आरएसआई पिवोट, बीबी, एसएमए, ईएमए, एसएमएमए, डब्ल्यूएमए, वीडब्ल्यूएमए के साथ विचलन

लेखक:चाओझांग, दिनांकः 2022-05-12 17:17:05टैगःएसएमएईएमएएसएमएमएडब्ल्यूएमएवीडब्ल्यूएमएबॉल

आरएसआई विचलन, बीबी, एमए कुछ उपयोगी सुविधाओं के साथ एक बुनियादी आरएसआई थरथरानवाला है, यह उपयोगकर्ता को सीधे आरएसआई संकेतक पर विचलन, पिवोट और मूविंग एवरेज प्रदर्शित करने की अनुमति देता है।

चलती औसत जो आप आरएसआई ऑसिलेटर पर प्रदर्शित कर सकते हैं वे हैंः एसएमए ईएमए एसएमएमए डब्ल्यूएमए वीडब्ल्यूएमए बोलिंगर बैंड

/*backtest

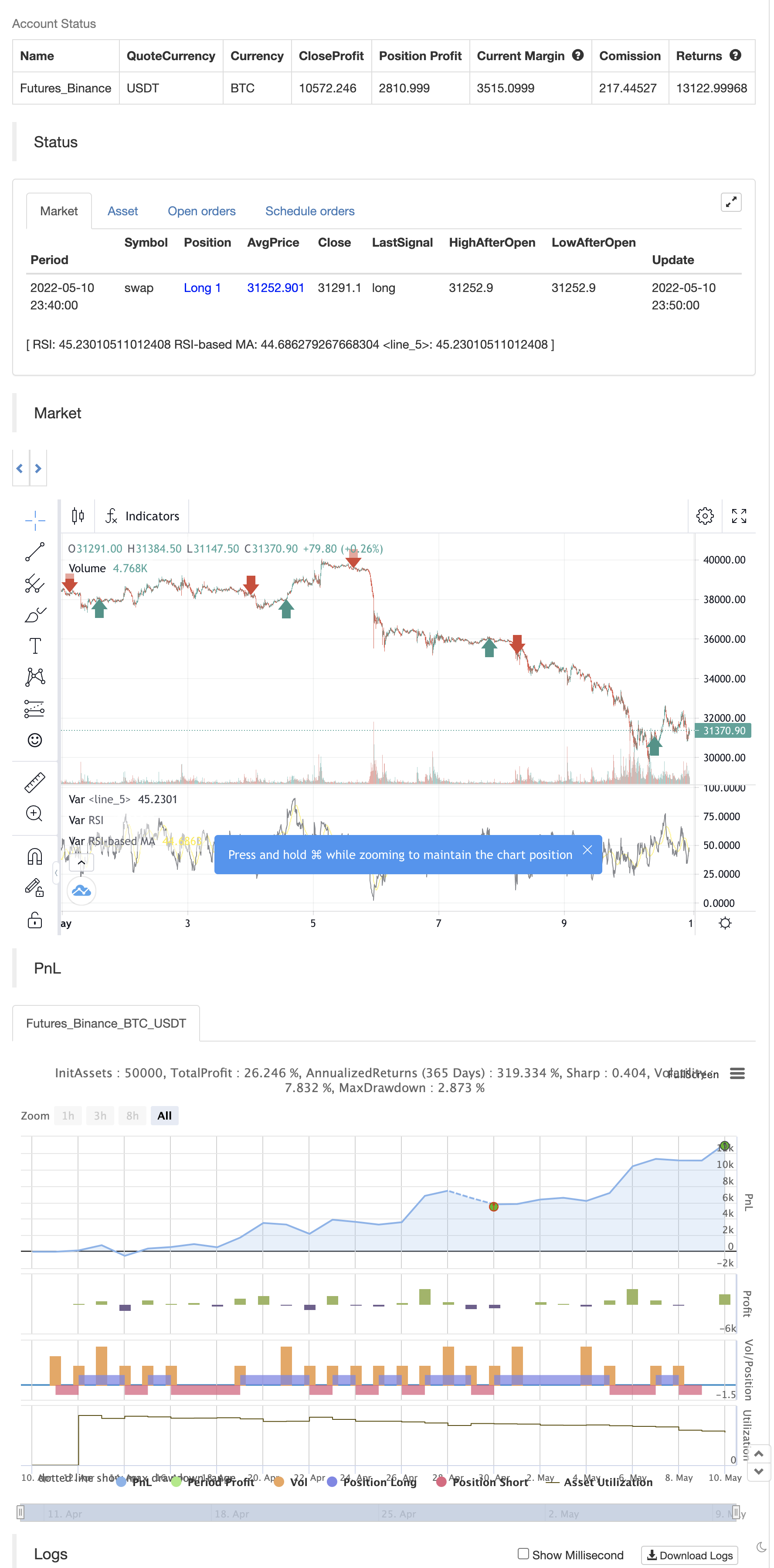

start: 2022-04-11 00:00:00

end: 2022-05-10 23:59:00

period: 10m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

////////////////////////////////////////////////////////////////////////////////

// //

// ====== My Crypto Succubus ====== //

// ====== RSI Divergence with Pivot, BB, SMA, EMA, SMMA, WMA, VWMA ====== //

// //

////////////////////////////////////////////////////////////////////////////////

////////////////////////////////////////////////////////////////////////////////

// //

// My Crypto Succubus is a project based on the community and participatory //

// aspect, knowledge sharing is the core of the project, the act of sharing //

// is destined to get richer, either on the intellectual or the wealth //

// side, the ultimate goal of MCS is that every single one of our members //

// can reach the financial freedom we all deserve. //

// //

// ====== Join us on our Discord : https://discord.gg/TmW6RQeyXp ====== //

// //

////////////////////////////////////////////////////////////////////////////////

//@version=5

indicator(title="RSI Divergences with Pivots, BB, MA [My Crypto Succubus]", shorttitle="RSI Div, Pivot, BB, MA [My Crypto Succubus]", format=format.price, precision=2)

