海肯阿希趋势追踪策略:多层级止损机制的多时间周期趋势识别系统

supertrend ADX ATR HEIKEN ASHI DMI

概述

海肯阿希趋势追踪策略是一个综合性的交易系统,结合了海肯阿希蜡烛图、超级趋势指标和平均方向性指数(ADX)过滤器的优势,旨在识别强劲的趋势运动并进行有效的资金管理。该策略专注于捕捉已建立趋势中的动量,同时采用先进的三层止损机制来保护资金并锁定利润。该策略适用于多种交易品种,特别是在波动性较大的市场中表现出色。

策略原理

海肯阿希趋势追踪策略基于三个核心技术指标的协同作用:

海肯阿希蜡烛图分析:该策略特别关注几乎没有上下影线的”实体”海肯阿希蜡烛,这些蜡烛表示价格在一个方向上果断移动,几乎没有回调,暗示强劲的动量和趋势延续。无下影线的绿色蜡烛被视为做多信号,无上影线的红色蜡烛被视为做空信号。

超级趋势指标过滤:系统使用超级趋势指标(默认因子:3.0,ATR周期:10)来确认潜在的趋势方向。入场信号必须与超级趋势方向一致,这增加了信号的可靠性,减少了错误交易。

ADX过滤器(可选):平均方向性指数被用来评估趋势的强度,交易只在ADX超过指定阈值(默认:25)时触发,这有助于过滤掉震荡或横盘市场中的噪音信号。

交易系统拥有明确的入场和出场规则: - 入场信号:当满足以下条件时形成:(1)无下影线的绿色海肯阿希蜡烛(做多)或无上影线的红色海肯阿希蜡烛(做空);(2)超级趋势方向确认;(3)ADX阈值(如果启用)。 - 出场信号:当出现相反方向的无影线蜡烛,或者任何一个止损机制触发时,交易结束。

该策略最显著的特点是其创新的三层止损系统: 1. ATR跟踪止损:基于市场波动性(ATR值)动态调整止损位置,随着趋势延伸锁定利润。 2. 摆动点止损:利用市场自然结构(回顾期内的最近高点/低点)来设置止损位,尊重市场自身的节奏。 3. 保险止损:基于入场价格的百分比设置的安全网,提供即时资本保护,特别是当摆动点止损位置可能距离入场点太远时。

策略优势

多层风险管理:三层止损系统提供了全面的资金保护,适应不同的市场条件和风险情景,这是该策略最显著的优势。

适应性强:所有组件(超级趋势、ADX)都可以根据不同市场条件启用/禁用,参数也可以调整,使策略具有很高的灵活性。

强大的趋势捕捉能力:通过结合海肯阿希蜡烛的清晰视觉信号、超级趋势的确认和ADX的趋势强度评估,该策略能够有效识别强劲的趋势移动。

清晰的视觉反馈:策略在图表上显示位置状态、入场价格和当前止损水平,使交易者能够直观地理解和跟踪策略执行情况。

内置资金管理:策略采用基于权益百分比的仓位管理方法(默认:3%),这确保了随着账户规模的变化,风险敞口保持一致。

完整的交易系统:提供从入场信号到出场规则的完整交易流程,无需额外的决策或指标。

策略风险

过度优化风险:策略包含多个可调参数,这可能导致曲线拟合问题,即策略在历史数据上表现良好,但在实时交易中效果不佳。解决方法是使用足够长的历史数据进行回测,并在不同市场条件下测试策略的稳健性。

趋势反转风险:尽管拥有多层止损机制,该策略在强劲趋势突然反转时仍可能面临较大的回撤。市场突发的极端波动可能导致止损未能及时触发,造成损失超出预期。解决方法是考虑增加波动率过滤器或实施更严格的风险管理规则。

