Take out slow movers of high frequency trading strategy

Author: Zero, Created: 2015-06-07 07:53:19, Updated: 2015-06-09 11:24:21If there is more than one market maker in a market, some market makers' information devices/software/algorithms will be faster, while others will be slower.

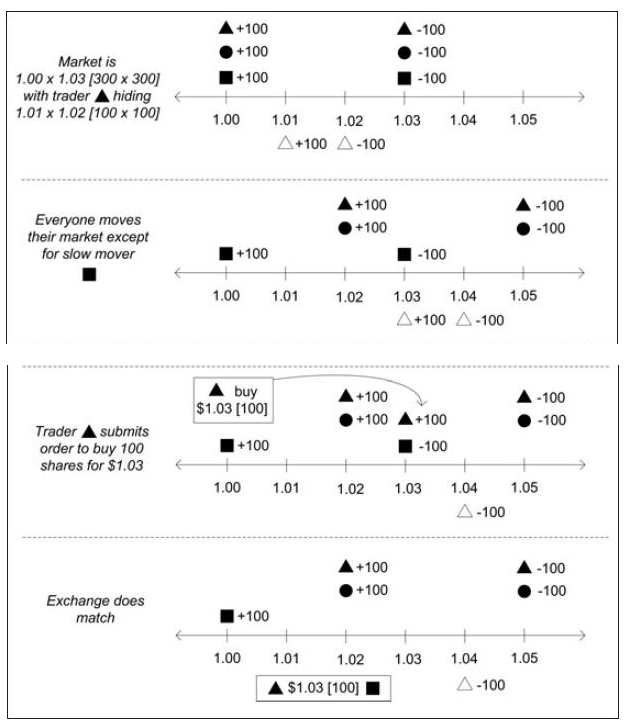

At certain points in time, market prices may change rapidly and dramatically, such as when an economic data report is published or a company has a major profit/loss announcement. Then faster market makers can react quickly to this price change, and those who react slower naturally become the fast market makers' lunch. For example, when market maker A places a buy and sell order of $1.00 x $1.03 in the market, he places a passive order, because he places the order in the market "passive" and is eaten by others.

Market makers will usually set the spread on the buy and sell lists in the market to be much larger than the buy and sell price they are actually willing to negotiate, this is because if someone is in a hurry to get out of the market, the market maker will usually put up a wider buy and sell list that will allow them to buy cheaper shares or sell for a higher price. But market maker A is actually willing to buy in at $1.01 and sell for $1.02 so he will have a $1.01 x $1.02 Acitve market, that is, the market maker will not put a $1.01 buy and sell list with a $1.02 in the market, but will look at the market as if there is no one hanging a $1.01 sell or $1.02 list, and if there is a list, then the buyer A will jump out of the market and eat these listings.

Now suppose that the market suddenly announces a significant profit message, at which point all the market makers respond to this significant profit message and raise their bids upwards. Suppose that all the market makers immediately raise their bids in the passive market to $1.02 x $1.05, while also increasing their active market to $1.03 x $1.04.

Now there is a slower-than-other buyer B who has not yet reacted to this news of profit, so his $1.00 x $1.03 buy-sell limit is still hanging in the market, at which time the fastest buyer A eats the entire $1.03 buy-sell of the slowest buyer B, which means that buyer A buys cheaper goods because it is faster, and buyer B sells a stock because it is slower than others.

So this is why the speed of the network/computer/software/algorithm is so important for those who specialize in high-frequency trading, in a world of high-frequency trading, only the fastest can make money.

- Bowen looks back on two years of the beach

- The Law of Grid Trading

- I've created a forum, use it for a while.

- Join the Makers in high-frequency trading strategy

- Reserve orders and iceberg orders for high-frequency trading strategies

- Poke for bargain high-frequency trading strategy

- Improvements and advantages of multi-platform hedge stability swap V2.7

- About being sucked in

- Single-point sniper with high-frequency stacking automatic counter-hand unlocking algorithm

- Penny Jump for high-frequency trading strategy

- Push the Elephant in high-frequency trading strategy

- Scratch for the Rebate high frequency trading strategy

- Lean your market high-frequency trading strategy