ma(source, length, type) =>

switch type

"SMA" => ta.sma(source, length)

"Bollinger Bands" => ta.sma(source, length)

"EMA" => ta.ema(source, length)

"SMMA (RMA)" => ta.rma(source, length)

"WMA" => ta.wma(source, length)

"VWMA" => ta.vwma(source, length)

rsiLengthInput = input.int(14, minval=1, title="RSI Length", group="RSI Settings")

rsiSourceInput = input.source(close, "Source", group="RSI Settings")

maTypeInput = input.string("SMA", title="MA Type", options=["SMA", "Bollinger Bands", "EMA", "SMMA (RMA)", "WMA", "VWMA"], group="MA Settings")

maLengthInput = input.int(14, title="MA Length", group="MA Settings")

bbMultInput = input.float(2.0, minval=0.001, maxval=50, title="BB StdDev", group="MA Settings")

up = ta.rma(math.max(ta.change(rsiSourceInput), 0), rsiLengthInput)

down = ta.rma(-math.min(ta.change(rsiSourceInput), 0), rsiLengthInput)

rsi = down == 0 ? 100 : up == 0 ? 0 : 100 - (100 / (1 + up / down))

rsiMA = ma(rsi, maLengthInput, maTypeInput)

isBB = maTypeInput == "Bollinger Bands"

plot(rsi, "RSI", color=#ffffff, linewidth=1)

plot(rsiMA, "RSI-based MA", color=color.yellow)

rsiUpperBand = hline(70, "RSI Upper Band", color=#787B86)

hline(50, "RSI Middle Band", color=color.new(#787B86, 50))

rsiLowerBand = hline(30, "RSI Lower Band", color=#787B86)

fill(rsiUpperBand, rsiLowerBand, color=color.rgb(178, 8, 120, 90), title="RSI Background Fill")

bbUpperBand = plot(isBB ? rsiMA + ta.stdev(rsi, maLengthInput) * bbMultInput : na, title = "Upper Bollinger Band", color=color.green)

bbLowerBand = plot(isBB ? rsiMA - ta.stdev(rsi, maLengthInput) * bbMultInput : na, title = "Lower Bollinger Band", color=color.green)

fill(bbUpperBand, bbLowerBand, color= isBB ? color.new(color.green, 90) : na, title="Bollinger Bands Background Fill")

