Supertrend des Drehpunkts

Schriftsteller:ChaoZhang, Datum: 2022-05-17 15:45:37Tags:DrehkreuzATR

Hallo alle,

Es gibt viele Arten von SuperTrend. Vor kurzem dachte ich über einen Supertrend basierend auf Pivot Points dann schrieb ich

Die Idee hinter diesem Skript ist, Drehpunkte zu finden, den Durchschnitt von ihnen zu berechnen und wie im Supertrend höhere/niedrigere Bands durch ATR zu erstellen. Wie Sie im Algorithmus sehen können, gibt das Skript den vergangenen Drehpunkten Gewicht, dies wird getan, um es ein wenig zu glätten.

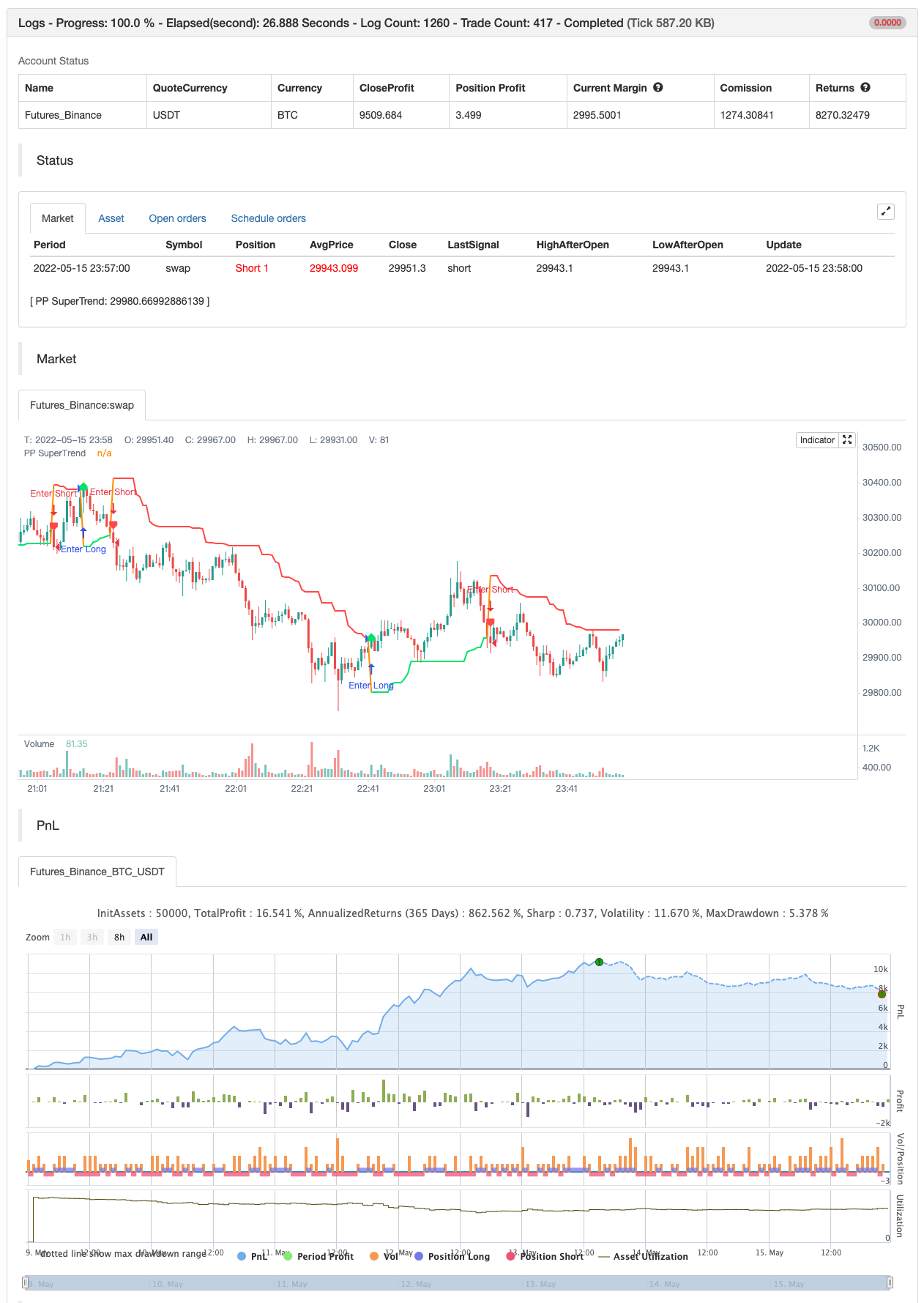

Zurückprüfung

/*backtest

start: 2022-05-09 00:00:00

end: 2022-05-15 23:59:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © LonesomeTheBlue

//@version=4

study("Pivot Point SuperTrend", overlay = true)

prd = input(defval = 3, title="Pivot Point Period", minval = 1, maxval = 50)