参数敏感性:不同的参数设置可能导致截然不同的结果,特别是超级趋势因子和ADX阈值。这要求交易者深入了解每个参数的影响,并找到适合特定市场环境的平衡点。

低波动环境表现不佳:在低波动性或横盘市场中,该策略可能产生多次错误信号,导致”锯齿”交易。解决方法是在此类环境中暂停交易,或增加额外的市场环境过滤器。

资金管理风险:固定百分比的仓位管理可能不适合所有市场环境,在高度波动的市场中可能需要减少仓位大小以控制风险。

策略优化方向

增加波动性适应机制:当前策略可以通过引入波动性过滤器进一步优化,例如历史波动率(HV)或隐含波动率(IV)指标,以便在不同的市场环境中自动调整参数。这将使策略能够在高波动和低波动期间都保持稳定表现。

整合时间过滤器:考虑添加基于时间的过滤器,避免在已知波动性较低或市场趋势性较弱的时间段进行交易。这对于交易特定品种尤其有用,因为不同品种在一天中的不同时间段表现出不同的行为特征。

引入机器学习优化:可以使用机器学习技术自动识别最佳参数组合,而不是依赖静态参数设置。这可以通过分析历史数据中的模式来预测哪些参数设置在未来特定市场条件下可能表现最佳。

增加相关市场过滤器:通过观察相关市场或指数的行为来增强入场信号,例如在交易特定品种时考虑整体市场趋势或相关市场的强弱。

优化止损机制:当前三层止损系统可以进一步优化,例如基于波动性动态调整保险止损百分比,或使用支撑/阻力水平来精确设置摆动点止损,而不是简单的回顾期高低点。

整合交易量分析:在信号确认过程中添加交易量过滤器,确保价格走势得到足够的交易量支持,从而提高信号的可靠性。

总结

海肯阿希趋势追踪策略是一个复杂而全面的交易系统,通过海肯阿希蜡烛图、超级趋势指标和ADX过滤器的独特组合,专注于捕捉强势趋势中的动量机会。其三层止损系统提供了全面的风险管理,同时其可定制的参数设置使其能够适应各种市场条件。

该策略的主要优势在于其清晰的视觉信号、强大的趋势识别能力以及全面的资金保护机制。然而,交易者应意识到参数优化的挑战以及在低波动性环境中的潜在局限性。

通过实施建议的优化方向,如增加波动性适应机制、整合时间过滤器和交易量分析,该策略可以进一步增强其稳健性和适应性。最终,海肯阿希趋势追踪策略代表了一种平衡的方法,结合了技术分析的清晰信号和系统化风险管理的原则,为趋势跟踪交易者提供了一个有价值的工具。

