Estratégia de negociação de rompimento de altura de candlestick com múltiplas médias móveis, RSI e saídas de desvio padrão

Visão geral da estratégia

A estratégia combina várias médias móveis de índices (EMA), índices de fraqueza relativa (RSI) e condições de saída baseadas em desvios padrão para identificar oportunidades de compra e venda potenciais. Usam EMAs de curto prazo (6,8,12 dias), médio prazo (55 dias) e longo prazo (150 dias, 200 dias, 250 dias) para analisar a direção e a intensidade da tendência do mercado. O RSI usa barreiras configuráveis de compra (~30) e venda (~70) para avaliar a dinâmica e identificar situações de sobrecompra ou sobrevenda.

Princípio da estratégia

- Calcule os EMAs de múltiplos ciclos (6, 8, 12, 55, 100, 150, 200) como referência visual para avaliar a tendência do mercado.

- De acordo com o número de linhas de arame que o usuário insere ((3-4 raízes), calcule o preço mais alto e o preço mais baixo dos últimos N linhas de arame.

- Condições de compra: o preço de fechamento atual é superior ao preço mais alto da linha de raiz N mais recente e é superior ao filtro EMA (se ativado).

- Condições de venda: o preço de fechamento atual é inferior ao preço mais baixo da linha de raiz N mais recente e é inferior ao filtro EMA (se ativado).

- Condições de saída para posições longas: o preço de fechamento atual está abaixo da EMA de 12 dias + 0,5 vezes o diferencial padrão, ou abaixo da EMA de 12 dias.

- Condições de saída de posição curta: o preço de fechamento atual está acima da EMA do dia 12 - 0,5 vezes a diferença padrão, ou acima da EMA do dia 12

- Usando o RSI como um indicador auxiliar, o ciclo padrão é de 14, o limiar de superalimento é de 30, o limiar de superalimento é de 70.

Vantagens estratégicas

- A combinação das duas dimensões de seguimento de tendências (múltiplos EMAs) e a dinâmica (RSI) fornece uma perspectiva mais abrangente de análise de mercado.

- O exclusivo mecanismo de saída baseado na diferença padrão permite um equilíbrio entre a proteção dos lucros e o controle dos riscos.

- O código é altamente modulado, os parâmetros-chave podem ser configurados pelo usuário e a flexibilidade é alta.

- Aplica-se a várias variedades e períodos de tempo, especialmente para ações e Bitcoin de transações de dia.

Análise de Riscos

- Os sinais falsos são frequentes durante os primeiros momentos de um mercado em turbulência ou de uma reversão de tendência, resultando em perdas contínuas.

- Os parâmetros padrão não são válidos para todos os cenários de mercado e precisam ser otimizados em combinação com o feedback.

- É arriscado negociar apenas com esta estratégia, e recomenda-se tomar decisões auxiliares, como a combinação de outros indicadores e a sustentação de resistências.

- A reação ao surgimento de um evento de grande importância é lenta.

Direção de otimização

- Optimizar os parâmetros EMA e RSI: Analisar as combinações de parâmetros de acordo com a variedade, o período e as características do mercado para encontrar o melhor intervalo de parâmetros.

- Adicionar um mecanismo de stop loss: consulte os indicadores de volatilidade, como o ATR, configure um stop loss e um stop loss razoáveis, controle o risco de uma única transação.

- Introdução de gerenciamento de posições: pode ajustar o tamanho das posições de acordo com a intensidade da tendência (como o ADX) ou a distância dos pontos de resistência de suporte crítico.

- Usado em combinação com outros indicadores técnicos, como Brinband, MACD, equilíbrio de cruzamentos, etc., para aumentar a confiabilidade do sinal de abertura de posição.

- Optimização de estado de segmentação de mercado: combinação de parâmetros de otimização para diferentes estados de mercado, como tendências, oscilações e reviravoltas.

