15 MIN BTCUSDTPERP BOT

El autor:¿ Qué pasa?, Fecha: 23 de mayo de 2022 16:26:54Las etiquetas:ADXLas medidas de seguridadIndicador de riesgoEl TWAPEl JMAEl MACD

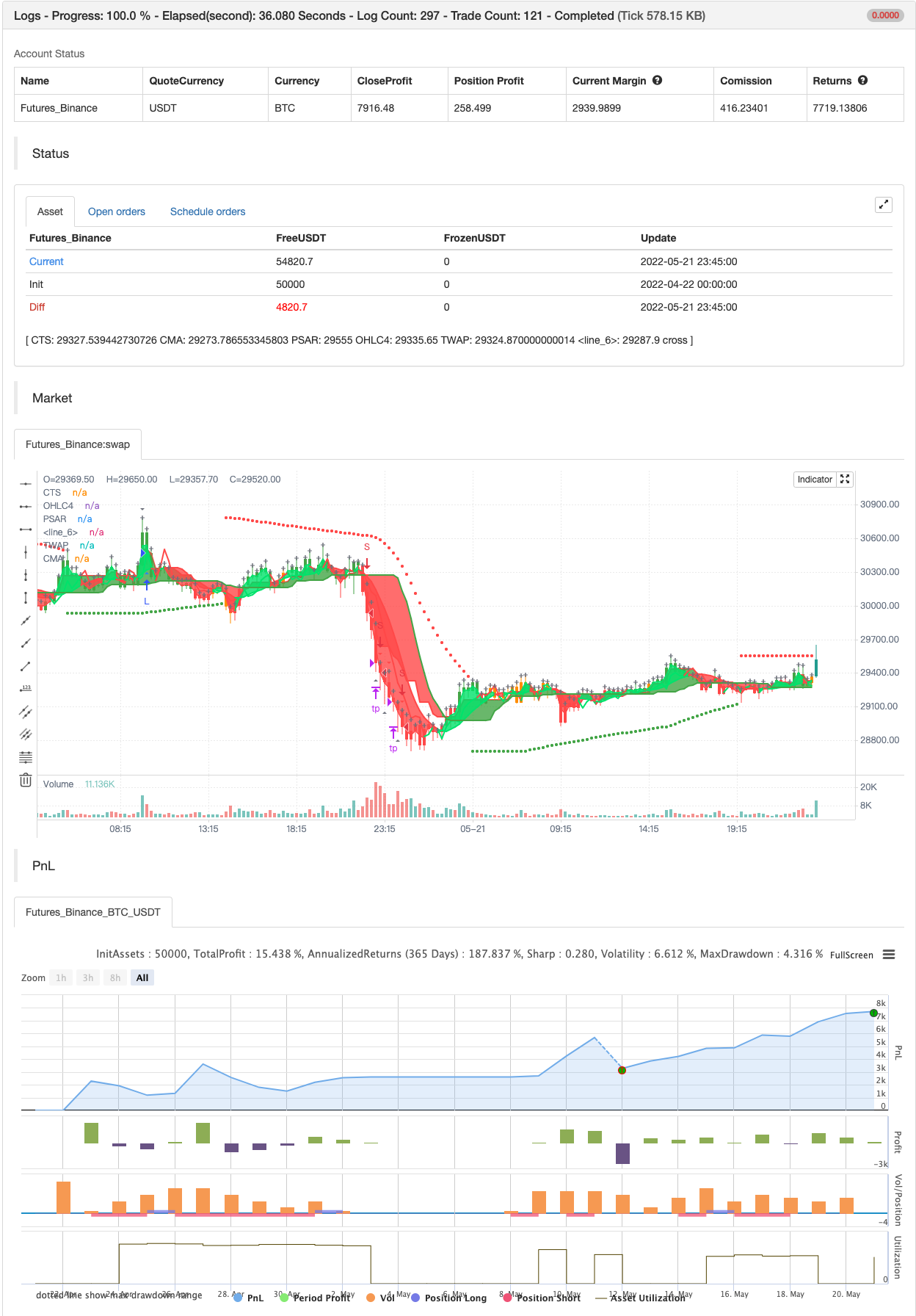

Este es mi BTCUSDTPERP 15 min bot Los mejores resultados son en BTCUSDTPERP en binancefutures Los resultados dependen de los indicadores de volumen específicos que funcionan mejor en binancefutures

Los bots de 15 minutos son muy rápidos, es difícil encontrar una buena configuración, debido a 15 minutos de backtesting que al menos alrededor de 3-4 meses

Este bot es específico tiene un muy alto % de operaciones rentables. El beneficio neto es también muy bueno. Sin embargo, los bots de 15 minutos son extremadamente difíciles de usar a largo plazo, así que hice los ajustes de desinflación que pude.

