概述

多时间周期趋势动量交易策略是一个综合性的交易系统,该策略通过整合多时间周期趋势分析、动量信号、成交量确认和智能资金概念(结构特性变化CHoCH和结构突破BOS),为交易者提供了一个强大的工具,帮助捕捉市场趋势并最小化虚假信号。策略的独特”AI”组件分析多个时间周期的趋势,提供清晰、可操作的仪表盘,使其对新手和有经验的交易者都易于使用。该策略完全可自定义,允许用户根据自己的交易风格调整过滤器。

策略原理

该策略是通过整合多个组件创建的一个连贯的交易系统:

多时间周期趋势分析:策略使用三个时间周期(1小时、4小时、日线)评估趋势,采用指数移动平均线(EMA)和成交量加权平均价格(VWAP)。当价格在EMA和VWAP之上时,趋势被视为看涨;当价格在下方时,则视为看跌;否则为中性。只有当用户选择的较高时间周期趋势与交易方向一致时(例如,买入信号需要较高时间周期的看涨趋势),才会生成信号。这减少了噪音,确保交易遵循更广泛的市场背景。

动量过滤器:测量连续柱之间的百分比价格变化,并将其与波动率调整阈值(基于平均真实范围[ATR])进行比较。这确保交易只在显著价格移动期间进行,过滤掉低动量条件。

成交量过滤器(可选):检查当前成交量是否超过长期平均值,并显示正短期成交量变化。这确认了强市场参与度,降低了假突破的风险。

突破过滤器(可选):要求价格突破(买入)或突破(卖出)最近的高点/低点,确保信号与市场结构变化一致。

智能资金概念(CHoCH/BOS):

- 结构特性变化(CHoCH):当价格分别以看跌或看涨蜡烛穿过最近的枢轴高点(卖出)或穿过最近的枢轴低点(买入)时,检测潜在反转。

- 结构突破(BOS):当价格以强劲动量突破最近的枢轴低点(卖出)或突破最近的枢轴高点(买入)时,确认趋势延续。这些信号被绘制为带标签的水平线,使关键水平易于可视化。

AI趋势仪表盘:结合不同时间框架的趋势方向、动量和波动率(ATR)计算趋势得分。得分高于0.5表示”向上”趋势,低于-0.5表示”向下”趋势,否则为”中性”。显示趋势强度(百分比)、AI信心(基于趋势一致性)和累积成交量差异(CVD)的市场背景汇总表。第二个表(可选)显示1小时、4小时和日线时间框架的趋势预测,帮助交易者预测未来市场方向。

动态趋势线:根据用户定义期间内(shortTrendPeriod、longTrendPeriod)的最近摆动低点和高点绘制支撑和阻力线。这些线根据市场条件自适应,并根据趋势强度着色。

策略优势

多时间周期趋势动量交易策略有以下几个显著优势:

减少虚假信号:通过要求趋势、动量、成交量和突破过滤器的一致性,该策略最小化了在波动或低置信度市场中的交易。

适应市场背景:基于ATR的动量阈值可以根据波动性动态调整,确保信号在趋势市场和区间市场中保持相关性。

简化决策制定:AI仪表盘将复杂的多时间周期数据整合成用户友好的表格,消除了手动分析的需要。

利用智能资金:CHoCH和BOS信号捕捉机构价格行动模式,为交易者提供识别反转和延续的优势。

视觉清晰度:策略通过标记关键水平、信号和趋势线,使市场结构变得清晰可见,帮助交易者更好地理解价格行为。

风险管理内置:预定义的止盈和止损水平促进了纪律严明的风险管理,这对长期交易成功至关重要。

提前预警:通过”做好准备”信号,交易者可以在设置完全发展之前得到提醒,允许更多的准备和计划时间。

策略风险

尽管该策略有很多优势,但也存在一些潜在风险:

参数优化陷阱:过度优化策略参数可能导致曲线拟合,在未来市场条件下表现不佳。解决方法是在多个市场和时间周期上进行广泛的回测,找到稳健的参数集。

延迟信号:多重过滤器的使用可能导致信号相对于价格动作有所延迟,有时错过理想的入场点。解决方法是调整对市场速度更敏感的参数,如枢轴长度和动量阈值。

错误的趋势识别:在高波动性或无方向性市场中,趋势评估可能不准确。解决方法是在这些条件下减少交易或增加更严格的过滤器要求。

资金管理缺陷:固定的止盈和止损点可能不适合所有市场条件。解决方法是将它们调整为基于ATR的值,以适应当前波动性。

计算密集型:策略的复杂性可能在某些平台上导致性能问题,特别是在分析大量历史数据时。解决方法是限制回测时间范围或简化不重要的计算。

数据依赖:策略依赖于准确的多时间周期数据,这可能并非在所有交易环境中都可用。解决方法是实现可靠的备选方案,如代码中所示的本地值计算。

对高流动性市场的偏好:策略在低流动性市场上可能产生更多错误信号。解决方法是专注于主要货币对、广泛持有的股票和主要加密货币。

策略优化方向

该策略可以通过以下几个方向进一步优化:

自适应参数:实现自动调整参数,如基于历史波动率数据的动量阈值优化。这可以提高策略在不同市场条件下的适应性。

机器学习整合:应用机器学习算法识别最佳参数组合,或者预测特定市场条件下策略表现。这可以通过分析历史表现数据来实现,进一步增强策略的”AI”方面。

市场情绪指标:添加外部市场情绪数据,如VIX指数或社交媒体情绪分析,为交易决策提供更广泛的背景。这可以帮助策略避免在极端市场条件下交易。

时间过滤器:增加基于市场波动时间模式的过滤器,避免在已知低波动期间(如亚洲会话中段)交易。这可以减少低质量信号的数量。

相关性分析:添加跨资产相关性检查,确保交易与相关市场(如:交易欧元/美元时考虑美元指数)的动向一致。这可以提供额外的信号确认。

资金管理优化:实现基于波动率的动态止盈/止损水平,并加入资金管理规则,如随着账户增长调整头寸规模。这将提高长期风险调整后的回报。

性能优化:简化代码,减少不必要的计算,特别是在趋势线和表格显示方面,以提高策略在实时交易中的响应性。

数据无关性:增强策略以更优雅地处理数据中断或缺失值,确保在不理想条件下的鲁棒性。

总结

多时间周期趋势动量交易策略提供了一个全面的交易系统,结合传统技术分析、智能资金概念和独特的AI驱动趋势分析。其强大之处在于多层次的过滤和确认机制,确保只在高可能性情况下生成交易信号。

该策略的一个特别创新的方面是将多时间周期趋势信息整合成直观的视觉仪表盘,使交易者能够快速评估市场状况而无需复杂的手动分析。动态支撑阻力线和关键结构水平的可视化进一步增强了这种易用性。

通过智能结合CHoCH和BOS概念,该策略能够捕捉市场心理的微妙变化,这通常预示着趋势延续或潜在反转。ATR调整阈值的使用确保策略可以适应不同的波动条件,使其适用于多种市场环境。

尽管存在一些风险和局限性,但通过建议的优化措施,这个已经强大的系统可以进一步增强。明智地应用风险管理原则,并根据特定交易目标和风险承受能力调整参数,该策略有潜力成为任何交易者工具箱中的宝贵工具。