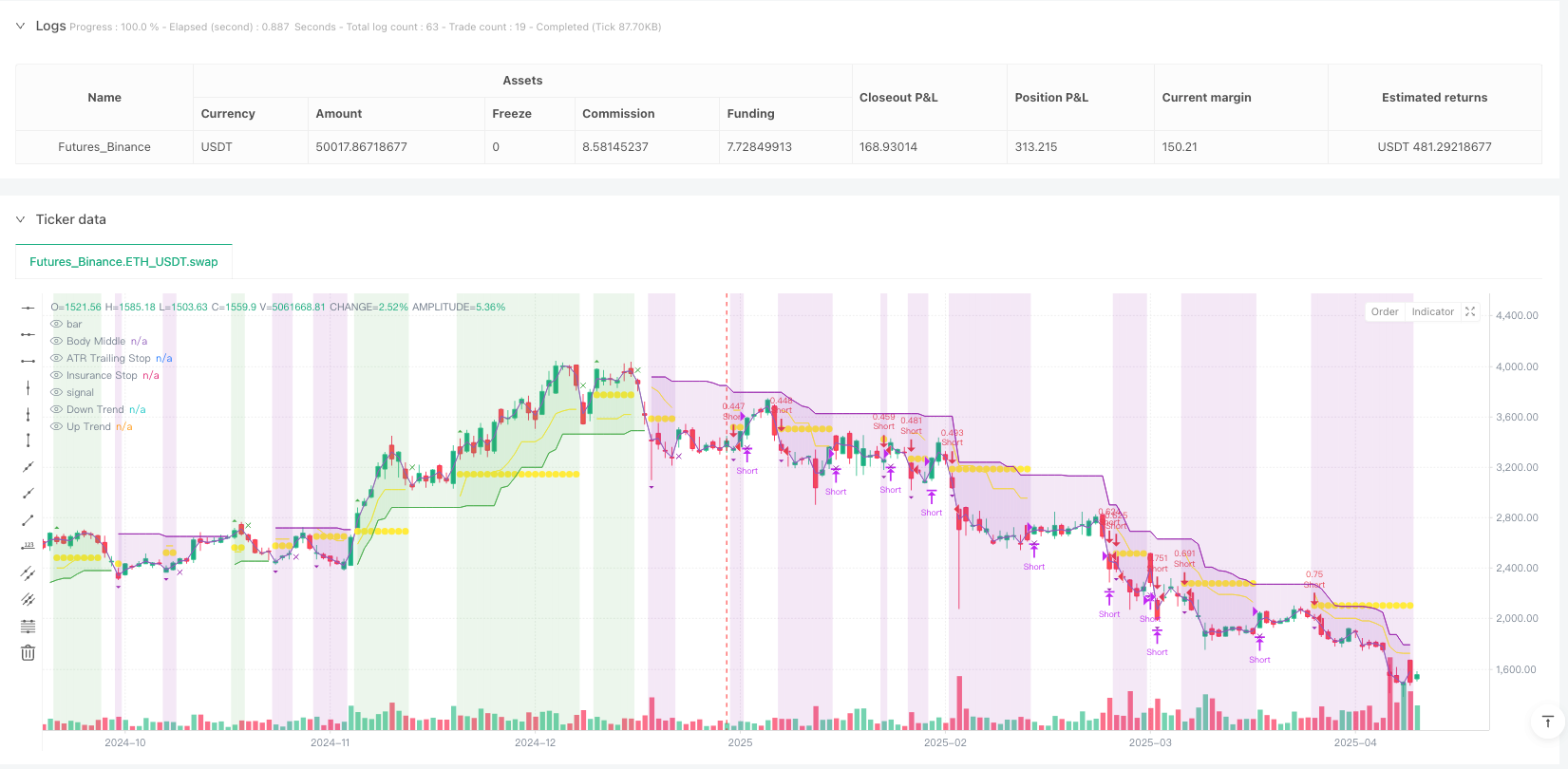

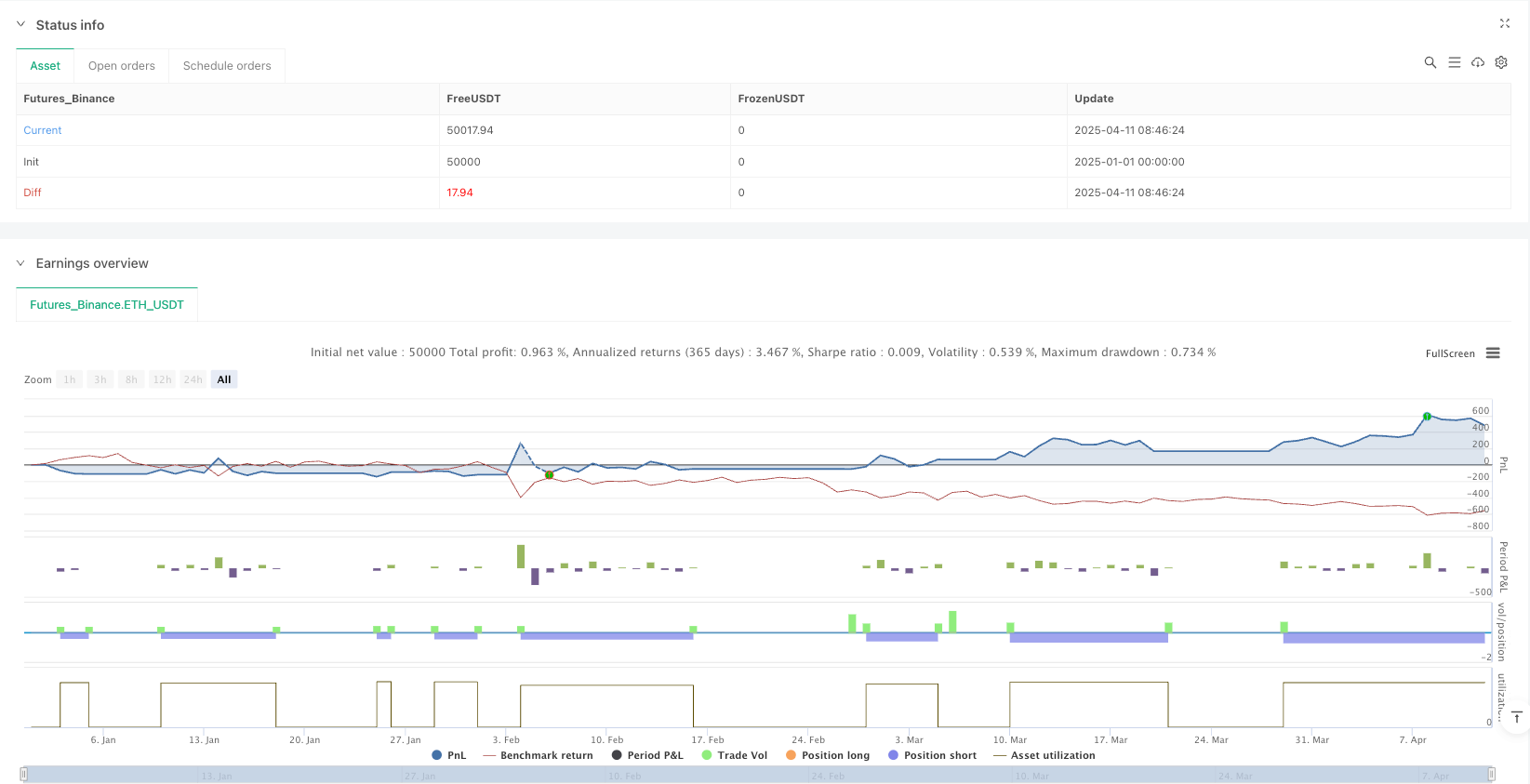

/*backtest

start: 2025-01-01 00:00:00

end: 2025-04-12 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

//@version=5

strategy("Heiken Ashi Supertrend ADX - Strategy", overlay=true, initial_capital=1000, commission_type=strategy.commission.percent, commission_value=0, calc_on_every_tick=true, process_orders_on_close=false, default_qty_type=strategy.percent_of_equity, default_qty_value=3)

// Supertrend Settings

useSupertrend = input.bool(true, "Use Supertrend for Entries", group="Supertrend Settings")

atrPeriod = input.int(10, "ATR Period", minval=1, group="Supertrend Settings")

factor = input.float(3.0, "Supertrend Factor", minval=0.5, step=0.1, group="Supertrend Settings")

// ADX Filter Settings

useAdxFilter = input.bool(false, "Use ADX Filter", group="ADX Filter")

adxPeriod = input.int(14, "ADX Period", minval=1, group="ADX Filter")

adxThreshold = input.float(25, "ADX Threshold", minval=0, group="ADX Filter")

// Stop Loss Options

useSwingStop = input.bool(false, "Use Swing Point Stop", group="Stop Loss Options")

swingLookback = input.int(3, "Swing Lookback Periods", minval=1, maxval=20, group="Stop Loss Options")

useSafetyNetStop = input.bool(true, "Use Insurance Stop", group="Stop Loss Options")

safetyNetPercent = input.float(5.0, "Insurance Stop Loss Percent", minval=0.1, step=0.1, group="Stop Loss Options")

