概述

本策略是一个基于三周期高低点的动量交易策略。它利用最近三周的价格数据来识别潜在的买入和卖出机会。该策略主要关注最新高点、最新收盘价以及三周前的收盘价之间的关系,通过比较这些价格水平来生成交易信号。这种方法旨在捕捉中期价格趋势,同时避免短期市场噪音的影响。

策略原理

该策略的核心原理包括以下几个关键要素:

计算指标:

- 最新高点:使用ta.highest()函数计算最近30个交易日(约4周)的最高价。

- 最新收盘价:使用close[1]获取前一天的收盘价。

- 三周前收盘价:使用close[30]获取30个交易日前的收盘价。

买入条件:

- 条件1:最新高点大于或等于三周前的收盘价。

- 条件2:最新收盘价大于三周前的收盘价。

卖出条件:

- 当最新收盘价大于三周前的收盘价时触发卖出信号。

交易执行:

- 买入信号触发时,执行做多入场。

- 卖出信号触发时,平仓结束当前多头头寸。

可视化:

- 使用plotshape()函数在图表上标记买入和卖出信号。

这种设计旨在捕捉价格突破三周前水平时的上升动量,同时在价格回落时及时平仓以保护利润。

策略优势

中期趋势捕捉:通过比较当前价格与三周前的价格水平,策略能够有效识别中期趋势的形成和延续。

噪音过滤:使用三周期的时间框架有助于过滤掉短期市场波动,提高信号的可靠性。

动态适应:策略根据最新的价格数据持续更新判断标准,能够动态适应市场变化。

风险管理:通过设置明确的卖出条件,策略能够在市场转向时及时平仓,有效控制风险。

简单易懂:策略逻辑直观,易于理解和实施,适合新手和有经验的交易者。

可视化支持:在图表上清晰标记买卖信号,便于交易者直观判断和回测分析。

策略风险

假突破风险:在横盘市场中,可能会出现频繁的假突破,导致过多的交易和不必要的手续费损失。

滞后性:使用三周期的历史数据可能导致信号滞后,在快速变化的市场中错过最佳入场时机。

单一时间框架局限:仅依赖三周期的数据可能忽视其他时间框架的重要市场信息。

缺乏止损机制:当前策略没有明确的止损机制,在市场剧烈波动时可能面临较大损失。

过度依赖收盘价:策略主要基于收盘价进行判断,可能忽视盘中重要的价格变动。

缺乏成交量确认:没有考虑成交量因素,可能导致在低成交量时期产生虚假信号。

策略优化方向

多时间框架分析:集成多个时间框架的数据,如日线、周线和月线,以提供更全面的市场视角。

引入成交量指标:结合成交量分析,可以提高信号的可靠性,特别是在突破确认方面。

动态止损机制:实现自适应的止损策略,如跟踪止损或基于ATR的止损,以更好地管理风险。

信号过滤器:添加额外的技术指标或市场情绪指标,如RSI或MACD,以减少假信号。

入场优化:考虑使用限价单或观察区间,而不是直接市价单入场,以获得更优的成交价格。

仓位管理:实现动态仓位管理策略,根据市场波动性和账户风险调整每次交易的仓位大小。

市场状态识别:加入市场状态(趋势、盘整、高波动)的识别逻辑,在不同市场环境下采用不同的交易参数。

回测与优化:进行大量的历史数据回测,优化策略参数,如时间周期、条件阈值等。

总结

三周期高低点动量交易策略是一个简单而有效的中期趋势跟踪方法。通过比较最新高点、最新收盘价与三周前的收盘价,策略能够捕捉价格突破和动量变化。其优势在于能够过滤短期噪音,捕捉中期趋势,并且逻辑简单易懂。然而,策略也面临假突破、信号滞后和风险管理不足等挑战。

未来的优化方向应该着眼于多时间框架分析、成交量确认、动态风险管理以及市场状态识别等方面。通过这些改进,策略有望在不同市场环境下表现更加稳健,为交易者提供更可靠的决策支持。

总的来说,这个策略为量化交易提供了一个良好的起点,通过持续优化和完善,有潜力成为一个强大的交易工具。然而,投资者在实际应用时应当谨慎,充分认识市场风险,并结合自身风险承受能力和投资目标来使用该策略。

Overview

This strategy is a momentum trading approach based on three-week high and low points. It utilizes price data from the recent three weeks to identify potential buying and selling opportunities. The strategy primarily focuses on the relationship between the latest high, the latest closing price, and the closing price from three weeks ago, generating trading signals by comparing these price levels. This method aims to capture medium-term price trends while avoiding the impact of short-term market noise.