最终,像所有交易策略一样,成功将取决于适当的参数优化、纪律执行、稳健的风险管理以及对市场动态的深入理解。

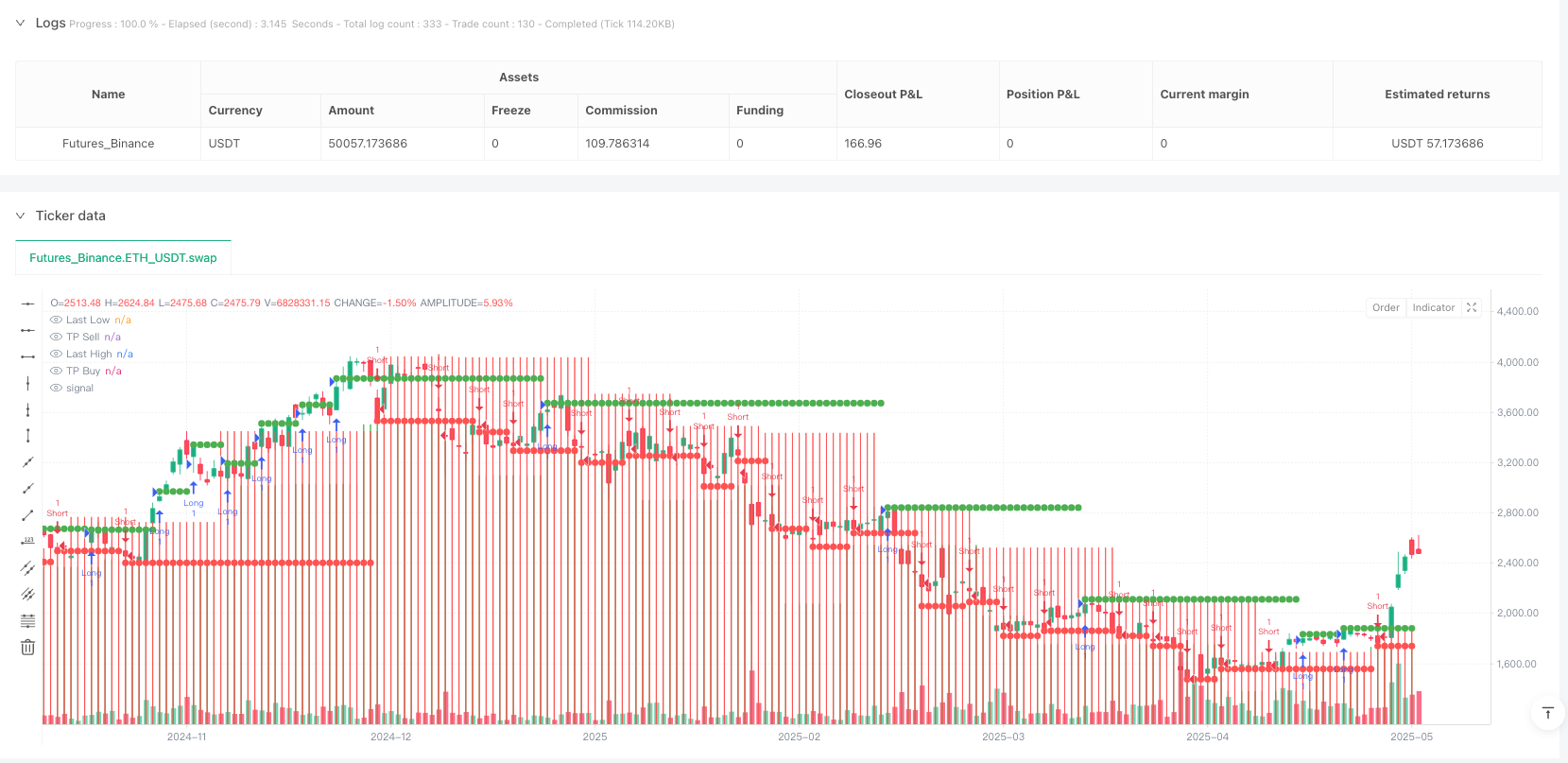

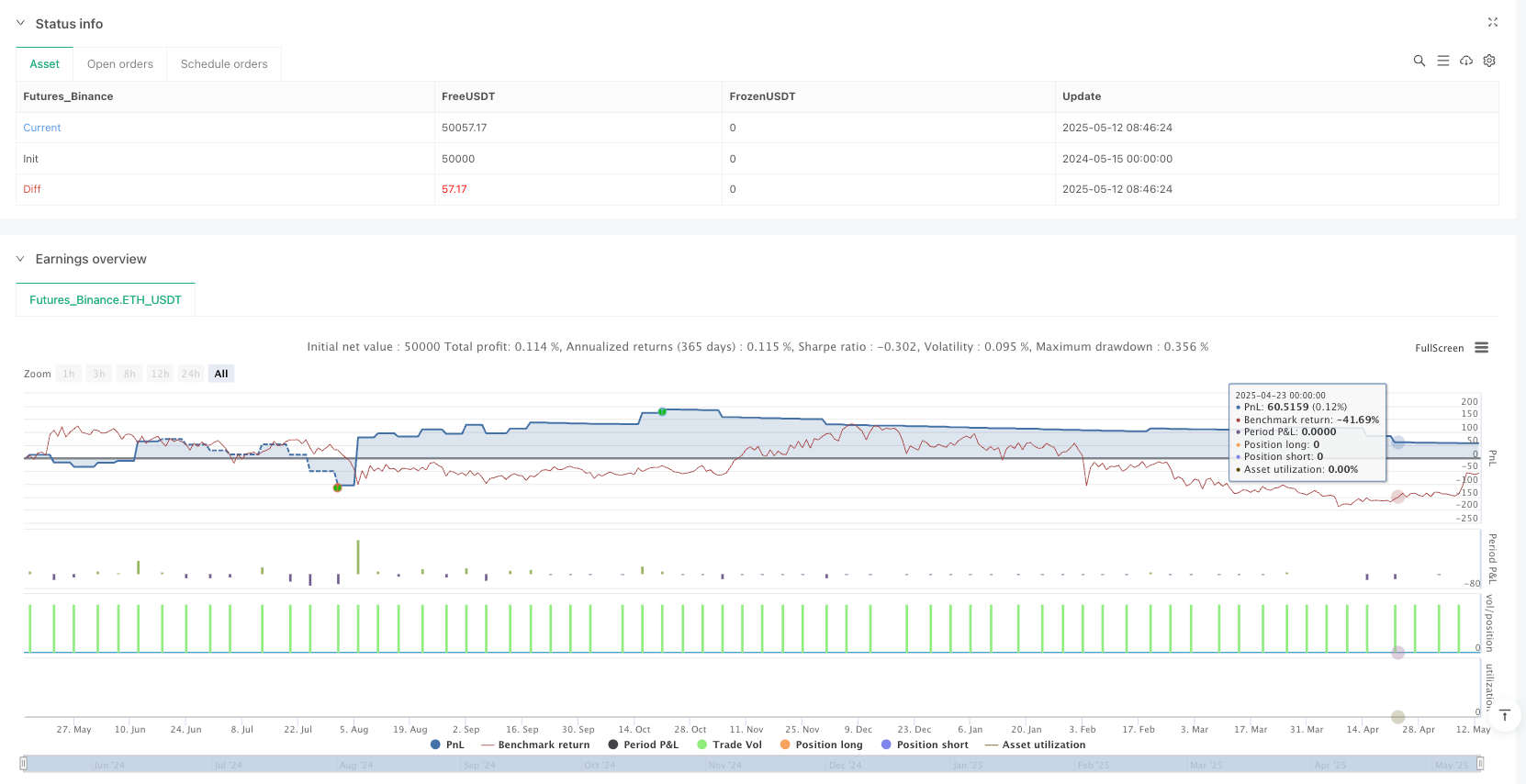

/*backtest

start: 2024-05-15 00:00:00

end: 2025-05-13 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

//@version=5

strategy("PowerHouse SwiftEdge AI v2.10 Strategy", overlay=true, calc_on_every_tick=true)

// Inputs med fleksible indstillinger

length = input.int(5, "Pivot Length", minval=1, maxval=20, step=1, tooltip="Number of bars to identify pivot highs and lows.")

momentum_threshold_base = input.float(0.01, "Base Momentum Threshold (%)", minval=0.001, maxval=1.0, step=0.001, tooltip="Base percentage change for signals.")

tp_points = input.int(10, "Take Profit (points)", minval=5, maxval=500, step=5)

sl_points = input.int(10, "Stop Loss (points)", minval=5, maxval=500, step=5)

min_signal_distance = input.int(5, "Min Signal Distance (bars)", minval=1, maxval=50, step=1)

tp_box_height = input.float(0.5, "TP Box Height % (Optional)", minval=0.1, maxval=2.0, step=0.1)

pre_momentum_factor_base = input.float(0.5, "Base Pre-Momentum Factor", minval=0.1, maxval=1.0, step=0.1, tooltip="Base factor for Get Ready signals.")

shortTrendPeriod = input.int(30, title="Short Trend Period", minval=10, maxval=100)

longTrendPeriod = input.int(100, title="Long Trend Period", minval=50, maxval=200)

// Brugerdefinerede filtre

use_momentum_filter = input.bool(true, "Use Momentum Filter", group="Signal Filters", tooltip="Require price change to exceed momentum threshold.")

use_trend_filter = input.bool(true, "Use Higher Timeframe Trend Filter", group="Signal Filters", tooltip="Require alignment with the selected higher timeframe trend.")

