概述

该策略是一个基于指数移动平均线(EMA)和动量指标的趋势跟踪策略。它通过动量突破信号和EMA趋势过滤器相结合的方式,在市场趋势明确时进行交易。策略包含了完整的风险管理模块,灵活的交易时间过滤,以及详细的统计分析功能,以提升策略的稳定性和可靠性。

策略原理

策略的核心逻辑基于以下几个关键要素: 1. 动量信号识别:通过计算用户自定义时间周期内的动量值,当动量突破上行阈值时产生做多信号,突破下行阈值时产生做空信号。 2. EMA趋势过滤:使用200周期EMA作为趋势判断依据,价格在EMA之上允许做多,价格在EMA之下允许做空。 3. 时间过滤:可设置具体的交易时段,并支持GMT时区调整,使策略更好地适应不同市场的交易时间。 4. 风险控制:支持基于ATR或固定百分比的止损和止盈设置,并限制每日最大交易次数。

策略优势

- 趋势跟踪能力强:通过EMA和动量的双重确认,能够有效捕捉主要趋势行情。

- 风险管理完善:提供多种止损方案,既可以使用ATR动态止损,也可以使用固定百分比止损。

- 统计分析全面:实时跟踪多个性能指标,包括多空胜率、风险收益比等。

- 参数灵活可调:主要参数都可以根据不同市场特点进行优化调整。

策略风险

震荡市场风险:在横盘震荡市场可能产生频繁假突破信号。 建议解决方案:增加震荡指标过滤或加大突破阈值。

滑点风险:在波动剧烈时期可能面临较大滑点。 建议解决方案:设置合理的止损范围,避免在高波动时段交易。

过度交易风险:信号过于频繁可能导致过度交易。 建议解决方案:合理设置每日最大交易次数限制。

策略优化方向

- 动态参数优化:可以根据市场波动率自动调整动量阈值和EMA周期。

- 多时间周期分析:增加多个时间周期的趋势确认,提高信号可靠性。

- 市场环境识别:加入波动率分析模块,在不同市场环境下采用不同的参数设置。

- 信号强度分级:对突破信号进行强度分级,根据信号强度动态调整持仓规模。

总结

这是一个设计完善的趋势跟踪策略,通过动量突破和EMA趋势相结合的方式捕捉市场机会。策略的风险管理体系完整,统计分析功能强大,具有良好的实用性和可扩展性。通过持续优化和完善,该策略有望在不同市场环境下都能保持稳定的表现。

