In fact, past prices don't really affect the future.

Author: The Little Dream, Created: 2016-11-15 13:02:36, Updated: 2016-11-15 13:06:40In fact, past prices don't really affect the future.

I'm not a financial student, I'm a mathematical computer student, and I heard a very bad story that affected many generations.

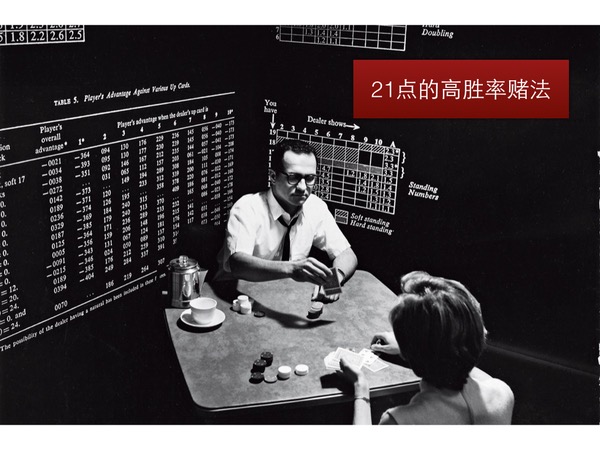

This guy is Edward Thorpe, he's famous, he started out as a mathematician, but he was addicted to gambling since he was 10 years old, but he was smart, and he ended up as a professor of mathematics, which was great, but he didn't study mathematics very well after he became a professor, and he was still studying gambling, and he studied the possible outcomes of all kinds of gambling games, and he found that the majority of gambling games had a probability of winning somewhere between 48% and 49%.

Figure 1

Why? Because if the probability of winning is more than 50%, according to the law of large numbers, it is a casino, the casino will definitely not make you win, the casino will definitely make you lose money. If your probability of winning is too low, the game cannot be played below 45%, so a good casino game must have a winning probability controlled between 48% and 49%.

Eventually, he analyzed almost all the casino problems in the world, influenced by another mathematician. The word Monte Carlo is now famous in the financial world, meaning all routes are tried again. It was originally a casino name. Previously, a mathematician in Monte Carlo had calculated the probability of all the numbers appearing on the reels.

Figure 2

Thorp was particularly interested in this and began to study the problems of modern casinos. The Russian spin of modern casinos has been digitally industrialized, but he found a problem with the rules, and he eventually discovered that a game called 21 points actually has a high winning odds formula, which is that if we sign cards, we can find that at a certain time the winning odds can be increased to almost 56%, and he can beat the casino.

And after he discovered this, he wrote the whole algorithm and the whole idea into a mathematical paper, and the mathematical paper was called the 21 Points Gamble, and you can imagine a mathematical paper titled the 21 Points Gamble, and it was submitted to the American Mathematical Society.

Figure 3

What if you're unlucky and you keep losing, and you don't wait for the law of large numbers to work, and your bankroll runs out? For example, if I have a million dollars in my hand, and I bet $200,000 every time, and I have a 56% chance of winning, but I don't have good luck and I'm wrong five times in a row, what if I actually don't wait for the law of large numbers to work, and I lose the light, and I get off the table, and you can't continue betting, which is the same thing as futures? Although we have a trading system with a very high winning rate of 60%, if you fail, you may go bust, and you may not be able to stand your own mentality. The fact is that he has no way to solve the problem of distribution of profits even with a high winning rate, unless you have an unlimited number of bets, you have the same number of bets every time, practice tens of millions of times, etc. How did you find the bottleneck? Look for the great God, the great god of the mathematical world. You people of science and technology should all know about Liu Shannon, at that time he was a general presence of God, and we people who study computers admired him very much.

Figure four

It probably took Shannon weeks without solving this issue of allocating the payouts, and then very unexpectedly, a lab run by Shannon called Campbell Labs, had a very young experimental researcher there named Kelly who was also working on a less formal problem, and if we had insider knowledge about the insides of Major League Baseball today, but the insider accuracy was limited, how we could get rich, mathematicians not quite what we imagined, Kelly worked out a way.

