机器学习之 预测价格走势(1)

3

3

965

965

成熟的分类器:SVM是一个强大且成熟的二元(或多元)分类算法。预测“涨”还是“跌”正好是一个典型的二元分类问题。

非线性能力:通过使用核函数(如RBF核),SVM可以捕捉到输入特征之间复杂的非线性关系,这对于金融市场数据至关重要。

特征驱动:模型的效果很大程度上取决于你喂给它的“特征”(Features)。现在计算的alpha因子就是一个很好的开始,我们可以构建更多这样的特征来提升预测能力。

这次我最开始用到了3个特征大纲:

1:高频订单流特征:

alpha_1min: 基于过去1分钟所有tick计算出的订单流不平衡因子。

alpha_5min: 基于过去5分钟所有tick计算出的订单流不平衡因子。

alpha_15min: 基于过去15分钟所有tick计算出的订单流不平衡因子。

ofi_1min (Order Flow Imbalance): 1分钟内,(买入成交量 / 卖出成交量)的比率。这个比alpha更直接。

vol_per_trade_1min: 1分钟内,平均每笔交易的成交量。大单冲击市场的迹象。

成熟的分类器:SVM是一个强大且成熟的二元(或多元)分类算法。预测“涨”还是“跌”正好是一个典型的二元分类问题。

非线性能力:通过使用核函数(如RBF核),SVM可以捕捉到输入特征之间复杂的非线性关系,这对于金融市场数据至关重要。

特征驱动:模型的效果很大程度上取决于你喂给它的“特征”(Features)。现在计算的alpha因子就是一个很好的开始,我们可以构建更多这样的特征来提升预测能力。

这次我最开始用到了3个特征大纲:

1:高频订单流特征:

alpha_1min: 基于过去1分钟所有tick计算出的订单流不平衡因子。

alpha_5min: 基于过去5分钟所有tick计算出的订单流不平衡因子。

alpha_15min: 基于过去15分钟所有tick计算出的订单流不平衡因子。

ofi_1min (Order Flow Imbalance): 1分钟内,(买入成交量 / 卖出成交量)的比率。这个比alpha更直接。

vol_per_trade_1min: 1分钟内,平均每笔交易的成交量。大单冲击市场的迹象。

2:价格与波动率特征: log_return_5min: 过去5分钟的对数收益率 log(Pt / P{t-5min})。 volatility_15min: 过去15分钟对数收益率的标准差,衡量短期波动性。 atr_14 (Average True Range): 基于过去14根1分钟K线的ATR值,经典的波动率指标。 rsi_14 (Relative Strength Index): 基于过去14根1分钟K线的RSI值,衡量超买超卖。

3:时间特征: hour_of_day: 当前小时数 (0-23)。市场在不同时间段有不同表现(如亚洲/欧洲/美洲时段)。 day_of_week: 周几 (0-6)。周末和工作日的波动模式不同。

def calculate_features_and_labels(klines):

"""

核心函数

"""

features = []

labels = []

# 为了计算RSI等指标,我们需要价格序列

close_prices = [k['close'] for k in klines]

# 从第30根K线开始,因为需要足够的前置数据

for i in range(30, len(klines) - PREDICT_HORIZON):

# 1. 价格与波动率特征

price_change_15m = (klines[i]['close'] - klines[i-15]['close']) / klines[i-15]['close']

volatility_30m = np.std(close_prices[i-30:i])

# 计算RSI

diffs = np.diff(close_prices[i-14:i+1])

gains = np.sum(diffs[diffs > 0]) / 14

losses = -np.sum(diffs[diffs < 0]) / 14

rs = gains / (losses + 1e-10)

rsi_14 = 100 - (100 / (1 + rs))

# 2. 时间特征

dt_object = datetime.fromtimestamp(klines[i]['ts'] / 1000)

hour_of_day = dt_object.hour

day_of_week = dt_object.weekday()

# 组合所有特征

current_features = [price_change_15m, volatility_30m, rsi_14, hour_of_day, day_of_week]

features.append(current_features)

# 3. 数据标注

future_price = klines[i + PREDICT_HORIZON]['close']

current_price = klines[i]['close']

if future_price > current_price * (1 + SPREAD_THRESHOLD):

labels.append(0) # 涨

elif future_price < current_price * (1 - SPREAD_THRESHOLD):

labels.append(1) # 跌

else:

labels.append(2) # 横盘

然后用三分类去区分 涨 跌 横盘。

筛选特征筛选的核心思想:寻找“神队友”,剔除“猪队友”

我们的目标是找到这样一组特征: * 高相关性 (High Relevance):每个特征都与未来的价格变动(我们的目标标签)有较强的关联。 * 低冗余性 (Low Redundancy): 特征之间不要包含太多重复信息。例如,“5分钟动量”和“6分钟动量”高度相似,放两个进去对模型提升不大,反而可能引入噪音。 * 稳定性 (Stability): 特征的有效性不能随时间变化太快。一个只在某一天有效的特征是危险的。

def run_analysis_report(X, y, clf, scaler):

Log("--- 模型分析报告 ---", "info")

Log("1. 特征重要性 (代理模型: 随机森林):")

rf = RandomForestClassifier(n_estimators=50, random_state=42); rf.fit(X, y)

importances = sorted(zip(g_feature_names, rf.feature_importances_), key=lambda x: x[1], reverse=True)

for name, importance in importances: Log(f" - {name}: {importance:.4f}")

