概述

这个策略结合了WaveTrend震荡指标(WT)和成交量加权平均价格(VWAP),通过识别价格和指标的背离来捕捉潜在的趋势反转机会。该策略使用ATR(Average True Range)来确定止损位置,并根据账户风险百分比动态调整头寸规模。该策略的主要优势在于其趋势跟踪能力和风险管理措施,但在震荡市场中可能会遭受亏损。优化方向包括增加额外的过滤条件和改进进出场规则。

策略原理

- 计算WaveTrend震荡指标(WT):通过比较当前价格与其通道和平均值之间的差异,生成动量振荡指标。

- 计算成交量加权平均价格(VWAP):使用成交量作为权重计算移动平均价格。

- 识别价格和WT指标的背离:当价格创新高/新低而指标未能创新高/新低时,表明可能发生趋势反转。

- 进场条件:当识别到看涨背离时,开仓做多;当识别到看跌背离时,平仓。

- 止损:基于ATR(Average True Range)设置动态止损位置。

- 头寸规模:根据账户风险百分比和止损距离动态调整每笔交易的头寸规模。

- 背景颜色:根据指标的超买/超卖水平改变背景颜色,提供额外的视觉提示。

优势分析

- 趋势跟踪:通过识别价格和指标背离,该策略能够捕捉潜在的趋势反转机会。

- 风险管理:使用基于ATR的动态止损和根据风险百分比调整头寸规模,有助于控制潜在损失。

- 视觉提示:背景颜色根据指标的超买/超卖状态变化,为交易者提供额外的视觉信号。

- 灵活性:该策略的参数(如通道长度、平均长度、超买/超卖等级)可以根据不同的市场条件和交易风格进行调整。

风险分析

- 震荡市场:在没有明确趋势的市场条件下,该策略可能会遭受连续亏损。

- 参数优化:该策略的表现在很大程度上取决于参数的选择,不当的参数设置可能导致次优结果。

- 过度交易:频繁的进出场信号可能导致较高的交易成本,影响策略的整体表现。

优化方向

- 趋势过滤:在发生背离时,引入额外的趋势确认指标(如移动平均线),以过滤掉潜在的假信号。

- 动态参数:根据市场波动性调整指标参数,在波动较低时使用较短的通道和平均长度,在波动较高时使用较长的参数。

- 止盈:引入基于风险回报比或目标价格的动态止盈水平,以更好地管理已获利的头寸。

- 多空过滤:根据市场的总体趋势方向(如长期移动平均线)过滤交易信号,只在趋势方向上进行交易。

总结

WaveTrend Oscillator Divergence Strategy结合了波动趋势指标和成交量加权平均价格,以识别潜在的趋势反转机会。该策略的优势在于其趋势跟踪能力和风险管理措施,但在震荡市场中可能面临风险。通过引入额外的过滤条件、动态参数调整和改进的进出场规则,可以进一步优化该策略的表现。在实施该策略之前,全面的回测和前瞻性分析是至关重要的。

