, if he makes a profit, it will cause the next single that can make a profit to disappear.

Let's imagine that if the current price is 1000, we stop at 1001 with 10 sell orders, and then in 1010 we find that the volatility stops and we execute 10 sell orders.

It seems that cancelling the order will cause us to lose 10 profits, but if we don't cancel the order, we will lose 100 profits because of the occupancy of funds, which will cause us to be unable to trade at 1010.

Suppose we have only 10 commodities at the moment. Then it actually looks like 10 were stolen, but it actually yields 90 extra income.

This is the first and most easily overlooked point, the importance of capital utilization.

I guess you've also found out. If your market is accurate, it's perfectly possible to get some of that profit by leveraging funds.

Yes, this is why if the strategy is stable, relaxing certain stop-loss limits, the same trend-setting parameters, the increase in earnings when making futures is much greater than under the same conditions, which is an important reason for the increase in cash. Futures greatly improve the utilization of funds (exchanged for the risk of a boom).

So, stop loss gains are real gains, and stop loss gains are not necessarily real gains.

Secondly, if you don't, if you're like me, if you're a stop-loss by reducing the probability of filing (high frequency, high frequency tactics are commonly used), then you're definitely paying a cost because you're not stopping the loss, you're just doing the right thing.

The cost was saved by cancelling the order.

In other words, a secondary high-frequency, high-frequency stop-loss-like approach reduces your losses by the equivalent of the cost of a hang order; that is, in this case, you should stop your losses as long as you have a sufficient 50% accuracy of the trend reversal. (Of course, you can also use my invitation link to buy Binance at a discount of $8:00)https://www.binance.com/cn/register?ref=ILBGUIDRRecommended ID: ILBGUIDR If you trade with my link, you can consult me free of charge once you encounter any specific technical issues regarding quantitative digital currency trading.

Finally, stop-loss is a trend-determined type of loss, a type of misjudgment, with few losses, and a highly exaggerated gain once it is accurate.

An example of a secondary high-frequency strategy is the market-trading strategy, where the frequency of trading is high, at least a few orders per second, so the number of times that is not allowed is very high if judged.

In many cases, judging mistakes thousands of times, the result is actually one percent.

But once the judgement is correct, the benefits are not as small as a few percent.

Once the stop loss is correct, the reduction of the drawdown is at least a tenth of it.

If there's something for a trader, the gain is real gain, the loss is not necessarily real loss; and once the gain is made, it's at least ten times your loss compared to the loss.

In addition, the company has been working on a number of projects to improve the quality of its products and services.

The short-term earnings curve is indeed maintained, and can appear to be 1-2 times higher.

You've made a stop loss, and you're taking a few cents a minute every second, in exchange for securing your position in the event of a big swing.

The position is not dead. But is it worth it?

I'm not going to lie.

But is it worth it?

I'm not going to lie.

- Quantifying Fundamental Analysis in the Cryptocurrency Market: Let Data Speak for Itself!

- Quantified research on the basics of coin circles - stop believing in all kinds of crazy professors, data is objective!

- The inventor of the Quantitative Data Exploration Module, an essential tool in the field of quantitative trading.

- Mastering Everything - Introduction to FMZ New Version of Trading Terminal (with TRB Arbitrage Source Code)

- Get all the details about the new FMZ trading terminal (with the TRB suite source code)

- FMZ Quant: An Analysis of Common Requirements Design Examples in the Cryptocurrency Market (II)

- How to Exploit Brainless Selling Bots with a High-Frequency Strategy in 80 Lines of Code

- FMZ quantification: common demands on the cryptocurrency market design example analysis (II)

- How to exploit brainless robots for sale with high-frequency strategies of 80 lines of code

- FMZ Quant: An Analysis of Common Requirements Design Examples in the Cryptocurrency Market (I)

- FMZ quantification: common demands of the cryptocurrency market design instance analysis (1)

- Binance perpetual funds rate adjustment (currently bull market annualized 100%)

- How to analyze cabbage harvesters (2)

- How to dissect cabbage harvesters (1)

- Years from now, you'll feel like this is the most valuable article in your investment career, figuring out the source of the return and the source of the risk.

bwxiaokThe last sentence... which makes me see that the more determined I am to stop the damage, the more I have doubts... disillusionment.

dsaidasiThe better the strategy, the less the need to stop the damage

The grassHigh yields lately.

The Little DreamLock Tower! ~ The lounge never goes up!

CousinsFor the tribe!

CousinsThe two days started to optimize the strategy again.