概述

本策略是一个结合布林带、MACD和RSI三大技术指标的综合交易系统。它通过分析价格波动、趋势强度和超买超卖状态来生成交易信号。该策略的核心思想是在市场出现极端波动且趋势和动量指标确认时进行交易。

策略原理

布林带:使用20周期的简单移动平均线(SMA)作为中轨,上下轨距离中轨2个标准差。它用于衡量价格波动性和识别潜在的突破点。

MACD:采用12和26周期作为快慢线,9周期作为信号线。MACD用于确认价格趋势和动量。

RSI:使用14周期的相对强弱指数,设定70为超买水平,30为超卖水平。RSI用于识别可能的市场反转点。

交易逻辑:

- 买入信号:当价格低于布林带下轨、MACD快线上穿慢线且RSI低于30时。

- 卖出信号:当价格高于布林带上轨、MACD快线下穿慢线且RSI高于70时。

可视化:策略在图表上绘制布林带、MACD和RSI指标,并用背景色标注RSI的超买超卖区域。买卖信号通过标签直观显示。

策略优势

多维度分析:结合了趋势、动量和波动性分析,提供更全面的市场洞察。

风险管理:通过布林带和RSI的极值设置,有效控制入场风险。

趋势确认:MACD的使用有助于过滤假突破,提高交易的可靠性。

视觉直观:图表上清晰展示各指标和信号,便于交易者快速判断市场状况。

灵活性:关键参数可自定义,适应不同市场和交易风格。

市场适应性:适用于各种时间周期和交易品种,具有广泛的应用场景。

策略风险

滞后性:技术指标本质上是滞后的,可能导致在趋势转折点附近的错误信号。

过度交易:在震荡市场中可能产生频繁的交易信号,增加交易成本。

假突破:尽管有多重确认,仍可能在波动剧烈的市场中产生假信号。

参数敏感性:策略性能高度依赖于参数设置,不同市场可能需要频繁调整。

忽视基本面:纯技术分析可能忽视重要的基本面因素,影响长期表现。

策略优化方向

动态参数调整:引入自适应机制,根据市场波动性动态调整布林带和RSI的参数。

加入成交量分析:结合成交量指标,如OBV或CMF,以增强信号的可靠性。

时间过滤:增加交易时间窗口限制,避开高波动性或低流动性时段。

止损止盈优化:加入动态止损止盈机制,如跟踪止损或基于ATR的止损设置。

市场regime识别:加入市场状态(趋势/震荡)的判断逻辑,在不同市场环境下采用不同的交易策略。

多时间周期分析:整合多个时间周期的信号,提高交易决策的稳健性。

总结

多指标动态波动预警交易系统是一个综合了布林带、MACD和RSI的复杂策略。它通过多维度分析市场,在极端波动时捕捉潜在的交易机会。该策略的优势在于其全面的市场洞察和灵活的参数设置,但也面临着技术指标固有的滞后性和过度交易的风险。通过引入动态参数调整、加入成交量分析和优化止损止盈机制等方法,可以进一步提升策略的性能和稳定性。对于寻求在波动市场中把握机会的交易者来说,这是一个值得考虑的策略框架。然而,使用者需要谨记,没有完美的交易系统,持续的回测、优化和风险管理对于策略的长期成功至关重要。