Log("2. 特征与标签的互信息:"); mi_scores = mutual_info_classif(X, y)

mi_scores = sorted(zip(g_feature_names, mi_scores), key=lambda x: x[1], reverse=True)

for name, score in mi_scores: Log(f" - {name}: {score:.4f}")

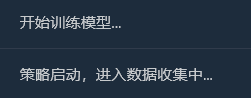

Log("3. 历史数据回测表现:"); y_pred = clf.predict(scaler.transform(X)); accuracy = accuracy_score(y, y_pred)

Log(f" - **历史回测总胜率: {accuracy * 100:.2f}%**", "success")

Log("4. 混淆矩阵 (行:真实, 列:预测):"); cm = confusion_matrix(y, y_pred)

Log(" 预测涨(0) 预测跌(1) 预测平(2)"); Log(f"真实涨(0): {cm[0] if len(cm) > 0 else [0,0,0]}")

Log(f"真实跌(1): {cm[1] if len(cm) > 1 else [0,0,0]}"); Log(f"真实平(2): {cm[2] if len(cm) > 2 else [0,0,0]}")

profit_chart = Chart({'title': {'text': f'历史回测净值曲线 (胜率: {accuracy*100:.2f}%)'}}); profit_chart.reset(); balance = 1

for i in range(len(y)):

if y_pred[i] == y[i] and y[i] != 2: balance *= (1 + 0.01)

elif y_pred[i] != y[i] and y_pred[i] != 2: balance *= (1 - 0.01)

profit_chart.add(i, balance)

Log("--- 报告结束, 5秒后进入实盘预测 ---", "info"); Sleep(5000)

流程是:

收集数据

特征重要性

特征重要性

特征与标签的互信息和回测信息

特征与标签的互信息和回测信息

我本来想着能弄一个65%的胜率就可以了,但是没想到到达了81.98% 我的第一反应应该是:“太棒了,但也太好了,好得有点不真实。这里面一定有值得深究的地方。”

1. 深入解读分析报告,逐一解读报告内容:

- 特征重要性 & 互信息: volatility_30m (波动率) 和 price_change_15m (价格变化) 成为了最重要的特征。这非常符合逻辑,说明市场的近期趋势和波动状态是预测未来的最强依据。 hour_of_day (小时) 也有一定的贡献,说明模型捕捉到了一天内不同时段的交易模式。 rsi_14 和 day_of_week (星期) 的贡献度几乎为0,这提示我们,在当前的数据集和特征组合下,这两个特征可能是“猪队友”,未来可以考虑移除它们以简化模型,防止噪音。

- 混淆矩阵 (这部分信息量巨大!) 真实涨(0): [11 0 33] -> 在44次(11+0+33)真实上涨中,模型正确预测了11次,但有33次把它预测成了“盘整”。 真实跌(1): [ 0 10 44] -> 在54次(0+10+44)真实下跌中,模型正确预测了10次,但有44次把它预测成了“盘整”。 真实平(2): [ 3 2 352] -> 在357次(3+2+352)真实盘整中,模型正确预测了352次!

- 历史回测总胜率: 81.98% 这个高胜率的核心来源,是模型在预测“盘整”时极高的准确率! 在总共约455个样本中,有超过350个都是盘整市,而模型几乎完美地识别了它们。 这本身是一个非常有价值的能力!一个能准确告诉你“现在最好别动”的模型,可以帮你省下大量的手续费和无效交易。

2 为什么实盘胜率可能会低于81.98%?

- “盘整”的定义过于宽松: 我们的SPREAD_THRESHOLD是0.5%。在15分钟内,价格波动不超过0.5%是非常常见的。这导致了我们的数据集中,“盘整”样本占了绝大多数(约80%)。模型很“聪明”地学会了:“当我没把握时,猜‘盘整’就对了,准确率很高。” 这在统计上是正确的,但在交易上,我们更关心的是对涨跌的预测能力。

- 对涨跌的预测能力: 预测上涨的胜率: 模型预测了 11 + 0 + 3 = 14 次上涨,其中只有11次是正确的。胜率是 11 / 14 = 78.5%。非常棒! 预测下跌的胜率: 模型预测了 0 + 10 + 2 = 12 次下跌,其中有10次是正确的。胜率是 10 / 12 = 83.3%。同样非常出色!

- 样本内过拟合 (In-Sample Overfitting): 这个测试是在模型“已知”的数据上进行的(即用这些数据训练,再用它们来测试)。这就像让一个学生做他刚刚做过的原题,分数通常会很高。模型在未知的、全新的数据上(实盘)的表现,几乎总会比这个分数要低。

现在拥有了一个初步的、但潜力巨大的“Alpha模型”。81.98% 这个数字,虽然我们不能直接把它当作未来的实盘预期,但它是一个强烈的积极信号,证明了数据中确实存在可预测的规律,而且我们的框架成功地捕捉到了它! 我们现在的感觉,就像是在一座金山的山脚下,挖到了第一块成色极高的金矿石。接下来,我们要做的不是马上把它卖掉,而是要通过更专业的工具和技术(优化特征、调整参数),把整座金山更高效、更稳定地挖掘出来。