Figure 5

He concludes that if in a deadlock we know that the odds of winning and losing are B, and we know that our odds of winning and losing are P, Q is our odds of losing, that is 1 minus P, then the jackpot we should lose every time should be F, which is a ratio that can be mathematically proven strictly by Kelly's formula that your money will never run out, and that your capital growth rate will always be the fastest. I've tried the Kelly formula with Monte Carlo methods, and I've ended up using all the publicly available money allocation methods on the market, and after practicing it for 1,000 times, the Kelly formula's betting method, or the money allocation method, is several times better than any other betting method, and the Kelly formula itself can determine that your money will never run out, which is mathematically proven. Shannon is a math tailor, and is not very good at participating personally, so he trains himself at home to quickly memorize Kelly's formula, which is actually quite simple. After training for a week, he finds himself memorizing Kelly's formula very quickly, and in the evening he goes to Las Vegas. He found the game over, so he wrote a book called The House That Won the War, which became the best-selling book in North America that year. The book details how a loophole could be used to move the money from the casino home, which sold so well that he was later fired by the black community because the casino had a black background, too many cases of drugs and assassinations, and he felt it was not necessary to gamble with his life and continue to make money in the casino. After he had solved the casino himself in mathematics, he was wondering where the casino would keep me playing on Wall Street, and he went to Wall Street. After Wall Street, he began to study the loopholes of Wall Street, and finally he found that convertible debt was a high-win-rate practice, betting on the Kelly formula, he formed a hedge fund, dedicated to the Kelly formula convertible debt, his hedge fund performance became the best on Wall Street that year, and he later wrote a book called The Win-Win Market, which became a best-seller in North America that year. He broke the casino in mathematics, and broke finance in mathematics, he felt that it was almost, he went back to studying mathematics. Like everyone else, I was exposed to a lot of god-like systems when I first came into contact with speculation, wave theory, Bill Williams etc. Because I was curious about it, I re-learned the mathematics of chaos myself, and I came to the conclusion that the chaos trading system has nothing to do with chaos mathematics, and there is a lot of technical analysis of god. I've been systematically studying philosophy myself, and I've found that there's a concept that everyone must have, which is falsifiability. I'm showing you a very famous thing called the lobster in the garage of Carl Sagan, which is a very famous example in the history of philosophy. Carl Sagan announced that there is now a flaming dragon in my garage, believe it or not.

Figure 6

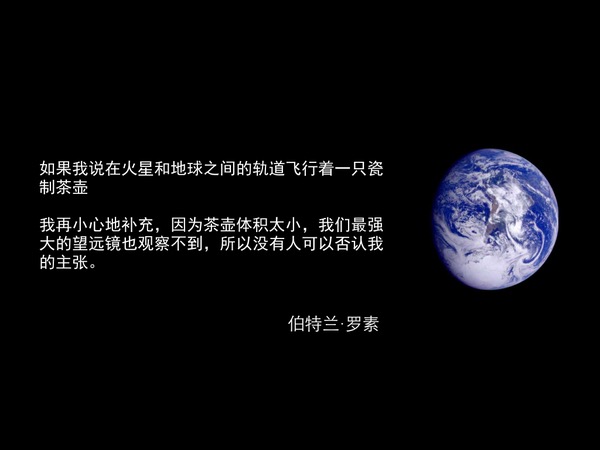

I'm sure I don't believe it, we say that the one who opened the garage door gave us the dragon, I haven't seen the dragon yet, I want to see it. I'm sorry, the fire is cold, so if you make it burn, you still can't feel it, but the dragon really exists, hidden. I went to the garage and painted it, and the dragon showed up, right? He said, "Sorry, I'm so sorry, my dragon doesn't paint, so you can't see it", and he added, "But believe me, it's real". Most ironically, Russell, who criticized this unfalsifiable theory with a metaphor, said that if I say that a teapot is flying in orbit around Mars and the Earth, it is not copper, it is not aluminum, it is aluminum, because the volume of the teapot is too small, even the most powerful telescopes cannot observe it, so no one can deny my proposition, no one can deny me. It is too small, invisible, you can't say it doesn't exist, right?