higher_tf_choice = input.string("60", "Higher Timeframe", options=["60", "240", "D"], group="Signal Filters", tooltip="Choose the timeframe for the higher timeframe filter.")

use_lower_tf_filter = input.bool(true, "Use Lower Timeframe Filter", group="Signal Filters", tooltip="Prevent signals against the selected lower timeframe trend.")

lower_tf_choice = input.string("60", "Lower Timeframe", options=["60", "240", "D"], group="Signal Filters", tooltip="Choose the timeframe for the lower timeframe filter.")

use_volume_filter = input.bool(false, "Use Volume Filter", group="Signal Filters", tooltip="Require volume above average (optional).")

use_breakout_filter = input.bool(false, "Use Breakout Filter", group="Signal Filters", tooltip="Require price to break previous high/low (optional).")

show_get_ready = input.bool(true, "Show Get Ready Signals", group="Signal Filters", tooltip="Enable or disable Get Ready signals.")

restrict_repeated_signals = input.bool(false, "Restrict Repeated Signals", group="Signal Filters", tooltip="Prevent multiple signals in the same trend direction until trend changes.")

restrict_trend_tf_choice = input.string("60", "Restrict Trend Timeframe", options=["60", "240", "D"], group="Signal Filters", tooltip="Choose the timeframe to check trend for restricting repeated signals.")

enable_ai_analysis = input.bool(true, "Enable AI Market Analysis", group="AI Market Analysis", tooltip="Show AI predictions for future trends across timeframes.")

ai_table_position = input.string("Bottom Center", "AI Market Analysis Table Position", options=["Top Left", "Top Center", "Top Right", "Middle Left", "Middle Center", "Middle Right", "Bottom Left", "Bottom Center", "Bottom Right"], group="AI Market Analysis", tooltip="Choose the position of the AI Market Analysis table.")