Strategy Principle

The core principles of this strategy include the following key elements:

Indicator Calculations:

- Latest High: Uses the ta.highest() function to calculate the highest price over the last 30 trading days (approximately 4 weeks).

- Latest Close: Uses close[1] to get the closing price of the previous day.

- Three Weeks Ago Close: Uses close[30] to get the closing price from 30 trading days ago.

Buy Conditions:

- Condition 1: The latest high is greater than or equal to the closing price from three weeks ago.

- Condition 2: The latest closing price is greater than the closing price from three weeks ago.

Sell Condition:

- Triggers a sell signal when the latest closing price is greater than the closing price from three weeks ago.

Trade Execution:

- Enters a long position when the buy signal is triggered.

- Closes the current long position when the sell signal is triggered.

Visualization:

- Uses the plotshape() function to mark buy and sell signals on the chart.

This design aims to capture upward momentum when the price breaks above the level from three weeks ago, while promptly closing positions to protect profits when the price falls back.

Strategy Advantages

Medium-Term Trend Capture: By comparing current prices with levels from three weeks ago, the strategy effectively identifies the formation and continuation of medium-term trends.

Noise Filtering: Using a three-week time frame helps filter out short-term market fluctuations, improving the reliability of signals.

Dynamic Adaptation: The strategy continuously updates its decision criteria based on the latest price data, allowing it to dynamically adapt to market changes.

Risk Management: Through clear sell conditions, the strategy can close positions promptly when the market turns, effectively controlling risk.

Simple and Understandable: The strategy logic is intuitive, easy to understand and implement, suitable for both novice and experienced traders.

Visual Support: Buy and sell signals are clearly marked on the chart, facilitating intuitive judgment and backtesting analysis for traders.

Strategy Risks

False Breakout Risk: In sideways markets, frequent false breakouts may occur, leading to excessive trading and unnecessary transaction fee losses.

Lagging Nature: Using historical data from three weeks may result in lagging signals, potentially missing optimal entry points in rapidly changing markets.

Single Time Frame Limitation: Relying solely on three-week data may overlook important market information from other time frames.

Lack of Stop-Loss Mechanism: The current strategy lacks a clear stop-loss mechanism, potentially facing significant losses during severe market fluctuations.

Over-reliance on Closing Prices: The strategy mainly bases its judgments on closing prices, potentially ignoring important intraday price movements.

Lack of Volume Confirmation: Not considering volume factors may lead to false signals during periods of low trading volume.

Strategy Optimization Directions

Multi-Time Frame Analysis: Integrate data from multiple time frames, such as daily, weekly, and monthly, to provide a more comprehensive market perspective.

Incorporate Volume Indicators: Combining volume analysis can improve signal reliability, especially in breakout confirmation.

Dynamic Stop-Loss Mechanism: Implement adaptive stop-loss strategies, such as trailing stops or ATR-based stops, for better risk management.

Signal Filters: Add additional technical or market sentiment indicators, like RSI or MACD, to reduce false signals.

Entry Optimization: Consider using limit orders or observation zones instead of direct market orders for entry to obtain better execution prices.

Position Management: Implement dynamic position sizing strategies, adjusting the size of each trade based on market volatility and account risk.

Market State Recognition: Add logic to identify market states (trending, ranging, high volatility) and adopt different trading parameters for different market environments.

Backtesting and Optimization: Conduct extensive historical data backtesting to optimize strategy parameters such as time periods and condition thresholds.

Summary

The Three-Week High-Low Momentum Trading Strategy is a simple yet effective method for medium-term trend following. By comparing the latest high, latest close, and the closing price from three weeks ago, the strategy can capture price breakouts and momentum changes. Its strengths lie in filtering short-term noise, capturing medium-term trends, and its simple, easy-to-understand logic. However, the strategy also faces challenges such as false breakouts, signal lag, and insufficient risk management.

Future optimization directions should focus on multi-time frame analysis, volume confirmation, dynamic risk management, and market state recognition. Through these improvements, the strategy has the potential to perform more robustly in different market environments, providing traders with more reliable decision support.

Overall, this strategy provides a good starting point for quantitative trading. With continuous optimization and refinement, it has the potential to become a powerful trading tool. However, investors should be cautious when applying it in practice, fully recognizing market risks and using the strategy in conjunction with their own risk tolerance and investment objectives.