// Trailing Stop Loss Settings

useTrailingStop = input.bool(true, "Use ATR Trailing Stop", group="Stop Loss Options")

trailAtrMultiplier = input.float(2.0, "Trailing Stop ATR Multiplier", minval=0.1, step=0.1, group="Stop Loss Options")

// Get HA data for signals

ha_security = ticker.heikinashi(syminfo.tickerid)

[o, h, l, c] = request.security(ha_security, timeframe.period, [open, high, low, close])

// Get real price data

real_open = open

real_high = high

real_low = low

real_close = close

// Calculate Supertrend using built-in function with real price data

[supertrend, direction] = ta.supertrend(factor, atrPeriod)

supertrend := barstate.isfirst ? na : supertrend

// Determine if we're in an uptrend or downtrend based on Supertrend

isUptrend = direction < 0 // In TradingView, negative direction means uptrend

isDowntrend = direction > 0 // In TradingView, positive direction means downtrend

// Calculate ATR for visualization

atrValue = ta.atr(atrPeriod)

// Calculate ADX and Trade Logic

[diplus, diminus, adx] = ta.dmi(adxPeriod, adxPeriod)

int trade = 0

if trade == 0 and diplus > diminus

trade := 1

else if trade == 0 and diminus > diplus

trade := -1

else if trade == 1 and diminus > diplus

trade := -1

else if trade == -1 and diplus > diminus

trade := 1

else

trade := trade[1]

// Combine with ADX Threshold

isAdxBullish = diplus > diminus and adx > adxThreshold

isAdxBearish = diminus > diplus and adx > adxThreshold

// Debug ADX Values (only if needed for development)

// plot(adx, "ADX", color=color.orange, linewidth=1)

// plot(diplus, "DI+", color=color.green, linewidth=1)

// plot(diminus, "DI-", color=color.red, linewidth=1)

// hline(adxThreshold, "ADX Threshold", color=color.gray, linestyle=hline.style_dashed)

// Check for wicks on the current candle

threshold = syminfo.mintick * 0.1

noBottomWick = math.abs(math.min(o, c) - l) <= threshold

noTopWick = math.abs(h - math.max(o, c)) <= threshold

// Identify candle color and signal conditions

isGreenCandle = c > o

isRedCandle = c < o

// KEY INTEGRATION: Color the real bars based on HA trend

bullishColor = color.green // Green for long/bullish

bearishColor = color.purple // Purple for short/bearish

barcolor(isGreenCandle ? bullishColor : bearishColor)

// Signal conditions for both entry and exit

longCondition = (isGreenCandle and noBottomWick and barstate.isconfirmed) and (not useSupertrend or isUptrend) and (not useAdxFilter or isAdxBullish)

shortCondition = (isRedCandle and noTopWick and barstate.isconfirmed) and (not useSupertrend or isDowntrend) and (not useAdxFilter or isAdxBearish)

exitLongCondition = isRedCandle and noTopWick and barstate.isconfirmed

exitShortCondition = isGreenCandle and noBottomWick and barstate.isconfirmed

// Calculate swing points based on real candles (not HA)

swingLow = ta.lowest(real_low, swingLookback)

swingHigh = ta.highest(real_high, swingLookback)

// Position tracking

var int position = 0 // 0 = no position, 1 = long, -1 = short

var float entryPrice = na

var float trailStopLevel = na // For ATR trailing stop

var float swingStopLevel = na // For swing point stop

var float safetyNetStopLevel = na // For safety net stop

var float highestSinceEntry = na // For tracking highest price since entry (for long positions)

var float lowestSinceEntry = na // For tracking lowest price since entry (for short positions)

// Alert variables

var bool longAlert = false

var bool shortAlert = false

var bool exitLongAlert = false

var bool exitShortAlert = false

// Reset alerts each bar

longAlert := false

shortAlert := false

exitLongAlert := false

exitShortAlert := false

// Handle entries and exits

if longCondition and (position <= 0)

if position < 0

exitShortAlert := true

strategy.close("Short", comment="Exit Short")

position := 0

longAlert := true

strategy.entry("Long", strategy.long, comment="Enter Long")

position := 1

entryPrice := real_close

highestSinceEntry := real_close

lowestSinceEntry := na

// Initialize trailing stops

if useTrailingStop

trailStopLevel := real_close - (atrValue * trailAtrMultiplier)