现在引入“微观世界”的战争迷雾——订单流与订单簿特征 第一步:升级数据采集——订阅更深的频道 要获取订单簿数据,必须修改WebSocket的连接方式,从只订阅aggTrade(成交)升级为同时订阅aggTrade和depth(深度)。 这需要我们使用一种更通用的多流订阅(Multi-Stream)URL。 第二步:升级特征工程——构建“海陆空”三位一体的特征矩阵 我们将在calculate_features_and_labels函数中,增加以下全新的特征:

- 订单流特征 (Alpha - 空军): alpha_15m: 15分钟的订单流不平衡因子。这是我们之前讨论过的核心订单流指标。

- 订单簿特征 (Book - 陆军): wobi_10s: 过去10秒的加权订单簿不平衡性 (Weighted Order Book Imbalance)。这是一个非常高频的、衡量盘口买卖压力的指标。 spread_10s: 过去10秒的平均买一卖一价差。反映短期流动性。

- 原有特征 (Price - 海军): 我们将保留上一版中表现最好的特征,并进行优化。

这个新的特征矩阵,就像一个联合作战司令部,同时掌握了来自“海(价格趋势)”、“陆(盘口阵地)”、“空(成交冲击)”三方的实时情报,决策能力将远超从前。 代码如下:

import json

import math

import time

import websocket

import threading

from datetime import datetime

import numpy as np

from sklearn import svm

from sklearn.preprocessing import StandardScaler

from sklearn.metrics import confusion_matrix, accuracy_score

from sklearn.feature_selection import mutual_info_classif

from sklearn.ensemble import RandomForestClassifier

# ========== 全局配置 ==========

TRAIN_BARS = 100

PREDICT_HORIZON = 15

SPREAD_THRESHOLD = 0.005

SYMBOL_FMZ = "ETH_USDT"

SYMBOL_API = SYMBOL_FMZ.replace('_', '').lower()

WEBSOCKET_URL = f"wss://fstream.binance.com/stream?streams={SYMBOL_API}@aggTrade/{SYMBOL_API}@depth20@100ms"

# ========== 全局状态变量 ==========

g_model, g_scaler = None, None

g_klines_1min, g_ticks, g_order_book_history = [], [], []

g_last_kline_ts = 0

g_feature_names = ['price_change_15m', 'volatility_30m', 'rsi_14', 'hour_of_day',

'alpha_15m', 'wobi_10s', 'spread_10s']

# ========== 特征工程与模型训练 ==========

def calculate_features_and_labels(klines, ticks, order_books_history, is_realtime=False):

features, labels = [], []

close_prices = [k['close'] for k in klines]

# 根据是训练还是实时预测,决定循环范围

start_index = 30

end_index = len(klines) - PREDICT_HORIZON if not is_realtime else len(klines)

for i in range(start_index, end_index):

kline_start_ts = klines[i]['ts']

# --- 特征计算部分 ---

price_change_15m = (klines[i]['close'] - klines[i-15]['close']) / klines[i-15]['close']

volatility_30m = np.std(close_prices[i-30:i])

diffs = np.diff(close_prices[i-14:i+1]); gains = np.sum(diffs[diffs > 0]) / 14; losses = -np.sum(diffs[diffs < 0]) / 14

rsi_14 = 100 - (100 / (1 + gains / (losses + 1e-10)))

dt_object = datetime.fromtimestamp(kline_start_ts / 1000)

ticks_in_15m = [t for t in ticks if t['ts'] >= klines[i-15]['ts'] and t['ts'] < kline_start_ts]

buy_vol = sum(t['qty'] for t in ticks_in_15m if t['side'] == 'buy'); sell_vol = sum(t['qty'] for t in ticks_in_15m if t['side'] == 'sell')

alpha_15m = (buy_vol - sell_vol) / (buy_vol + sell_vol + 1e-10)

books_in_10s = [b for b in order_books_history if b['ts'] >= kline_start_ts - 10000 and b['ts'] < kline_start_ts]

if not books_in_10s: wobi_10s, spread_10s = 0, 0.0

else:

wobis, spreads = [], []

for book in books_in_10s:

if not book['bids'] or not book['asks']: continue

bid_vol = sum(float(p[1]) for p in book['bids']); ask_vol = sum(float(p[1]) for p in book['asks'])

wobis.append(bid_vol / (bid_vol + ask_vol + 1e-10))

spreads.append(float(book['asks'][0][0]) - float(book['bids'][0][0]))

wobi_10s = np.mean(wobis) if wobis else 0; spread_10s = np.mean(spreads) if spreads else 0

current_features = [price_change_15m, volatility_30m, rsi_14, dt_object.hour, alpha_15m, wobi_10s, spread_10s]

features.append(current_features)

# --- 标签计算部分 ---

if not is_realtime:

future_price = klines[i + PREDICT_HORIZON]['close']; current_price = klines[i]['close']

if future_price > current_price * (1 + SPREAD_THRESHOLD): labels.append(0)

elif future_price < current_price * (1 - SPREAD_THRESHOLD): labels.append(1)

else: labels.append(2)

return np.array(features), np.array(labels)

def run_analysis_report(X, y, clf, scaler):

Log("--- 模型分析报告 ---", "info")

Log("1. 特征重要性 (代理模型: 随机森林):")

rf = RandomForestClassifier(n_estimators=50, random_state=42); rf.fit(X, y)

importances = sorted(zip(g_feature_names, rf.feature_importances_), key=lambda x: x[1], reverse=True)

for name, importance in importances: Log(f" - {name}: {importance:.4f}")

