15 мин BTCUSDTPERP BOT

Автор:Чао Чжан, Дата: 23 мая 2022 16:26:54Тэги:ADXSARРСИTWAPJMAMACD

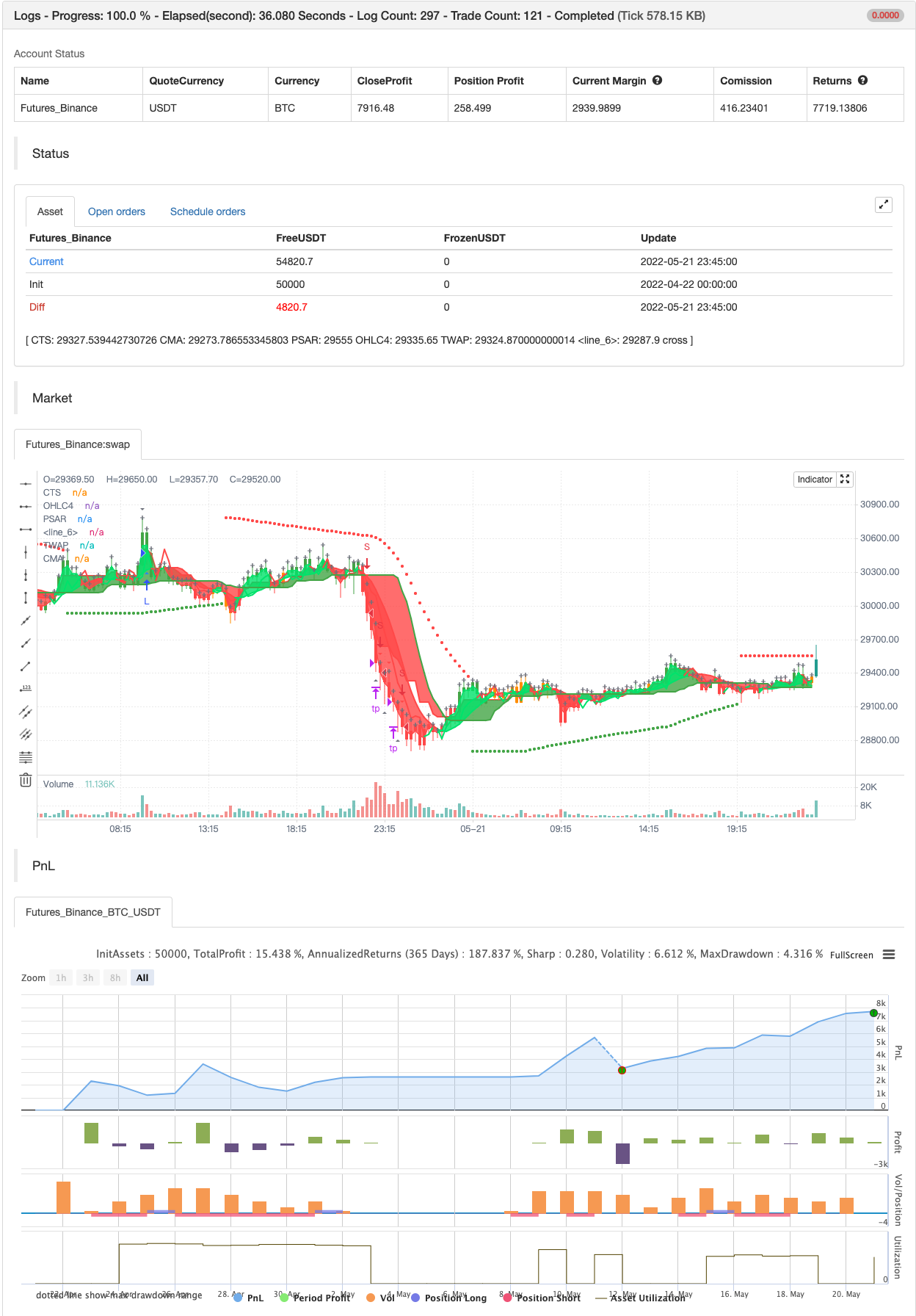

Это мой бот BTCUSDTPERP 15 мин. Лучшие результаты на BTCUSDTPERP на binancefutures Результаты зависят от конкретных показателей объема, которые лучше всего работают на binancefutures

15-минутные боты очень быстрые, трудно найти хорошую конфигурацию, из-за 15-минутного бэкстестинга, который как минимум около 3-4 месяцев

Этот бот имеет очень высокий процент выгодных сделок. Чистая прибыль также очень хороша. Однако 15 минут ботов чрезвычайно трудно использовать в долгосрочной перспективе, поэтому я сделал как дефлоут настройки, как я могу.