策略源码

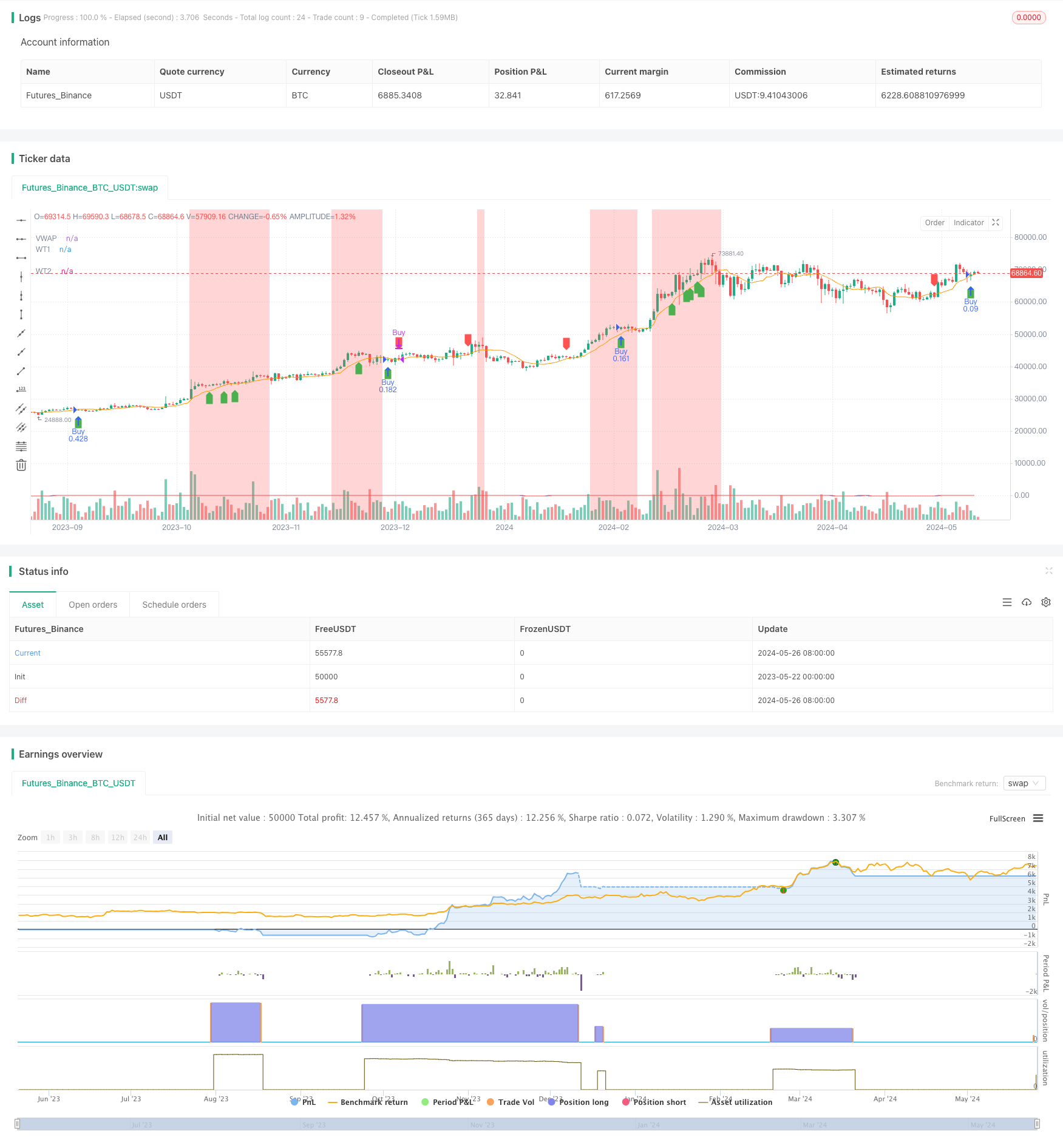

/*backtest

start: 2023-05-22 00:00:00

end: 2024-05-27 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("PipShiesty Swagger", overlay=true)

// WaveTrend Oscillator (WT)

n1 = input.int(10, "Channel Length")

n2 = input.int(21, "Average Length")

obLevel1 = input.float(60.0, "Overbought Level 1")

obLevel2 = input.float(53.0, "Overbought Level 2")

osLevel1 = input.float(-60.0, "Oversold Level 1")

osLevel2 = input.float(-53.0, "Oversold Level 2")

ap = hlc3

esa = ta.ema(ap, n1)

d = ta.ema(math.abs(ap - esa), n1)

ci = (ap - esa) / (0.015 * d)

tci = ta.ema(ci, n2)

// VWAP

vwap = ta.vwma(close, n1)

// Signal Line

wt1 = tci

wt2 = ta.sma(wt1, 4)

// Bullish and Bearish Divergences

bullishDivergence = (ta.lowest(close, 5) > ta.lowest(close[1], 5)) and (wt1 < wt1[1]) and (close > close[1])

bearishDivergence = (ta.highest(close, 5) < ta.highest(close[1], 5)) and (wt1 > wt1[1]) and (close < close[1])

// Plot WaveTrend Oscillator

plot(wt1, title="WT1", color=color.blue)

plot(wt2, title="WT2", color=color.red)

// Plot Divergences

plotshape(series=bullishDivergence, location=location.belowbar, color=color.green, style=shape.labelup, title="Bullish Divergence")

plotshape(series=bearishDivergence, location=location.abovebar, color=color.red, style=shape.labeldown, title="Bearish Divergence")

// Risk Management Parameters

riskPercentage = input.float(1, title="Risk Percentage per Trade", minval=0.1, step=0.1) / 100

stopLossATR = input.float(1.5, title="Stop Loss ATR Multiplier", minval=0.5, step=0.1)

// ATR Calculation

atr = ta.atr(14)

// Position Size Calculation

calculatePositionSize(stopLoss) =>

riskAmount = strategy.equity * riskPercentage

positionSize = riskAmount / stopLoss

positionSize

// Entry and Exit Logic with Stop Loss

if bullishDivergence

stopLoss = low - atr * stopLossATR

positionSize = calculatePositionSize(close - stopLoss)

strategy.entry("Buy", strategy.long, qty=positionSize)

strategy.exit("Sell", from_entry="Buy", stop=stopLoss)

if bearishDivergence

strategy.close("Buy")

// Plot VWAP

plot(vwap, title="VWAP", color=color.orange)

// Background color to indicate Overbought/Oversold conditions

bgcolor(wt1 > obLevel1 ? color.new(color.red, 90) : na, title="Overbought Level 1")

bgcolor(wt1 < osLevel1 ? color.new(color.green, 90) : na, title="Oversold Level 1")

bgcolor(wt1 > obLevel2 ? color.new(color.red, 70) : na, title="Overbought Level 2")

bgcolor(wt1 < osLevel2 ? color.new(color.green, 70) : na, title="Oversold Level 2")

相关推荐