Strategi Osilator Delta-RSI

Penulis:ChaoZhang, Tarikh: 2022-05-30 11:51:02Tag:RSI

Strategi Delta-RSI Oscillator:

Strategi ini menggambarkan penggunaan Delta-RSI Oscillator yang baru diterbitkan sebagai penunjuk yang berdiri sendiri.

Delta-RSI mewakili derivatif masa rata dari RSI, digambarkan sebagai histogram dan berfungsi sebagai penunjuk momentum.

Terdapat tiga syarat pilihan untuk menjana isyarat perdagangan (ditentukan secara berasingan untuk isyarat Beli, Jual dan Keluar): Zero-crossing: bullish apabila D-RSI melintasi sifar dari nilai negatif ke nilai positif (bearish sebaliknya) Penembusan Garis Isyarat: bullish apabila D-RSI melintasi dari bawah ke atas garis isyarat (bearish sebaliknya) Perubahan Arah: bullish apabila D-RSI adalah negatif dan mula meningkat (bearish sebaliknya) Oleh kerana osilator D-RSI berdasarkan pemasangan polinomial keluk RSI, terdapat juga pilihan untuk menapis isyarat perdagangan dengan menggunakan kesilapan akar rata-rata persegi pemasangan (dinormalkan oleh purata sampel).