// Initialize swing point stop

if useSwingStop

swingStopLevel := swingLow

// Initialize safety net stop

if useSafetyNetStop

safetyNetStopLevel := real_close * (1 - safetyNetPercent / 100)

if shortCondition and (position >= 0)

if position > 0

exitLongAlert := true

strategy.close("Long", comment="Exit Long")

position := 0

shortAlert := true

strategy.entry("Short", strategy.short, comment="Enter Short")

position := -1

entryPrice := real_close

highestSinceEntry := na

lowestSinceEntry := real_close

// Initialize trailing stops

if useTrailingStop

trailStopLevel := real_close + (atrValue * trailAtrMultiplier)

// Initialize swing point stop

if useSwingStop

swingStopLevel := swingHigh

// Initialize safety net stop

if useSafetyNetStop

safetyNetStopLevel := real_close * (1 + safetyNetPercent / 100)

if position > 0 and exitLongCondition

exitLongAlert := true

strategy.close("Long", comment="Exit Long Signal")

position := 0

trailStopLevel := na

swingStopLevel := na

safetyNetStopLevel := na

highestSinceEntry := na

if position < 0 and exitShortCondition

exitShortAlert := true

strategy.close("Short", comment="Exit Short Signal")

position := 0

trailStopLevel := na

swingStopLevel := na

safetyNetStopLevel := na

lowestSinceEntry := na

// Check for swing point stop hit

if useSwingStop and position != 0 and not na(swingStopLevel)

// For long positions, check if price drops below the swing low

if position > 0 and real_low <= swingStopLevel

strategy.close("Long", comment="Swing Point Stop Hit")

position := 0

trailStopLevel := na

swingStopLevel := na

safetyNetStopLevel := na

highestSinceEntry := na

// For short positions, check if price rises above the swing high

else if position < 0 and real_high >= swingStopLevel

strategy.close("Short", comment="Swing Point Stop Hit")

position := 0

trailStopLevel := na

swingStopLevel := na

safetyNetStopLevel := na

lowestSinceEntry := na

// Check for safety net stop loss hit

if useSafetyNetStop and position != 0 and not na(safetyNetStopLevel)

// For long positions, check if price drops below the safety net level

if position > 0 and real_low <= safetyNetStopLevel

strategy.close("Long", comment="Safety Net Stop Hit")

position := 0

trailStopLevel := na

swingStopLevel := na

safetyNetStopLevel := na

highestSinceEntry := na

// For short positions, check if price rises above the safety net level

else if position < 0 and real_high >= safetyNetStopLevel

strategy.close("Short", comment="Safety Net Stop Hit")

position := 0

trailStopLevel := na

swingStopLevel := na

safetyNetStopLevel := na

lowestSinceEntry := na

// Track highest/lowest prices for trailing stop calculation

if position > 0 and not na(highestSinceEntry)

highestSinceEntry := math.max(highestSinceEntry, real_high)

if position < 0 and not na(lowestSinceEntry)

lowestSinceEntry := math.min(lowestSinceEntry, real_low)

// Update and check trailing stop (ATR-based)

if useTrailingStop and position != 0 and not na(trailStopLevel)

// Update trailing stop level for long positions

if position > 0

// Calculate new potential trailing stop level

trailStopNew = real_close - (atrValue * trailAtrMultiplier)

// Only move the stop up, never down

if trailStopNew > trailStopLevel

trailStopLevel := trailStopNew

// Check if price hit stop

if real_low <= trailStopLevel

strategy.close("Long", comment="ATR Trailing Stop Hit")

position := 0

trailStopLevel := na

swingStopLevel := na

safetyNetStopLevel := na

highestSinceEntry := na

// Update trailing stop level for short positions

else if position < 0

// Calculate new potential trailing stop level

trailStopNew = real_close + (atrValue * trailAtrMultiplier)