Factor=input(defval = 2, title = "ATR Factor", minval = 1, step = 0.1)

Pd=input(defval = 6, title = "ATR Period", minval=1)

showpivot = input(defval = false, title="Show Pivot Points")

showlabel = input(defval = true, title="Show Buy/Sell Labels")

showcl = input(defval = false, title="Show PP Center Line")

showsr = input(defval = false, title="Show Support/Resistance")

// get Pivot High/Low

float ph = pivothigh(prd, prd)

float pl = pivotlow(prd, prd)

// drawl Pivot Points if "showpivot" is enabled

plotshape(ph and showpivot, text="H", style=shape.labeldown, color=na, textcolor=color.red, location=location.abovebar, transp=0, offset = -prd)

plotshape(pl and showpivot, text="L", style=shape.labeldown, color=na, textcolor=color.lime, location=location.belowbar, transp=0, offset = -prd)

// calculate the Center line using pivot points

var float center = na

float lastpp = ph ? ph : pl ? pl : na

if lastpp

if na(center)

center := lastpp

else

//weighted calculation

center := (center * 2 + lastpp) / 3

// upper/lower bands calculation

Up = center - (Factor * atr(Pd))

Dn = center + (Factor * atr(Pd))

// get the trend

float TUp = na

float TDown = na

Trend = 0

TUp := close[1] > TUp[1] ? max(Up, TUp[1]) : Up

TDown := close[1] < TDown[1] ? min(Dn, TDown[1]) : Dn

Trend := close > TDown[1] ? 1: close < TUp[1]? -1: nz(Trend[1], 1)

Trailingsl = Trend == 1 ? TUp : TDown

// plot the trend

linecolor = Trend == 1 and nz(Trend[1]) == 1 ? color.lime : Trend == -1 and nz(Trend[1]) == -1 ? color.red : na

plot(Trailingsl, color = linecolor , linewidth = 2, title = "PP SuperTrend")

plot(showcl ? center : na, color = showcl ? center < hl2 ? color.blue : color.red : na)

// check and plot the signals

bsignal = Trend == 1 and Trend[1] == -1

ssignal = Trend == -1 and Trend[1] == 1

plotshape(bsignal and showlabel ? Trailingsl : na, title="Buy", text="Buy", location = location.absolute, style = shape.labelup, size = size.tiny, color = color.lime, textcolor = color.black, transp = 0)

plotshape(ssignal and showlabel ? Trailingsl : na, title="Sell", text="Sell", location = location.absolute, style = shape.labeldown, size = size.tiny, color = color.red, textcolor = color.white, transp = 0)

//get S/R levels using Pivot Points

float resistance = na

float support = na

support := pl ? pl : support[1]

resistance := ph ? ph : resistance[1]

// if enabled then show S/R levels

plot(showsr and support ? support : na, color = showsr and support ? color.lime : na, style = plot.style_circles, offset = -prd)

plot(showsr and resistance ? resistance : na, color = showsr and resistance ? color.red : na, style = plot.style_circles, offset = -prd)

// alerts

alertcondition(Trend == 1 and Trend[1] == -1, title='Buy Signal', message='Buy Signal')

alertcondition(Trend == -1 and Trend[1] == 1, title='Sell Signal', message='Sell Signal')

alertcondition(change(Trend), title='Trend Changed', message='Trend Changed')

if Trend == 1 and Trend[1] == -1

strategy.entry("Enter Long", strategy.long)

else if Trend == -1 and Trend[1] == 1

strategy.entry("Enter Short", strategy.short)

Verwandt

- Villa Dynamic Pivot Supertrend-Strategie

- Baguette nach Mehrkorn

- Supertrend mit dem Trailing-Stopp-Verlust

- - Die Maschine.

- Fibonacci-Progression mit Pausen

- AlphaTrend-Verwendung

- Lustre-Ausgang

- Pivot-Ordnungsblöcke

- Drehpunkte Hoch-Niedrig-Multi-Zeitrahmen

- Pivot-basierte Rücklaufmaxime und -minime

Mehr

- RedK Volumen-Beschleunigte Richtungsenergie-Verhältnis

- Donchian Breakout keine Ummalung

- RedK-Momentumsbalken

- Superjump-Rückschritt Bollinger-Band

- Fukuiz-Trend

- Johnny's BOT

- SSL-Hybrid

- Lustre-Ausgang

- RISOTTO

- EMA-Intraday-Strategie in der Cloud

- Supertrend+4bewegt

- Momentum-basierte ZigZag

- VuManChu-Chiffer B + Divergenzstrategie

- Konzept Dual SuperTrend

- Super Scalper

- Zurückprüfung - Indikator

- Trendylich

- Sma-BTC-Killer

- ML-Warnungsvorlage

- Fibonacci-Progression mit Pausen