Resumir

Este artigo propõe uma estratégia de negociação de alta ruptura de linha de ancoragem baseada em múltiplas médias móveis, RSI e saídas padrão. A estratégia analisa o mercado a partir de duas dimensões de tendência e dinâmica, e usa um mecanismo exclusivo de saída padrão para controlar o risco ao mesmo tempo em que capta oportunidades de tendência.

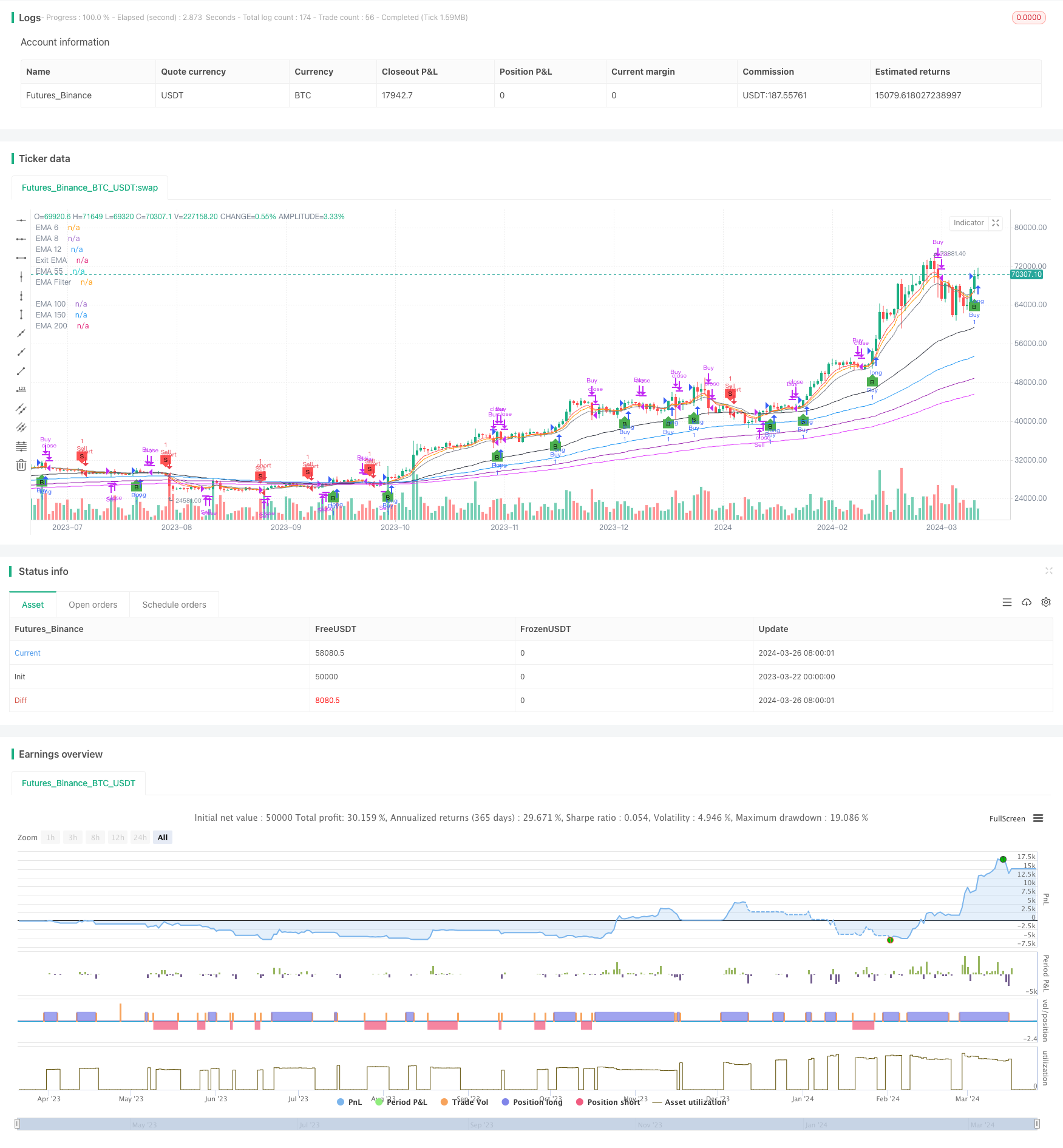

/*backtest

start: 2023-03-22 00:00:00

end: 2024-03-27 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Candle Height Breakout with Configurable Exit and Signal Control", shorttitle="CHB Single Signal", overlay=true)

