Poke for bargain high-frequency trading strategy

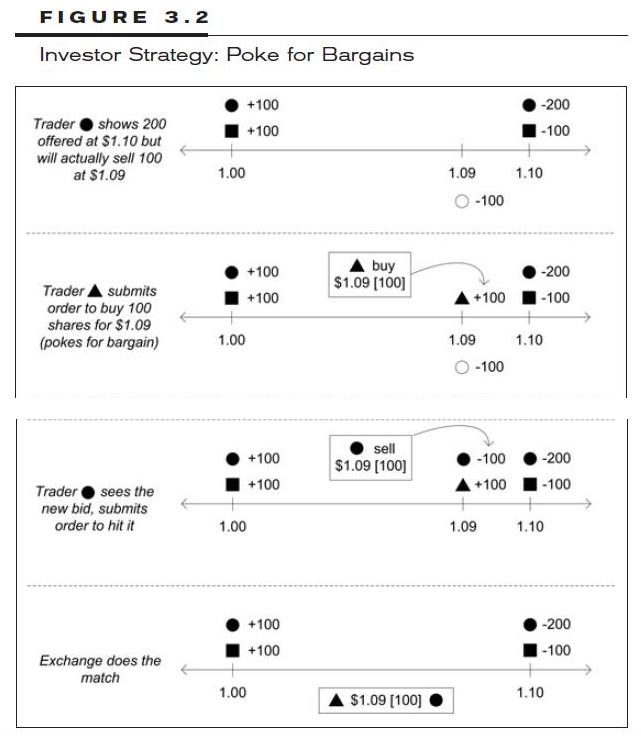

Author: Zero, Created: 2015-06-07 08:24:43, Updated: 2015-06-09 11:23:41Before introducing this strategy, we first categorized the people involved in trading in the market into two categories, investors and market makers. Investors are usually large investment firms, such as overseas trust fund managers, life insurance investment departments, sovereign wealth fund managers, etc. They buy stocks in the market and earn a profit from the increase in the stock price. They usually take a single market order at the market price or a single limit order entry close to the current market price. If they take a single market order entry, then they are "using liquidity". Market makers are usually securities brokers or specialized market makers, who are responsible for placing a number of bid-ask spreads in the market, and their main purpose is not to make a profit from the rise (or fall) in the price of the stock after the transaction. Their main purpose is to earn the price difference between the bid and the ask. In a practical trading world, a market maker (or so-called liquidity creator) may place a buy and sell order a little farther away from the price at which she is actually willing to trade. For example, a market maker today would be willing to buy a stock for $1.01, but her put option hangs a little lower than $1.01, say a $1.00 buy. Similarly, if the market maker is willing to sell a stock for $1.09, but she may post a $1.10 bid to attract a more aggressive buyer to buy at the market price; then, when the deal is done, she will sell the $1.10 at a slightly higher price than she expected the $1.09. If I'm an investor now, and I know that the market maker will have this pattern of behavior, I can develop a corresponding strategy called poke for bargains. If I'm about to start buying a stock now and its current bid price is $1.00 x $1.10 then I can post a $1.09 bid and see if the market maker will eat my $1.09 bid. If so, then the price I buy at $1.09 will be $0.01 better than the price I buy at $1.10 on the listing.

The next step is, if I want to buy this stock, I don't hang the $1.09 bill, I try to hang the $1.05 bill to see if someone jumps out and eats my bill, and if it doesn't get eaten, I cancel the $1.05 bill, and then I hang the $1.06 bill to see if it gets eaten, and if it doesn't get eaten, I cancel the $1.06 bill, and then I hang the $1.07 bill, and then I keep doing the same process until my bill gets eaten. The above actions are not manually entered slowly from the keyboard by the trader in front of the computer, but are all handed over to a program that has already been written. The speed of execution of these transactions is usually completed in a matter of seconds.

- On the strategy of single platform balancing

- Why choose to trade strategically on the FMZ Quantitative Trading Platform (BotVS)

- The strategy of making money could also be a coin.

- Inventors quantify the path of automated trading

- Three of the more classic strategies are Dual Thrust, R-Breaker, and Dynamic Breakout II.

- Bowen looks back on two years of the beach

- The Law of Grid Trading

- I've created a forum, use it for a while.

- Join the Makers in high-frequency trading strategy

- Reserve orders and iceberg orders for high-frequency trading strategies

- Improvements and advantages of multi-platform hedge stability swap V2.7

- About being sucked in

- Single-point sniper with high-frequency stacking automatic counter-hand unlocking algorithm

- Penny Jump for high-frequency trading strategy

- Take out slow movers of high frequency trading strategy

- Push the Elephant in high-frequency trading strategy

- Scratch for the Rebate high frequency trading strategy

- Lean your market high-frequency trading strategy