///////////////////////////////////////////////////////////////////////////////////////////////////////

len = input.int(14, minval=1, title='RSI Length', group="RSI Settings")

ob = input.int(defval=70, title='Overbought', minval=0, maxval=100, group="RSI Settings")

os = input.int(defval=30, title='Oversold', minval=0, maxval=100, group="RSI Settings")

// RSI code

band1 = hline(ob)

band0 = hline(os)

plot(rsi, color=rsi > ob or rsi < os ? color.rgb(255, 0, 0, 0) : color.new(color.black, 100), linewidth=1)

fill(band1, band0, color=color.new(color.purple, 97))

// DIVS code

piv = input(false, 'Hide pivots?')

shrt = input(false, 'Shorter labels?')

hidel = input(true, 'Hide labels and color background')

xbars = input.int(defval=90, title='Div lookback period (bars)?', minval=1)

hb = math.abs(ta.highestbars(rsi, xbars)) // Finds bar with highest value in last X bars

lb = math.abs(ta.lowestbars(rsi, xbars)) // Finds bar with lowest value in last X bars

// Defining variable values, mandatory in Pine 3

max = float(na)

max_rsi = float(na)

min = float(na)

min_rsi = float(na)

pivoth = bool(na)

pivotl = bool(na)

divbear = bool(na)

divbull = bool(na)

// If bar with lowest / highest is current bar, use it's value

max := hb == 0 ? close : na(max[1]) ? close : max[1]

max_rsi := hb == 0 ? rsi : na(max_rsi[1]) ? rsi : max_rsi[1]

min := lb == 0 ? close : na(min[1]) ? close : min[1]

min_rsi := lb == 0 ? rsi : na(min_rsi[1]) ? rsi : min_rsi[1]

// Compare high of current bar being examined with previous bar's high

// If curr bar high is higher than the max bar high in the lookback window range

if close > max // we have a new high

max := close // change variable "max" to use current bar's high value

max

if rsi > max_rsi // we have a new high

max_rsi := rsi // change variable "max_rsi" to use current bar's RSI value

max_rsi

if close < min // we have a new low

min := close // change variable "min" to use current bar's low value

min

if rsi < min_rsi // we have a new low

min_rsi := rsi // change variable "min_rsi" to use current bar's RSI value

min_rsi

// Finds pivot point with at least 2 right candles with lower value

pivoth := max_rsi == max_rsi[2] and max_rsi[2] != max_rsi[3] ? true : na

pivotl := min_rsi == min_rsi[2] and min_rsi[2] != min_rsi[3] ? true : na

// Detects divergences between price and indicator with 1 candle delay so it filters out repeating divergences

if max[1] > max[2] and rsi[1] < max_rsi and rsi <= rsi[1]

divbear := true

divbear

if min[1] < min[2] and rsi[1] > min_rsi and rsi >= rsi[1]

divbull := true

divbull

// Alerts

alertcondition(divbear, title='Bear div', message='Bear div')

alertcondition(divbull, title='Bull div', message='Bull div')

alertcondition(pivoth, title='Pivot high', message='Pivot high')

alertcondition(pivotl, title='Pivot low', message='Pivot low')

// Plots divergences and pivots with offest

//l = divbear ? label.new(bar_index - 1, rsi[1] + 1, 'BEAR', color=color.red, textcolor=color.white, style=label.style_label_down, yloc=yloc.price, size=size.small) : divbull ? label.new(bar_index - 1, rsi[1] - 1, 'BULL', color=color.green, textcolor=color.white, style=label.style_label_up, yloc=yloc.price, size=size.small) : pivoth ? label.new(bar_index - 2, max_rsi + 1, 'PIVOT', color=color.blue, textcolor=color.white, style=label.style_label_down, yloc=yloc.price, size=size.small) : pivotl ? label.new(bar_index - 2, min_rsi - 1, 'PIVOT', color=color.blue, textcolor=color.white, style=label.style_label_up, yloc=yloc.price, size=size.small) : na