Así que... Este bot usa 11 indicadores diferentes:

-

ADX

-

Filtro de rango

-

Las medidas de seguridad

-

Indicador de riesgo

-

El TWAP

-

El JMA

-

El MACD

-

VOLUME DELTA

-

Peso del volumen

-

- ¿Qué es? y el último para los mejores resultados en los gráficos de qucik (15 min) decidí añadir:

-

STOCH

-

ADX - - hace una visión sólida de la tendencia sin ningún tipo de trampa: largo sólo en barras verdes, cortos sólo en barras rojas.

-

Filtro de rango - este indicador es para una mejor visión de las tendencias, definir las tendencias, que es importante para todas las trampas toro/oso que ayuda mucho debido a las tendencias muy variables.

-

SAR - El SAR parabólico es un indicador técnico utilizado para determinar la dirección del precio de un activo, así como llamar la atención sobre cuándo está cambiando la dirección del precio.

-

El valor del RSI ayuda a la estrategia a detener el comercio en el momento adecuado. Cuando el RSI está sobrecomprado, la estrategia no abre nuevos tramos largos, también cuando el RSI está sobrevendido, la estrategia no abre nuevos cortos.

-

TWAP - tiene la misma tarea que el filtro de rango, es sólo para una mejor visión de las tendencias, definir las tendencias.

-

JMA - El indicador Jurik Moving Average es una de las maneras más seguras de suavizar las curvas de precios dentro de un lapso de tiempo mínimo. El indicador ofrece a los operadores de divisas uno de los mejores filtros de precios durante los movimientos de precios fuertes. En este momento, cuando la acción del precio del bitcoin es tan fuerte, este indicador es necesario.

-

El MACD - Moving average convergence divergence (MACD) es un indicador de impulso de tendencia que muestra la relación entre dos promedios móviles del precio de un valor. El MACD se calcula restando la media móvil exponencial de 26 períodos (EMA) de la EMA de 12 períodos. Hoy en día, MACD al igual que JMA es necesario para hacer un bot rentable.

-

Volume Delta - Un enfoque cumulativo de volumen delta basado en el indicador de balance de toro y oso de Vadim Gimelfarb publicado en la edición de octubre de 2003 de la revista S&C. Ajuste la longitud de la media móvil de acuerdo con sus necesidades (símbolo, marco de tiempo, etc.)

-

Peso de volumen - es el indicador más importante para la estrategia, para evitar operaciones abiertas en gráfico plano, las nuevas operaciones se abren después de una fuerte barras de volumen.

-

MA 5-10-30 - como los anteriores esto es para una mejor visión de las tendencias, y definir correctamente las tendencias, también Speed_MA están utilizando para predecir la acción futura del precio.

-

El stochastic-stock es útil para predecir inversiones de tendencia. También se centra en el impulso de los precios y se puede utilizar para identificar los niveles de sobrecompra y sobreventa

Disfruta.

Prueba posterior

/*backtest

start: 2022-05-20 00:00:00

end: 2022-06-18 23:59:00

period: 45m

basePeriod: 5m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © wielkieef

//@version=4

strategy("15MIN BTCUSDTPERP BOT", overlay=true, pyramiding=1,initial_capital = 10000, default_qty_type= strategy.percent_of_equity, default_qty_value = 100, calc_on_order_fills=false, slippage=0,commission_type=strategy.commission.percent,commission_value=0)

//SOURCE ==================================================================================================================================================================================================================================================================

src = input(ohlc4)

// INPUTS ==================================================================================================================================================================================================================================================================

//ADX -------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Act_ADX = input(true, title = "AVERAGE DIRECTIONAL INDEX", type = input.bool)

ADX_options = input("MASANAKAMURA", title = "ADX OPTION", options = ["CLASSIC", "MASANAKAMURA"])