Так что... Этот бот использует 11 различных индикаторов:

-

ADX

-

ФИЛТЕР диапазона

-

SAR

-

РСИ

-

TWAP

-

JMA

-

MACD

-

Объем DELTA

-

ВОЛУМЕННЫЙ ВАЖ

-

М.А. и последний для лучших результатов на qucik графики (15 мин) Я решил добавить:

-

СТОЧ

-

ADX - - дает твердое представление о тренде без каких-либо мошеннических фитилей: длинный только на зеленых полосках, короткий только на красных полосках.

-

РАЗНОЖЕНИЕ ФИЛТЕРА - этот показатель предназначен для лучшего представления тенденций, определения тенденций, что важно для всех бычьих/медвежьих ловушек, что очень помогает из-за очень переменных тенденций.

-

SAR - Параболический SAR - это технический индикатор, используемый для определения направления цены актива, а также привлечения внимания к тому, когда изменяется направление цены.

-

RSI- значение помогает стратегии прекратить торговлю в нужное время. когда RSI перекупленная стратегия не открывать новые длинные, также когда RSI перепроданная стратегия не открывать новые короткие

-

TWAP - имеет ту же задачу, что и Range Filter, только для лучшего просмотра тенденций, определения тенденций.

-

JMA - индикатор Jurik Moving Average является одним из самых надежных способов сглаживания кривых цен в течение минимального промежутка времени.

-

MACD - Moving average convergence divergence (MACD) - индикатор импульса, показывающий взаимосвязь между двумя скользящими средними ценами ценных бумаг. MACD рассчитывается путем вычитания 26-периодного экспоненциального скользящего среднего (EMA) из 12-периодного EMA. Сегодня MacD, как и JMA, необходим для создания прибыльных ботов.

-

Volume Delta - Cumulative Volume Delta approach, основанный на индикаторе баланса быка и медведя Вадима Гимельфарба, опубликованном в октябре 2003 года в журнале S&C. Настройка длины скользящей средней в соответствии с вашими потребностями (символ, временные рамки и т.д.)

-

Вес объема - является наиболее важным показателем для стратегии, чтобы избежать открытых сделок на плоском графике, новые сделки открываются после сильного объема бар.

-

MA 5-10-30 - как и предыдущие это для лучшего просмотра тенденций, и правильно определить тенденции, также Speed_MA используются для предсказать будущее движение цены.

-

Stochastic-stock полезен для прогнозирования перемены тренда. Он также фокусируется на динамике цен и может быть использован для определения уровня перекупленности и перепродажи

Наслаждайтесь.

обратная проверка

/*backtest

start: 2022-05-20 00:00:00

end: 2022-06-18 23:59:00

period: 45m

basePeriod: 5m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © wielkieef

//@version=4

strategy("15MIN BTCUSDTPERP BOT", overlay=true, pyramiding=1,initial_capital = 10000, default_qty_type= strategy.percent_of_equity, default_qty_value = 100, calc_on_order_fills=false, slippage=0,commission_type=strategy.commission.percent,commission_value=0)

//SOURCE ==================================================================================================================================================================================================================================================================

src = input(ohlc4)

// INPUTS ==================================================================================================================================================================================================================================================================

//ADX -------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Act_ADX = input(true, title = "AVERAGE DIRECTIONAL INDEX", type = input.bool)

ADX_options = input("MASANAKAMURA", title = "ADX OPTION", options = ["CLASSIC", "MASANAKAMURA"])

ADX_len = input(11, title = "ADX LENGTH", type = input.integer, minval = 1)

th = input(12, title = "ADX THRESHOLD", type = input.float, minval = 0, step = 0.5)