Log("2. 特征与标签的互信息:"); mi_scores = mutual_info_classif(X, y)

mi_scores = sorted(zip(g_feature_names, mi_scores), key=lambda x: x[1], reverse=True)

for name, score in mi_scores: Log(f" - {name}: {score:.4f}")

Log("3. 历史数据回测表现:"); y_pred = clf.predict(scaler.transform(X)); accuracy = accuracy_score(y, y_pred)

Log(f" - **历史回测总胜率: {accuracy * 100:.2f}%**", "success")

Log("4. 混淆矩阵 (行:真实, 列:预测):"); cm = confusion_matrix(y, y_pred)

Log(" 预测涨(0) 预测跌(1) 预测平(2)"); Log(f"真实涨(0): {cm[0] if len(cm) > 0 else [0,0,0]}")

Log(f"真实跌(1): {cm[1] if len(cm) > 1 else [0,0,0]}"); Log(f"真实平(2): {cm[2] if len(cm) > 2 else [0,0,0]}")

profit_chart = Chart({'title': {'text': f'历史回测净值曲线 (胜率: {accuracy*100:.2f}%)'}}); profit_chart.reset(); balance = 1

for i in range(len(y)):

if y_pred[i] == y[i] and y[i] != 2: balance *= (1 + 0.01)

elif y_pred[i] != y[i] and y_pred[i] != 2: balance *= (1 - 0.01)

profit_chart.add(i, balance)

Log("--- 报告结束, 5秒后进入实盘预测 ---", "info"); Sleep(5000)

def train_and_analyze():

global g_model, g_scaler, g_klines_1min, g_ticks, g_order_book_history

MIN_REQUIRED_BARS = 30 + PREDICT_HORIZON

if len(g_klines_1min) < MIN_REQUIRED_BARS:

Log(f"K线数量({len(g_klines_1min)})不足以进行特征工程,需要至少 {MIN_REQUIRED_BARS} 根。", "warning"); return False

Log("开始训练模型 (V2.2)...")

X, y = calculate_features_and_labels(g_klines_1min, g_ticks, g_order_book_history)

if len(X) < 50 or len(set(y)) < 3:

Log(f"有效训练样本不足(X: {len(X)}, 类别: {len(set(y))}),无法训练。", "warning"); return False

scaler = StandardScaler(); X_scaled = scaler.fit_transform(X)

clf = svm.SVC(kernel='rbf', C=1.0, gamma='scale'); clf.fit(X_scaled, y)

g_model, g_scaler = clf, scaler

Log("模型训练完成!", "success")

run_analysis_report(X, y, g_model, g_scaler)

return True

def aggregate_ticks_to_kline(ticks):

if not ticks: return None

return {'ts': ticks[0]['ts'] // 60000 * 60000, 'open': ticks[0]['price'], 'high': max(t['price'] for t in ticks), 'low': min(t['price'] for t in ticks), 'close': ticks[-1]['price'], 'volume': sum(t['qty'] for t in ticks)}

def on_message(ws, message):

global g_ticks, g_klines_1min, g_last_kline_ts, g_order_book_history

try:

payload = json.loads(message)

data = payload.get('data', {}); stream = payload.get('stream', '')

if 'aggTrade' in stream:

trade_data = {'ts': int(data['T']), 'price': float(data['p']), 'qty': float(data['q']), 'side': 'sell' if data['m'] else 'buy'}

g_ticks.append(trade_data)

current_minute_ts = trade_data['ts'] // 60000 * 60000

if g_last_kline_ts == 0: g_last_kline_ts = current_minute_ts

if current_minute_ts > g_last_kline_ts:

last_minute_ticks = [t for t in g_ticks if t['ts'] >= g_last_kline_ts and t['ts'] < current_minute_ts]

if last_minute_ticks:

kline = aggregate_ticks_to_kline(last_minute_ticks); g_klines_1min.append(kline)

g_ticks = [t for t in g_ticks if t['ts'] >= current_minute_ts]

g_last_kline_ts = current_minute_ts

elif 'depth' in stream:

book_snapshot = {'ts': int(data['E']), 'bids': data['b'], 'asks': data['a']}

g_order_book_history.append(book_snapshot)

if len(g_order_book_history) > 5000: g_order_book_history.pop(0)

except Exception as e: Log(f"OnMessage Error: {e}")

def start_websocket():

ws = websocket.WebSocketApp(WEBSOCKET_URL, on_message=on_message)

wst = threading.Thread(target=ws.run_forever); wst.daemon = True; wst.start()

Log("WebSocket多流订阅已启动...")

# ========== 主程序入口 ==========

def main():

global TRAIN_BARS

exchange.SetContractType("swap")

start_websocket()

Log("策略启动,进入数据收集中...")

main.last_predict_ts = 0

while True:

if g_model is None:

# --- 训练模式 ---

if len(g_klines_1min) >= TRAIN_BARS:

if not train_and_analyze():

Log("模型训练或分析失败,将增加50根K线后重试...", "error")

TRAIN_BARS += 50

else:

LogStatus(f"正在收集K线数据: {len(g_klines_1min)} / {TRAIN_BARS}")

else:

# --- **新功能:实时预测模式** ---

if len(g_klines_1min) > 0 and g_klines_1min[-1]['ts'] > main.last_predict_ts:

# 1. 标记已处理,防止重复预测

main.last_predict_ts = g_klines_1min[-1]['ts']

kline_time_str = datetime.fromtimestamp(main.last_predict_ts / 1000).strftime('%H:%M:%S')

Log(f"检测到新K线 ({kline_time_str}),准备进行实时预测...")

