Disclosure of the Big Data Fund

Author: The Little Dream, Created: 2017-02-27 13:01:49, Updated: 2017-02-27 23:43:03Disclosure of the Big Data Fund

Today's science investment article talks about how big data funds work and how internet data from Taobao, Baidu, Sina, and others helps fund managers make stock choices.

-

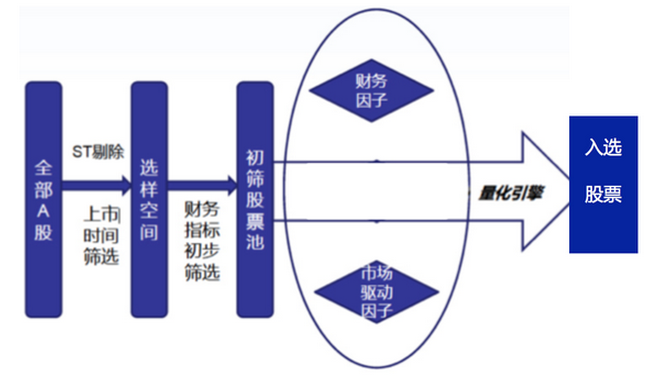

Before we reveal the big data fund, let's take a look at the steps for choosing a typical equity fund:

From all the A-shares, the initial pitch criteria generally take into account more basic indicators such as the time of listing, market value, etc. Select a pool of initial stock options from the sample space, where the selection criteria generally use industry data, financial indicators, profitability, etc. The pool of initial stock options will serve as a sample of the multi-factor stock options model. The traditional multi-factor model is used to quantify stock selection. The traditional multi-factor model mainly takes into account financial factors (market cap, market net, market sales, asset value ratios, operating income growth rates, net profit growth rates, EPS growth rates, total asset growth rates, etc.), market drivers (short-term yields, long-term yields, specific fluctuation rates, changes in trading volume, free market value) and gives a comprehensive score for a stock based on the long-term historical returns and stable progressive weighting of all the above factors. Calculate the fund's component shares and corresponding weights by learning from a quantitative engine.

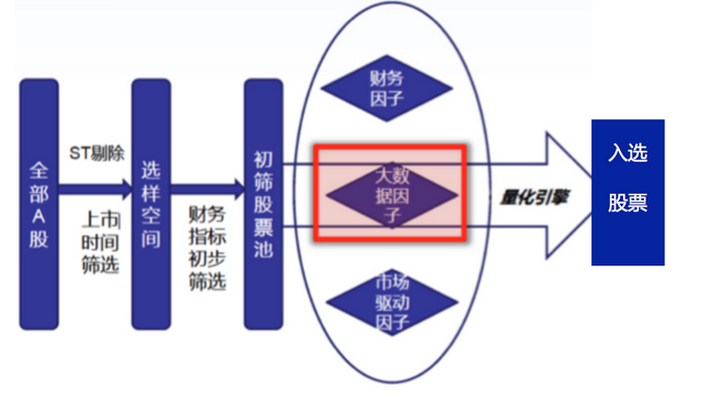

So what is the difference between a big data fund and a traditional fund?

Previously, when we created a multi-factor stock selection model, the factors used were all from within the market, we focused on the properties of the stock itself, but the introduction of big data factors brought new information, we will focus on whether the change in search volume of Baidu is related to the change in the stock, we will focus on whether the sales of Taobao in a particular industry affect the share price of the companies in the industry, we will also focus on whether the number of reader comments related to a stock news in the financial sector of Sina is affected by the fluctuation of the stock price.

We'll give an example of a real big data fund to give you a better idea of the big data factor.

An example of this is the Big Data 100 of Gold Digest, launched by the Boost Fund in partnership with Gold Digest.

In constructing the sampling space, Taobao Big Data 100 selected relevant stocks in the CSE tier 3 industry related to the e-commerce commodity category as its sampling space, which includes the following categories:

- Household durable consumer goods

- Leisure equipment and supplies

- Textiles and clothing

- Hotels, restaurants and leisure

- Retail of food and basic supplies

- Food and drink

- Common household items

- Personal items

-

As you can see, these industries are very similar to Taobao's own product categories, because the Big Data factor generated by Taobao data can provide more information in these industries.

Based on the sample space of Taobao-related industries, Bohai Fund and Zhongshan Group generated the Choice Shares for the multi-factor quantification model. In which the Taobao Financial Information Service platform provides online consumer statistical trend characteristics. According to the resulting industry research indicators, a comprehensive survey of the industry's economic performance, including: growth, price, supply situation, etc., is ranked according to the market performance.

Finally, a quantitative stock selection model uses big data, financial, and market drivers to rank stocks and determine the components of a big data fund.

In addition to the Taobao 100 Index, the Big Data Funds also use Big Data Factors from various Big Data sources such as Baidu, Snowball, Sina Weibo, and FedEx. The factors used by the Big Data Funds are as follows:

The 100 Index is a dynamic search engine.

Calculate the total number of searches and the search increment for the most recent month for the stock in the sample space, recorded as a total factor and an incremental factor, respectively; construct a factor analysis model for the total search factor and the incremental factor, and calculate the aggregate score for each stock period, recorded as a search factor;

Snowballs with 100 tonnes of heat factor

Firstly, the coverage of the selected sample is calculated based on the resulting snowball composition in the second step; secondly, according to the coverage of the selected stock, the stock is given a corresponding score, which is recorded as the snowball heat factor score of the stock.

The South Sina Big Data is the biggest data factor in Sina.

The number of page clicks on the Sina Finance Channel, the negative reporting on Weibo and the impact of news coverage.

The Fed's Big Data Index is based on the Fed's industry Big Data Factors.

Based on the statistical trend characteristics of the Bank's consumption data, the industry research indicators are processed; second, based on the resulting industry research indicators, the industry's economic performance is analyzed, including: consumption amount, number of transactions, etc., and the industry performance is ranked; finally, according to the industry performance, the industry's stock is given a corresponding rating, and the industry big data factor is scored.

There are many people who think that the performance of the Big Data Fund is actually poor, and in fact, so far, several Big Data Funds have not performed as expected, but this does not lead us to conclude that the Big Data Fund is in the wrong direction. Because the current application of Big Data is still conservative and experimental, we only add Big Data Factors based on the traditional multi-factor model and do not take more disruptive innovations in the model itself.

In fact, the application of big data has already touched every aspect of our lives, where it unintentionally stores treasures of investment value, and although the performance of existing big data funds has not yet shown that they have the ability to effectively mine these values, the treasures in big data have always been there, perhaps already enjoyed by some unknown high-ranking people.

Translated from Science Investments, Verified Investments

- Money and credit in monetary banking

- Futures trading: The pursuit of perfect certainty is a toxin in the trading system!

- Trading strategies of gamblers

- HttpQuery is not used in Python

- What does it mean to be a "dispossessed" hedge fund?

- Details: Shares subject to size restrictions (Shares Trading Rules)

- Talking about the odds of winning and losing

- This is probably the biggest lie in investing!

- How to Survive in a Random World

- Discover trends and follow trends

- Why are retail investors buying and selling (Contrarian)?

- Inventors Quantify Platform Strategy Code written entirely using Manual 1.0

- If you can't win, throw a coin and make a deal, can you still make money?

- The journey of machine learning algorithms

- When we predict probabilities, what do we predict?

- Programmatic transaction flow chart (an idea to the program)

- _C() Re-test the function

- _N() function, small number of decimal places, precision control

- Adaptive learning in the first place

- Real and formal trading systems