概述

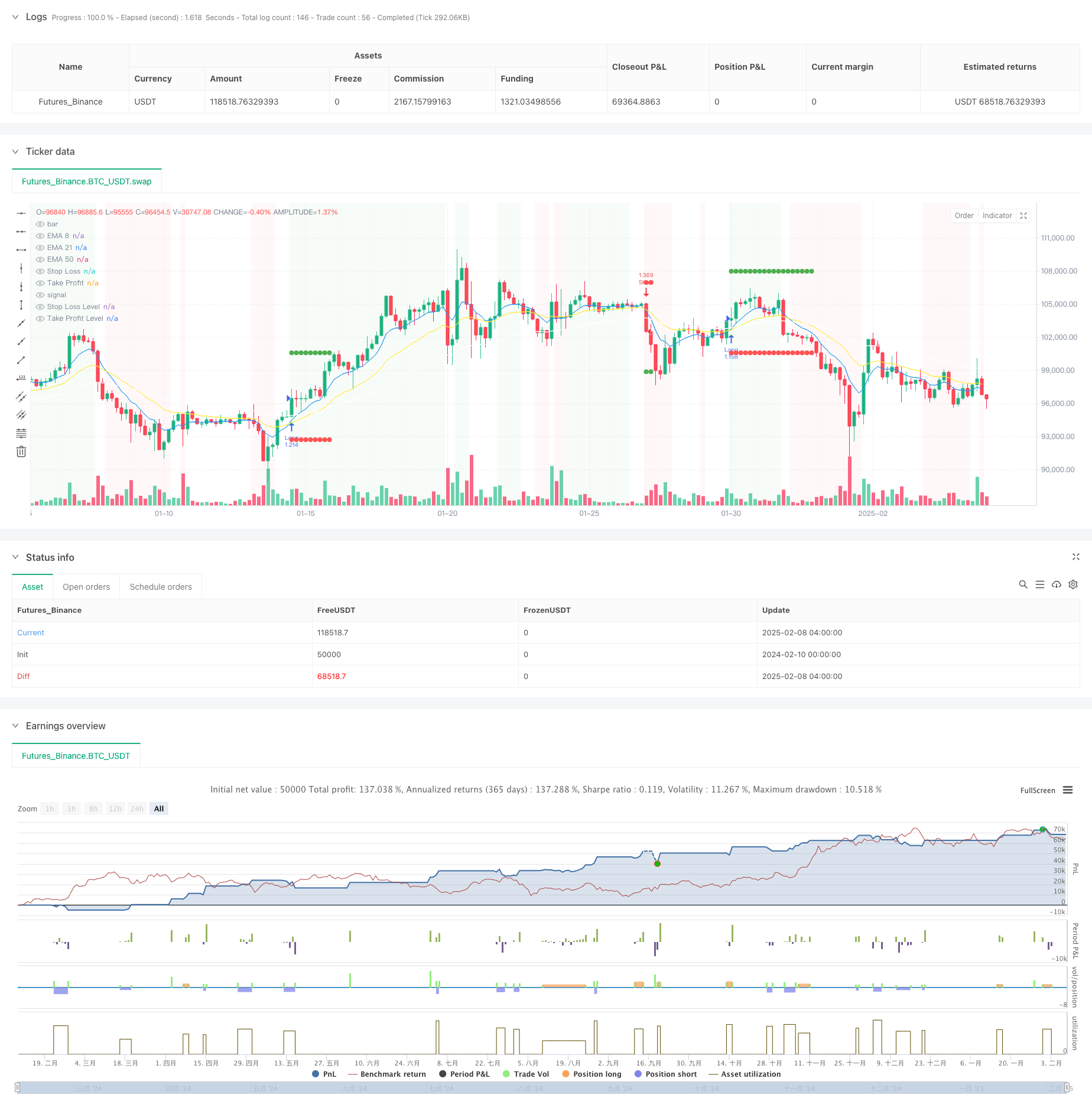

这是一个基于多重技术指标和风险管理的趋势跟踪策略。该策略综合运用了移动平均线、相对强弱指标(RSI)、动向指标(DMI)等多个技术指标来识别市场趋势,并通过动态止损、头寸管理和每月最大回撤限制等风险控制手段来保护资金安全。策略的核心在于通过多维度的技术指标来确认趋势的有效性,同时严格控制风险敞口。