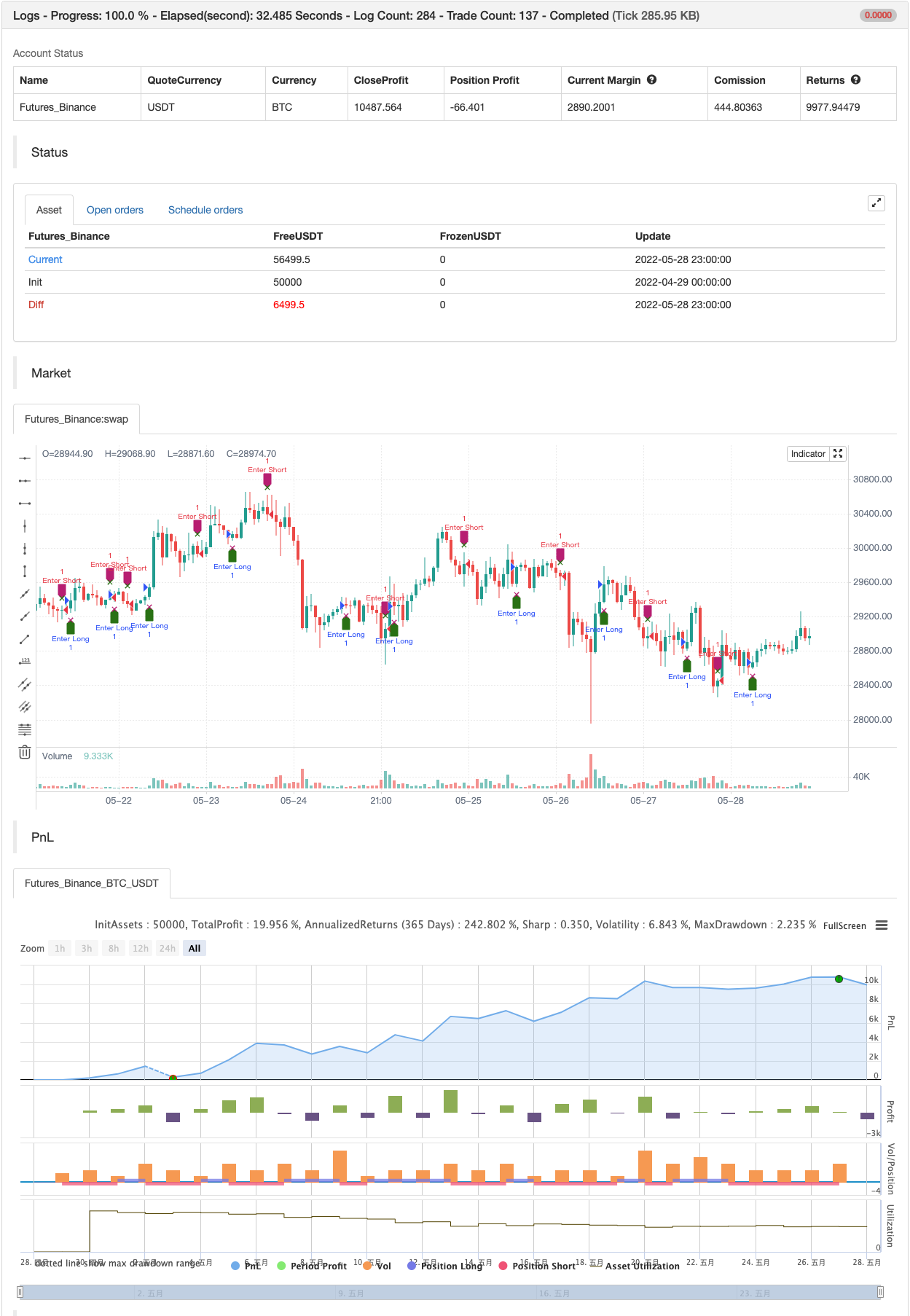

Ujian belakang

/*backtest

start: 2022-04-29 00:00:00

end: 2022-05-28 23:59:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © tbiktag

//

// Delta-RSI Oscillator Strategy

//

// A strategy that uses Delta-RSI Oscillator (© tbiktag) as a stand-alone indicator:

// https://www.tradingview.com/script/OXQVFTQD-Delta-RSI-Oscillator/

//

// Delta-RSI is a smoothed time derivative of the RSI, plotted as a histogram

// and serving as a momentum indicator.

//

// Input parameters:

// RSI Length: The timeframe of the RSI that serves as an input to D-RSI.

// Length: The length of the lookback frame used for local regression.

// Polynomial Order: The order of the local polynomial function used to interpolate the RSI.

// Signal Length: The length of a EMA of the D-RSI series that is used as a signal line.

// Trade signals are generated based on three optional conditions:

// - Zero-crossing: bullish when D-RSI crosses zero from negative to positive values (bearish otherwise)

// - Signal Line Crossing: bullish when D-RSI crosses from below to above the signal line (bearish otherwise)

// - Direction Change: bullish when D-RSI was negative and starts ascending (bearish otherwise)

//

// Since D-RSI oscillator is based on polynomial fitting of the RSI curve, there is also an option

// to filter trade signal by means of the root mean-square error of the fit (normalized by the sample average).

//

//@version=4

study(title="Delta-RSI Oscillator Strategy", shorttitle = "D-RSI", overlay = true)

// ---Subroutines---

matrix_get(_A,_i,_j,_nrows) =>

// Get the value of the element of an implied 2d matrix

//input:

// _A :: array: pseudo 2d matrix _A = [[column_0],[column_1],...,[column_(n-1)]]

// _i :: integer: row number

// _j :: integer: column number

// _nrows :: integer: number of rows in the implied 2d matrix

array.get(_A,_i+_nrows*_j)

matrix_set(_A,_value,_i,_j,_nrows) =>

// Set a value to the element of an implied 2d matrix

//input:

// _A :: array, changed on output: pseudo 2d matrix _A = [[column_0],[column_1],...,[column_(n-1)]]

// _value :: float: the new value to be set

// _i :: integer: row number

// _j :: integer: column number

// _nrows :: integer: number of rows in the implied 2d matrix

array.set(_A,_i+_nrows*_j,_value)

transpose(_A,_nrows,_ncolumns) =>

// Transpose an implied 2d matrix

// input:

// _A :: array: pseudo 2d matrix _A = [[column_0],[column_1],...,[column_(n-1)]]

// _nrows :: integer: number of rows in _A

// _ncolumns :: integer: number of columns in _A

// output:

// _AT :: array: pseudo 2d matrix with implied dimensions: _ncolums x _nrows

var _AT = array.new_float(_nrows*_ncolumns,0)

for i = 0 to _nrows-1

for j = 0 to _ncolumns-1

matrix_set(_AT, matrix_get(_A,i,j,_nrows),j,i,_ncolumns)

_AT

multiply(_A,_B,_nrowsA,_ncolumnsA,_ncolumnsB) =>

// Calculate scalar product of two matrices

// input:

// _A :: array: pseudo 2d matrix

// _B :: array: pseudo 2d matrix

// _nrowsA :: integer: number of rows in _A

// _ncolumnsA :: integer: number of columns in _A

// _ncolumnsB :: integer: number of columns in _B

// output:

// _C:: array: pseudo 2d matrix with implied dimensions _nrowsA x _ncolumnsB

var _C = array.new_float(_nrowsA*_ncolumnsB,0)

int _nrowsB = _ncolumnsA

float elementC= 0.0

for i = 0 to _nrowsA-1

for j = 0 to _ncolumnsB-1

elementC := 0

for k = 0 to _ncolumnsA-1

elementC := elementC + matrix_get(_A,i,k,_nrowsA)*matrix_get(_B,k,j,_nrowsB)

matrix_set(_C,elementC,i,j,_nrowsA)

_C

vnorm(_X,_n) =>

//Square norm of vector _X with size _n

float _norm = 0.0

for i = 0 to _n-1

_norm := _norm + pow(array.get(_X,i),2)

sqrt(_norm)

qr_diag(_A,_nrows,_ncolumns) =>

//QR Decomposition with Modified Gram-Schmidt Algorithm (Column-Oriented)

// input:

// _A :: array: pseudo 2d matrix _A = [[column_0],[column_1],...,[column_(n-1)]]

// _nrows :: integer: number of rows in _A

// _ncolumns :: integer: number of columns in _A

// output:

// _Q: unitary matrix, implied dimenstions _nrows x _ncolumns

// _R: upper triangular matrix, implied dimansions _ncolumns x _ncolumns

var _Q = array.new_float(_nrows*_ncolumns,0)

var _R = array.new_float(_ncolumns*_ncolumns,0)

var _a = array.new_float(_nrows,0)

var _q = array.new_float(_nrows,0)

float _r = 0.0

float _aux = 0.0

//get first column of _A and its norm:

for i = 0 to _nrows-1

array.set(_a,i,matrix_get(_A,i,0,_nrows))

_r := vnorm(_a,_nrows)

//assign first diagonal element of R and first column of Q

matrix_set(_R,_r,0,0,_ncolumns)

for i = 0 to _nrows-1

matrix_set(_Q,array.get(_a,i)/_r,i,0,_nrows)

if _ncolumns != 1

//repeat for the rest of the columns

for k = 1 to _ncolumns-1

for i = 0 to _nrows-1

array.set(_a,i,matrix_get(_A,i,k,_nrows))

for j = 0 to k-1

//get R_jk as scalar product of Q_j column and A_k column:

_r := 0

for i = 0 to _nrows-1

_r := _r + matrix_get(_Q,i,j,_nrows)*array.get(_a,i)

matrix_set(_R,_r,j,k,_ncolumns)

//update vector _a

for i = 0 to _nrows-1

_aux := array.get(_a,i) - _r*matrix_get(_Q,i,j,_nrows)

array.set(_a,i,_aux)

//get diagonal R_kk and Q_k column

_r := vnorm(_a,_nrows)

matrix_set(_R,_r,k,k,_ncolumns)

for i = 0 to _nrows-1

matrix_set(_Q,array.get(_a,i)/_r,i,k,_nrows)

[_Q,_R]

pinv(_A,_nrows,_ncolumns) =>

//Pseudoinverse of matrix _A calculated using QR decomposition

// Input:

// _A:: array: implied as a (_nrows x _ncolumns) matrix _A = [[column_0],[column_1],...,[column_(_ncolumns-1)]]

// Output:

// _Ainv:: array implied as a (_ncolumns x _nrows) matrix _A = [[row_0],[row_1],...,[row_(_nrows-1)]]

// ----

// First find the QR factorization of A: A = QR,

// where R is upper triangular matrix.

// Then _Ainv = R^-1*Q^T.