ADX_len = input(11, title = "ADX LENGTH", type = input.integer, minval = 1)

th = input(12, title = "ADX THRESHOLD", type = input.float, minval = 0, step = 0.5)

//Range Filter----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

length0 = input(13, title="Range Filter lenght"),mult = input(1, title="Range Filter mult")

//SAR-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

start = input(title="SAR Start", type=input.float, step=0.001, defval=0)

increment = input(title="SAR Increment", type=input.float, step=0.001, defval=0.006)

maximum = input(title="SAR Maximum", type=input.float, step=0.01, defval=1)

width = input(title="SAR Point Width", type=input.integer, minval=1, defval=1)

//RSI---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

len_3 = input(70, minval=1, title="RSI lenght")

src_3 = input(close, "RSI Source")

//TWAP Trend --------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

smoothing = input(title="TWAP Smoothing", defval= 10)

resolution = input("0", "TWAP Timeframe")

//JMA------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

inp = input(title="JMA Source", type=input.source, defval=close)

reso = input(title="JMA Resolution", type=input.resolution, defval="")

rep = input(title="JMA Allow Repainting?", type=input.bool, defval=false)

src0 = security(syminfo.tickerid, reso, inp[rep ? 0 : barstate.isrealtime ? 1 : 0])[rep ? 0 : barstate.isrealtime ? 0 : 1]

lengths = input(title="JMA Length", type=input.integer, defval=4, minval=1)

//MACD------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

fast_length = input(title="MACD Fast Length", type=input.integer, defval=25)

slow_length = input(title="MACD Slow Length", type=input.integer, defval=50)

signal_length = input(title="MACD Signal Smoothing", type=input.integer, minval = 1, maxval = 50, defval = 9)

//Volume Delta -----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

periodMa = input(title="Delta Length", minval=1, defval=45)

//Volume weight------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

maLength = input(title="Volume Weight Length", type=input.integer, defval=100, minval=1)

maType = input(title="Volume Weight Type", type=input.string, defval="SMA", options=["EMA", "SMA", "HMA", "WMA", "DEMA"])

rvolTrigger = input(title="Volume To Trigger Signal", type=input.float, defval=1.5, step=0.1 , minval=0.1)

//MA----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

length = input(51, minval=1, title="MA Length")

matype = input(5, minval=1, maxval=5, title="AvgType")

//Momentum------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

tmolength = input(45, title="Momentum Length")

calcLength = input(12, title="Momentum Calc length")

smoothLength = input(9, title="Momentum Smooth length")

//INDICATORS ==============================================================================================================================================================================================================================================================

//ADX----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

calcADX(_len) =>

up = change(high)

down = -change(low)

plusDM = na(up) ? na : (up > down and up > 0 ? up : 0)

minusDM = na(down) ? na : (down > up and down > 0 ? down : 0)

truerange = rma(tr, _len)

_plus = fixnan(100 * rma(plusDM, _len) / truerange)

_minus = fixnan(100 * rma(minusDM, _len) / truerange)

sum = _plus + _minus

_adx = 100 * rma(abs(_plus - _minus) / (sum == 0 ? 1 : sum), _len)

[_plus,_minus,_adx]

calcADX_Masanakamura(_len) =>

SmoothedTrueRange = 0.0

SmoothedDirectionalMovementPlus = 0.0

SmoothedDirectionalMovementMinus = 0.0

TrueRange = max(max(high - low, abs(high - nz(close[1]))), abs(low - nz(close[1])))

DirectionalMovementPlus = high - nz(high[1]) > nz(low[1]) - low ? max(high - nz(high[1]), 0) : 0

DirectionalMovementMinus = nz(low[1]) - low > high - nz(high[1]) ? max(nz(low[1]) - low, 0) : 0

SmoothedTrueRange := nz(SmoothedTrueRange[1]) - (nz(SmoothedTrueRange[1]) /_len) + TrueRange

SmoothedDirectionalMovementPlus := nz(SmoothedDirectionalMovementPlus[1]) - (nz(SmoothedDirectionalMovementPlus[1]) / _len) + DirectionalMovementPlus

SmoothedDirectionalMovementMinus := nz(SmoothedDirectionalMovementMinus[1]) - (nz(SmoothedDirectionalMovementMinus[1]) / _len) + DirectionalMovementMinus