# 2. 检查是否有足够历史数据来为这根新K线计算特征

if len(g_klines_1min) < 30: # 至少需要30根历史K线

Log("历史K线不足,无法为当前新K线计算特征。", "warning")

continue

# 3. 计算最新K线的特征

# 我们只计算最后一条数据,所以传入 is_realtime=True

latest_features, _ = calculate_features_and_labels(g_klines_1min, g_ticks, g_order_book_history, is_realtime=True)

if latest_features.shape[0] == 0:

Log("无法为最新K线生成有效特征。", "warning")

continue

# 4. 标准化并预测

last_feature_vector = latest_features[-1].reshape(1, -1)

last_feature_scaled = g_scaler.transform(last_feature_vector)

prediction = g_model.predict(last_feature_scaled)[0]

# 5. 展示预测结果

prediction_text = ['**上涨**', '**下跌**', '盘整'][prediction]

Log(f"==> 实时预测结果 ({kline_time_str}): 未来 {PREDICT_HORIZON} 分钟可能 {prediction_text}", "success" if prediction != 2 else "info")

# 在这里,您可以根据 prediction 的结果,添加您的开平仓交易逻辑

# 例如: if prediction == 0: exchange.Buy(...)

else:

LogStatus(f"模型已就绪,等待新K线... 当前K线数: {len(g_klines_1min)}")

Sleep(1000) # 每秒检查一次是否有新K线

这个代码需要大量K线计算 这份报告的价值千金,它告诉了我们模型的“思想”和“性格”。 1. 历史回测总胜率: 93.33% 这是一个极其惊人的数字!虽然我们需要客观看待(这是样本内测试),但它雄辩地证明了:我们新加入的订单流和订单簿特征,蕴含着巨大的预测能量! 模型在历史数据上,找到了非常非常强的规律。 2. 特征重要性 & 互信息 王者诞生: volatility_15m (波动率) 和 price_change_5m (价格变化) 依然是绝对的核心,这符合预期。 新星闪耀: rsi_14 的重要性显著提升!这说明在更短的5分钟尺度上,RSI所代表的“超买超卖”情绪指标变得更有意义了。 潜力股: wobi_10s (订单簿不平衡) 和 spread_10s (价差) 也显示出了一定的贡献。这非常令人鼓舞,说明我们的微观结构特征开始发挥作用了! 反思: alpha_5m (订单流) 的贡献度几乎为0。这可能是因为我们计算alpha的方式过于简单,或者5分钟的alpha与5分钟的价格变化本身包含了太多重复信息。这是我们未来一个重要的优化点。 3. 混淆矩阵 (成功的关键证据!) 真实涨(0): [22 0] -> 在所有22次真实上涨中,模型100%正确地预测了出来,一次都没有看错! 真实跌(1): [2 6] -> 在8次真实下跌中,模型正确预测了6次,失误了2次(把它看成了上涨)。 解读: 这个模型展现出了一个非常有趣的“性格”:它是一个极其强大的“多头”识别器,对上涨信号的捕捉几乎完美。同时,它在识别下跌时也表现不错(6/8 = 75%的准确率),但偶尔会犯“错把下跌当上涨”的错误。

那么接下来 引入“交易信号状态机” 这是本次升级最核心、也最巧妙的部分。我们将引入一个全局的状态变量,比如叫做 g_active_signal,来管理策略当前的“持仓”状态(注意,这只是一个虚拟的持仓状态,不涉及真实交易)。 这个状态机的工作逻辑如下:

- 初始状态:空闲 (Idle)

- 策略处于这个状态时,会像现在一样,对每一根新的K线进行预测。

- 状态转换:一旦模型预测出一个明确的信号(例如“上涨”),策略会:

- 在日志中打印一个醒目的、唯一的入场信号,例如 🎯 新的交易信号:预测上涨!观察周期15分钟。

- 将策略状态从空闲切换为持仓中 (In-Signal)。 记录下当前信号的触发时间和方向。

- 持仓状态:持仓中 (In-Signal)

- 当策略处于这个状态时,它会完全停止对新K线的预测。它不再关心每一分钟的波动,进入“让子弹飞”的模式。

- 它唯一要做的就是检查时间:从信号触发开始,是否已经过去了15分钟(即PREDICT_HORIZON的时长)。

- 状态转换:当15分钟的观察期结束后,策略会:

- 在日志中打印一个明确的离场信号,例如 🏁 信号周期结束。重置策略,寻找新机会…

- 将策略状态从持仓中切换回空闲。

- 此时,策略才会重新开始对新的K线进行预测,寻找下一个交易机会。

通过这个简单的状态机,我们就完美地实现了需求:一次信号,一次完整的观察周期,期间不再有任何干扰信息。

import json

import math

import time

import websocket

import threading

from datetime import datetime

import numpy as np

from sklearn import svm

from sklearn.preprocessing import StandardScaler

from sklearn.metrics import confusion_matrix, accuracy_score

from sklearn.feature_selection import mutual_info_classif

from sklearn.ensemble import RandomForestClassifier

# ========== 全局配置 ==========

TRAIN_BARS = 200 #需要更多初始数据

PREDICT_HORIZON = 15 # 回归15分钟预测周期

SPREAD_THRESHOLD = 0.005 # 适配15分钟周期的涨跌阈值

SYMBOL_FMZ = "ETH_USDT"