// Ekstra inputs til valgfrie filtre

volumeLongPeriod = input.int(50, "Long Volume Period", minval=10, maxval=100, group="Volume Filter Settings")

volumeShortPeriod = input.int(5, "Short Volume Period", minval=1, maxval=20, group="Volume Filter Settings")

breakoutPeriod = input.int(5, "Breakout Period", minval=1, maxval=50, group="Breakout Filter Settings")

// Funktion til at konvertere streng til position

f_getTablePosition(position_string) =>

switch position_string

"Top Left" => position.top_left

"Top Center" => position.top_center

"Top Right" => position.top_right

"Middle Left" => position.middle_left

"Middle Center" => position.middle_center

"Middle Right" => position.middle_right

"Bottom Left" => position.bottom_left

"Bottom Center" => position.bottom_center

"Bottom Right" => position.bottom_right

=> position.middle_right // Standard fallback

// AI-drevet adaptiv signaljustering med ATR

atr_raw = ta.atr(14)

atr = na(atr_raw) and bar_index > 0 ? (high - low) : atr_raw

volatility_factor = atr / close

momentum_threshold = momentum_threshold_base * (1 + volatility_factor * 2)

pre_momentum_factor = pre_momentum_factor_base * (1 - volatility_factor * 0.5)

pre_momentum_threshold = momentum_threshold * pre_momentum_factor

// Raw CVD-beregning

var float raw_cvd = 0.0

delta_volume = close > close[1] ? volume : close < close[1] ? -volume : 0

raw_cvd := raw_cvd + delta_volume

// Volatility Context baseret på absolut CVD

cvd_level = math.abs(raw_cvd) < 10000 ? "Low" : math.abs(raw_cvd) < 50000 ? "Medium" : "High"

cvd_color = raw_cvd > 0 ? color.lime : raw_cvd < 0 ? color.red : color.yellow

// Beregn prisændring (momentum)

price_change = ((close - close[1]) / close[1]) * 100

// Find højder og lavpunkter

pivot_high = ta.pivothigh(high, length, length)

pivot_low = ta.pivotlow(low, length, length)

// Variabler til at gemme seneste højder og lavpunkter

var float last_high = na

var float last_low = na

if not na(pivot_high)

last_high := pivot_high

if not na(pivot_low)

last_low := pivot_low

// Variabler til signalstyring

var float choch_sell_level = na

var float choch_buy_level = na

var float bos_sell_level = na

var float bos_buy_level = na

var float tp_sell_level = na

var float tp_buy_level = na

var int last_signal_bar = -min_signal_distance - 1

var string last_signal = "Neutral"

var int last_trend = 0 // Sporer den sidste trendretning for restrict_repeated_signals

// Multi-tidsramme trendanalyse med robust fallback

// Beregn EMA og VWAP for hver tidsramme

ema60_raw = request.security(syminfo.tickerid, "60", ta.ema(close, 20), lookahead=barmerge.lookahead_on)

vwap60_raw = request.security(syminfo.tickerid, "60", ta.vwap(hlc3), lookahead=barmerge.lookahead_on)

ema240_raw = request.security(syminfo.tickerid, "240", ta.ema(close, 20), lookahead=barmerge.lookahead_on)

vwap240_raw = request.security(syminfo.tickerid, "240", ta.vwap(hlc3), lookahead=barmerge.lookahead_on)

emaD_raw = request.security(syminfo.tickerid, "D", ta.ema(close, 20), lookahead=barmerge.lookahead_on)

vwapD_raw = request.security(syminfo.tickerid, "D", ta.vwap(hlc3), lookahead=barmerge.lookahead_on)

// Lokale EMA og VWAP som fallback

local_ema = ta.ema(close, 20)

local_vwap = ta.vwap(hlc3)

// Fallback for manglende data

ema60 = na(ema60_raw) ? local_ema : ema60_raw

vwap60 = na(vwap60_raw) ? local_vwap : vwap60_raw

ema240 = na(ema240_raw) ? local_ema : ema240_raw

vwap240 = na(vwap240_raw) ? local_vwap : vwap240_raw

emaD = na(emaD_raw) ? local_ema : emaD_raw

vwapD = na(vwapD_raw) ? local_vwap : vwapD_raw

// Trendbestemmelse (1 = op, -1 = ned, 0 = neutral)

trend60 = close > ema60 and close > vwap60 ? 1 : close < ema60 and close < vwap60 ? -1 : 0

trend240 = close > ema240 and close > vwap240 ? 1 : close < ema240 and close < vwap240 ? -1 : 0

trendD = close > emaD and close > vwapD ? 1 : close < emaD and close < vwapD ? -1 : 0