策略原理

策略采用多层次的趋势确认机制: 1. 通过8/21/50周期指数移动平均线(EMA)判断趋势方向 2. 使用价格通道中线作为趋势过滤器 3. 结合RSI均线(5周期)在35-65区间内的运动来过滤假突破 4. 通过DMI指标(14周期)确认趋势强度 5. 利用动量指标(8周期)和成交量放大来验证趋势的持续性 6. 采用基于ATR的动态止损来控制风险 7. 实施固定风险模式的头寸管理,每次交易风险额度为初始资金的5% 8. 设置10%的月度最大回撤限制以避免过度损失

策略优势

- 多重技术指标交叉验证,提高了趋势判断的准确性

- 动态止损机制有效控制单笔交易风险

- 固定风险的头寸管理方式使资金利用更加合理

- 月度最大回撤限制提供了系统性风险防护

- 结合成交量指标,增强了趋势确认的可靠性

- 2:1的盈亏比设置提高了长期盈利能力

策略风险

- 多重指标的使用可能导致信号滞后

- 在震荡市场中可能产生频繁虚假信号

- 固定风险模式在波动率剧烈变化时可能不够灵活

- 月度回撤限制可能导致错过重要交易机会

- 趋势反转时可能承受较大回撤

策略优化方向

- 引入自适应的指标参数,以适应不同市场环境

- 开发更灵活的头寸管理方案,考虑市场波动率变化

- 增加趋势强度的量化评估,优化入场时机

- 设计更智能的月度风险限制机制

- 加入市场环境识别模块,在不同市场条件下调整策略参数

总结

该策略通过多维度技术指标的综合运用,建立了一个相对完整的趋势跟踪交易系统。策略的优势在于其全面的风险管理框架,包括动态止损、头寸管理和回撤控制。虽然存在一定的滞后性风险,但通过优化和改进,策略有望在不同市场环境下保持稳定的表现。关键是要在保持策略核心逻辑的同时,增强其对市场环境的适应能力。

策略源码

/*backtest

start: 2024-02-10 00:00:00

end: 2025-02-08 08:00:00

period: 4h

basePeriod: 4h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("High Win-Rate Crypto Strategy with Drawdown Limit", overlay=true, initial_capital=10000, default_qty_type=strategy.fixed, process_orders_on_close=true)

// Moving Averages

ema8 = ta.ema(close, 8)

ema21 = ta.ema(close, 21)

ema50 = ta.ema(close, 50)

// RSI settings

rsi = ta.rsi(close, 14)

rsi_ma = ta.sma(rsi, 5)

// Momentum and Volume

mom = ta.mom(close, 8)

vol_ma = ta.sma(volume, 15)

high_vol = volume > vol_ma * 1

// Trend Strength

[diplus, diminus, _] = ta.dmi(14, 14)

strong_trend = diplus > 20 or diminus > 20

// Price channels

highest_15 = ta.highest(high, 15)

lowest_15 = ta.lowest(low, 15)

mid_channel = (highest_15 + lowest_15) / 2

// Trend Conditions

uptrend = ema8 > ema21 and close > mid_channel

downtrend = ema8 < ema21 and close < mid_channel

// Entry Conditions

longCondition = uptrend and ta.crossover(ema8, ema21) and rsi_ma > 35 and rsi_ma < 65 and mom > 0 and high_vol and diplus > diminus

shortCondition = downtrend and ta.crossunder(ema8, ema21) and rsi_ma > 35 and rsi_ma < 65 and mom < 0 and high_vol and diminus > diplus