// Input parameters for EMA filter and its length

useEmaFilter = input.bool(true, "Use EMA Filter", group="Entry Conditions")

emaFilterLength = input.int(55, "EMA Filter Length", minval=1, group="Entry Conditions")

candleCount = input.int(4, "SamG Configurable Candle Count for Entry", minval=3, maxval=4, step=1, group="Entry Conditions")

exitEmaLength = input.int(12, "Exit EMA Length", minval=1, group="Exit Conditions", defval=12)

exitStdDevMultiplier = input.float(0.5, "Exit Std Dev Multiplier", minval=0.1, maxval=2.0, step=0.1, group="Exit Conditions")

// State variables to track if we are in a long or short position

var bool inLong = false

var bool inShort = false

// Calculating EMAs with fixed periods for visual reference

ema6 = ta.ema(close, 6)

ema8 = ta.ema(close, 8)

ema12 = ta.ema(close, 12)

ema55 = ta.ema(close, 55)

ema100 = ta.ema(close, 100)

ema150 = ta.ema(close, 150)

ema200 = ta.ema(close, 200)

emaFilter = ta.ema(close, emaFilterLength)

exitEma = ta.ema(close, exitEmaLength)

// Plotting EMAs

plot(ema6, "EMA 6", color=color.red)

plot(ema8, "EMA 8", color=color.orange)

plot(ema12, "EMA 12", color=color.yellow)

plot(ema55, "EMA 55", color=color.green)

plot(ema100, "EMA 100", color=color.blue)

plot(ema150, "EMA 150", color=color.purple)

plot(ema200, "EMA 200", color=color.fuchsia)

plot(emaFilter, "EMA Filter", color=color.black)

plot(exitEma, "Exit EMA", color=color.gray)

// Calculating the highest and lowest of the last N candles based on user input

highestOfN = ta.highest(high[1], candleCount)

lowestOfN = ta.lowest(low[1], candleCount)

// Entry Conditions with EMA Filter

longEntryCondition = not inLong and not inShort and (close > highestOfN) and (not useEmaFilter or (useEmaFilter and close > emaFilter))

shortEntryCondition = not inLong and not inShort and (close < lowestOfN) and (not useEmaFilter or (useEmaFilter and close < emaFilter))

// Update position state on entry

if (longEntryCondition)

strategy.entry("Buy", strategy.long, comment="B")

inLong := true

inShort := false

if (shortEntryCondition)

strategy.entry("Sell", strategy.short, comment="S")

inLong := false

inShort := true

// Exit Conditions based on configurable EMA and Std Dev Multiplier

smaForExit = ta.sma(close, exitEmaLength)

upperExitBand = smaForExit + exitStdDevMultiplier * ta.stdev(close, exitEmaLength)

lowerExitBand = smaForExit - exitStdDevMultiplier * ta.stdev(close, exitEmaLength)

exitConditionLong = inLong and (close < upperExitBand or close < exitEma)

exitConditionShort = inShort and (close > lowerExitBand or close > exitEma)

// Strategy exits

if (exitConditionLong)

strategy.close("Buy", comment="Exit")

inLong := false

if (exitConditionShort)

strategy.close("Sell", comment="Exit")

inShort := false

// Visualizing entry and exit points

plotshape(series=longEntryCondition, style=shape.labelup, location=location.belowbar, color=color.green, size=size.tiny, title="Buy Signal", text="B")

plotshape(series=shortEntryCondition, style=shape.labeldown, location=location.abovebar, color=color.red, size=size.tiny, title="Sell Signal", text="S")