概述

该策略是一个基于多个技术指标的交易策略,通过综合考虑Bollinger Bands (BB)、Moving Averages (MA)、MACD、RSI、Stochastic Oscillator (STOCH)和Volume Weighted Average Price (VWAP)等指标,在15分钟时间周期上生成买卖信号。当多个指标同时满足特定条件时,策略就会产生买入或卖出信号,同时设置止损和止盈价位来管理风险和锁定利润。

策略原理

- 使用15分钟的收盘价数据作为策略的主要分析对象。

- 计算Bollinger Bands指标,包括上轨、中轨和下轨。

- 计算两条不同周期的移动平均线(10周期和30周期)。

- 计算MACD指标,包括MACD线、信号线和MACD柱。

- 计算RSI指标。

- 计算Stochastic Oscillator指标,包括%K线和%D线。

- 计算VWAP指标。

- 当快速移动平均线上穿慢速移动平均线、MACD线大于信号线、RSI大于50、价格高于VWAP、%K线大于%D线时,产生买入信号。

- 当快速移动平均线下穿慢速移动平均线、MACD线小于信号线、RSI小于50、价格低于VWAP、%K线小于%D线时,产生卖出信号。

- 设置止损价和止盈价,控制风险和锁定利润。

优势分析

- 多因子融合,提高信号可靠性:该策略综合考虑了多个技术指标,这些指标从不同角度反映了市场趋势和动量,共同构成了一个更加可靠的交易信号。

- 趋势跟踪能力强:通过移动平均线的交叉和MACD指标,策略可以有效捕捉市场的主要趋势。

- 适应性强:通过RSI、Stochastic Oscillator等指标,策略可以适应不同的市场状态,在趋势和震荡行情中都有良好表现。

- 风险管理严格:策略设置了止损和止盈价位,能够有效控制单笔交易的风险敞口,同时锁定已获利润。

风险分析

- 参数优化风险:策略包含多个参数,如果参数设置不当,可能导致策略表现欠佳。因此,需要对参数进行优化和稳健性测试。

- 市场风险:策略在极端行情下可能出现失效的情况,如突发事件导致的剧烈波动等。

- 过拟合风险:如果策略参数过于优化,可能存在过拟合的风险,导致在样本外数据上表现不佳。

优化方向

- 动态止损和止盈:根据市场波动情况动态调整止损和止盈水平,以更好地适应市场。

- 引入更多因子:考虑引入更多有效的技术指标或基本面因子,如成交量、市场情绪等,以进一步提高信号的可靠性。

- 加入仓位管理:根据市场风险状况和信号强度,动态调整仓位大小,以更好地控制整体风险。

- 优化参数:定期对策略参数进行优化和调整,以适应不断变化的市场环境。

总结

该策略通过融合多个技术指标,在15分钟时间周期上产生可靠的交易信号。策略具有良好的趋势跟踪能力和风险管理措施,能够在不同市场状态下取得稳健的表现。但是,策略也存在一定的参数优化风险和过拟合风险,需要进一步优化和改进。未来可以考虑引入更多因子、动态止损止盈、仓位管理等措施,以提高策略的稳健性和盈利能力。

