概述

该策略基于不同时间尺度的简单移动平均线(SMA)来捕捉市场趋势。通过比较短期和长期SMA的相对位置,生成买入和卖出信号。同时,该策略采用趋势确认条件来过滤伪信号,提高交易准确性。此外,该策略还设置了止盈和止损功能,实现风险管理。

策略原理

- 计算短期和长期SMA,用于判断市场趋势方向。

- 当短期SMA上穿长期SMA时,生成买入信号;当短期SMA下穿长期SMA时,生成卖出信号。

- 利用趋势确认条件过滤伪信号,只有当主要趋势为多头时才执行买入,只有当主要趋势为空头时才执行卖出。

- 设置止盈和止损功能,控制交易风险。当价格达到预设的止盈或止损水平时,平仓离场。

- 根据趋势确认条件动态调整持仓。当主要趋势发生变化时,及时平仓,防止趋势反转带来的损失。

策略优势

- 趋势跟踪:该策略基于不同时间尺度的SMA,能够有效捕捉市场主要趋势,适应不同市场状态。

- 趋势确认:通过引入趋势确认条件,过滤伪信号,提高交易信号的可靠性,减少无效交易。

- 风险管理:内置止盈和止损功能,帮助控制交易风险,保护投资者资金安全。

- 动态调整:根据趋势确认条件动态调整持仓,及时应对市场变化,减少趋势反转带来的损失。

策略风险

- 参数优化风险:该策略的表现依赖于SMA周期、止盈止损水平等参数的选择。不恰当的参数设置可能导致策略效果不佳。

- 震荡市风险:在震荡市场环境下,频繁的交易信号可能导致过度交易,增加交易成本和风险。

- 突发事件风险:面对突发重大事件,市场可能出现剧烈波动,该策略可能无法及时应对,导致较大损失。

策略优化方向

- 引入更多技术指标:结合其他技术指标,如MACD、RSI等,提高趋势判断的准确性和稳健性。

- 优化参数选择:通过历史数据回测和参数优化,寻找最佳的SMA周期、止盈止损水平等参数组合,提升策略表现。

- 改进风险管理:引入更高级的风险管理技术,如动态止损、仓位管理等,进一步控制风险敞口。

- 适应不同市场状态:根据市场波动性和趋势强度,动态调整策略参数,使策略能够适应不同的市场状态。

总结

该多时间尺度SMA趋势跟踪与动态止损策略利用不同时间尺度的SMA捕捉市场趋势,通过趋势确认条件过滤伪信号,同时设置止盈止损和动态持仓调整功能,实现了趋势跟踪和风险管理的目标。尽管该策略具有一定优势,但仍面临参数优化、震荡市和突发事件等风险。未来可通过引入更多技术指标、优化参数选择、改进风险管理和适应不同市场状态等方面进行优化,以提升策略的稳健性和盈利能力。