// Dynamic Stop Loss based on ATR

atr = ta.atr(14)

stopSize = atr * 1.3

// Calculate position size based on fixed risk

riskAmount = strategy.initial_capital * 0.05

getLongPosSize(riskAmount, stopSize) => riskAmount / stopSize

getShortPosSize(riskAmount, stopSize) => riskAmount / stopSize

// Monthly drawdown tracking

var float peakEquity = na

var int currentMonth = na

var float monthlyDrawdown = na

maxDrawdownPercent = 10

// Variables for SL and TP

var float stopLoss = na

var float takeProfit = na

var bool inTrade = false

var string tradeType = na

// Reset monthly metrics

monthNow = month(time)

if na(currentMonth) or currentMonth != monthNow

currentMonth := monthNow

peakEquity := strategy.equity

monthlyDrawdown := 0.0

// Update drawdown metrics

peakEquity := math.max(peakEquity, strategy.equity)

monthlyDrawdown := math.max(monthlyDrawdown, (peakEquity - strategy.equity) / peakEquity * 100)

// Trading condition

canTrade = monthlyDrawdown < maxDrawdownPercent

// Entry and Exit Logic

if strategy.position_size == 0

inTrade := false

if longCondition and canTrade

stopLoss := low - stopSize

takeProfit := close + (stopSize * 2)

posSize = getLongPosSize(riskAmount, stopSize)

strategy.entry("Long", strategy.long, qty=posSize)

strategy.exit("Long Exit", "Long", stop=stopLoss, limit=takeProfit)

inTrade := true

tradeType := "long"

if shortCondition and canTrade

stopLoss := high + stopSize

takeProfit := close - (stopSize * 2)

posSize = getShortPosSize(riskAmount, stopSize)

strategy.entry("Short", strategy.short, qty=posSize)

strategy.exit("Short Exit", "Short", stop=stopLoss, limit=takeProfit)

inTrade := true

tradeType := "short"

// Plot variables

plotSL = inTrade ? stopLoss : na

plotTP = inTrade ? takeProfit : na

// EMA Plots

plot(ema8, "EMA 8", color=color.blue, linewidth=1)

plot(ema21, "EMA 21", color=color.yellow, linewidth=1)

plot(ema50, "EMA 50", color=color.white, linewidth=1)

// SL and TP Plots

plot(plotSL, "Stop Loss", color=color.red, style=plot.style_linebr, linewidth=1)

plot(plotTP, "Take Profit", color=color.green, style=plot.style_linebr, linewidth=1)

// Signal Plots

plotshape(longCondition and canTrade, "Buy Signal", style=shape.triangleup, location=location.belowbar, color=color.green, size=size.small)

plotshape(shortCondition and canTrade, "Sell Signal", style=shape.triangledown, location=location.abovebar, color=color.red, size=size.small)

// SL/TP Markers with correct y parameter syntax

plot(inTrade ? stopLoss : na, "Stop Loss Level", style=plot.style_circles, color=color.red, linewidth=2)

plot(inTrade ? takeProfit : na, "Take Profit Level", style=plot.style_circles, color=color.green, linewidth=2)

// Background Color

noTradingMonth = monthlyDrawdown >= maxDrawdownPercent

bgcolor(noTradingMonth ? color.new(color.gray, 80) : uptrend ? color.new(color.green, 95) : downtrend ? color.new(color.red, 95) : na)

// Drawdown Label

var label drawdownLabel = na

label.delete(drawdownLabel)

drawdownLabel := label.new(bar_index, high, "Monthly Drawdown: " + str.tostring(monthlyDrawdown, "#.##") + "%\n" + (noTradingMonth ? "NO TRADING" : "TRADING ALLOWED"), style=label.style_label_down, color=noTradingMonth ? color.red : color.green, textcolor=color.white, size=size.small)

相关推荐