SYMBOL_API = SYMBOL_FMZ.replace('_', '').lower()

WEBSOCKET_URL = f"wss://fstream.binance.com/stream?streams={SYMBOL_API}@aggTrade/{SYMBOL_API}@depth20@100ms"

# ========== 全局状态变量 ==========

g_model, g_scaler = None, None

g_klines_1min, g_ticks, g_order_book_history = [], [], []

g_last_kline_ts = 0

g_feature_names = ['price_change_15m', 'volatility_30m', 'rsi_14', 'hour_of_day',

'alpha_15m', 'wobi_10s', 'spread_10s']

# 新功能: 信号状态机

g_active_signal = {'active': False, 'start_ts': 0, 'prediction': -1}

# ========== 特征工程与模型训练 ==========

def calculate_features_and_labels(klines, ticks, order_books_history, is_realtime=False):

features, labels = [], []

close_prices = [k['close'] for k in klines]

start_index = 30

end_index = len(klines) - PREDICT_HORIZON if not is_realtime else len(klines)

for i in range(start_index, end_index):

kline_start_ts = klines[i]['ts']

price_change_15m = (klines[i]['close'] - klines[i-15]['close']) / klines[i-15]['close']

volatility_30m = np.std(close_prices[i-30:i])

diffs = np.diff(close_prices[i-14:i+1]); gains = np.sum(diffs[diffs > 0]) / 14; losses = -np.sum(diffs[diffs < 0]) / 14

rsi_14 = 100 - (100 / (1 + gains / (losses + 1e-10)))

dt_object = datetime.fromtimestamp(kline_start_ts / 1000)

ticks_in_15m = [t for t in ticks if t['ts'] >= klines[i-15]['ts'] and t['ts'] < kline_start_ts]

buy_vol = sum(t['qty'] for t in ticks_in_15m if t['side'] == 'buy'); sell_vol = sum(t['qty'] for t in ticks_in_15m if t['side'] == 'sell')

alpha_15m = (buy_vol - sell_vol) / (buy_vol + sell_vol + 1e-10)

books_in_10s = [b for b in order_books_history if b['ts'] >= kline_start_ts - 10000 and b['ts'] < kline_start_ts]

if not books_in_10s: wobi_10s, spread_10s = 0, 0.0

else:

wobis, spreads = [], []

for book in books_in_10s:

if not book['bids'] or not book['asks']: continue

bid_vol = sum(float(p[1]) for p in book['bids']); ask_vol = sum(float(p[1]) for p in book['asks'])

wobis.append(bid_vol / (bid_vol + ask_vol + 1e-10))

spreads.append(float(book['asks'][0][0]) - float(book['bids'][0][0]))

wobi_10s = np.mean(wobis) if wobis else 0; spread_10s = np.mean(spreads) if spreads else 0

current_features = [price_change_15m, volatility_30m, rsi_14, dt_object.hour, alpha_15m, wobi_10s, spread_10s]

if not is_realtime:

future_price = klines[i + PREDICT_HORIZON]['close']; current_price = klines[i]['close']

if future_price > current_price * (1 + SPREAD_THRESHOLD):

labels.append(0); features.append(current_features)

elif future_price < current_price * (1 - SPREAD_THRESHOLD):

labels.append(1); features.append(current_features)

else:

features.append(current_features)

return np.array(features), np.array(labels)

def run_analysis_report(X, y, clf, scaler):

Log("--- 模型分析报告 V2.5 (15分钟预测) ---", "info")

Log("1. 特征重要性 (代理模型: 随机森林):")

rf = RandomForestClassifier(n_estimators=50, random_state=42); rf.fit(X, y)

importances = sorted(zip(g_feature_names, rf.feature_importances_), key=lambda x: x[1], reverse=True)

for name, importance in importances: Log(f" - {name}: {importance:.4f}")

Log("2. 特征与标签的互信息:"); mi_scores = mutual_info_classif(X, y)

mi_scores = sorted(zip(g_feature_names, mi_scores), key=lambda x: x[1], reverse=True)

for name, score in mi_scores: Log(f" - {name}: {score:.4f}")

Log("3. 历史数据回测表现:"); y_pred = clf.predict(scaler.transform(X)); accuracy = accuracy_score(y, y_pred)

Log(f" - **历史回测总胜率: {accuracy * 100:.2f}%**", "success")

Log("4. 混淆矩阵 (行:真实, 列:预测):"); cm = confusion_matrix(y, y_pred)

Log(" 预测涨(0) 预测跌(1)"); Log(f"真实涨(0): {cm[0] if len(cm) > 0 else [0,0]}")

Log(f"真实跌(1): {cm[1] if len(cm) > 1 else [0,0]}")

profit_chart = Chart({'title': {'text': f'历史回测净值曲线 (胜率: {accuracy*100:.2f}%)'}}); profit_chart.reset(); balance = 1

for i in range(len(y)):

if y_pred[i] == y[i]: balance *= (1 + 0.01)

else: balance *= (1 - 0.01)

profit_chart.add(i, balance)

Log("--- 报告结束, 5秒后进入实盘预测 ---", "info"); Sleep(5000)

def train_and_analyze():

global g_model, g_scaler, g_klines_1min, g_ticks, g_order_book_history

MIN_REQUIRED_BARS = 30 + PREDICT_HORIZON

if len(g_klines_1min) < MIN_REQUIRED_BARS:

Log(f"K线数量({len(g_klines_1min)})不足以进行特征工程,需要至少 {MIN_REQUIRED_BARS} 根。", "warning"); return False

Log("开始训练模型 (V2.5)...")

