概述

该策略是一个结合RSI指标超买超卖信号与布林带边界的交易系统,通过设定动态止损位和基于风险收益比的止盈位来管理交易风险。策略核心是在RSI指标与超买超卖水平发生交叉时产生交易信号,并结合价格在布林带中的位置来提高交易的准确性。

策略原理

策略主要基于以下几个核心原理: 1. 使用14周期的RSI指标来衡量市场的超买超卖状态 2. 当RSI从下向上穿越30(超卖)水平时,触发做多信号 3. 当RSI从上向下穿越70(超买)水平时,触发做空信号 4. 基于过去10个周期的最低价设置多头止损 5. 基于过去10个周期的最高价设置空头止损 6. 采用2:1的风险收益比动态计算止盈位 7. 结合布林带位置确认交易信号的有效性

策略优势

- 动态风险管理:策略通过动态设置止损位和止盈位,能够适应市场波动性的变化

- 明确的风险收益比:固定2:1的风险收益比设置,有利于长期稳定盈利

- 多重信号确认:结合RSI和布林带两个技术指标,提高交易信号的可靠性

- 自动化执行:策略完全自动化,消除人为情绪干扰

- 灵活的参数设置:可根据不同市场特征调整RSI参数和风险管理参数

策略风险

- 假突破风险:RSI交叉信号可能出现假突破,导致错误交易

- 震荡市场风险:在区间震荡市场中,可能频繁触发止损

- 止损位设置风险:固定周期的最高最低价设置止损,可能不适应所有市场环境

- 资金管理风险:固定的风险收益比可能在某些市场条件下过于激进

- 滑点风险:在波动剧烈时期,实际成交价格可能与信号价格有较大偏差

策略优化方向

- 引入趋势过滤器:可添加移动平均线等趋势指标,在顺势方向交易

- 优化止损设置:可考虑使用ATR动态调整止损距离

- 增加成交量确认:加入成交量指标验证信号有效性

- 市场环境分类:根据不同市场环境动态调整风险收益比

- 增加时间过滤:避免在波动性较低的时段交易

- 优化参数自适应:引入自适应机制动态调整RSI参数

总结

该策略通过结合RSI超买超卖信号和布林带边界位置,构建了一个完整的交易系统。策略的核心优势在于动态的风险管理和明确的风险收益比设置,但仍需注意假突破和市场环境变化带来的风险。通过引入趋势过滤、优化止损设置等方向,策略还有进一步提升的空间。