// AI-Trend Strength (-100 til +100)

trend_strength_raw = trend60 + trend240 + trendD

trend_strength = (trend_strength_raw / 3) * 100

// AI Confidence (simuleret succesrate)

var float ai_confidence = 50.0

if trend_strength_raw == 3 or trend_strength_raw == -3

ai_confidence := 90.0

else if trend_strength_raw >= 2 or trend_strength_raw <= -2

ai_confidence := 75.0

else

ai_confidence := 60.0

// Filterbetingelser

// Dynamisk valg af higher timeframe trend (til signalfiltrering)

var int higher_tf_trend = 0

switch higher_tf_choice

"60" => higher_tf_trend := trend60

"240" => higher_tf_trend := trend240

"D" => higher_tf_trend := trendD

bullish_trend_ok = higher_tf_trend == 1

bearish_trend_ok = higher_tf_trend == -1

// Dynamisk valg af lower timeframe trend (til signalfiltrering)

var int lower_tf_trend = 0

switch lower_tf_choice

"60" => lower_tf_trend := trend60

"240" => lower_tf_trend := trend240

"D" => lower_tf_trend := trendD

lower_tf_bullish = lower_tf_trend == 1

lower_tf_bearish = lower_tf_trend == -1

lower_tf_not_neutral = lower_tf_trend != 0

// Dynamisk valg af trend-tidsramme til restrict_repeated_signals

var int restrict_tf_trend = 0

switch restrict_trend_tf_choice

"60" => restrict_tf_trend := trend60

"240" => restrict_tf_trend := trend240

"D" => restrict_tf_trend := trendD

volAvg50 = ta.sma(volume, volumeLongPeriod)

volShort = ta.sma(volume, volumeShortPeriod)

volCondition = volume > volAvg50 and ta.change(volShort) > 0

highestBreakout = ta.highest(high, breakoutPeriod)

lowestBreakout = ta.lowest(low, breakoutPeriod)

// CHoCH og BOS definitioner

choch_sell = ta.crossunder(low, last_high) and close < open

choch_buy = ta.crossover(high, last_low) and close > open

bos_sell = ta.crossunder(low, last_low[1]) and low < last_low[1] and close < open

bos_buy = ta.crossover(high, last_high[1]) and high > last_high[1] and close > open

// Signalbetingelser med valgbare filtre

early_sell_signal = use_momentum_filter ? price_change < -momentum_threshold : true

early_buy_signal = use_momentum_filter ? price_change > momentum_threshold : true

sell_trend_ok = use_trend_filter ? bearish_trend_ok : true

buy_trend_ok = use_trend_filter ? bullish_trend_ok : true

sell_lower_tf_ok = use_lower_tf_filter ? (not lower_tf_bullish and lower_tf_not_neutral) : true

buy_lower_tf_ok = use_lower_tf_filter ? (not lower_tf_bearish and lower_tf_not_neutral) : true

sell_volume_ok = use_volume_filter ? volCondition : true

buy_volume_ok = use_volume_filter ? volCondition : true

sell_breakout_ok = use_breakout_filter ? close < lowestBreakout[1] : true

buy_breakout_ok = use_breakout_filter ? close > highestBreakout[1] : true

// Logik for at begrænse gentagne signaler baseret på restrict_tf_trend

sell_allowed = not restrict_repeated_signals or (last_signal != "Sell" or (last_signal == "Sell" and restrict_tf_trend != last_trend and restrict_tf_trend != -1))

buy_allowed = not restrict_repeated_signals or (last_signal != "Buy" or (last_signal == "Buy" and restrict_tf_trend != last_trend and restrict_tf_trend != 1))

sell_condition = early_sell_signal and (bar_index - last_signal_bar >= min_signal_distance) and sell_trend_ok and sell_lower_tf_ok and sell_volume_ok and sell_breakout_ok and sell_allowed

buy_condition = early_buy_signal and (bar_index - last_signal_bar >= min_signal_distance) and buy_trend_ok and buy_lower_tf_ok and buy_volume_ok and buy_breakout_ok and buy_allowed

get_ready_sell = use_momentum_filter ? (price_change < -pre_momentum_threshold and price_change > -momentum_threshold) : true and (bar_index - last_signal_bar >= min_signal_distance) and sell_trend_ok and sell_lower_tf_ok and sell_volume_ok and sell_breakout_ok

get_ready_buy = use_momentum_filter ? (price_change > pre_momentum_threshold and price_change < momentum_threshold) : true and (bar_index - last_signal_bar >= min_signal_distance) and buy_trend_ok and buy_lower_tf_ok and buy_volume_ok and buy_breakout_ok

// Strategy logic

if buy_condition

strategy.entry("Long", strategy.long)

strategy.exit("TP/SL Long", "Long", limit=close + tp_points, stop=close - sl_points)

label.new(bar_index, low, "Buy", color=color.green, style=label.style_label_up, textcolor=color.white)

tp_buy_level := high + tp_points

last_signal := "Buy"

last_signal_bar := bar_index

last_trend := restrict_tf_trend

if sell_condition

strategy.entry("Short", strategy.short)

strategy.exit("TP/SL Short", "Short", limit=close - tp_points, stop=close + sl_points)

label.new(bar_index, high, "Sell", color=color.red, style=label.style_label_down, textcolor=color.white)

tp_sell_level := low - tp_points

last_signal := "Sell"

last_signal_bar := bar_index

last_trend := restrict_tf_trend

// Plot Get Ready signals

if show_get_ready and get_ready_sell

label.new(bar_index, high, "Get Ready SELL", color=color.orange, style=label.style_label_down, textcolor=color.black, size=size.small)

if show_get_ready and get_ready_buy

label.new(bar_index, low, "Get Ready BUY", color=color.yellow, style=label.style_label_up, textcolor=color.black, size=size.small)