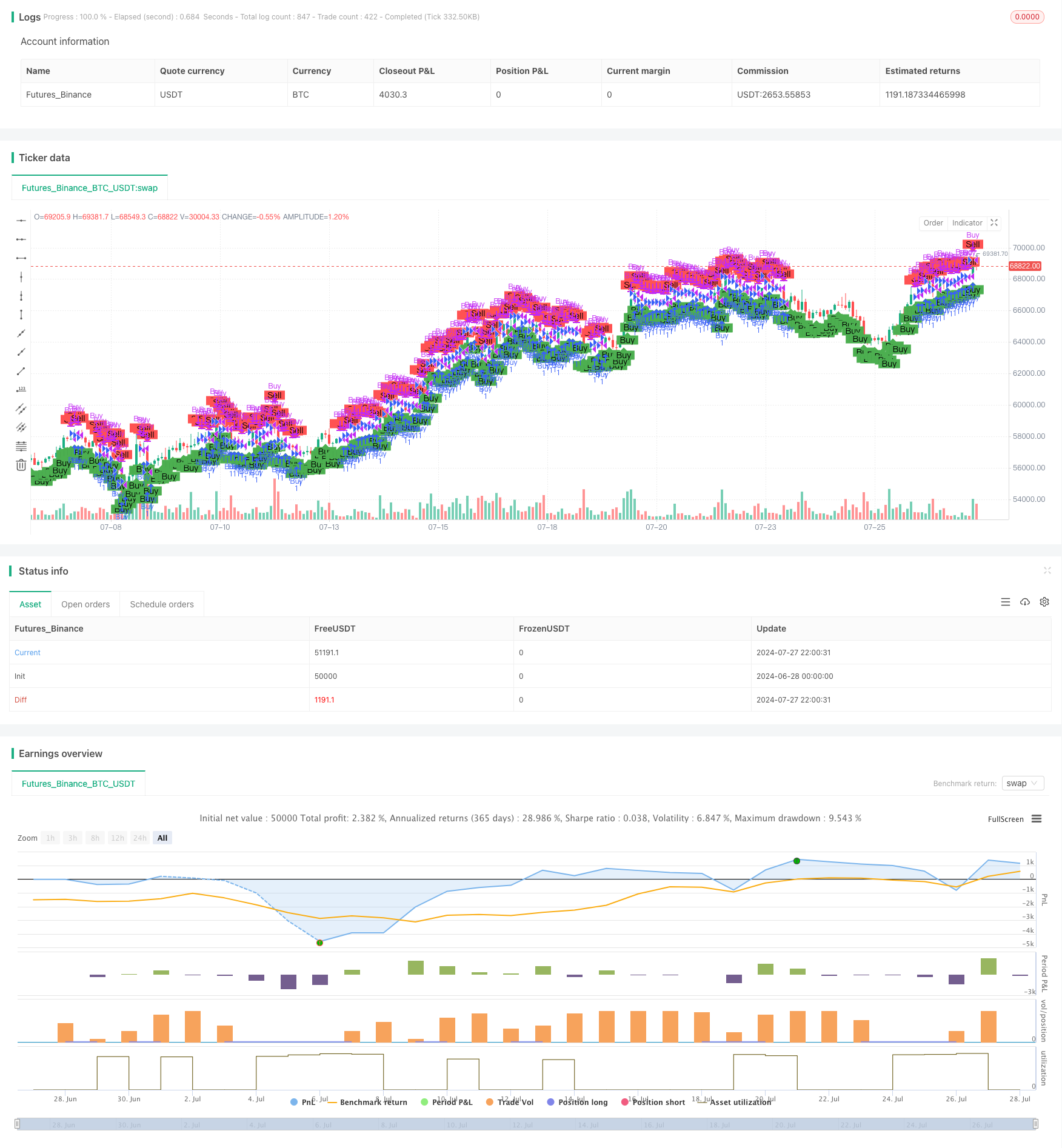

/*backtest

start: 2024-06-28 00:00:00

end: 2024-07-28 00:00:00

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Buy and Sell Strategy", overlay=true)

// Calculate the latest high, close, and volume

latestHigh = ta.highest(high, 30) // 4 weeks = 30 trading days

latestClose = close[1]

// Calculate the high, close,

threeWeeksAgoClose = close[30] // 4 weeks = 30 trading days + 1 current day

// Condition 1: Buy if latest high >= 4 weeks ago close

condition1 = latestHigh >= threeWeeksAgoClose

// Condition 2: Buy if latest close > 4 weeks ago close

condition2 = latestClose > threeWeeksAgoClose

// Generate buy and sell signals

buySignal = condition1

sellSignal = condition2

// Entry and exit logic using if statements

if buySignal

strategy.entry("Buy", strategy.long)

if sellSignal

strategy.close("Buy")

// Plotting buy and sell signals on the chart

plotshape(buySignal, color=color.green, style=shape.labelup, location=location.belowbar, text="Buy")

plotshape(sellSignal, color=color.red, style=shape.labeldown, location=location.abovebar, text="Sell")