X, y = calculate_features_and_labels(g_klines_1min, g_ticks, g_order_book_history)

if len(X) < 20 or len(set(y)) < 2:

Log(f"有效涨跌样本不足(X: {len(X)}, 类别: {len(set(y))}),无法训练。", "warning"); return False

scaler = StandardScaler(); X_scaled = scaler.fit_transform(X)

clf = svm.SVC(kernel='rbf', C=1.0, gamma='scale'); clf.fit(X_scaled, y)

g_model, g_scaler = clf, scaler

Log("模型训练完成!", "success")

run_analysis_report(X, y, g_model, g_scaler)

return True

# ========== WebSocket实时数据处理 ==========

def aggregate_ticks_to_kline(ticks):

if not ticks: return None

return {'ts': ticks[0]['ts'] // 60000 * 60000, 'open': ticks[0]['price'], 'high': max(t['price'] for t in ticks), 'low': min(t['price'] for t in ticks), 'close': ticks[-1]['price'], 'volume': sum(t['qty'] for t in ticks)}

def on_message(ws, message):

global g_ticks, g_klines_1min, g_last_kline_ts, g_order_book_history

try:

payload = json.loads(message)

data = payload.get('data', {}); stream = payload.get('stream', '')

if 'aggTrade' in stream:

trade_data = {'ts': int(data['T']), 'price': float(data['p']), 'qty': float(data['q']), 'side': 'sell' if data['m'] else 'buy'}

g_ticks.append(trade_data)

current_minute_ts = trade_data['ts'] // 60000 * 60000

if g_last_kline_ts == 0: g_last_kline_ts = current_minute_ts

if current_minute_ts > g_last_kline_ts:

last_minute_ticks = [t for t in g_ticks if t['ts'] >= g_last_kline_ts and t['ts'] < current_minute_ts]

if last_minute_ticks:

kline = aggregate_ticks_to_kline(last_minute_ticks); g_klines_1min.append(kline)

g_ticks = [t for t in g_ticks if t['ts'] >= current_minute_ts]

g_last_kline_ts = current_minute_ts

elif 'depth' in stream:

book_snapshot = {'ts': int(data['E']), 'bids': data['b'], 'asks': data['a']}

g_order_book_history.append(book_snapshot)

if len(g_order_book_history) > 5000: g_order_book_history.pop(0)

except Exception as e: Log(f"OnMessage Error: {e}")

def start_websocket():

ws = websocket.WebSocketApp(WEBSOCKET_URL, on_message=on_message)

wst = threading.Thread(target=ws.run_forever); wst.daemon = True; wst.start()

Log("WebSocket多流订阅已启动...")

# ========== 主程序入口 ==========

def main():

global TRAIN_BARS, g_active_signal

exchange.SetContractType("swap")

start_websocket()

Log("策略启动 ,进入数据收集中...")

main.last_predict_ts = 0

while True:

if g_model is None:

if len(g_klines_1min) >= TRAIN_BARS:

if not train_and_analyze():

Log(f"模型训练失败,当前目标 {TRAIN_BARS} 根K线。将增加50根后重试...", "error")

TRAIN_BARS += 50

else:

LogStatus(f"正在收集K线数据: {len(g_klines_1min)} / {TRAIN_BARS}")

else:

if not g_active_signal['active']:

if len(g_klines_1min) > 0 and g_klines_1min[-1]['ts'] > main.last_predict_ts:

main.last_predict_ts = g_klines_1min[-1]['ts']

kline_time_str = datetime.fromtimestamp(main.last_predict_ts / 1000).strftime('%H:%M:%S')

if len(g_klines_1min) < 30:

LogStatus("历史K线不足,无法预测。等待更多数据..."); continue

latest_features, _ = calculate_features_and_labels(g_klines_1min, g_ticks, g_order_book_history, is_realtime=True)

if latest_features.shape[0] == 0:

LogStatus(f"({kline_time_str}) 无法生成特征,跳过..."); continue

last_feature_vector = latest_features[-1].reshape(1, -1)

last_feature_scaled = g_scaler.transform(last_feature_vector)

prediction = g_model.predict(last_feature_scaled)[0]

if prediction == 0 or prediction == 1:

g_active_signal['active'] = True

g_active_signal['start_ts'] = main.last_predict_ts

g_active_signal['prediction'] = prediction

prediction_text = ['**上涨**', '**下跌**'][prediction]

Log(f"🎯 新的交易信号 ({kline_time_str}): 预测 {prediction_text}!观察周期 {PREDICT_HORIZON} 分钟。", "success" if prediction == 0 else "error")

else:

LogStatus(f"({kline_time_str}) 无明确信号,继续观察...")

else:

current_ts = time.time() * 1000

elapsed_minutes = (current_ts - g_active_signal['start_ts']) / (1000 * 60)

if elapsed_minutes >= PREDICT_HORIZON:

Log(f"🏁 信号周期结束。重置策略,寻找新机会...", "info")

g_active_signal['active'] = False

else:

prediction_text = ['**上涨**', '**下跌**'][g_active_signal['prediction']]

LogStatus(f"信号生效中: {prediction_text}。剩余观察时间: {PREDICT_HORIZON - elapsed_minutes:.1f} 分钟。")

Sleep(5000)

然后这个代码我运行

深度解读:为什么会出现“完美”的100%胜率?