策略源码

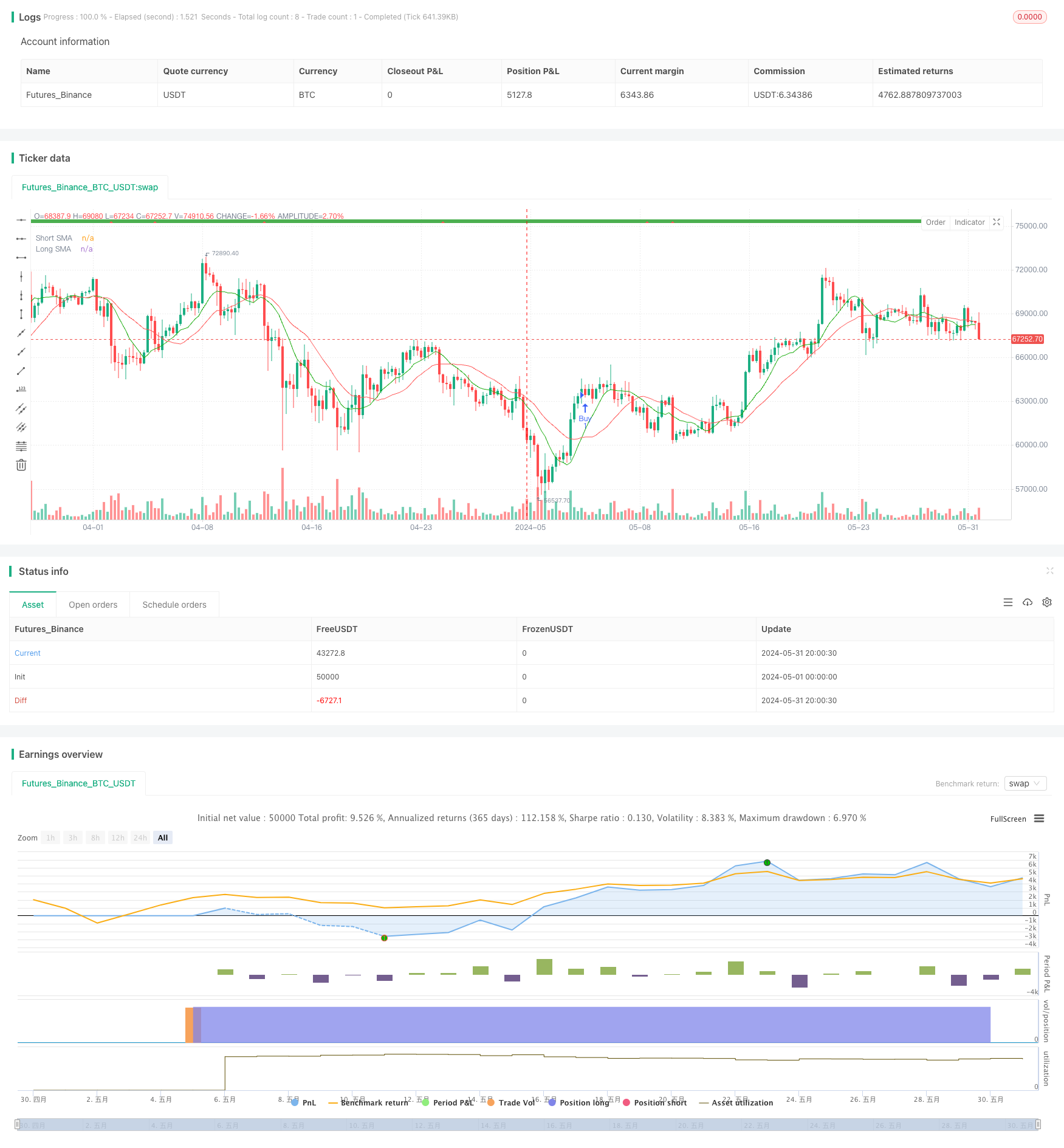

/*backtest

start: 2024-05-01 00:00:00

end: 2024-05-31 23:59:59

period: 6h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("market slayer v3", overlay=true)

// Input parameters

showConfirmationTrend = input(title='Show Trend', defval=true)

confirmationTrendTimeframe = input.timeframe(title='Main Trend', defval='240')

confirmationTrendValue = input(title='Main Trend Value', defval=2)

showConfirmationBars = input(title='Show Confirmation Bars', defval=true)

topCbarValue = input(title='Top Confirmation Value', defval=60)

short_length = input.int(10, minval=1, title="Short SMA Length")

long_length = input.int(20, minval=1, title="Long SMA Length")

takeProfitEnabled = input(title="Take Profit Enabled", defval=false)

takeProfitValue = input.float(title="Take Profit (points)", defval=20, minval=1)

stopLossEnabled = input(title="Stop Loss Enabled", defval=false)

stopLossValue = input.float(title="Stop Loss (points)", defval=50, minval=1)

// Calculate SMAs

short_sma = ta.sma(close, short_length)

long_sma = ta.sma(close, long_length)

// Generate buy and sell signals based on SMAs

buy_signal = ta.crossover(short_sma, long_sma)

sell_signal = ta.crossunder(short_sma, long_sma)

// Plot SMAs

plot(short_sma, color=color.rgb(24, 170, 11), title="Short SMA")

plot(long_sma, color=color.red, title="Long SMA")