//Range Filter----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

length0 = input(13, title="Range Filter lenght"),mult = input(1, title="Range Filter mult")

//SAR-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

start = input(title="SAR Start", type=input.float, step=0.001, defval=0)

increment = input(title="SAR Increment", type=input.float, step=0.001, defval=0.006)

maximum = input(title="SAR Maximum", type=input.float, step=0.01, defval=1)

width = input(title="SAR Point Width", type=input.integer, minval=1, defval=1)

//RSI---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

len_3 = input(70, minval=1, title="RSI lenght")

src_3 = input(close, "RSI Source")

//TWAP Trend --------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

smoothing = input(title="TWAP Smoothing", defval= 10)

resolution = input("0", "TWAP Timeframe")

//JMA------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

inp = input(title="JMA Source", type=input.source, defval=close)

reso = input(title="JMA Resolution", type=input.resolution, defval="")

rep = input(title="JMA Allow Repainting?", type=input.bool, defval=false)

src0 = security(syminfo.tickerid, reso, inp[rep ? 0 : barstate.isrealtime ? 1 : 0])[rep ? 0 : barstate.isrealtime ? 0 : 1]

lengths = input(title="JMA Length", type=input.integer, defval=4, minval=1)

//MACD------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

fast_length = input(title="MACD Fast Length", type=input.integer, defval=25)

slow_length = input(title="MACD Slow Length", type=input.integer, defval=50)

signal_length = input(title="MACD Signal Smoothing", type=input.integer, minval = 1, maxval = 50, defval = 9)

//Volume Delta -----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

periodMa = input(title="Delta Length", minval=1, defval=45)

//Volume weight------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

maLength = input(title="Volume Weight Length", type=input.integer, defval=100, minval=1)

maType = input(title="Volume Weight Type", type=input.string, defval="SMA", options=["EMA", "SMA", "HMA", "WMA", "DEMA"])

rvolTrigger = input(title="Volume To Trigger Signal", type=input.float, defval=1.5, step=0.1 , minval=0.1)

//MA----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

length = input(51, minval=1, title="MA Length")

matype = input(5, minval=1, maxval=5, title="AvgType")

//Momentum------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

tmolength = input(45, title="Momentum Length")

calcLength = input(12, title="Momentum Calc length")

smoothLength = input(9, title="Momentum Smooth length")

//INDICATORS ==============================================================================================================================================================================================================================================================

//ADX----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

calcADX(_len) =>

up = change(high)

down = -change(low)

plusDM = na(up) ? na : (up > down and up > 0 ? up : 0)

minusDM = na(down) ? na : (down > up and down > 0 ? down : 0)

truerange = rma(tr, _len)

_plus = fixnan(100 * rma(plusDM, _len) / truerange)

_minus = fixnan(100 * rma(minusDM, _len) / truerange)

sum = _plus + _minus

_adx = 100 * rma(abs(_plus - _minus) / (sum == 0 ? 1 : sum), _len)

[_plus,_minus,_adx]

calcADX_Masanakamura(_len) =>

SmoothedTrueRange = 0.0

SmoothedDirectionalMovementPlus = 0.0

SmoothedDirectionalMovementMinus = 0.0

TrueRange = max(max(high - low, abs(high - nz(close[1]))), abs(low - nz(close[1])))

DirectionalMovementPlus = high - nz(high[1]) > nz(low[1]) - low ? max(high - nz(high[1]), 0) : 0

DirectionalMovementMinus = nz(low[1]) - low > high - nz(high[1]) ? max(nz(low[1]) - low, 0) : 0

SmoothedTrueRange := nz(SmoothedTrueRange[1]) - (nz(SmoothedTrueRange[1]) /_len) + TrueRange

SmoothedDirectionalMovementPlus := nz(SmoothedDirectionalMovementPlus[1]) - (nz(SmoothedDirectionalMovementPlus[1]) / _len) + DirectionalMovementPlus

SmoothedDirectionalMovementMinus := nz(SmoothedDirectionalMovementMinus[1]) - (nz(SmoothedDirectionalMovementMinus[1]) / _len) + DirectionalMovementMinus