策略源码

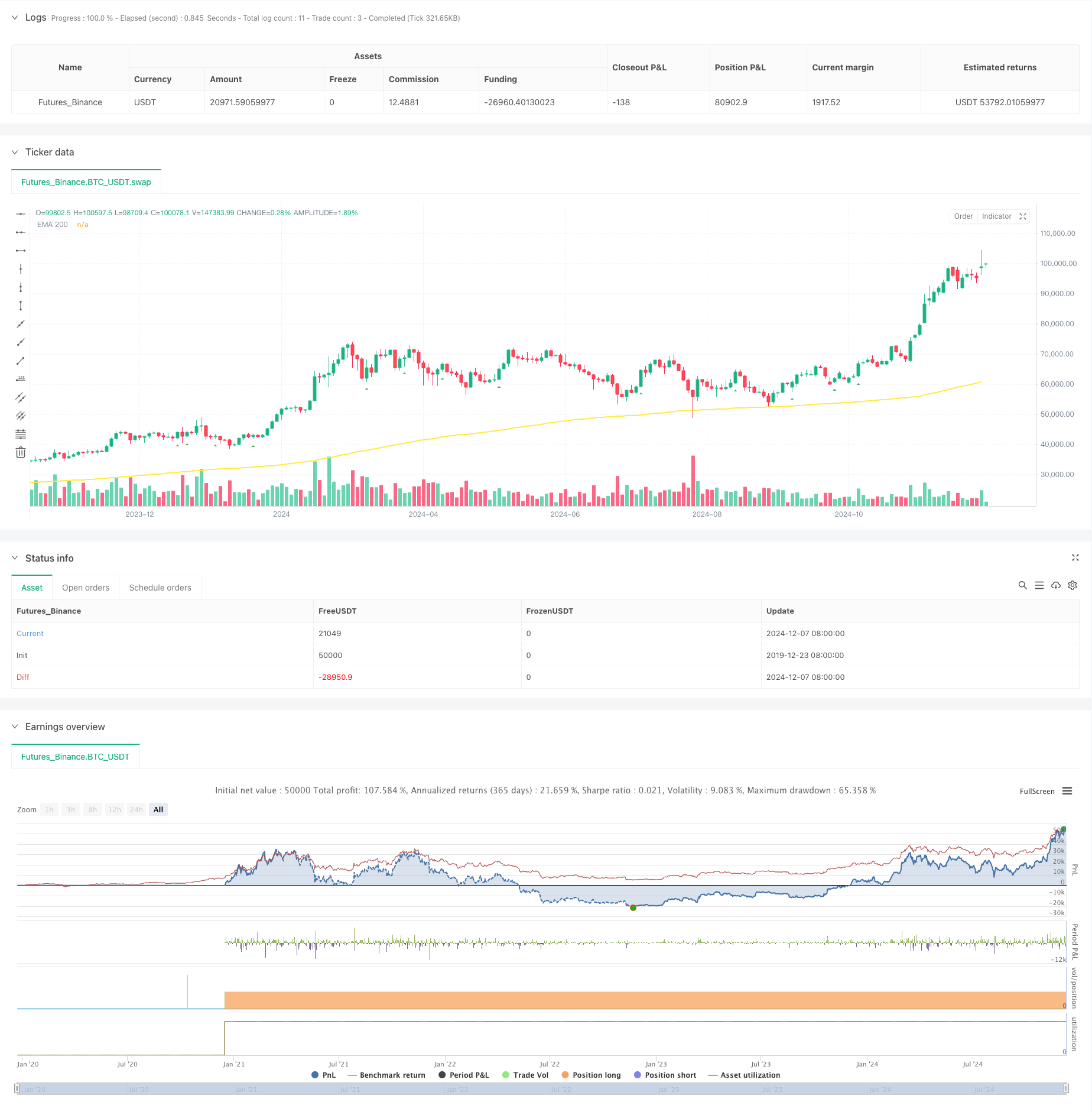

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-09 08:00:00

period: 2d

basePeriod: 2d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=6

strategy("[Mustang Algo] EMA Momentum Strategy",

shorttitle="[Mustang Algo] Mom Strategy",

overlay=true,

initial_capital=10000,

default_qty_type=strategy.fixed,

default_qty_value=1,

pyramiding=0,

calc_on_every_tick=false,

max_bars_back=5000)

// Momentum Parameters

len = input.int(10, minval=1, title="Length")

src = input(close, title="Source")

momTimeframe = input.timeframe("", title="Momentum Timeframe")

timeframe_gaps = input.bool(true, title="Autoriser les gaps de timeframe")

momFilterLong = input.float(5, title="Filtre Momentum Long", minval=0)

momFilterShort = input.float(-5, title="Filtre Momentum Short", maxval=0)

// EMA Filter

useEmaFilter = input.bool(true, title="Utiliser Filtre EMA")

emaLength = input.int(200, title="EMA Length", minval=1)

// Position Size

contractSize = input.float(1.0, title="Taille de position", minval=0.01, step=0.01)

// Time filter settings

use_time_filter = input.bool(false, title="Utiliser le Filtre de Temps")

start_hour = input.int(9, title="Heure de Début", minval=0, maxval=23)

start_minute = input.int(30, title="Minute de Début", minval=0, maxval=59)

end_hour = input.int(16, title="Heure de Fin", minval=0, maxval=23)

end_minute = input.int(30, title="Minute de Fin", minval=0, maxval=59)

gmt_offset = input.int(0, title="Décalage GMT", minval=-12, maxval=14)

