概述

纽约开盘高波动突破策略是一种基于市场开盘区间突破原理的量化交易策略,旨在利用纽约市场开盘时段的高波动特性进行交易。该策略通过捕捉开盘后30分钟(即8:30)形成的价格区间突破信号,设定严格的入场规则和风险管理机制,以获取高效的交易机会。策略核心在于识别开盘价格区间(Opening Range)的高点和低点,当价格突破这些关键水平时触发交易信号,并采用动态止损和目标盈利设置,确保风险回报比的优化。

策略原理

该策略的核心原理基于市场在开盘时段往往呈现出较高的波动性和方向性,通过以下几个关键步骤实现:

- 区间确定:在每个交易日的8:30(纽约开盘时段),记录当前K线的最高价和最低价,分别作为开盘区间(ORB)的上下边界。

- 突破信号:当价格收盘突破ORB高点时,触发做多信号;当价格收盘突破ORB低点时,触发做空信号。

- 风险管理:策略设定了精确的风险控制机制,风险单位定义为ORB高点与低点之间的距离。

- 动态止损:初始止损设置在ORB的对应边界(多单止损在ORB低点,空单止损在ORB高点)。

- 盈利目标:通过可调整的风险回报比(默认为2.0)来设定目标利润,计算为风险单位的倍数。

- 移动止损:当价格达到一定盈利水平(1:1风险回报比)时,将止损移至盈亏平衡点(Breakeven),保护已获利润。

- 交易限制:策略设置了每日最大交易次数(默认为8次),以避免过度交易。

- 序列管理:实现了交易序列控制逻辑,防止在同一区间内重复触发相同方向的交易。

策略通过严格的条件判断和状态管理,实现了高效的交易执行和风险控制。代码中使用了多个布尔变量和条件判断来追踪交易状态,确保交易执行的准确性和一致性。

策略优势

通过深入分析代码,该策略展现出以下显著优势:

- 简明直观:策略规则清晰明确,易于理解和执行,适合各级别交易者。

- 高波动利用:专门针对纽约开盘时段的高波动特性设计,能够有效捕捉大幅价格波动带来的利润机会。

- 精确的风险控制:通过明确定义的风险单位和动态止损策略,实现了精确的风险管理。

- 动态止损优化:当达到1:1风险回报比时自动将止损移至盈亏平衡点,既锁定部分利润又允许行情继续发展。

- 灵活的参数调整:风险回报比可通过输入参数调整,使策略适应不同市场环境和个人风险偏好。

- 交易频率控制:设置了每日最大交易次数限制,避免过度交易和资金过度暴露于市场风险。

- 自动化执行:完全编码化的策略逻辑,可实现自动化交易执行,减少人为干预和情绪影响。

- 可视化支持:提供了关键价格水平的可视化显示和交易信号标记,便于策略监控和回测分析。

- 警报功能:内置交易信号警报条件,便于实时监控和提醒。

策略风险

尽管该策略设计精良,但仍存在以下潜在风险和挑战:

- 假突破风险:开盘区间突破后可能出现假突破和价格回撤,导致止损被触发。解决方法可以考虑增加确认指标或延迟进场逻辑。

- 波动性依赖:策略效果高度依赖市场的波动性,在低波动市场环境中可能表现欠佳。可以考虑增加波动性过滤器,仅在满足最小波动条件时启用策略。

- 固定时间框架限制:策略仅基于8:30的开盘区间,可能错过其他时间段的有效交易机会。可考虑扩展到多个时间窗口或动态时间窗口。

- 市场噪音干扰:短期价格波动可能导致不必要的交易触发。可以考虑增加价格过滤器或使用更高时间框架的确认信号。

- 参数敏感性:策略表现可能对风险回报比等参数设置高度敏感。建议进行全面的参数优化和稳健性测试。

- 交易成本影响:未考虑交易成本可能导致回测结果与实际表现有差异。实际应用时应将交易成本纳入策略评估。

- 资金管理不足:虽然策略设置了风险控制机制,但缺乏完整的资金管理系统。建议增加动态仓位管理功能,根据账户规模和市场条件调整交易规模。

策略优化方向

基于代码分析,以下是可能的策略优化方向:

- 多重时间框架分析:集成更高时间框架的市场趋势信息,仅在趋势方向一致时执行交易,提高成功率。

- 动态风险回报设置:根据市场波动性或其他市场状态指标动态调整风险回报比,在不同市场环境中优化性能。

- 增加过滤条件:引入额外的技术指标或市场情绪指标作为交易过滤器,如移动平均线、相对强弱指数(RSI)或成交量加权平均价格(VWAP)等。

- 优化进场时机:考虑使用价格行为模式或蜡烛图形态作为额外的进场确认,减少假突破带来的损失。

- 改进止损策略:实现更复杂的跟踪止损机制,例如基于ATR(平均真实范围)的动态止损或根据市场噪音水平调整的止损。

- 增强资金管理:实现基于波动性和胜率的动态仓位管理系统,优化资金利用效率和风险控制。

- 季节性调整:分析并利用市场的季节性模式,在不同市场季节性条件下调整策略参数或交易条件。

- 多样化出场策略:实现部分利润获取机制,允许在不同价格水平分批平仓,优化整体盈利表现。

- 机器学习优化:考虑使用机器学习算法预测突破的有效性,或优化策略参数,提高策略的适应性和稳健性。

总结

纽约开盘高波动突破策略是一种设计精良、规则明确的量化交易策略,通过捕捉市场开盘时段的高波动特性,结合严格的风险管理和交易执行规则,为交易者提供了一种可靠的交易方法。该策略的核心优势在于其简明直观的逻辑和精确的风险控制机制,通过动态止损和目标盈利设置,有效平衡了风险和回报。

然而,策略也面临假突破、波动性依赖和参数敏感性等挑战。通过引入多重时间框架分析、动态风险回报设置、优化进场时机和改进止损策略等优化方向,可以进一步提升策略的稳健性和盈利能力。特别是结合技术指标过滤器和机器学习方法,有望显著改善策略在不同市场环境下的适应性。