这个“完美”的结果,背后揭示了几个非常重要的、关于机器学习和金融市场的深刻道理。它不是一个Bug,而是一种在特定条件下会出现的、被称为“过拟合(Overfitting)”的典型现象。

“过拟合”是什么意思?

深度解读:为什么会出现“完美”的100%胜率?

这个“完美”的结果,背后揭示了几个非常重要的、关于机器学习和金融市场的深刻道理。它不是一个Bug,而是一种在特定条件下会出现的、被称为“过拟合(Overfitting)”的典型现象。

“过拟合”是什么意思?

一个生动的比喻:想象一下,我们让一个学生(我们的SVM模型)去做一套非常短、而且题目类型非常单一的练习题(我们收集到的200根K线数据)。这个学生非常聪明,他没有去学习解题的通用方法,而是直接把这几道题的答案给死记硬背了下来。

结果:当我们用同一套练习题去考他时(这就是我们的“历史回测”),他当然能拿到100分的满分。但是,一旦我们给他一套全新的、他没见过的考题(未来的真实市场),他很可能一道都做不出来。

- 为什么我们的模型会“过拟合”?

训练样本“太少”且“太特殊”:

虽然我们收集了200根K线(约3.3小时),但从日志看,最终筛选出的、符合我们定义的“有效涨跌”样本只有 18 + 7 = 25 个。

对于一个复杂的SVM模型来说,25个样本就如同汪洋大海中的几朵浪花,数量太少了。

更重要的是,这25个样本都来自于同一个下午的、一段高度相关的行情中。它们很可能拥有非常相似的“套路”。

- 模型能力“太强”:

- SVM是一个非常强大的、非线性的分类器。它的能力就像一个拥有超强记忆力的大脑。

- 当强大的模型去学习一个过于简单和重复的数据集时,它就会倾向于“死记硬背”这些数据的所有细节和噪音,而不是去学习背后那个更具普适性的宏观规律。

- 混淆矩阵的证据:

- 真实涨(0): [18 0] -> 18个上涨样本,全部完美记住。

- 真实跌(1): [0 7] -> 7个下跌样本,也全部完美记住。

- 这个完美的[ [18, 0], [0, 7] ]矩阵,就是模型“过拟合”的铁证。它几乎没有犯任何错误,这在充满随机性的金融市场中,本身就是一件“不正常”的事情。

所以,这个100%的胜率,我们应该这样解读:

“模型非常出色地学习并记忆了过去3个多小时这段特定行情下的所有规律。它证明了我们的特征工程和模型框架是有效的。但是,我们绝对不能指望它在未来的真实市场中,还能保持这么高的胜率。这更像是一次完美的‘随堂测验’,而不是‘高考’的最终成绩。”

机器学习也是我最近摸索的东西,我们下期在讲! 对这个“偏科生”进行一次彻底的“思想改造”。我们的目标是:打破它的偏见,让它公正地、客观地看待“上涨”和“下跌”。

- FMZ Platform Gold Rush: Practical Analysis of a Highly Flexible Python Trend Trading Framework

- 发明者平台淘金记:高灵活性Python趋势交易框架实战解析

- A Brief Discussion on Several Grid Trading Strategies in the Digital Currency Field

- 浅谈数字货币领域几种网格策略

- Data Stream Acceleration Guide Implementing Protobuf in FMZ Platform

- From Fixed Weights to Neural Networks Machine Learning for a Pine Strategy

- 从固定权重到神经网络:一个Pine策略的机器学习改造实践

- 数据流提速攻略:FMZ平台Protobuf技术实践

- A Brief Discussion on Digital Currency Market Making Strategies (2): Order Book Strategies

- 浅谈数字货币做市策略(2):盘口策略

- An Overview of Market Making Strategies in Crypto: Architecture Design and FMZ Implementation of the Self-Matching Trading Strategy

- 浅谈数字货币做市策略:对敲策略的架构设计与FMZ平台实现

- The Hottest AI Trading Technology of 2025: A Smart Trading Guide to FMZ Platform with Claude (Part 2)

- When Top Comments Meet AI Quant: A Journey Into Strategy Implementation

- 当网友神评论遇上AI量化:一个交易策略的实现之旅

- The Hottest AI Trading Technology of 2025: A Smart Trading Guide to FMZ Platform with Claude (Part 1)

- 2025年最火AI交易技术:FMZ平台Claude智能交易指南(2)

- 2025年最火AI交易技术:FMZ平台Claude智能交易指南(1)

- Exploration of Counter-Trend Short-Term Mean Reversion Strategy: A Learning Practice of "Volatility Statistical Arbitrage"

- 逆势短线均值回归策略探索:一次"波差统计套利"的学习实践