// Risk Management

useAtrSl = input.bool(false, title="Utiliser ATR pour SL/TP")

atrPeriod = input.int(14, title="Période ATR", minval=1)

atrMultiplier = input.float(1.5, title="Multiplicateur ATR pour SL", minval=0.1, step=0.1)

stopLossPerc = input.float(1.0, title="Stop Loss (%)", minval=0.01, step=0.01)

tpRatio = input.float(2.0, title="Take Profit Ratio", minval=0.1, step=0.1)

// Daily trade limit

maxDailyTrades = input.int(2, title="Limite de trades par jour", minval=1)

// Variables for tracking daily trades

var int dailyTradeCount = 0

// Reset daily trade count

if dayofweek != dayofweek[1]

dailyTradeCount := 0

// Time filter function

is_within_session() =>

current_time = time(timeframe.period, "0000-0000:1234567", gmt_offset)

start_time = timestamp(year, month, dayofmonth, start_hour, start_minute, 0)

end_time = timestamp(year, month, dayofmonth, end_hour, end_minute, 0)

in_session = current_time >= start_time and current_time <= end_time

not use_time_filter or in_session

// EMA Calculation

ema200 = ta.ema(close, emaLength)

// Momentum Calculation

gapFillMode = timeframe_gaps ? barmerge.gaps_on : barmerge.gaps_off

mom = request.security(syminfo.tickerid, momTimeframe, src - src[len], gapFillMode)

// ATR Calculation

atr = ta.atr(atrPeriod)

// Signal Detection with Filters

crossoverUp = ta.crossover(mom, momFilterLong)

crossoverDown = ta.crossunder(mom, momFilterShort)

emaUpTrend = close > ema200

emaDownTrend = close < ema200

// Trading Conditions

longCondition = crossoverUp and (not useEmaFilter or emaUpTrend) and is_within_session() and dailyTradeCount < maxDailyTrades and barstate.isconfirmed

shortCondition = crossoverDown and (not useEmaFilter or emaDownTrend) and is_within_session() and dailyTradeCount < maxDailyTrades and barstate.isconfirmed

// Calcul des niveaux de Stop Loss et Take Profit

float stopLoss = useAtrSl ? (atr * atrMultiplier) : (close * stopLossPerc / 100)

float takeProfit = stopLoss * tpRatio

// Modification des variables pour éviter les erreurs de repainting

var float entryPrice = na

var float currentStopLoss = na

var float currentTakeProfit = na

// Exécution des ordres avec gestion des positions

if strategy.position_size == 0

if longCondition

entryPrice := close

currentStopLoss := entryPrice - stopLoss

currentTakeProfit := entryPrice + takeProfit

strategy.entry("Long", strategy.long, qty=contractSize)

strategy.exit("Exit Long", "Long", stop=currentStopLoss, limit=currentTakeProfit)

dailyTradeCount += 1

if shortCondition

entryPrice := close

currentStopLoss := entryPrice + stopLoss

currentTakeProfit := entryPrice - takeProfit

strategy.entry("Short", strategy.short, qty=contractSize)

strategy.exit("Exit Short", "Short", stop=currentStopLoss, limit=currentTakeProfit)

dailyTradeCount += 1

// Plot EMA

plot(ema200, color=color.yellow, linewidth=2, title="EMA 200")

// Plot Signals

plotshape(longCondition, title="Long Signal", location=location.belowbar, color=color.green, style=shape.triangleup, size=size.small)

plotshape(shortCondition, title="Short Signal", location=location.abovebar, color=color.red, style=shape.triangledown, size=size.small)

// // Performance Statistics

// var int longWins = 0

// var int longLosses = 0

// var int shortWins = 0

// var int shortLosses = 0

// if strategy.closedtrades > 0

// trade = strategy.closedtrades - 1

// isLong = strategy.closedtrades.entry_price(trade) < strategy.closedtrades.exit_price(trade)

// isWin = strategy.closedtrades.profit(trade) > 0

// if isLong and isWin

// longWins += 1

// else if isLong and not isWin

// longLosses += 1

// else if not isLong and isWin

// shortWins += 1

// else if not isLong and not isWin

// shortLosses += 1

// longTrades = longWins + longLosses

// shortTrades = shortWins + shortLosses

// longWinRate = longTrades > 0 ? (longWins / longTrades) * 100 : 0

// shortWinRate = shortTrades > 0 ? (shortWins / shortTrades) * 100 : 0

// overallWinRate = strategy.closedtrades > 0 ? (strategy.wintrades / strategy.closedtrades) * 100 : 0