Figure 7

These theories are commonly known as the unverifiable theory of the butterfly. My point is that the unverifiable theory of the butterfly is all sleazy and doesn't make any sense, although it looks powerful, it actually means the same thing as Carl Sagan's dragon. There are many such things on the market, implying changes in the 12 houses of gold, the movement is the external manifestation of the unity of the people, the belief of many people, the repetitive manifestation of the cycle of the highways of the heavens and the earth, and then a bunch of old books come out.

After much trial and error, I have carefully studied the techniques of these theories, which are basically bland, not to mention the specific methods of operation that he derived from the theory. What does it mean to do mathematical planning, mathematical planning of all the basic analytical systems that can be falsified? For example, I have a few resources in my hands, how to maximize it, in fact I have not learned mathematics from my own experience, in fact, it is already established in operations theory, through a series of mathematical planning formulas of operations theory, I can maximize the efficiency of the resources in my hands, I use all the available methods of technical analysis that have historically performed at least more than 50% of the technical analysis, all of which are performed in operations theory, I come up with such a system.

I've tested it all and you don't have to compare it to any trading system on the market, because if you're testing it, nobody can do it better than it, just like using the Kelly formula, no one money distribution system can beat the Kelly formula, linear planning in operations theory is the best way to prove the resource allocation strictly mathematically. For this kind of money we have a term called the bid-ask spread, and it's very monotonous, and that's the model I made with this thing.

Afterwards, when the trading system was running in real time, although it was still profitable, there was a huge retreat that could not have existed in history. This is the situation that the system should not have. I repeatedly reflected on what was wrong with the system?

I was thinking about what assumptions I had used, and I only assumed one thing, that the technical indicator was useful, which was my only assumption, and since all the steps after this assumption were not wrong, I began to shake its original belief.

Figure 8

I'm using an algorithm in a neural network, which theoretically can approximate any function, what does that mean? If something is caused by the variable ABCD, then the relationship of ABCD exists, and I don't need to know the actual way, I just throw it into the algorithm, and I get the function. If the result R is caused by any of the factors ABCDE, then the relationship, the way that scientists used to do experiments is, say, in Newtonian mechanics, I give it a force of two newtons, and then the friction coefficient, how far it can go, and you guess the relationship between the force and the velocity and the mass. And then I gave it all the technical analysis data, and I had it trace the relationship to the future price in the neural network, and I did a lot of hard, brilliant programming.

The result is very shocking, past prices have no effect on the future, a word that is deafening to me as a technical analyst, that you use past prices to predict future prices, is the premise of all technical indicators. Whether the technical indicator is falsifiable or not, it is their common premise, almost self-evident. But I came to the conclusion that it didn't matter, and my worldview collapsed. I was thinking about a question, is the magic combination of technical indicators not found yet, or is historical experience inherently insufficient in itself, because all technical indicators are historical experience? I pushed my assumptions one level further, and whether the technical indicators themselves are problematic, or historical experience is incorrect, is not a mathematical problem, or am I going to study philosophy for a while?

Translated from the all-weather quantitative financial information reading

- Math and gambling (1)

- Inventor quantification Commodity futures cooperative process of opening

- Futures and options

- Rethinking the Uniform System

- The Kelly formula for positioning control of the lever

- The trend trading of an old bird, the idea of a quantitative trading system

- Bitcoin High Frequency Strategy Ideas to be recommended

- The three secrets of keeping a quantized model alive

- High-frequency trading strategies based on machine learning

- 2.9 Debugging in the run of the strategy robot (JS - the usefulness of the eval function)

- What does "co-integration" mean in statistical terms?

- 3.4 Complement the strategic framework to get the robots up and running!

- 3.3 The general architecture of the strategic process, a strategic framework

- 3.1 Template:Repeatable code _ Directory of digital currency spot transactions

- 2.6 Goods

- 2.7 Use of indicators

- 2.5 Interface showing API policy interaction

- 2.4 Get order information, cancel orders, and get all unfinished orders

- 2.3 List of market prices

- 2.2 Lower price lists