// ----

[_Q,_R] = qr_diag(_A,_nrows,_ncolumns)

_QT = transpose(_Q,_nrows,_ncolumns)

// Calculate Rinv:

var _Rinv = array.new_float(_ncolumns*_ncolumns,0)

float _r = 0.0

matrix_set(_Rinv,1/matrix_get(_R,0,0,_ncolumns),0,0,_ncolumns)

if _ncolumns != 1

for j = 1 to _ncolumns-1

for i = 0 to j-1

_r := 0.0

for k = i to j-1

_r := _r + matrix_get(_Rinv,i,k,_ncolumns)*matrix_get(_R,k,j,_ncolumns)

matrix_set(_Rinv,_r,i,j,_ncolumns)

for k = 0 to j-1

matrix_set(_Rinv,-matrix_get(_Rinv,k,j,_ncolumns)/matrix_get(_R,j,j,_ncolumns),k,j,_ncolumns)

matrix_set(_Rinv,1/matrix_get(_R,j,j,_ncolumns),j,j,_ncolumns)

//

_Ainv = multiply(_Rinv,_QT,_ncolumns,_ncolumns,_nrows)

_Ainv

norm_rmse(_x, _xhat) =>

// Root Mean Square Error normalized to the sample mean

// _x. :: array float, original data

// _xhat :: array float, model estimate

// output

// _nrmse:: float

float _nrmse = 0.0

if array.size(_x) != array.size(_xhat)

_nrmse := na

else

int _N = array.size(_x)

float _mse = 0.0

for i = 0 to _N-1

_mse := _mse + pow(array.get(_x,i) - array.get(_xhat,i),2)/_N

_xmean = array.sum(_x)/_N

_nrmse := sqrt(_mse) /_xmean

_nrmse

diff(_src,_window,_degree) =>

// Polynomial differentiator

// input:

// _src:: input series

// _window:: integer: wigth of the moving lookback window

// _degree:: integer: degree of fitting polynomial

// output:

// _diff :: series: time derivative

// _nrmse:: float: normalized root mean square error

//

// Vandermonde matrix with implied dimensions (window x degree+1)

// Linear form: J = [ [z]^0, [z]^1, ... [z]^degree], with z = [ (1-window)/2 to (window-1)/2 ]

var _J = array.new_float(_window*(_degree+1),0)

for i = 0 to _window-1

for j = 0 to _degree

matrix_set(_J,pow(i,j),i,j,_window)

// Vector of raw datapoints:

var _Y_raw = array.new_float(_window,na)

for j = 0 to _window-1

array.set(_Y_raw,j,_src[_window-1-j])

// Calculate polynomial coefficients which minimize the loss function

_C = pinv(_J,_window,_degree+1)

_a_coef = multiply(_C,_Y_raw,_degree+1,_window,1)

// For first derivative, approximate the last point (i.e. z=window-1) by

float _diff = 0.0

for i = 1 to _degree

_diff := _diff + i*array.get(_a_coef,i)*pow(_window-1,i-1)

// Calculates data estimate (needed for rmse)

_Y_hat = multiply(_J,_a_coef,_window,_degree+1,1)

float _nrmse = norm_rmse(_Y_raw,_Y_hat)

[_diff,_nrmse]

/// --- main ---

degree = input(title="Polynomial Order", group = "Model Parameters:",

inline = "linepar1", type = input.integer, defval=2, minval = 1)

rsi_l = input(title = "RSI Length", group = "Model Parameters:",

inline = "linepar1", type = input.integer, defval = 21, minval = 1,

tooltip="The period length of RSI that is used as input.")

window = input(title="Length ( > Order)", group = "Model Parameters:",

inline = "linepar2", type = input.integer, defval=21, minval = 2)

signalLength = input(title="Signal Length", group = "Model Parameters:",

inline = "linepar2", type=input.integer, defval=9,

tooltip="The signal line is a EMA of the D-RSI time series.")

islong = input(title = "Buy", group = "Show Signals:",

inline = "lineent",type = input.bool, defval = true)

isshort = input(title = "Sell", group = "Show Signals:",

inline = "lineent", type = input.bool, defval= true)

showendlabels = input(title = "Exit", group = "Show Signals:",

inline = "lineent", type = input.bool, defval= true)

buycond = input(title="Buy", group = "Entry and Exit Conditions:",

inline = "linecond",type = input.string, defval="Zero-Crossing",

options=["Zero-Crossing", "Signal Line Crossing","Direction Change"])

sellcond = input(title="Sell", group = "Entry and Exit Conditions:",

inline = "linecond",type = input.string, defval="Zero-Crossing",

options=["Zero-Crossing", "Signal Line Crossing","Direction Change"])

endcond = input(title="Exit", group = "Entry and Exit Conditions:",

inline = "linecond",type = input.string, defval="Zero-Crossing",

options=["Zero-Crossing", "Signal Line Crossing","Direction Change"])

usenrmse = input(title = "", group = "Filter by Means of Root-Mean-Square Error of RSI Fitting:",

inline = "linermse",type = input.bool, defval = false)

rmse_thrs = input(title = "RSI fitting Error Threshold, %", type = input.float,

group = "Filter by Means of Root-Mean-Square Error of RSI Fitting:",

inline = "linermse", defval = 10, minval = 0.0) /100

src = rsi(close,rsi_l)