DIP = SmoothedDirectionalMovementPlus / SmoothedTrueRange * 100

DIM = SmoothedDirectionalMovementMinus / SmoothedTrueRange * 100

DX = abs(DIP-DIM) / (DIP+DIM)*100

adx = sma(DX, _len)

[DIP,DIM,adx]

[DIPlusC,DIMinusC,ADXC] = calcADX(ADX_len)

[DIPlusM,DIMinusM,ADXM] = calcADX_Masanakamura(ADX_len)

DIPlus = ADX_options == "CLASSIC" ? DIPlusC : DIPlusM

DIMinus = ADX_options == "CLASSIC" ? DIMinusC : DIMinusM

ADX = ADX_options == "CLASSIC" ? ADXC : ADXM

ADX_color = DIPlus > DIMinus and ADX > th ? color.green : DIPlus < DIMinus and ADX > th ? color.red : color.orange

barcolor(color = Act_ADX ? ADX_color : na, title = "ADX")

//Range Filter---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

out = 0., cma = 0., cts = 0.

Var = variance(src,length0)*mult

sma = sma(src,length0)

secma = pow(nz(sma - cma[1]),2)

sects = pow(nz(src - cts[1]),2)

ka = Var < secma ? 1 - Var/secma : 0

kb = Var < sects ? 1 - Var/sects : 0

cma := ka*sma+(1-ka)*nz(cma[1],src)

cts := kb*src+(1-kb)*nz(cts[1],src)

css = cts > cma ? color.green : color.red

a = plot(cts,"CTS",color.red,2,transp=0)

b = plot(cma,"CMA",color.green,2,transp=0)

fill(a,b,color=css,transp=80)

rangegood = cts > cma

rangebad = cts < cma

//SAR-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

psar = sar(start, increment, maximum)

dir = psar < close ? 1 : -1

psarColor = dir == 1 ? color.green : color.red

psarPlot = plot(psar, title="PSAR", style=plot.style_circles, linewidth=width, color=psarColor, transp=0)

var color longColor = color.green

var color shortColor = color.red

sargood = dir ==1

sarbad = dir ==-1

//RSI---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

up_3 = rma(max(change(src_3), 0), len_3)

down_3 = rma(-min(change(src_3), 0), len_3)

rsi_3 = down_3 == 0 ? 100 : up_3 == 0 ? 0 : 100 - (100 / (1 + up_3 / down_3))

rsiob = (rsi_3 < 70)

rsios = (rsi_3 > 30)

//TWAP Trend --------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

res = resolution != "0" ? resolution : timeframe.period

weight = barssince(change(security(syminfo.tickerid, res, time, lookahead=barmerge.lookahead_on)))

price = 0.

price:= weight == 0 ? src : src + nz(price[1])

twap = price / (weight + 1)

ma_ = smoothing < 2 ? twap : sma(twap, smoothing)

bullish = iff(smoothing < 2, src >= ma_, src > ma_)

disposition = bullish ? color.lime : color.red

basis = plot(src, "OHLC4", disposition, linewidth=1, transp=100)

work = plot(ma_, "TWAP", disposition, linewidth=2, transp=20)

fill(basis, work, disposition, transp=65)

//JMA------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

jsa = (src0 + src0[lengths]) / 2

sig = src0 > jsa ? 1 : src0 < jsa ? -1 : 0

jsaColor = sig > 0 ? color.lime : sig < 0 ? color.red : color.orange

plot(jsa, color=jsaColor, linewidth=2)

jmagood = sig > 0

jmabad = sig < 0

//MACD------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

fast_ma = ema(src, fast_length)

slow_ma = ema(src, slow_length)

macd = fast_ma - slow_ma

signal = sma(macd, signal_length)

macdgood = macd > signal

macdbad = macd < signal

//Volume Delta -----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

bullPower = iff(close < open, iff(close[1] < open, max(high - close[1], close - low), max(high - open, close - low)), iff(close > open, iff(close[1] > open, high - low, max(open - close[1], high - low)), iff(high - close > close - low, iff(close[1] < open, max(high - close[1], close - low), high - open), iff(high - close < close - low, iff(close[1] > open, high - low, max(open - close[1], high - low)), iff(close[1] > open, max(high - open, close - low), iff(close[1] < open, max(open - close[1], high - low), high-low))))))