DIP = SmoothedDirectionalMovementPlus / SmoothedTrueRange * 100

DIM = SmoothedDirectionalMovementMinus / SmoothedTrueRange * 100

DX = abs(DIP-DIM) / (DIP+DIM)*100

adx = sma(DX, _len)

[DIP,DIM,adx]

[DIPlusC,DIMinusC,ADXC] = calcADX(ADX_len)

[DIPlusM,DIMinusM,ADXM] = calcADX_Masanakamura(ADX_len)

DIPlus = ADX_options == "CLASSIC" ? DIPlusC : DIPlusM

DIMinus = ADX_options == "CLASSIC" ? DIMinusC : DIMinusM

ADX = ADX_options == "CLASSIC" ? ADXC : ADXM

ADX_color = DIPlus > DIMinus and ADX > th ? color.green : DIPlus < DIMinus and ADX > th ? color.red : color.orange

barcolor(color = Act_ADX ? ADX_color : na, title = "ADX")

//Range Filter---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

out = 0., cma = 0., cts = 0.

Var = variance(src,length0)*mult

sma = sma(src,length0)

secma = pow(nz(sma - cma[1]),2)

sects = pow(nz(src - cts[1]),2)

ka = Var < secma ? 1 - Var/secma : 0

kb = Var < sects ? 1 - Var/sects : 0

cma := ka*sma+(1-ka)*nz(cma[1],src)

cts := kb*src+(1-kb)*nz(cts[1],src)

css = cts > cma ? color.green : color.red

a = plot(cts,"CTS",color.red,2,transp=0)

b = plot(cma,"CMA",color.green,2,transp=0)

fill(a,b,color=css,transp=80)

rangegood = cts > cma

rangebad = cts < cma

//SAR-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

psar = sar(start, increment, maximum)

dir = psar < close ? 1 : -1

psarColor = dir == 1 ? color.green : color.red

psarPlot = plot(psar, title="PSAR", style=plot.style_circles, linewidth=width, color=psarColor, transp=0)

var color longColor = color.green

var color shortColor = color.red

sargood = dir ==1

sarbad = dir ==-1

//RSI---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

up_3 = rma(max(change(src_3), 0), len_3)

down_3 = rma(-min(change(src_3), 0), len_3)

rsi_3 = down_3 == 0 ? 100 : up_3 == 0 ? 0 : 100 - (100 / (1 + up_3 / down_3))

rsiob = (rsi_3 < 70)

rsios = (rsi_3 > 30)

//TWAP Trend --------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

res = resolution != "0" ? resolution : timeframe.period

weight = barssince(change(security(syminfo.tickerid, res, time, lookahead=barmerge.lookahead_on)))

price = 0.

price:= weight == 0 ? src : src + nz(price[1])

twap = price / (weight + 1)

ma_ = smoothing < 2 ? twap : sma(twap, smoothing)

bullish = iff(smoothing < 2, src >= ma_, src > ma_)

disposition = bullish ? color.lime : color.red

basis = plot(src, "OHLC4", disposition, linewidth=1, transp=100)

work = plot(ma_, "TWAP", disposition, linewidth=2, transp=20)

fill(basis, work, disposition, transp=65)

//JMA------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

jsa = (src0 + src0[lengths]) / 2

sig = src0 > jsa ? 1 : src0 < jsa ? -1 : 0

jsaColor = sig > 0 ? color.lime : sig < 0 ? color.red : color.orange

plot(jsa, color=jsaColor, linewidth=2)

jmagood = sig > 0

jmabad = sig < 0

//MACD------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

fast_ma = ema(src, fast_length)

slow_ma = ema(src, slow_length)

macd = fast_ma - slow_ma

signal = sma(macd, signal_length)

macdgood = macd > signal

macdbad = macd < signal

//Volume Delta -----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

bullPower = iff(close < open, iff(close[1] < open, max(high - close[1], close - low), max(high - open, close - low)), iff(close > open, iff(close[1] > open, high - low, max(open - close[1], high - low)), iff(high - close > close - low, iff(close[1] < open, max(high - close[1], close - low), high - open), iff(high - close < close - low, iff(close[1] > open, high - low, max(open - close[1], high - low)), iff(close[1] > open, max(high - open, close - low), iff(close[1] < open, max(open - close[1], high - low), high-low))))))