// Shorter labels

//if shrt

// label.set_text(l, na)

// Hides pivots or labels

//if piv and (pivoth or pivotl) or hidel

// label.delete(l)

// Colors indicator background

//bgcolor(hidel ? divbear ? color.new(color.red, 50) : divbull ? color.new(color.green, 50) : na : na, offset=-1, transp=90)

//bgcolor(hidel ? piv ? na : pivoth or pivotl ? color.new(color.blue, 50) : na : na, offset=-2, transp=90)

// Debug tools

// plot(max, color=blue, linewidth=2)

// plot(max_rsi, color=red, linewidth=2)

// plot(hb, color=orange, linewidth=2)

// plot(lb, color=purple, linewidth=1)

// plot(min_rsi, color=lime, linewidth=1)

// plot(min, color=black, linewidth=1)

////////////////////////////////////////////////////////////////////////////////

// //

// ====== My Crypto Succubus ====== //

// ====== RSI Divergence with Pivot, BB, SMA, EMA, SMMA, WMA, VWMA ====== //

// //

////////////////////////////////////////////////////////////////////////////////

////////////////////////////////////////////////////////////////////////////////

// //

// My Crypto Succubus is a project based on the community and participatory //

// aspect, knowledge sharing is the core of the project, the act of sharing //

// is destined to get richer, either on the intellectual or the wealth //

// side, the ultimate goal of MCS is that every single one of our members //

// can reach the financial freedom we all deserve. //

// //

// ====== Join us on our Discord : https://discord.gg/TmW6RQeyXp ====== //

// //

////////////////////////////////////////////////////////////////////////////////

if divbear

strategy.entry("Enter Long", strategy.long)

else if divbull

strategy.entry("Enter Short", strategy.short)

संबंधित

- एसएसएस

- क्रॉडल का सुपरट्रेंड

- ओसीसी रणनीति आर5.1

- 2 चलती औसत रंग दिशा का पता लगाना

- वीडब्ल्यूएमए-एडीएक्स गति और ट्रेंड-आधारित बिटकॉइन लंबी रणनीति

- गति-आधारित ज़िगज़ैग

- चलती औसत और बोलिंगर बैंड पर आधारित मात्रात्मक ट्रेडिंग रणनीति

- HALFTREND + HEMA + SMA (गलत संकेत की रणनीति)

- एनर्जी बार के साथ रेडके डुअल वेडर

- चलती औसत क्रॉस अलर्ट, मल्टी टाइमफ्रेम (MTF)

अधिक

- विला डायनामिक पिवोट सुपरट्रेंड रणनीति

- क्रॉडल का सुपरट्रेंड

- zdmre द्वारा आरएसआई

- FTL - रेंज फिल्टर X2 + EMA + UO

- ब्राह्मस्त्र

- मोबो बैंड

- एसएआर + 3एसएमएमए SL और TP के साथ

- एसएसएस

- चंद्रमा प्रक्षेपण अलर्ट टेम्पलेट [सूचक]

- HALFTREND + HEMA + SMA (गलत संकेत की रणनीति)

- आरएसआई और बीबी और एक साथ ओवरसोल्ड

- रोलिंग हेकिन आशी मोमबत्तियाँ

- कॉम्बो 2/20 ईएमए और बैंडपास फ़िल्टर

- ईएसएसएमए

- 3EMA

- पिवोट ऑर्डर ब्लॉक

- NMVOB-S

- चलती औसत रंगीन ईएमए/एसएमए

- MAHL बैंड

- इस सिंगल स्क्रिप्ट में 3 सुपरट्रेंड जोड़ें