对于希望利用市场开盘高波动特性的交易者而言,该策略提供了一个结构化的框架,通过严格遵循策略规则并结合个人风险偏好进行参数调整,可以构建一个高效、稳健的交易系统。

策略源码

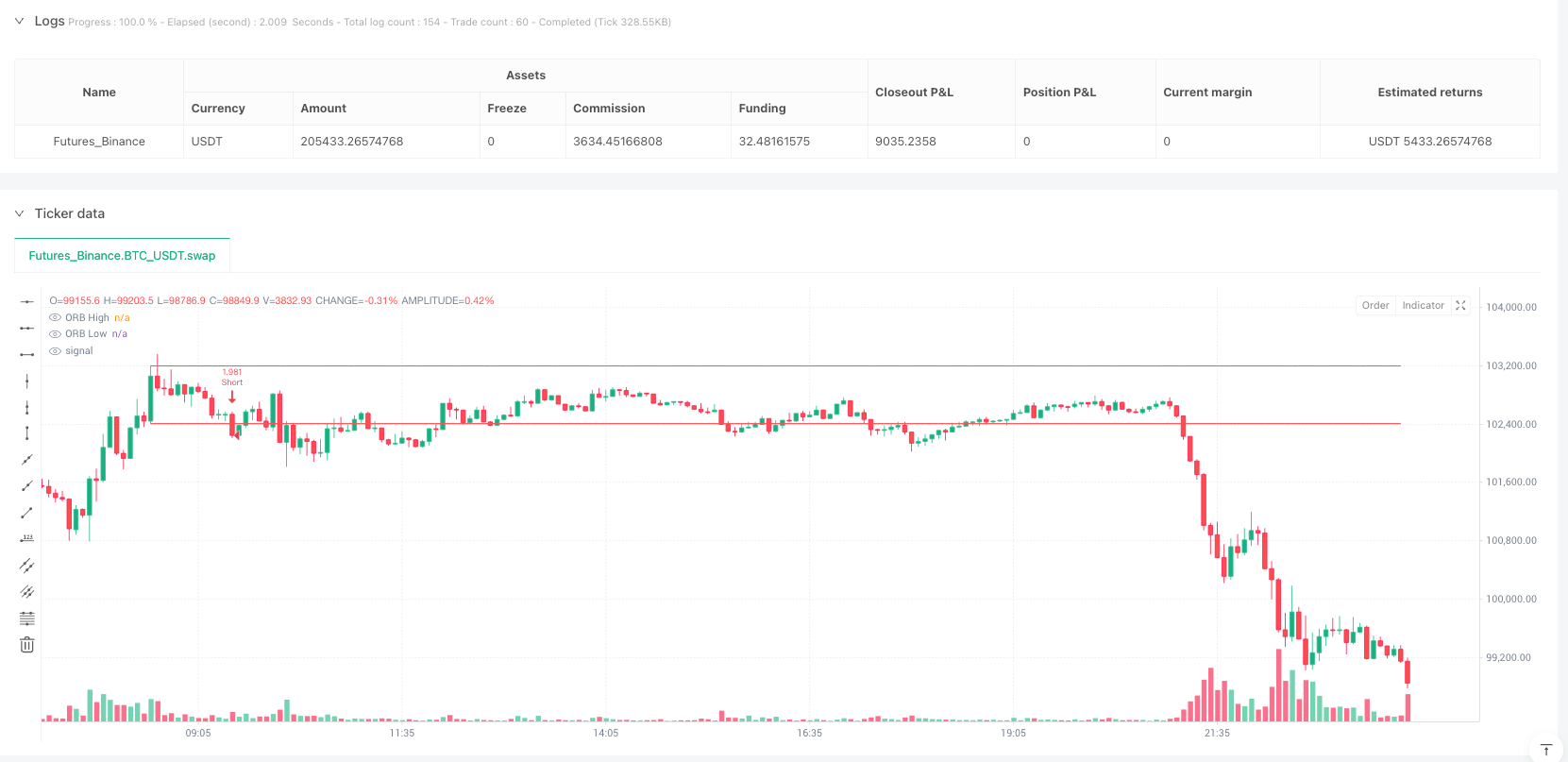

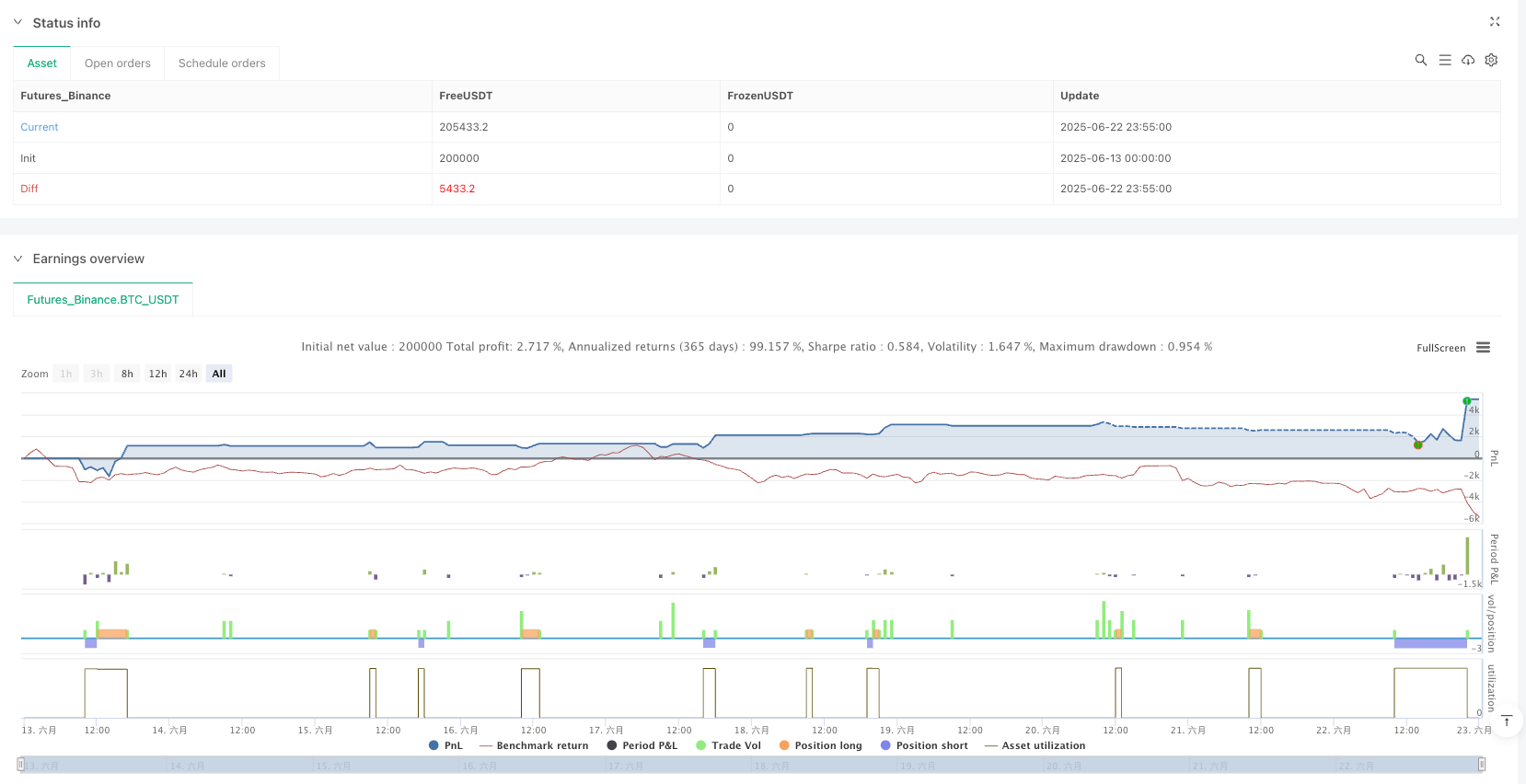

/*backtest

start: 2025-06-13 00:00:00

end: 2025-06-23 00:00:00

period: 5m

basePeriod: 5m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT","balance":200000}]

*/

//@version=5

strategy("The Price Model", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=100)

// === INPUTS ===

rrRatio = input.float(2.0, "Take Profit RR", minval=1.0)

showLevels = input.bool(true, "Show ORB High/Low Levels")

maxTradesPerDay = 8

// === TIME SETUP ===

isNewDay = ta.change(time("D"))

is830 = (hour == 8 and minute == 30)

// === ORB VARIABLES ===

var float orbHigh = na

var float orbLow = na

var bool orbSet = false

var int tradeCount = 0

var bool longSequenceDone = false

var bool shortSequenceDone = false

if isNewDay

orbHigh := na

orbLow := na

orbSet := false

tradeCount := 0

longSequenceDone := false

shortSequenceDone := false

if is830

orbHigh := high

orbLow := low

orbSet := true

// === RISK/REWARD SETTINGS ===

risk = orbHigh - orbLow

longTP = orbHigh + (risk * rrRatio)

shortTP = orbLow - (risk * rrRatio)

longSL = orbLow

shortSL = orbHigh

longBE = orbHigh + risk

shortBE = orbLow - risk

// === ENTRY CONDITIONS ===

validLongBreak = not longSequenceDone and close > orbHigh

validShortBreak = not shortSequenceDone and close < orbLow

longCond = orbSet and validLongBreak and strategy.opentrades == 0 and tradeCount < maxTradesPerDay

shortCond = orbSet and validShortBreak and strategy.opentrades == 0 and tradeCount < maxTradesPerDay

// === TRADE TRACKING ===

var bool inLong = false

var bool inShort = false

var bool longMovedToBE = false

var bool shortMovedToBE = false

// === STRATEGY ENTRIES ===

if longCond

strategy.entry("Long", strategy.long)