// Confirmation Bars

f_confirmationBarBullish(cbValue) =>

cBarClose = close

slowConfirmationBarSmaHigh = ta.sma(high, cbValue)

slowConfirmationBarSmaLow = ta.sma(low, cbValue)

slowConfirmationBarHlv = int(na)

slowConfirmationBarHlv := cBarClose > slowConfirmationBarSmaHigh ? 1 : cBarClose < slowConfirmationBarSmaLow ? -1 : slowConfirmationBarHlv[1]

slowConfirmationBarSslDown = slowConfirmationBarHlv < 0 ? slowConfirmationBarSmaHigh : slowConfirmationBarSmaLow

slowConfirmationBarSslUp = slowConfirmationBarHlv < 0 ? slowConfirmationBarSmaLow : slowConfirmationBarSmaHigh

slowConfirmationBarSslUp > slowConfirmationBarSslDown

fastConfirmationBarBullish = f_confirmationBarBullish(topCbarValue)

fastConfirmationBarBearish = not fastConfirmationBarBullish

fastConfirmationBarClr = fastConfirmationBarBullish ? color.green : color.red

fastConfirmationChangeBullish = fastConfirmationBarBullish and fastConfirmationBarBearish[1]

fastConfirmationChangeBearish = fastConfirmationBarBearish and fastConfirmationBarBullish[1]

confirmationTrendBullish = request.security(syminfo.tickerid, confirmationTrendTimeframe, f_confirmationBarBullish(confirmationTrendValue), lookahead=barmerge.lookahead_on)

confirmationTrendBearish = not confirmationTrendBullish

confirmationTrendClr = confirmationTrendBullish ? color.green : color.red

// Plot trend labels

plotshape(showConfirmationTrend, style=shape.square, location=location.top, color=confirmationTrendClr, title='Trend Confirmation Bars')

plotshape(showConfirmationBars and (fastConfirmationChangeBullish or fastConfirmationChangeBearish), style=shape.triangleup, location=location.top, color=fastConfirmationChangeBullish ? color.green : color.red, title='Fast Confirmation Bars')

plotshape(showConfirmationBars and buy_signal and confirmationTrendBullish, style=shape.triangleup, location=location.top, color=color.green, title='Buy Signal')

plotshape(showConfirmationBars and sell_signal and confirmationTrendBearish, style=shape.triangledown, location=location.top, color=color.red, title='Sell Signal')

// Generate trade signals

buy_condition = buy_signal and confirmationTrendBullish and not (strategy.opentrades > 0)

sell_condition = sell_signal and confirmationTrendBearish and not (strategy.opentrades > 0)

strategy.entry("Buy", strategy.long, when=buy_condition, comment ="BUY CALLS")

strategy.entry("Sell", strategy.short, when=sell_condition, comment ="BUY PUTS")

// Take Profit

if (takeProfitEnabled)

strategy.exit("Take Profit Buy", from_entry="Buy", profit=takeProfitValue)

strategy.exit("Take Profit Sell", from_entry="Sell", profit=takeProfitValue)

// Stop Loss

if (stopLossEnabled)

strategy.exit("Stop Loss Buy", from_entry="Buy", loss=stopLossValue)

strategy.exit("Stop Loss Sell", from_entry="Sell", loss=stopLossValue)

// Close trades based on trend confirmation bars

if strategy.opentrades > 0

if strategy.position_size > 0

if not confirmationTrendBullish

strategy.close("Buy", comment ="CLOSE CALLS")

else

if not confirmationTrendBearish

strategy.close("Sell", comment ="CLOSE PUTS")

// Define alert conditions as booleans

buy_open_alert = buy_condition

sell_open_alert = sell_condition

buy_closed_alert = strategy.opentrades < 0

sell_closed_alert = strategy.opentrades > 0

// Alerts

alertcondition(buy_open_alert, title='Buy calls', message='Buy calls Opened')

alertcondition(sell_open_alert, title='buy puts', message='buy Puts Opened')

alertcondition(buy_closed_alert, title='exit calls', message='exit calls ')

alertcondition(sell_closed_alert, title='exit puts', message='exit puts Closed')

相关推荐