// avgRR = strategy.grossloss != 0 ? math.abs(strategy.grossprofit / strategy.grossloss) : 0

// // Display Statistics

// var table statsTable = table.new(position.top_right, 4, 7, border_width=1)

// if barstate.islastconfirmedhistory

// table.cell(statsTable, 0, 0, "Type", bgcolor=color.new(color.blue, 90))

// table.cell(statsTable, 1, 0, "Win", bgcolor=color.new(color.blue, 90))

// table.cell(statsTable, 2, 0, "Lose", bgcolor=color.new(color.blue, 90))

// table.cell(statsTable, 3, 0, "Daily Trades", bgcolor=color.new(color.blue, 90))

// table.cell(statsTable, 0, 1, "Long", bgcolor=color.new(color.blue, 90))

// table.cell(statsTable, 1, 1, str.tostring(longWins), bgcolor=color.new(color.blue, 90))

// table.cell(statsTable, 2, 1, str.tostring(longLosses), bgcolor=color.new(color.blue, 90))

// table.cell(statsTable, 3, 1, str.tostring(dailyTradeCount) + "/" + str.tostring(maxDailyTrades), bgcolor=color.new(color.blue, 90))

// table.cell(statsTable, 0, 2, "Short", bgcolor=color.new(color.blue, 90))

// table.cell(statsTable, 1, 2, str.tostring(shortWins), bgcolor=color.new(color.blue, 90))

// table.cell(statsTable, 2, 2, str.tostring(shortLosses), bgcolor=color.new(color.blue, 90))

// table.cell(statsTable, 0, 3, "Win Rate", bgcolor=color.new(color.blue, 90))

// table.cell(statsTable, 1, 3, "Long: " + str.tostring(longWinRate, "#.##") + "%", bgcolor=color.new(color.blue, 90))

// table.cell(statsTable, 2, 3, "Short: " + str.tostring(shortWinRate, "#.##") + "%", bgcolor=color.new(color.blue, 90))

// table.cell(statsTable, 0, 4, "Overall", bgcolor=color.new(color.blue, 90))

// table.cell(statsTable, 1, 4, "Win Rate: " + str.tostring(overallWinRate, "#.##") + "%", bgcolor=color.new(color.blue, 90))

// table.cell(statsTable, 2, 4, "Total: " + str.tostring(strategy.closedtrades) + " | RR: " + str.tostring(avgRR, "#.##"), bgcolor=color.new(color.blue, 90))

// table.cell(statsTable, 0, 5, "Trading Hours", bgcolor=color.new(color.blue, 90))

// table.cell(statsTable, 1, 5, "Start: " + str.format("{0,time,HH:mm}", start_hour * 60 * 60 * 1000 + start_minute * 60 * 1000), bgcolor=color.new(color.blue, 90))

// table.cell(statsTable, 2, 5, "End: " + str.format("{0,time,HH:mm}", end_hour * 60 * 60 * 1000 + end_minute * 60 * 1000), bgcolor=color.new(color.blue, 90))

// table.cell(statsTable, 3, 5, "GMT: " + (gmt_offset >= 0 ? "+" : "") + str.tostring(gmt_offset), bgcolor=color.new(color.blue, 90))

// table.cell(statsTable, 0, 6, "SL/TP Method", bgcolor=color.new(color.blue, 90))

// table.cell(statsTable, 1, 6, useAtrSl ? "ATR-based" : "Percentage-based", bgcolor=color.new(color.blue, 90))

// table.cell(statsTable, 2, 6, useAtrSl ? "ATR: " + str.tostring(atrPeriod) : "SL%: " + str.tostring(stopLossPerc), bgcolor=color.new(color.blue, 90))

// table.cell(statsTable, 3, 6, "TP Ratio: " + str.tostring(tpRatio), bgcolor=color.new(color.blue, 90))

相关推荐