bearPower = iff(close < open, iff(close[1] > open, max(close[1] - open, high - low), high - low), iff(close > open, iff(close[1] > open, max(close[1] - low, high - close), max(open - low, high - close)), iff(high - close > close - low, iff(close[1] > open, max(close[1] - open, high - low), high - low), iff(high - close < close - low, iff(close[1] > open, max(close[1] - low, high - close), open - low), iff(close[1] > open, max(close[1] - open, high - low), iff(close[1] < open, max(open - low, high - close), high - low))))))

bullVolume = (bullPower / (bullPower + bearPower)) * volume

bearVolume = (bearPower / (bullPower + bearPower)) * volume

delta = bullVolume - bearVolume

cvd = cum(delta)

cvdMa = sma(cvd, periodMa)

deltagood = cvd > cvdMa

deltabad = cvd < cvdMa

//Volume weight------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

getMA0(length) =>

maPrice = ema(volume, length)

if maType == "SMA"

maPrice := sma(volume, length)

if maType == "HMA"

maPrice := hma(volume, length)

if maType == "WMA"

maPrice := wma(volume, length)

if maType == "DEMA"

e1 = ema(volume, length)

e2 = ema(e1, length)

maPrice := 2 * e1 - e2

maPrice

ma = getMA0(maLength)

rvol = volume / ma

volumegood = volume > rvolTrigger * ma

//MA----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

ma5 = sma(close, 5)

ma10 = sma(close, 10)

ma30 = sma(close, 30)

magood = ma5 > ma30

mabad = ma5 < ma30

simplema = sma(src,length)

exponentialma = ema(src,length)

hullma = wma(2*wma(src, length/2)-wma(src, length), round(sqrt(length)))

weightedma = wma(src, length)

volweightedma = vwma(src, length)

avgval = matype==1 ? simplema : matype==2 ? exponentialma : matype==3 ? hullma : matype==4 ? weightedma : matype==5 ? volweightedma : na

MA_speed = (avgval / avgval[1] -1 ) *100

masgood = MA_speed > 0

masbad = MA_speed < 0

//Momentum-----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

data = 0

for i = 1 to tmolength-1

if close > open[i]

data := data + 1

if close < open[i]

data := data - 1

EMA5 = ema(data, calcLength)

Main = ema(EMA5, smoothLength)

Signal = ema(Main, smoothLength)

momentumgood = Main > Signal

momentumbad = Main < Signal

//STRATEGY===============================================================================================================================================================================================================================================================

Long = (DIPlus > DIMinus and ADX > th) and volumegood and sargood and rsiob and macdgood and deltagood and magood and masgood and bullish and jmagood and rangegood and momentumgood

Short = (DIPlus < DIMinus and ADX > th) and volumegood and sarbad and rsios and macdbad and deltabad and mabad and masbad and jmabad and rangebad and momentumbad

//BACKTESTING==========================================================================================================================================================================================================================

// ————— Backtest input

Act_BT = input(true, title = "BACKTEST", type = input.bool)

backtest_time = input(180, title ="BACKTEST DAYS", type = input.integer, minval = 1)*24*60*60*1000

entry_Type = input("% EQUITY", title = "ENTRY TYPE", options = ["CONTRACTS","CASH","% EQUITY"])

et_Factor = (entry_Type == "CONTRACTS") ? 1 : (entry_Type == "% EQUITY") ? (100/(strategy.equity/close)) : close

//Signals----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

// SL AND TP-----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

stopPer = input(3.6, title='Stop Loss % [plotshape]', type=input.float) / 100

takePer = input(0.8, title='Take Profit % [plotshape]', type=input.float) / 100

long_short = 0

long_last = Long and (nz(long_short[1]) == 0 or nz(long_short[1]) == -1)

short_last = Short and (nz(long_short[1]) == 0 or nz(long_short[1]) == 1)

long_short := long_last ? 1 : short_last ? -1 : long_short[1]

longPrice = valuewhen(long_last, close, 0)

shortPrice = valuewhen(short_last, close, 0)

longStop = longPrice * (1 - stopPer)

shortStop = shortPrice * (1 + stopPer)

longTake = longPrice * (1 + takePer)

shortTake = shortPrice * (1 - takePer)