bearPower = iff(close < open, iff(close[1] > open, max(close[1] - open, high - low), high - low), iff(close > open, iff(close[1] > open, max(close[1] - low, high - close), max(open - low, high - close)), iff(high - close > close - low, iff(close[1] > open, max(close[1] - open, high - low), high - low), iff(high - close < close - low, iff(close[1] > open, max(close[1] - low, high - close), open - low), iff(close[1] > open, max(close[1] - open, high - low), iff(close[1] < open, max(open - low, high - close), high - low))))))

bullVolume = (bullPower / (bullPower + bearPower)) * volume

bearVolume = (bearPower / (bullPower + bearPower)) * volume

delta = bullVolume - bearVolume

cvd = cum(delta)

cvdMa = sma(cvd, periodMa)

deltagood = cvd > cvdMa

deltabad = cvd < cvdMa

//Volume weight------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

getMA0(length) =>

maPrice = ema(volume, length)

if maType == "SMA"

maPrice := sma(volume, length)

if maType == "HMA"

maPrice := hma(volume, length)

if maType == "WMA"

maPrice := wma(volume, length)

if maType == "DEMA"

e1 = ema(volume, length)

e2 = ema(e1, length)

maPrice := 2 * e1 - e2

maPrice

ma = getMA0(maLength)

rvol = volume / ma

volumegood = volume > rvolTrigger * ma

//MA----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

ma5 = sma(close, 5)

ma10 = sma(close, 10)

ma30 = sma(close, 30)

magood = ma5 > ma30

mabad = ma5 < ma30

simplema = sma(src,length)

exponentialma = ema(src,length)

hullma = wma(2*wma(src, length/2)-wma(src, length), round(sqrt(length)))

weightedma = wma(src, length)

volweightedma = vwma(src, length)

avgval = matype==1 ? simplema : matype==2 ? exponentialma : matype==3 ? hullma : matype==4 ? weightedma : matype==5 ? volweightedma : na

MA_speed = (avgval / avgval[1] -1 ) *100

masgood = MA_speed > 0

masbad = MA_speed < 0

//Momentum-----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

data = 0

for i = 1 to tmolength-1

if close > open[i]

data := data + 1

if close < open[i]

data := data - 1

EMA5 = ema(data, calcLength)

Main = ema(EMA5, smoothLength)

Signal = ema(Main, smoothLength)

momentumgood = Main > Signal

momentumbad = Main < Signal

//STRATEGY===============================================================================================================================================================================================================================================================

Long = (DIPlus > DIMinus and ADX > th) and volumegood and sargood and rsiob and macdgood and deltagood and magood and masgood and bullish and jmagood and rangegood and momentumgood

Short = (DIPlus < DIMinus and ADX > th) and volumegood and sarbad and rsios and macdbad and deltabad and mabad and masbad and jmabad and rangebad and momentumbad

//BACKTESTING==========================================================================================================================================================================================================================

// ————— Backtest input

Act_BT = input(true, title = "BACKTEST", type = input.bool)

backtest_time = input(180, title ="BACKTEST DAYS", type = input.integer, minval = 1)*24*60*60*1000

entry_Type = input("% EQUITY", title = "ENTRY TYPE", options = ["CONTRACTS","CASH","% EQUITY"])

et_Factor = (entry_Type == "CONTRACTS") ? 1 : (entry_Type == "% EQUITY") ? (100/(strategy.equity/close)) : close

//Signals----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

// SL AND TP-----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

stopPer = input(3.6, title='Stop Loss % [plotshape]', type=input.float) / 100

takePer = input(0.8, title='Take Profit % [plotshape]', type=input.float) / 100

long_short = 0

long_last = Long and (nz(long_short[1]) == 0 or nz(long_short[1]) == -1)

short_last = Short and (nz(long_short[1]) == 0 or nz(long_short[1]) == 1)

long_short := long_last ? 1 : short_last ? -1 : long_short[1]

longPrice = valuewhen(long_last, close, 0)

shortPrice = valuewhen(short_last, close, 0)

longStop = longPrice * (1 - stopPer)

shortStop = shortPrice * (1 + stopPer)

longTake = longPrice * (1 + takePer)

shortTake = shortPrice * (1 - takePer)