策略源码

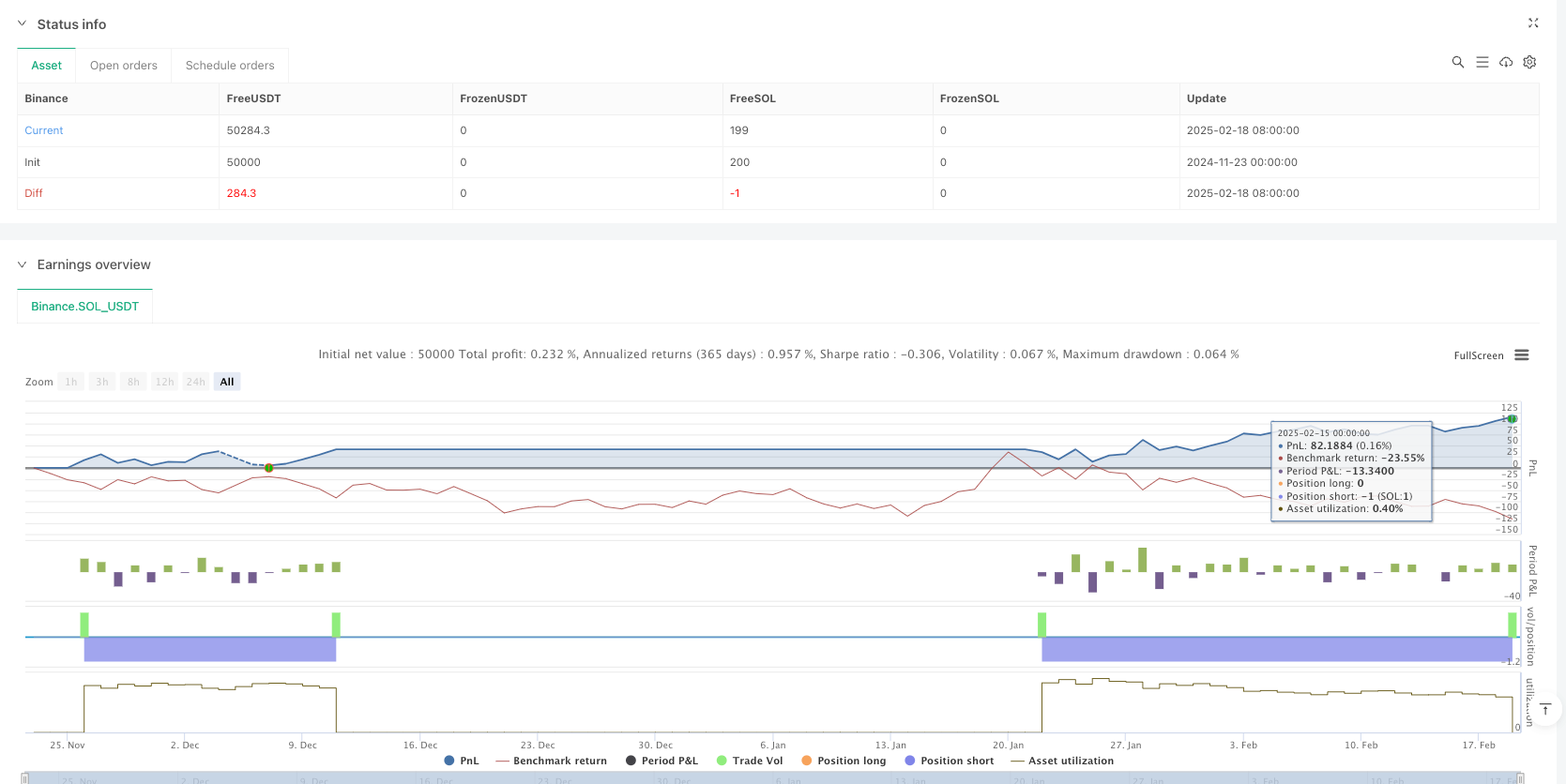

/*backtest

start: 2024-11-23 00:00:00

end: 2025-02-19 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Binance","currency":"SOL_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © humblehustle

//@version=5

strategy("RSI Oversold Crossover Strategy", overlay=true)

// === INPUT PARAMETERS ===

rsi_length = input(14, title="RSI Length")

rsi_overbought = input(70, title="RSI Overbought Level")

rsi_oversold = input(30, title="RSI Oversold Level")

// === RSI CALCULATION ===

rsi = ta.rsi(close, rsi_length)

// === ENTRY CONDITIONS ===

long_condition = ta.crossover(rsi, rsi_oversold) // RSI crosses above 30

short_condition = ta.crossunder(rsi, rsi_overbought) // RSI crosses below 70

// === STOP LOSS & TARGET CALCULATION ===

longStop = ta.lowest(low, 10) // Recent swing low for longs

shortStop = ta.highest(high, 10) // Recent swing high for shorts

longTarget = close + (close - longStop) * 2 // 2:1 Risk-Reward

shortTarget = close - (shortStop - close) * 2 // 2:1 Risk-Reward

// === EXECUTE TRADES ===

if long_condition

strategy.entry("Long", strategy.long)

strategy.exit("ExitLong", from_entry="Long", stop=longStop, limit=longTarget)

if short_condition

strategy.entry("Short", strategy.short)

strategy.exit("ExitShort", from_entry="Short", stop=shortStop, limit=shortTarget)

// === ALERTS ===

alertcondition(long_condition, title="Long Signal", message="BUY: RSI Crossed Above 30 (Oversold)")

alertcondition(short_condition, title="Short Signal", message="SELL: RSI Crossed Below 70 (Overbought)")

// === PLOTTING INDICATORS & SIGNALS ===

hline(rsi_overbought, "RSI Overbought", color=color.red)

hline(rsi_oversold, "RSI Oversold", color=color.green)

plot(rsi, title="RSI", color=color.blue, linewidth=2)

plotshape(series=long_condition, location=location.belowbar, color=color.green, style=shape.labelup, title="BUY Signal", size=size.large)

plotshape(series=short_condition, location=location.abovebar, color=color.red, style=shape.labeldown, title="SELL Signal", size=size.large)

相关推荐