//plot lines ---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

plotshape(long_short==1 ? longTake : na, style=shape.cross, color=color.gray, location=location.absolute )

plotshape(long_short==-1 ? shortTake : na, style=shape.cross, color=color.gray, location=location.absolute )

longBar1 = barssince(long_last)

longBar2 = longBar1 >= 1 ? true : false

shortBar1 = barssince(short_last)

shortBar2 = shortBar1 >= 1 ? true : false

Long_SL = long_short==1 and longBar2 and low < longStop

Short_SL = long_short==-1 and shortBar2 and high > shortStop

Long_TP = long_short==1 and longBar2 and high > longTake

Short_TP = long_short==-1 and shortBar2 and low < shortTake

long_short := (long_short==1 or long_short==0) and longBar2 and (Long_SL or Long_TP) ? 0 : (long_short==-1 or long_short==0) and shortBar2 and (Short_SL or Short_TP) ? 0 : long_short

last_long_cond = Long and long_last

last_short_cond = Short and short_last

//plotshapes---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

plotshape(last_long_cond, title="Long x1", color=color.blue, style=shape.triangleup, location=location.belowbar, size=size.small, textcolor=color.white, text="Long" , transp=1)

plotshape(last_short_cond, title="Short x1", color=color.red, style=shape.triangledown, location=location.abovebar, size=size.tiny, textcolor=color.white, text="Short" ,transp=1)

plotshape(Long_SL, location=location.belowbar, color=color.black, size=size.tiny , text="SL", textcolor=color.fuchsia)

plotshape(Short_SL, location=location.abovebar, color=color.black, size=size.tiny , text="SL", textcolor=color.fuchsia)

plotshape(Long_TP,style=shape.triangledown, location=location.abovebar, color=color.gray, size=size.tiny , text="TP", textcolor=color.red)

plotshape(Short_TP,style=shape.triangleup, location=location.belowbar, color=color.gray, size=size.tiny , text="TP", textcolor=color.green)

if last_long_cond and Act_BT

strategy.entry("L", strategy.long)

if last_short_cond and Act_BT

strategy.entry("S", strategy.short)

per(pcnt) =>

strategy.position_size != 0 ? round(pcnt / 100 * strategy.position_avg_price / syminfo.mintick) : float(na)

stoploss=input(title=" stop loss [BT]", defval=3.6, minval=0.01)

los = per(stoploss)

q=input(title=" qty percent", defval=100, minval=1)

tp=input(title=" Take profit [BT]", defval=0.8, minval=0.01)

strategy.exit("tp", qty_percent = q, profit = per(tp), loss = los)

//By wielkieef

- Teoría de las ondas de Elliott 4-9 Detección automática de ondas de impulso Estrategia de negociación

- El BOT de Johnny

- VuManChu Cifrado B + Divergencias Estrategia

- Estrategia de cuadrícula de posición variable basada en la tendencia

- Estrategia dinámica de DCA basada en el volumen

- El valor de las emisiones de gases de efecto invernadero se calculará en función de las emisiones de gases de efecto invernadero.

- Estrategia de negociación a largo plazo combinada del MACD y del RSI

- Estrategia de divergencia de precios v1.0

- Estrategia de negociación de alta frecuencia de criptomonedas estable y de bajo riesgo basada en el RSI y el MACD

- MACD RSI Ichimoku Tendencia de impulso después de una estrategia larga

- Super Scalper - 5 Min 15 Min

- Indice de fuerza relativa - Divergencias - Libertus

- Regresión lineal ++

- RedK Dual VADER con barras de energía

- Zonas de consolidación - en vivo

- Estimación cualitativa cuantitativa

- Alerta cruzada de promedio móvil, marco de tiempo múltiple (MTF)

- La estrategia de recarga del MACD

- Promedios móviles con tendencia superior

- Negociación de ABC

- Entropía de Shannon V2

- Supertrend ATR con el seguimiento de la parada de pérdidas

- Flujo de volumen v3

- Scalping por hora de futuros de criptomonedas con ma & rsi - ogcheckers

- ATR suavizado

- Buscador de bloques de orden

- TendenciaScalp-FractalBox-3EMA

- Señales de QQE

- Selección de amplitud de red en U

- Indicador personalizado CM MACD - Marco de tiempo múltiple - V2