// Plot CHoCH og BOS som fulde linjer med AI-agtige farver

var line choch_sell_line = na

var line choch_buy_line = na

var line bos_sell_line = na

var line bos_buy_line = na

// Trendlinjer med bufferkontrol og AI-laser-look

var line sup = na

var line res = na

if barstate.islast

float lowest_y2 = 60000

int lowest_x2 = 0

float highest_y2 = 0

int highest_x2 = 0

// Begræns lookback til max 2000 bars for at undgå bufferfejl

int maxShortBars = math.min(math.min(shortTrendPeriod, bar_index), 2000)

for i = 1 to maxShortBars

if low[i] < lowest_y2

lowest_y2 := low[i]

lowest_x2 := i

if high[i] > highest_y2

highest_y2 := high[i]

highest_x2 := i

float lowest_y1 = 60000

int lowest_x1 = 0

float highest_y1 = 0

int highest_x1 = 0

// Begræns lookback til max 2000 bars for at undgå bufferfejl

int maxLongBars = math.min(math.min(longTrendPeriod, bar_index), 2000)

for j = shortTrendPeriod + 1 to maxLongBars

if low[j] < lowest_y1

lowest_y1 := low[j]

lowest_x1 := j

if high[j] > highest_y1

highest_y1 := high[j]

highest_x1 := j

int trendStrength = trend_strength_raw

// Plot niveauer

plot(choch_sell_level, title="Last High at CHoCH", color=color.aqua, style=plot.style_circles, linewidth=1, trackprice=false)

plot(choch_buy_level, title="Last Low at CHoCH", color=color.lime, style=plot.style_circles, linewidth=1, trackprice=false)

plot(bos_sell_level, title="Last Low at BOS", color=color.fuchsia, style=plot.style_circles, linewidth=1, trackprice=false)

plot(bos_buy_level, title="Last High at BOS", color=color.teal, style=plot.style_circles, linewidth=1, trackprice=false)

plot(tp_sell_level, title="TP Sell", color=color.red, style=plot.style_circles, linewidth=1, trackprice=false)

plot(tp_buy_level, title="TP Buy", color=color.green, style=plot.style_circles, linewidth=1, trackprice=false)

plot(last_high, title="Last High", color=color.red, style=plot.style_histogram, linewidth=1, trackprice=true)

plot(last_low, title="Last Low", color=color.green, style=plot.style_histogram, linewidth=1, trackprice=true)

// AI Markedsanalyse - Beregn data uanset betingelse

momentum_1h = request.security(syminfo.tickerid, "60", close - close[3], lookahead=barmerge.lookahead_on)

momentum_4h = request.security(syminfo.tickerid, "240", close - close[3], lookahead=barmerge.lookahead_on)

momentum_d = request.security(syminfo.tickerid, "D", close - close[3], lookahead=barmerge.lookahead_on)

// Beregn ATR og SMA(ATR) for hver tidsramme

atr_1h = request.security(syminfo.tickerid, "60", ta.atr(14), lookahead=barmerge.lookahead_on)

atr_4h = request.security(syminfo.tickerid, "240", ta.atr(14), lookahead=barmerge.lookahead_on)

atr_d = request.security(syminfo.tickerid, "D", ta.atr(14), lookahead=barmerge.lookahead_on)

sma_atr_1h = request.security(syminfo.tickerid, "60", ta.sma(ta.atr(14), 20), lookahead=barmerge.lookahead_on)

sma_atr_4h = request.security(syminfo.tickerid, "240", ta.sma(ta.atr(14), 20), lookahead=barmerge.lookahead_on)

sma_atr_d = request.security(syminfo.tickerid, "D", ta.sma(ta.atr(14), 20), lookahead=barmerge.lookahead_on)

// Lokale ATR og SMA(ATR) som fallback

local_atr = ta.atr(14)

local_sma_atr = ta.sma(ta.atr(14), 20)