inLong := true

inShort := false

longMovedToBE := false

shortMovedToBE := false

tradeCount += 1

longSequenceDone := true

shortSequenceDone := false

if shortCond

strategy.entry("Short", strategy.short)

inShort := true

inLong := false

longMovedToBE := false

shortMovedToBE := false

tradeCount += 1

shortSequenceDone := true

longSequenceDone := false

// === LONG MANAGEMENT ===

if inLong

if not longMovedToBE and close >= longBE

longMovedToBE := true

if longMovedToBE

strategy.exit("Long Exit BE", from_entry="Long", stop=orbHigh, limit=longTP)

else

strategy.exit("Long Exit", from_entry="Long", stop=longSL, limit=longTP)

if longMovedToBE and close <= orbHigh

inLong := false

// === SHORT MANAGEMENT ===

if inShort

if not shortMovedToBE and close <= shortBE

shortMovedToBE := true

if shortMovedToBE

strategy.exit("Short Exit BE", from_entry="Short", stop=orbLow, limit=shortTP)

else

strategy.exit("Short Exit", from_entry="Short", stop=shortSL, limit=shortTP)

if shortMovedToBE and close >= orbLow

inShort := false

// === BLOCK RE-ENTRIES INSIDE ORB ===

if close < orbHigh and close > orbLow

if longSequenceDone

longSequenceDone := true

if shortSequenceDone

shortSequenceDone := true

// === PLOTTING ===

plotshape(longCond, title="Buy", location=location.belowbar, color=color.green, style=shape.triangleup, size=size.small)

plotshape(shortCond, title="Sell", location=location.abovebar, color=color.red, style=shape.triangledown, size=size.small)

plot(showLevels and orbSet ? orbHigh : na, title="ORB High", color=color.green, linewidth=1)

plot(showLevels and orbSet ? orbLow : na, title="ORB Low", color=color.red, linewidth=1)

// === ALERTS ===

alertcondition(longCond, title="Long Entry", message="ORB Long Entry Triggered")

alertcondition(shortCond, title="Short Entry", message="ORB Short Entry Triggered")

相关推荐