策略源码

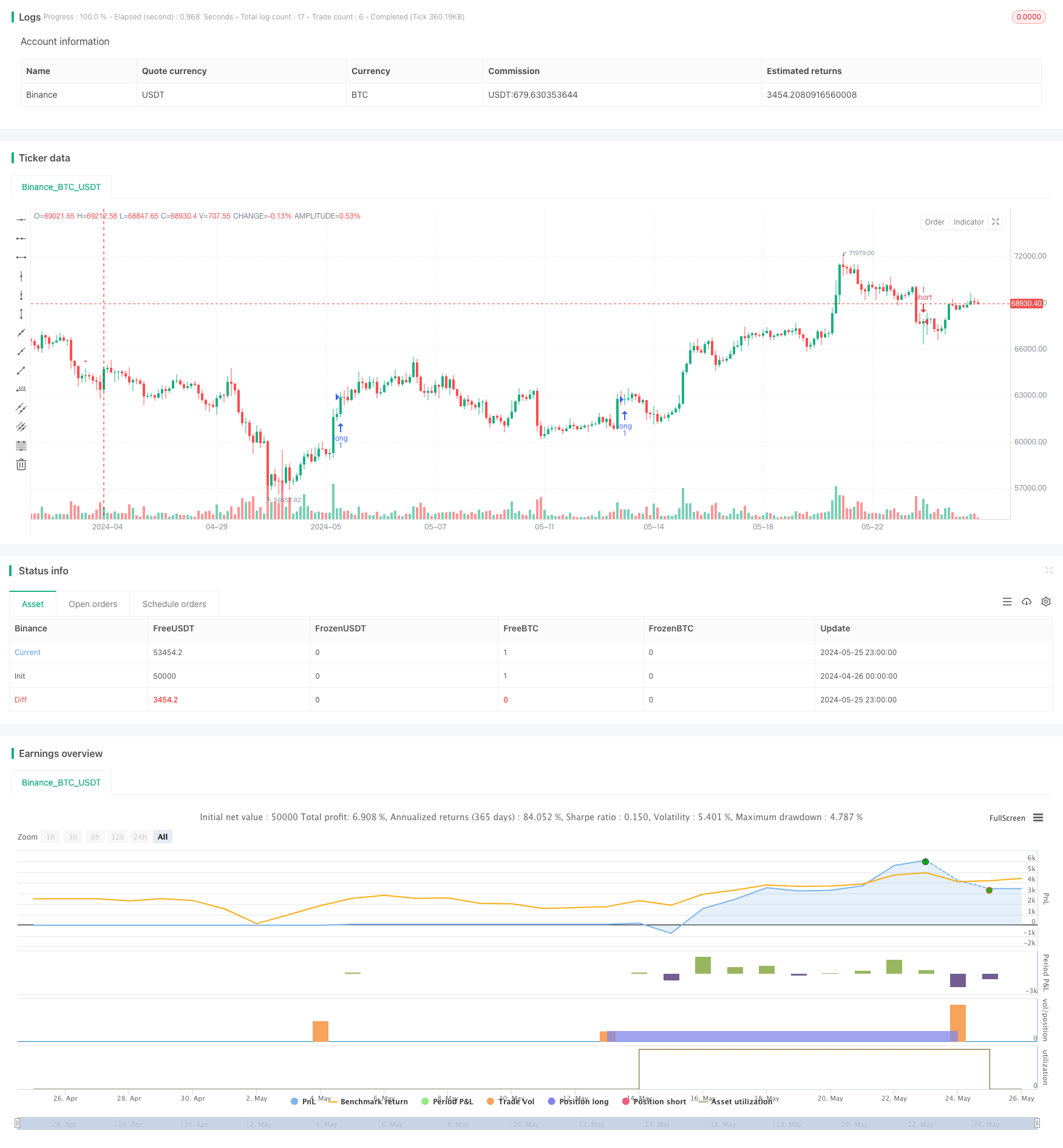

/*backtest

start: 2024-04-26 00:00:00

end: 2024-05-26 00:00:00

period: 3h

basePeriod: 15m

exchanges: [{"eid":"Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Gelişmiş Al-Sat Sinyalleri", overlay=true, process_orders_on_close=true)

// 15 dakikalık grafik verileri

fifteen_minute_close = request.security(syminfo.tickerid, "15", close)

// Stop loss ve take profit seviyelerini hesaplamak için kullanılacak oranlar

stop_loss_ratio = input.float(0.01, title="Stop Loss Oranı")

take_profit_ratio = input.float(0.02, title="Take Profit Oranı")

// Bollinger Bantları göstergesi

length = input.int(20, title="BB Dönemi")

mult = input.float(2.0, title="BB Çarpanı")

basis = ta.sma(fifteen_minute_close, length)

dev = mult * ta.stdev(fifteen_minute_close, length)

upper = basis + dev

lower = basis - dev

// Moving Averages (Hareketli Ortalamalar)

fast_ma = ta.sma(fifteen_minute_close, 10)

slow_ma = ta.sma(fifteen_minute_close, 30)

// MACD göstergesi

macd_line = ta.ema(fifteen_minute_close, 12) - ta.ema(fifteen_minute_close, 26)

macd_signal = ta.ema(macd_line, 9)

macd_hist = macd_line - macd_signal

// RSI göstergesi

rsi = ta.rsi(fifteen_minute_close, 14)

// Stochastic Oscillator (Stokastik Osilatör)

kPeriod = input.int(14, title="Stochastic %K Periyodu")

dPeriod = input.int(3, title="Stochastic %D Periyodu")

smoothK = input.int(3, title="Stochastic %K Düzleştirme")

k = ta.stoch(fifteen_minute_close, high, low, kPeriod)

d = ta.sma(k, dPeriod)

// Hacim ağırlıklı hareketli ortalamalar göstergesi (VWAP)

vwap_length = input.int(20, title="VWAP Dönemi")

vwap = ta.sma(volume * (high + low + fifteen_minute_close) / 3, vwap_length) / ta.sma(volume, vwap_length)

// Al-Sat Sinyallerini hesaplayın

long_signal = ta.crossover(fast_ma, slow_ma) and macd_line > macd_signal and rsi > 50 and fifteen_minute_close > vwap and k > d

short_signal = ta.crossunder(fast_ma, slow_ma) and macd_line < macd_signal and rsi < 50 and fifteen_minute_close < vwap and k < d

// Al ve Sat işaretlerini, yanlarında ok işaretleri olan üçgenlerle değiştirin

plotshape(series=long_signal, style=shape.triangleup, location=location.belowbar, color=color.green, size=size.small)

plotshape(series=short_signal, style=shape.triangledown, location=location.abovebar, color=color.red, size=size.small)

// Uzun ve kısa pozisyonlar için girişler

if (long_signal)

strategy.entry("long", strategy.long)

strategy.exit("exit_long", "long", stop=fifteen_minute_close * (1 - stop_loss_ratio), limit=fifteen_minute_close * (1 + take_profit_ratio))

if (short_signal)

strategy.entry("short", strategy.short)

strategy.exit("exit_short", "short", stop=fifteen_minute_close * (1 + stop_loss_ratio), limit=fifteen_minute_close * (1 - take_profit_ratio))

相关推荐