[drsi,nrmse] = diff(src,window,degree)

signalline = ema(drsi, signalLength)

// Conditions and filters

filter_rmse = usenrmse?nrmse<rmse_thrs:true

dirchangeup = (drsi>drsi[1]) and (drsi[1]<drsi[2]) and drsi[1]<0.0

dirchangedw = (drsi<drsi[1]) and (drsi[1]>drsi[2]) and drsi[1]>0.0

crossup = crossover(drsi,0.0)

crossdw = crossunder(drsi,0.0)

crosssignalup = crossover(drsi,signalline)

crosssignaldw = crossunder(drsi,signalline)

//Signals

golong = (buycond=="Direction Change"?dirchangeup:(buycond=="Zero-Crossing"?crossup:crosssignalup)) and filter_rmse

goshort= (sellcond=="Direction Change"?dirchangedw:(sellcond=="Zero-Crossing"?crossdw:crosssignaldw)) and filter_rmse

endlong = (endcond=="Direction Change"?dirchangedw:(endcond=="Zero-Crossing"?crossdw:crosssignaldw)) and filter_rmse

endshort= (endcond=="Direction Change"?dirchangeup:(endcond=="Zero-Crossing"?crossup:crosssignalup)) and filter_rmse

plotshape((golong and islong) ? low : na, location=location.belowbar, style=shape.labelup, color=#2E7C13, size=size.small, title='Buy')

plotshape((goshort and isshort) ? high: na, location=location.abovebar, style=shape.labeldown, color=#BF217C, size=size.small, title='Sell')

plotshape((showendlabels and endlong and islong) ? high: na, location=location.abovebar, style=shape.xcross, color=#2E7C13, size=size.tiny, title='Exit Long')

plotshape((showendlabels and endshort and isshort) ? low : na, location=location.belowbar, style=shape.xcross, color=#BF217C, size=size.tiny, title='Exit Short')

alertcondition(golong, title='Long Signal', message='D-RSI: Long Signal')

alertcondition(goshort, title='Short Signal', message='D-RSI: Short Signal')

alertcondition(endlong, title='Exit Long Signal', message='D-RSI: Exit Long')

alertcondition(endshort, title='Exit Short Signal', message='D-RSI: Exit Short')

if golong

strategy.entry("Enter Long", strategy.long)

else if goshort

strategy.entry("Enter Short", strategy.short)

- MACD RSI Ichimoku Trend Momentum Berikutan Strategi Panjang

- Strategi Perubahan Arah RSI

- Strategi Perdagangan RSI Bollinger Bands yang Dipertingkatkan

- Strategi Pivot dan Momentum

- Strategi Dagangan Komprehensif Purata Bergerak dan RSI

- Strategi Kembalikan Selasa (Filter hujung minggu)

- Strategi silang EMA yang dipertingkatkan dengan RSI/MACD/ATR

- Strategi Dagangan Jangka Panjang Bersama MACD dan RSI

- RSI2 Strategi Peralihan Intraday Win Rate Backtest

- Trend Multi-Indikator Mengikut Strategi

- Strategi Perdagangan AlphaTradingBot

- Indikator Setup Demark

- Bollinger Bands Stochastic RSI Extreme

- AK MACD BB INDIKATOR V 1.00

- SAR Parabolik

- Indikator Perbezaan RSI

- Indikator OBV MACD

- Trend Pivot

- Strategi Perbezaan Harga v1.0

- Penembusan Sokongan-Tentang

- Rata-rata Bergerak Beradaptasi cerun

- Low Scanner strategi crypto

- [blackcat] L2 Reversal Label Strategi

- SuperB

- SAR tinggi rendah

- SuperTREX

- Pengesan puncak

- Pencari rendah

- Trend SMA

- Bollinger rendah

- Super trend B