// Only move the stop down, never up

if trailStopNew < trailStopLevel

trailStopLevel := trailStopNew

// Check if price hit stop

if real_high >= trailStopLevel

strategy.close("Short", comment="ATR Trailing Stop Hit")

position := 0

trailStopLevel := na

swingStopLevel := na

safetyNetStopLevel := na

lowestSinceEntry := na

// Plot stop loss levels

plot(useTrailingStop and position != 0 ? trailStopLevel : na, "ATR Trailing Stop", color=color.yellow, style=plot.style_linebr, linewidth=1)

plot(useSwingStop and position != 0 ? swingStopLevel : na, "Swing Point Stop", color=color.red, style=plot.style_circles, linewidth=2)

plot(useSafetyNetStop and position != 0 ? safetyNetStopLevel : na, "Insurance Stop", color=color.yellow, style=plot.style_circles, linewidth=1)

// Visual signals for chart (just entry/exit markers, no ADX labels)

plotshape(longAlert, title="Long Entry", location=location.abovebar, color=bullishColor, style=shape.triangleup, size=size.small)

plotshape(shortAlert, title="Short Entry", location=location.belowbar, color=bearishColor, style=shape.triangledown, size=size.small)

plotshape(exitLongAlert, title="Long Exit Signal", location=location.abovebar, color=bullishColor, style=shape.xcross, size=size.small)

plotshape(exitShortAlert, title="Short Exit Signal", location=location.belowbar, color=bearishColor, style=shape.xcross, size=size.small)

// Supertrend visualization

bodyMiddlePlot = plot((real_open + real_close) / 2, "Body Middle", display=display.none)

upTrend = plot(useSupertrend and isUptrend ? supertrend : na, "Up Trend", color=bullishColor, style=plot.style_linebr, linewidth=1)

downTrend = plot(useSupertrend and isDowntrend ? supertrend : na, "Down Trend", color=bearishColor, style=plot.style_linebr, linewidth=1)

fill(upTrend, bodyMiddlePlot, color=useSupertrend ? color.new(bullishColor, 85) : na, title="Uptrend Background")

fill(downTrend, bodyMiddlePlot, color=useSupertrend ? color.new(bearishColor, 85) : na, title="Downtrend Background")

// Position background

bgcolor(position == 1 ? color.new(bullishColor, 85) : position == -1 ? color.new(bearishColor, 85) : na, title="Position Background")

// Position label

var label positionLabel = na

label.delete(positionLabel)

if barstate.islast

positionText = position == 1 ? "LONG" : position == -1 ? "SHORT" : "FLAT"

entryInfo = not na(entryPrice) ? "\nEntry: " + str.tostring(entryPrice, "#.00000") : ""

atrStopInfo = useTrailingStop and not na(trailStopLevel) ? "\nATR Stop: " + str.tostring(trailStopLevel, "#.00000") + " (" + str.tostring(trailAtrMultiplier, "#.0") + "x ATR)" : ""

swingStopInfo = useSwingStop and not na(swingStopLevel) ? "\nSwing Stop: " + str.tostring(swingStopLevel, "#.00000") + " (" + str.tostring(swingLookback) + " bars)" : ""

safetyNetInfo = useSafetyNetStop and not na(safetyNetStopLevel) ? "\nInsurance Stop: " + str.tostring(safetyNetStopLevel, "#.00000") + " (" + str.tostring(safetyNetPercent, "#.0") + "%)" : ""

supertrendInfo = useSupertrend ? "\nSupertrend: " + (isUptrend ? "UPTREND" : "DOWNTREND") : ""

positionColor = position == 1 ? bullishColor : position == -1 ? bearishColor : color.gray

positionLabel := label.new(bar_index, high, positionText + entryInfo + atrStopInfo + swingStopInfo + safetyNetInfo + supertrendInfo, color=positionColor, style=label.style_label_down, textcolor=color.white)