// Fallback for manglende data

volatility_1h = na(atr_1h) ? local_atr : atr_1h

volatility_4h = na(atr_4h) ? local_atr : atr_4h

volatility_d = na(atr_d) ? local_atr : atr_d

volatility_avg_1h = na(sma_atr_1h) ? local_sma_atr : sma_atr_1h

volatility_avg_4h = na(sma_atr_4h) ? local_sma_atr : sma_atr_4h

volatility_avg_d = na(sma_atr_d) ? local_sma_atr : sma_atr_d

momentum_1h := na(momentum_1h) ? 0 : momentum_1h

momentum_4h := na(momentum_4h) ? 0 : momentum_4h

momentum_d := na(momentum_d) ? 0 : momentum_d

// Analyse baseret på trend, momentum og volatilitet

score_1h = trend60 + (momentum_1h > 0 ? 0.5 : momentum_1h < 0 ? -0.5 : 0) + (volatility_1h > volatility_avg_1h ? 0.5 : 0)

score_4h = trend240 + (momentum_4h > 0 ? 0.5 : momentum_4h < 0 ? -0.5 : 0) + (volatility_4h > volatility_avg_4h ? 0.5 : 0)

score_d = trendD + (momentum_d > 0 ? 0.5 : momentum_d < 0 ? -0.5 : 0) + (volatility_d > volatility_avg_d ? 0.5 : 0)

// Forudsigelser

pred_1h = score_1h > 0.5 ? "Up" : score_1h < -0.5 ? "Down" : "Neutral"

pred_4h = score_4h > 0.5 ? "Up" : score_4h < -0.5 ? "Down" : "Neutral"

pred_d = score_d > 0.5 ? "Up" : score_d < -0.5 ? "Down" : "Neutral"

// Futuristisk AI-Trend Dashboard

var table trendTable = table.new(position.top_right, columns=2, rows=6, bgcolor=color.new(color.black, 50), border_width=2, border_color=color.new(color.teal, 20))

table.cell(trendTable, 0, 0, "AI-Trend Matrix v2.10", text_color=color.new(color.aqua, 0), bgcolor=color.new(color.navy, 60))

table.cell(trendTable, 1, 0, "", bgcolor=color.new(color.navy, 60))

table.merge_cells(trendTable, 0, 0, 1, 0)

table.cell(trendTable, 0, 1, "Trend Strength", text_color=color.white)

table.cell(trendTable, 1, 1, str.tostring(math.round(trend_strength)), text_color=trend_strength > 0 ? color.rgb(0, math.min(255, trend_strength * 2.55), 0) : color.rgb(math.min(255, math.abs(trend_strength) * 2.55), 0, 0))

table.cell(trendTable, 0, 2, "AI Confidence", text_color=color.white)

table.cell(trendTable, 1, 2, str.tostring(ai_confidence) + "%", text_color=color.teal)

table.cell(trendTable, 0, 3, "AI Calibration", text_color=color.white)

table.cell(trendTable, 1, 3, "CVD: " + str.tostring(math.round(raw_cvd)) + " (" + cvd_level + ")", text_color=cvd_color)

table.cell(trendTable, 0, 4, "1H", text_color=color.white)

table.cell(trendTable, 1, 4, trend60 == 1 ? "Up" : trend60 == -1 ? "Down" : "Neutral", text_color=trend60 == 1 ? color.lime : trend60 == -1 ? color.fuchsia : color.yellow)

table.cell(trendTable, 0, 5, "4H", text_color=color.white)

table.cell(trendTable, 1, 5, trend240 == 1 ? "Up" : trend240 == -1 ? "Down" : "Neutral", text_color=trend240 == 1 ? color.lime : trend240 == -1 ? color.fuchsia : color.yellow)

// Tabel for AI Markedsanalyse

if enable_ai_analysis

var table ai_table = table.new(f_getTablePosition(ai_table_position), columns=4, rows=2, bgcolor=color.new(color.black, 50), border_width=2, border_color=color.new(color.teal, 20))

table.cell(ai_table, 0, 0, "AI Market Analysis", text_color=color.new(color.aqua, 0), bgcolor=color.new(color.navy, 60))

table.cell(ai_table, 1, 0, "1H", text_color=color.white)

table.cell(ai_table, 2, 0, "4H", text_color=color.white)

table.cell(ai_table, 3, 0, "1D", text_color=color.white)

table.cell(ai_table, 0, 1, "Prediction", text_color=color.white)

table.cell(ai_table, 1, 1, pred_1h, text_color=pred_1h == "Up" ? color.lime : pred_1h == "Down" ? color.fuchsia : color.yellow)

table.cell(ai_table, 2, 1, pred_4h, text_color=pred_4h == "Up" ? color.lime : pred_4h == "Down" ? color.fuchsia : color.yellow)

table.cell(ai_table, 3, 1, pred_d, text_color=pred_d == "Up" ? color.lime : pred_d == "Down" ? color.fuchsia : color.yellow)

// Debug alerts for null data

if na(ema60) or na(vwap60)

alert("Warning: 60-minute timeframe data is null!", alert.freq_once_per_bar)

if na(ema240) or na(vwap240)

alert("Warning: 240-minute timeframe data is null!", alert.freq_once_per_bar)

if na(emaD) or na(vwapD)

alert("Warning: Daily timeframe data is null!", alert.freq_once_per_bar)