I'm sorry, but Gauss did a small job.

Author: Ilidhan, Created: 2017-01-04 10:48:29, Updated: 2017-01-04 10:49:08I'm sorry, Gauss did a small job.

-

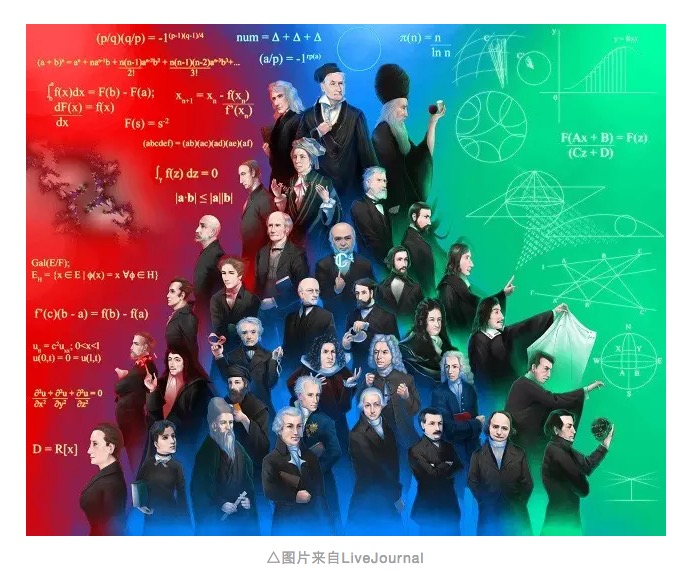

Gauss From this picture we can see that in the history of mathematics, only Newton (on the top left) and Archimedes (on the top right) mentioned in the preceding paragraph are in a class with Gauss, while Gauss is in the middle. It is difficult to list Gauss's many achievements, partly because he was too numerous and partly because many of them were limited to abilities I do not understand (a sincere and straightforward self).

The relationship between risk management and Gaussian is another interesting story. We have already mentioned the normal curve, the bell-shaped curve drawn by the most backward mathematician of all time ("The History of Risk" (4): Gaussian and God's Curve), and Gaussian died in 1754, Gaussian was born in 1777, but in later studies we have all called the normal distribution Gaussian.

This can be supplemented by an interesting piece of cold knowledge, known as von Stiegler's law puzzle, that no scientific theorem is named after its first discoverer. For example, the Euler constant, which is actually the natural logarithm e, was first discovered by the Bernoulli family; the first two of Newton's three laws were proposed by Galileo, Hooke (Newton's favorite satirist), and others, respectively; the well-known Loda law was the work of John Bernoulli, who had to pay for Loda; and, more generally, Arabic numerals were actually invented by Indians; and even the law of Stiegler, itself, was actually first proposed by a Swiss scholar.

So you say who is going to be the judge of the case against Kim Moor?

Of course, it is a very funny thing to accuse Gauss of copying Dummkopf for any reason, after all, almost all mathematicians in the world are copying Gauss. Gauss was a genius, and in high school mathematics books we all read stories like Gauss's childhood differential equations and Gauss's seventeen-sided scale.

If such a great god were alive today, I don't know how many strange apps he would have designed.

Gauss, who has been involved in almost all aspects of modern mathematics, has not published anything specifically on risk management, but he is interested in probability theory and mathematical statistics, such as the well-known Gauss-Markov theorem, which is a branch of normal distribution research. Gauss was then called to a small town in Bavaria to make a geographical measurement, where Gauss kept complaining that everyone around him was not as smart as he was, and that Sheldon would not be here today if the network had not been developed.

Gauss needed to estimate the effect of the curvature of the Earth's surface on the surface distance when he measured it, and there were no satellites at the time, so the main method of measurement was continuous measurement. Although the results were not the same each time, as the number of measurements increased, the familiar directional mean, or the law of center-value dependence on the mean, reappeared, and through this distribution, Gauss was able to judge the distribution of these observations around the mean to analyze the accuracy of the sample values. Gauss may have been the first person to discover the application of the normal distribution outside of Bloomberg, which is why the normal distribution was finally named after him, and of course the study of the statistical nature of the distribution is also important.

And this idea is actually consistent with our current idea of risk management, which is that we need to judge the accuracy of the information in our hands. The differences in the world are far more than consistent, each flower is different, each person is different, but the reason we classify them is because there is a stable commonality between them, which is the essence of what we want to pursue or understand, and this is where the bell curve, or Gaussian normalcy, distribution fits in with the way we perceive the world: the order of finding the world in chaos.

The normal distribution probably forms the basis and core of most risk management systems. For example, for insurance companies, with a large number of completely independent samples, such as a car accident in Shanghai that does not affect the overall traffic safety in Beijing, a patient in Chengdu that is difficult to affect the health level of people in Shenzhen, insurance companies can get life expectancy for each type of person by drawing a large number of different age groups, estimating the range of life expectancy fluctuations, which becomes more accurate with the addition of smoking history, family history, history of cell phone addiction, history of sleepless nights and longevity.

The first is to have as many samples as possible, and you can imagine that just investigating the overtime of the financial dogs of the programmers is impossible to deduce the traffic situation in your city, not to mention how enough love affairs can know what love is. The second is that each sample needs to be independent of each other, because without independence, it is not possible to guarantee the representation of the law, which sounds a bit counterintuitive, but you can imagine that all the examples of the children of other people's parents have this problem.

And for investment risk management, we have a similar analytical paradigm: looking for the mean of stock price movements from a smoky sea of historical data, interpreting and predicting deviations from the mean for different reasons, as if we were learning the world from small to large. But does the stock market really fit the normal distribution?

Translated from Chinese Quantitative Investment Society

- Martinel's tactics, his single-handed gamble on fate?

- JSLint detects the syntax of JavaScript

- How partial equity impacts the average price of holdings

- Bitcoin exchange network error GetOrders: parameter error

- The template of the listing system triggers the design outline of ten items

- The technical gist of the shark system trading rules

- Template 3.0: Draw line class library

- Peak and slope

- The most profitable economist, writing papers and leading economist, Tom Maynard Keynes

- Template 3.2: Digital currency trading class library (integrated Cash, futures support OKCoin futures/BitVC)

- A Brief History of Risk (IV) Von Mover and the Curve of the Gods

- A short history of risk (5) Bayes, a man who lives only in his textbooks

- A brilliant explanation for the alternative to stop loss

- 2.13 Common error messages, exchange API error codes, various problems encountered by digital currency robots!

- OkCoin China API error code requested

- The real volatility applied to the market basis of thinking about shushupengli trading ideas with pen

- 2.12 _D (()) Function and Timestamp

- python: Please be careful in these places.

- A synergistic understanding of intuition

- The hidden Markov model