//plot lines ---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

plotshape(long_short==1 ? longTake : na, style=shape.cross, color=color.gray, location=location.absolute )

plotshape(long_short==-1 ? shortTake : na, style=shape.cross, color=color.gray, location=location.absolute )

longBar1 = barssince(long_last)

longBar2 = longBar1 >= 1 ? true : false

shortBar1 = barssince(short_last)

shortBar2 = shortBar1 >= 1 ? true : false

Long_SL = long_short==1 and longBar2 and low < longStop

Short_SL = long_short==-1 and shortBar2 and high > shortStop

Long_TP = long_short==1 and longBar2 and high > longTake

Short_TP = long_short==-1 and shortBar2 and low < shortTake

long_short := (long_short==1 or long_short==0) and longBar2 and (Long_SL or Long_TP) ? 0 : (long_short==-1 or long_short==0) and shortBar2 and (Short_SL or Short_TP) ? 0 : long_short

last_long_cond = Long and long_last

last_short_cond = Short and short_last

//plotshapes---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

plotshape(last_long_cond, title="Long x1", color=color.blue, style=shape.triangleup, location=location.belowbar, size=size.small, textcolor=color.white, text="Long" , transp=1)

plotshape(last_short_cond, title="Short x1", color=color.red, style=shape.triangledown, location=location.abovebar, size=size.tiny, textcolor=color.white, text="Short" ,transp=1)

plotshape(Long_SL, location=location.belowbar, color=color.black, size=size.tiny , text="SL", textcolor=color.fuchsia)

plotshape(Short_SL, location=location.abovebar, color=color.black, size=size.tiny , text="SL", textcolor=color.fuchsia)

plotshape(Long_TP,style=shape.triangledown, location=location.abovebar, color=color.gray, size=size.tiny , text="TP", textcolor=color.red)

plotshape(Short_TP,style=shape.triangleup, location=location.belowbar, color=color.gray, size=size.tiny , text="TP", textcolor=color.green)

if last_long_cond and Act_BT

strategy.entry("L", strategy.long)

if last_short_cond and Act_BT

strategy.entry("S", strategy.short)

per(pcnt) =>

strategy.position_size != 0 ? round(pcnt / 100 * strategy.position_avg_price / syminfo.mintick) : float(na)

stoploss=input(title=" stop loss [BT]", defval=3.6, minval=0.01)

los = per(stoploss)

q=input(title=" qty percent", defval=100, minval=1)

tp=input(title=" Take profit [BT]", defval=0.8, minval=0.01)

strategy.exit("tp", qty_percent = q, profit = per(tp), loss = los)

//By wielkieef

- Теория волн Эллиота 4-9 Импульсная волна Автоматическое обнаружение Стратегия торговли

- Джонни БОТ

- VuManChu Шифр B + Дивергенции Стратегия

- Стратегия сетки переменной позиции, следующая за тенденцией

- Динамическая стратегия DCA на основе объема

- TUE ADX/MACD Слияние V1.0

- Комбинированная долгосрочная стратегия торговли MACD и RSI

- Стратегия ценовой дивергенции v1.0

- Стратегия торговли высокочастотными криптовалютами с низким риском и стабильностью на основе RSI и MACD

- MACD RSI Ichimoku Моментальный тренд после долгой стратегии

- Супер скальпер - 5 минут 15 минут

- Индекс относительной силы - Дивергенции - Либертус

- Линейная регрессия ++

- RedK Dual VADER с энергетическими прутками

- Консолидационные зоны - живые

- Количественная качественная оценка

- Переключающаяся средняя перекрестная тревога, многочасовая тревога (MTF)

- СТРАТЕГИЯ перегрузки MACD

- Супертендирующие скользящие средние

- Торговля ABC

- Энтропия Шеннона V2

- Супер-трейдер с задержкой остановки

- Поток объема v3

- Часовой скальпинг крипто-фьючерсов с ma & rsi - ogcheckers

- АТР сглаженный

- Поисковик блоков заказов

- TrendScalp-FractalBox-3EMA (включение)

- Сигналы QQE

- U-битная сетка фильтрации амплитуды

- CM MACD Custom Indicator - Многократные временные рамки - V2