概述

这是一个基于成交量加权平均价格(VWAP)和Garman-Klass波动率(GKV)的自适应交易策略。该策略通过波动率动态调整VWAP的标准差波段,实现对市场趋势的智能跟踪。当价格突破上轨时开仓做多,突破下轨时平仓,波动率越大突破门槛越高,波动率越小突破门槛越低。

策略原理

策略的核心是将VWAP与GKV波动率相结合。首先计算VWAP作为价格中枢,然后利用收盘价的标准差构建波段。关键在于使用GKV公式计算波动率,其考虑了开高低收四个价格,比传统波动率更准确。波动率会动态调整波段宽度 - 当波动率升高时,波段变宽,提高突破门槛;当波动率降低时,波段变窄,降低突破门槛。这种自适应机制有效避免了虚假突破。

策略优势

- 结合了量价关系和波动特征,信号更可靠

- 波段宽度自适应调整,降低噪音干扰

- 使用GKV波动率,对市场微观结构把握更准确

- 计算逻辑简单清晰,易于实现和维护

- 适合不同市场环境,具有较强的普适性

策略风险

- 在震荡市可能频繁交易,增加成本

- 对VWAP长度和波动率周期较敏感

- 在快速趋势逆转时可能反应较慢

- 需要实时行情数据,对数据质量要求较高 风险控制建议:

- 设置合理的止损位

- 优化参数以适应不同市场

- 增加趋势确认指标

- 控制资金规模

策略优化方向

- 引入多周期分析,提高信号可靠性

- 增加成交量分析维度,确认突破有效性

- 优化波动率计算方法,如考虑引入EWMA

- 增加趋势强度过滤器

- 考虑加入动态止损机制 这些优化可以提高策略的稳定性和收益质量。

总结

该策略通过将VWAP与GKV波动率创新结合,实现了对市场的动态跟踪。其自适应特性使其在不同市场环境下都能保持稳定表现。虽然存在一些潜在风险,但通过合理的风险控制和持续优化,策略具有良好的应用前景。

策略源码

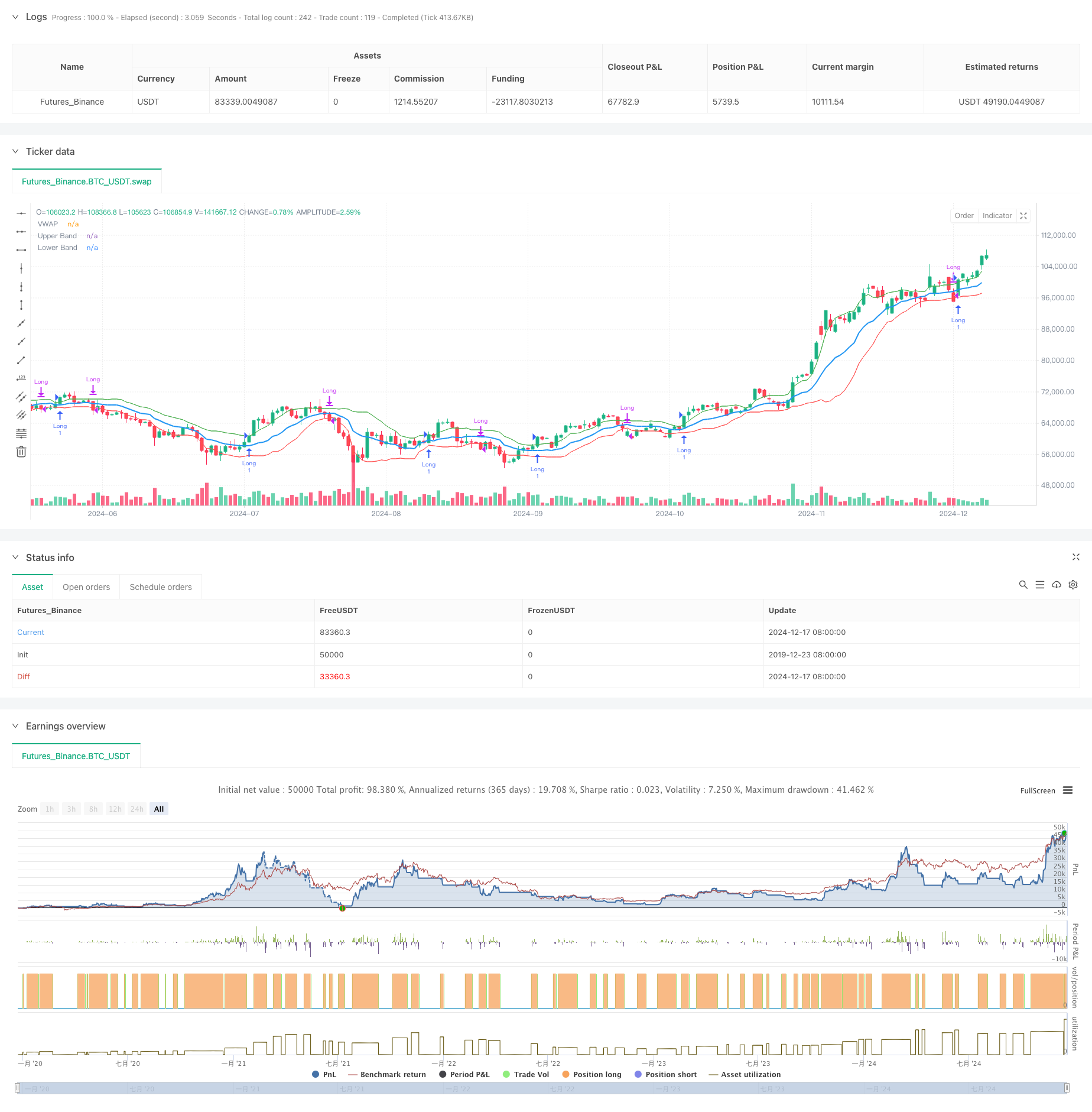

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-18 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Adaptive VWAP Bands with Garman Klass Volatility", overlay=true)

// Inputs

length = input.int(25, title="Volatility Length")

vwapLength = input.int(14, title="VWAP Length")

vol_multiplier = input.float(1,title="Volatility Multiplier")

// Function to calculate Garman-Klass Volatility

var float sum_gkv = na

if na(sum_gkv)

sum_gkv := 0.0

sum_gkv := 0.0

for i = 0 to length - 1

sum_gkv := sum_gkv + 0.5 * math.pow(math.log(high[i]/low[i]), 2) - (2*math.log(2)-1) * math.pow(math.log(close[i]/open[i]), 2)

gcv = math.sqrt(sum_gkv / length)

// VWAP calculation

vwap = ta.vwma(close, vwapLength)

// Standard deviation for VWAP bands

vwapStdDev = ta.stdev(close, vwapLength)

// Adaptive multiplier based on GCV

multiplier = (gcv / ta.sma(gcv, length)) * vol_multiplier

// Upper and lower bands

upperBand = vwap + (vwapStdDev * multiplier)

lowerBand = vwap - (vwapStdDev * multiplier)

// Plotting VWAP and bands

plot(vwap, title="VWAP", color=color.blue, linewidth=2)

plot(upperBand, title="Upper Band", color=color.green, linewidth=1)

plot(lowerBand, title="Lower Band", color=color.red, linewidth=1)

var barColor = color.black

// Strategy: Enter long above upper band, go to cash below lower band

if (close > upperBand)

barColor := color.green

strategy.entry("Long", strategy.long)

else if (close < lowerBand)

barColor := color.fuchsia

strategy.close("Long")

barcolor(barColor)

相关推荐