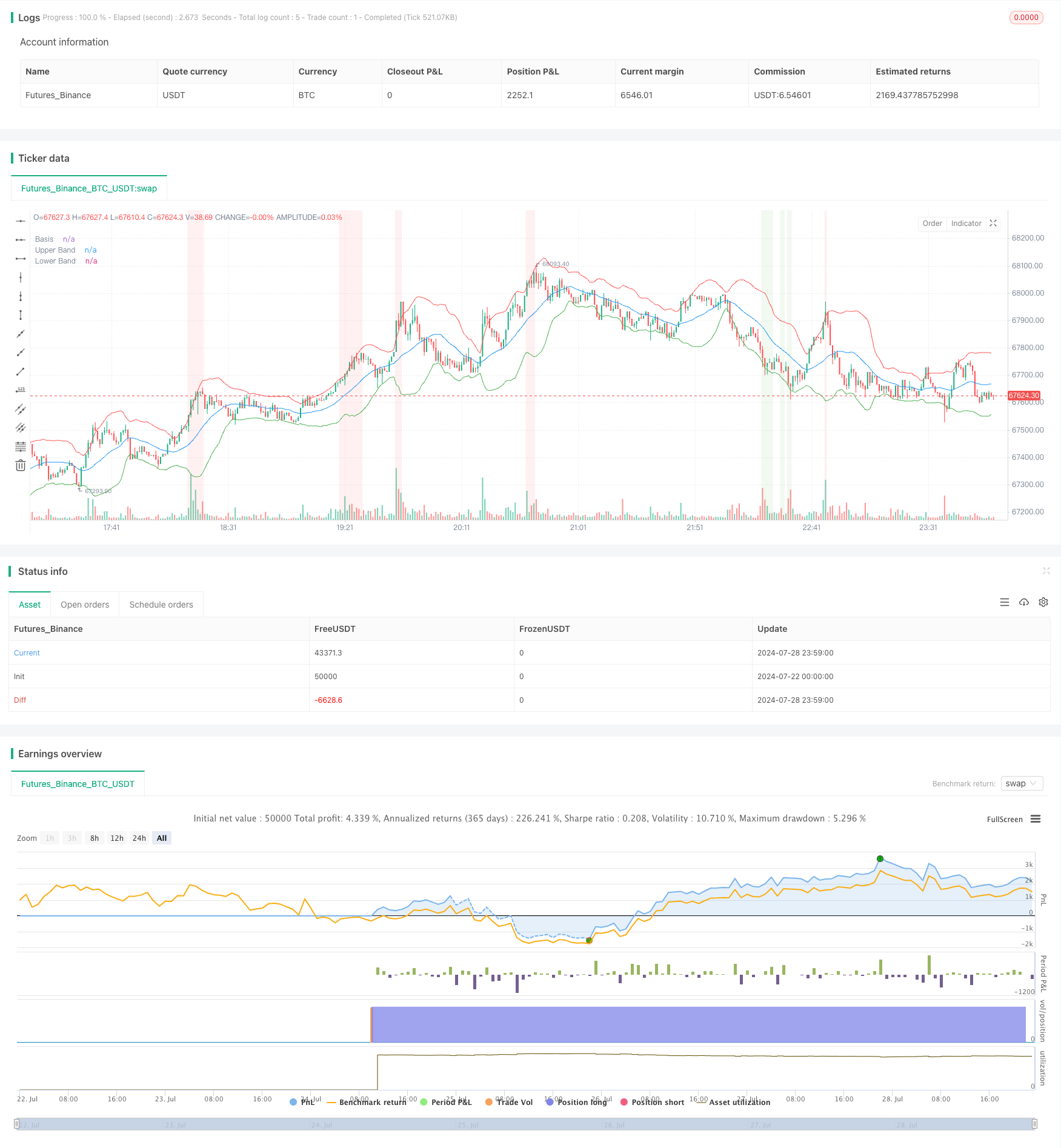

/*backtest

start: 2024-07-22 00:00:00

end: 2024-07-29 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Bollinger Bands with MACD and RSI Strategy", overlay=true)

// Bollinger Bands parameters

length = input(20, title="Bollinger Bands Length")

src = input(close, title="Source")

mult = input(2.0, title="Bollinger Bands Multiplier")

// MACD parameters

macdFastLength = input(12, title="MACD Fast Length")

macdSlowLength = input(26, title="MACD Slow Length")

macdSignalSmoothing = input(9, title="MACD Signal Smoothing")

// RSI parameters

rsiLength = input(14, title="RSI Length")

rsiOverbought = input(70, title="RSI Overbought Level")

rsiOversold = input(30, title="RSI Oversold Level")

// Bollinger Bands calculation

basis = ta.sma(src, length)

dev = mult * ta.stdev(src, length)

upper = basis + dev

lower = basis - dev

plot(basis, color=color.blue, linewidth=1, title="Basis")

plot(upper, color=color.red, linewidth=1, title="Upper Band")

plot(lower, color=color.green, linewidth=1, title="Lower Band")

// MACD calculation

[macdLine, signalLine, _] = ta.macd(src, macdFastLength, macdSlowLength, macdSignalSmoothing)

macdHist = macdLine - signalLine

// RSI calculation

rsi = ta.rsi(src, rsiLength)

// Buy/Sell signals based on Bollinger Bands, MACD, and RSI

buySignal = (src < lower) and (macdLine > signalLine) and (rsi < rsiOversold)

sellSignal = (src > upper) and (macdLine < signalLine) and (rsi > rsiOverbought)

plotshape(series=buySignal, location=location.belowbar, color=color.green, style=shape.labelup, text="BUY")

plotshape(series=sellSignal, location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL")

// Plotting the MACD and RSI on the chart

// hline(0, "Zero Line", color=color.gray)

// plot(macdLine, title="MACD Line", color=color.blue, linewidth=1)

// plot(signalLine, title="Signal Line", color=color.orange, linewidth=1)

// plot(macdHist, title="MACD Histogram", color=color.red, style=plot.style_histogram, histbase=0)

// hline(rsiOverbought, "Overbought", color=color.red, linestyle=hline.style_dotted)

// hline(rsiOversold, "Oversold", color=color.green, linestyle=hline.style_dotted)

// plot(rsi, title="RSI", color=color.orange, linewidth=1)

// Background color for RSI levels

bgcolor(rsi > rsiOverbought ? color.new(color.red, 90) : na)

bgcolor(rsi < rsiOversold ? color.new(color.green, 90) : na)

// Strategy logic

if (buySignal)

strategy.entry("Buy", strategy.long)

if (sellSignal)

strategy.entry("Sell", strategy.short)