Details: Shares subject to size restrictions (Shares Trading Rules)

Author: The Little Dream, Created: 2017-03-02 10:07:19, Updated: 2017-03-02 10:27:35Details: Shares subject to size restrictions (Shares Trading Rules)

A rough comparison of the original book on the size of a position unit is explained in detail with a practical example here.

-

Originally published

The original text of the P110 trading rule reads as follows: we want the price change of 1ATR to be exactly equal to 1% of our account size. For a $1 million account, 1% is $10,000. So we calculate the dollar amount that represents each contract in a market with a 1ATR change magnitude, and then divide this amount by $10,000 to get the number of contracts corresponding to trading capital per $1 million. We call these numbers the size of the position unit.

-

Understanding

Many of the above are terms of futures trading, which can be explained in terms of the stock market, which is more familiar to us. First, explain what ATR is and how we get this value. In the book ((P64)), the explanation of ATR is that the true volatility is even. The ATR indicator is described by the ATR software as the true N-day moving average.

As an example, the ATR for 2016-10-12 is 0.08; suppose my account has a working capital of 100,000 yuan and a volatility risk tolerance of 1%, Z = 100,000.1% = 1000 yuan. The minimum trading unit in the stock market is 100 shares per hand, the price of the stock trading on the day is 6.39 yuan, and the amount of the ATR change magnitude X = 6.39100ATR=6.391000.08 = 51.12 yuan, the unit position size is Y = Z/X = 1000/51.12 = 19.56 hands≈ 20 hands. 20 hands.100 shares6.39 yuan/share = 12780 yuan. That is, in the current situation, the size of the position is 12780 yuan. What does this mean?The larger the n, the greater the risk. In cases where the market risk is high, a maximum value can be set for n, e.g. no greater than 4.

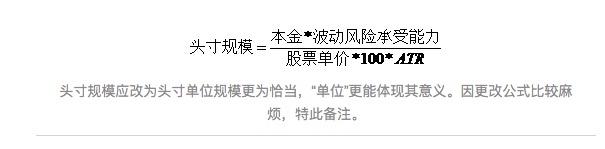

Let's get this formula straight, and look at the effect on the unit of position when the parameters in the formula change. The unit of position size is Y = Z / X = capital.Volatility risk tolerance) / (share price)100*ATR) ‒ that is:

The position size should be changed to the position unit size, which is more appropriate, and the position unit size should reflect its meaning better.

The capital and share price can be seen as fixed in the current situation. The higher the volatility risk tolerance, i.e. the greater the loss on the balance sheet that can be borne, the larger the size of the position unit will be. The larger the ATR, the smaller the size of the position unit, the reason is also simple, the recent price fluctuation is too large, indicating that the risk of the stock is too large, whether it rises or falls.

This method is merely a method of calculating the size of the position unit, and does not play a real decisive role in the positioning and selling of the stock. N is not fixed, and is decided by the decision maker based on the price, location, trend, intervention position, current position size of the stock. A small ATR value seems to predict a small change in the stock price, and the stock is depressed, although it is safe to invest in a larger position unit size under fixed risks, but is it really possible to buy this stock only when the stock is depressed.

While the formula for position size does not provide practical guidance on positions and trades, it provides a clear, quantifiable, reliable, and executable theory that helps us build trading systems, segment positions, and control risk.

-

The weight of the weight, the beautiful dividing line, what is said below is very important!

After repeated calculations, a fatal error is discovered, not knowing if someone can find it. This error is about the rationality of the above formula for the value of ATR. By definition, ATR is the range of recent price movements and should be an amount, not a percentage.100ATR has absolutely no meaning. If by this definition it should be 100.ATR, the value at 1ATR for each hand of stock, 1000/ (((100ATR) is 125 hands, 125 hands.1006.39 = 79875 yuan. The total capital is not more than 100,000, with ATR as a risk control, as the total position is still reasonable at the current value, but it is not possible to talk about what position unit, let alone what n times the size of the position unit.

In this case, there are three possibilities: first, I don't understand the author's intention at all, excuse my stupidity; second, the author didn't write it clearly, or simply said it wrong or didn't convey it clearly; and third, the author's method is entirely for futures, not for stocks.

But this is not necessarily inspired for me, I feel that there is a completely different method of calculating the unit position, which is my original misunderstanding of the basis of the intention, which is the percentage of psychological maximum loss of the current preparation of stock to build a warehouse, this explanation is reasonable. For example, in the case of 100,000 yuan, 2016-10-12, Shenzhen Hong Kong ((000166) in the price of 6.39 to prepare to build a warehouse, at the beginning I do not know how much better to buy first. If I think there is a greater support at 5.87, if it falls below 5.87, it may continue downwards, I have to build a warehouse. Then I will set the stop loss at 5.87, which is about 6.39% loss.

What is the meaning of this? The meaning is that the total value of the shares purchased by Y = 20 handshake makers is 12,780 yuan. Even if the stock is not selected correctly, after falling by 8%, the loss margin is 1022.4, which is only about 1% of the total assets of the account, fully in line with the psychological tolerability of the initial risk of 1% of the total assets of the account. This is also the biggest attraction of position control, in case of error, although the purchased shares fell by 8%, but the risk for the entire account is very small.

That is, in the case of stop loss levels and total account risk tolerance, it can help you to determine the holding position, the risk control of the system to do a good total account. I didn't think to do a round, and finally a big joke fell. But in the book I think it is still not possible, or not suitable for investment in ordinary stocks.

After reading the book, I think it's very reasonable, but I can't necessarily find the holes in the book. Even if the book is not holes, it's not necessarily for my use. I understand the truth, it's in line with reality, but it doesn't summarize specific detailed formulas, and it can't be really practiced.

Translated from the Japanese.

- Playing JavaScript with the old man - creating a partner who will do the buying and selling (4) teaching him a little simple knowledge (even-line applications)

- Playing JavaScript with the old man - creating a buyer/seller partner (3) A lively little guy who likes fresh things around

- I'm going to ask the gods about my doubts about future functions!

- Playing JavaScript with the old man - creating a partner who buys and sells - born in a sandbox

- Playing JavaScript with the old man - creating a partner who will buy and sell 1) The boring life of a front-end middle-aged farmer

- Money and credit in monetary banking

- Futures trading: The pursuit of perfect certainty is a toxin in the trading system!

- Trading strategies of gamblers

- HttpQuery is not used in Python

- What does it mean to be a "dispossessed" hedge fund?

- Talking about the odds of winning and losing

- This is probably the biggest lie in investing!

- How to Survive in a Random World

- Discover trends and follow trends

- Disclosure of the Big Data Fund

- Why are retail investors buying and selling (Contrarian)?

- Inventors Quantify Platform Strategy Code written entirely using Manual 1.0

- If you can't win, throw a coin and make a deal, can you still make money?

- The journey of machine learning algorithms

- When we predict probabilities, what do we predict?