China's four largest futures exchanges exposed

Author: The Little Dream, Created: 2017-02-09 09:54:15, Updated:China's four largest futures exchanges exposed

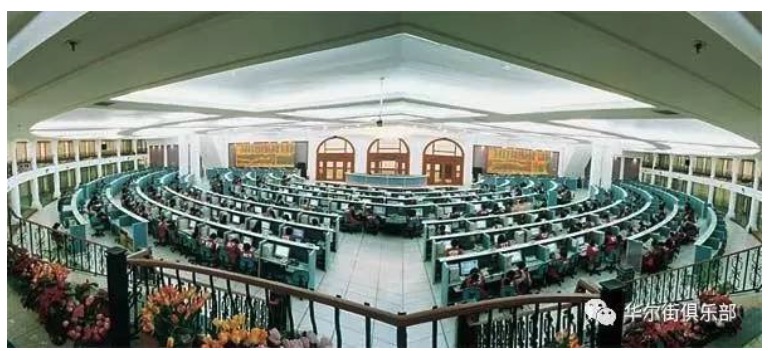

Compared to stocks, futures are a bit mysterious, futures are a type of financial derivative, so where are they traded? Futures are a financial derivative, so where are they traded? Futures, as a formal contractual contract, have their own centralized trading venues and are generally traded on formal, dedicated futures exchanges. The Chicago Futures Exchange, the New York Commodity Exchange, the London Metals Exchange and the London International Petroleum Exchange are all well known abroad. There are four official futures exchanges in China: the China Financial Futures Exchange, the Dalian Commodity Exchange, the Zhejiang Commodity Exchange, and the Shanghai Futures Exchange.

-

China's four largest futures exchanges unveiled

For futures trading, the exchange is a good place to start. It addresses the previously chaotic and disorderly trading situation and provides the traders with a system of support services related to futures trading, such as varieties, settlements, wind control, etc.

There are four regular futures exchanges in China, of which the financial futures are traded on the Chinese Financial Futures Exchange, while the commodity futures are traded on the other three futures exchanges.

Of these four, the most famous should be the China Financial Futures Exchange, after all, the name of the title is China, the brand is loud, it is natural to feel that the position is also higher than the other three, financial-related futures are all concentrated here.

The other three futures exchanges named after the city are located at a glance, basically above the sea futures exchanges are the most famous, and the upper and middle gold exchanges are very close.

Both the Dalian Commodity Exchange and the Zhejiang Commodity Exchange, which are not called futures exchanges, are directly named after commodities, which also indirectly reflects the characteristics of their trading varieties.

-

Trade varieties

Futures can be classified into commodity futures, financial futures, precious metals futures, foreign exchange futures, interest rate futures, etc. Each exchange lists different types of futures, each with its own division of labor.

There are only two varieties listed on the market by the most prominent central banks, stock futures (IF) and government bonds (TF). Although the type is simply a rough one, the volume of these two varieties in the futures trading market is the medium-stream column, accounting for about half of the capacity.

In the last few years, the listed varieties, mainly metals, are the main metal trading venues in the country, with gold, silver, also screw steel, aluminum, copper and other varieties.

The supermarket has both agricultural products such as beans, corn, eggs, and industrial products such as plastics, PVC, iron ore. But the supermarket is also known for its soybean meal as a futures trading variety. Soybean meal is a high-protein, can be used as a main raw material for livestock and poultry feed, so its price fluctuations directly affect the price of meat and poultry, is the trading leader in agricultural products.

The last outlet, which is still mainly agricultural, has white sugar, wheat, rapeseed oil, cotton, etc., as well as raw materials for the textile industry such as PTA, raw materials for power plants such as coal.

We can see that four of the futures trading varieties are financial assets, while the other three are mainly VW products.

Kate from the CFA Research Centre at Gauntlet points out that futures are as high risk as stocks, and that price movements in futures affect many industries at home and abroad.

Translated from The Wall Street Club

- High-frequency strategy: exchange of applications for cabbage harvesters

- Leaving school for a low level of hard work is a trap

- Talk about network trading law

- It's incredible how easy it is to make a profit on futures.

- 2.10.2 Variable values in the API documentation

- Your biggest enemy is inertial thinking.

- Foolish trading: the power of rules

- 2.7.1 Windows 32-bit system Python 2.7 environment Install the talib index library

- Details of futures options

- Why are many commodity futures contracts primarily traded in January, May and September each year?

- 1.4 Futures Basics of knowledge

- Not support market order error

- Inventors describe the mechanism of quantitative analogue level retesting

- The K-Line is not compatible with mainstream channels.

- Quantitative trading "reverse investment from the mean to the return"

- I've been reading a lot about equity, counter-equity, the profit formula, the gambler's loss theorem (very inspiring).

- The Deutsche Bank study notes several common mistakes in the quantification strategy

- Bitcoin contracts for okcoin: the dollar-renminbi exchange rate problem

- The more complex the method, the more it deviates from the essence of the transaction.

- Quantified trading strategies for the CCI indicator