Mikrofon Rusak dan Strategi Rata-rata Pergerakan Multi-Kerangka Waktu

Ringkasan

Strategi ini menggabungkan indikator MACD dan Garis Rata-Rata Kerangka Waktu Berkali-kali untuk membentuk strategi perdagangan jangka panjang dan bilateral yang memanfaatkan tren dan sinyal pembalikan tren secara komprehensif. Strategi ini dapat memperoleh keuntungan tambahan dalam situasi yang sedang tren, sementara juga dapat menangkap peluang pembalikan.

Prinsip Strategi

Menggunakan dua set EMA rata-rata dengan periode yang berbeda bekerja sama sebagai filter multi-frame waktu, untuk menentukan arah jangka panjang: 15 menit EMA cepat lebih tinggi dari 1 jam EMA lambat untuk filter bullish, 15 menit EMA cepat kurang dari 1 jam EMA lambat untuk filter bullish.

Ketika observasi dari pembentukan misalignment pada microfiber (misalnya misalignment pada garis pilar dan harga), penilaian dapat berbalik.

Pada saat pembukaan filter bullish, jika ditemukan adanya bull market yang menyimpang ((harga baru tinggi dan MACD tidak berinovasi tinggi), tunggu MACD naik ke sumbu nol, lakukan lebih banyak; pada saat pembukaan filter bullish, jika ditemukan adanya bear market yang menyimpang ((harga baru rendah dan MACD tidak berinovasi rendah), tunggu MACD turun ke sumbu nol, lakukan kosong 。

Stop loss adalah stop loss yang terus-menerus dilacak, yang dihitung berdasarkan harga tertinggi dan harga terendah. Stop loss adalah beberapa kali lipat dari stop loss.

Bila MACD berupa garis-garis pilar terjadi di arah nol, maka posisi akan terpatahkan.

Analisis Keunggulan

Portfolio EMA multi-frame dapat menilai tren siklus besar dan menghindari perdagangan berlawanan.

MACD adalah strategi yang tepat untuk menangkap peluang untuk membalikkan harga.

Tracking Stop loss secara dinamis dapat mengunci keuntungan dan mencegah pertumbuhan kerugian.

Stop loss adalah perhitungan jarak tempuh untuk mendapatkan return yang diharapkan.

Analisis risiko

Kelompok EMA bekerja sama untuk memfilter kesalahan penilaian yang mungkin terjadi pada periode penyusunan.

MACD tidak memiliki cukup rebound setelah mundur, dan mungkin tidak menguntungkan.

Stop loss jarak yang tidak tepat, mungkin terlalu longgar atau terlalu ketat.

Tidak ada ruang untuk berbalik, dan keuntungan terbatas.

“Kalau ada yang terlambat, ada yang terlambat, kalau ada yang terlambat, ada yang terlambat, kalau ada yang terlambat, ada yang terlambat”.

Arah optimasi

EMA dapat diuji dengan kombinasi parameter yang berbeda untuk mendapatkan penilaian tren yang lebih akurat.

Anda dapat mencoba untuk menyesuaikan argumen MACD menjadi kombinasi argumen yang lebih sensitif.

Anda dapat menguji berbagai pengaturan stop loss stop loss ratio.

Kondisi penyaringan tambahan dapat ditambahkan untuk menghindari terjerumus ke dalam bouncing palsu. Misalnya, menambahkan jangka waktu yang lebih tinggi untuk menilai tren global oleh EMA.

Hal ini dapat dioptimalkan untuk memastikan bahwa reversal telah cukup matang.

Meringkaskan

Strategi ini menggabungkan metode seperti penyaringan tren, sinyal pembalikan tren, dan manajemen stop loss dinamis, yang dapat berlanjut, dan dapat menangkap pembalikan. Dengan menyesuaikan parameter dan mengoptimalkan kondisi penyaringan, dapat disesuaikan dengan lingkungan pasar yang lebih luas, dan memperoleh keuntungan yang stabil dengan mengontrol risiko.

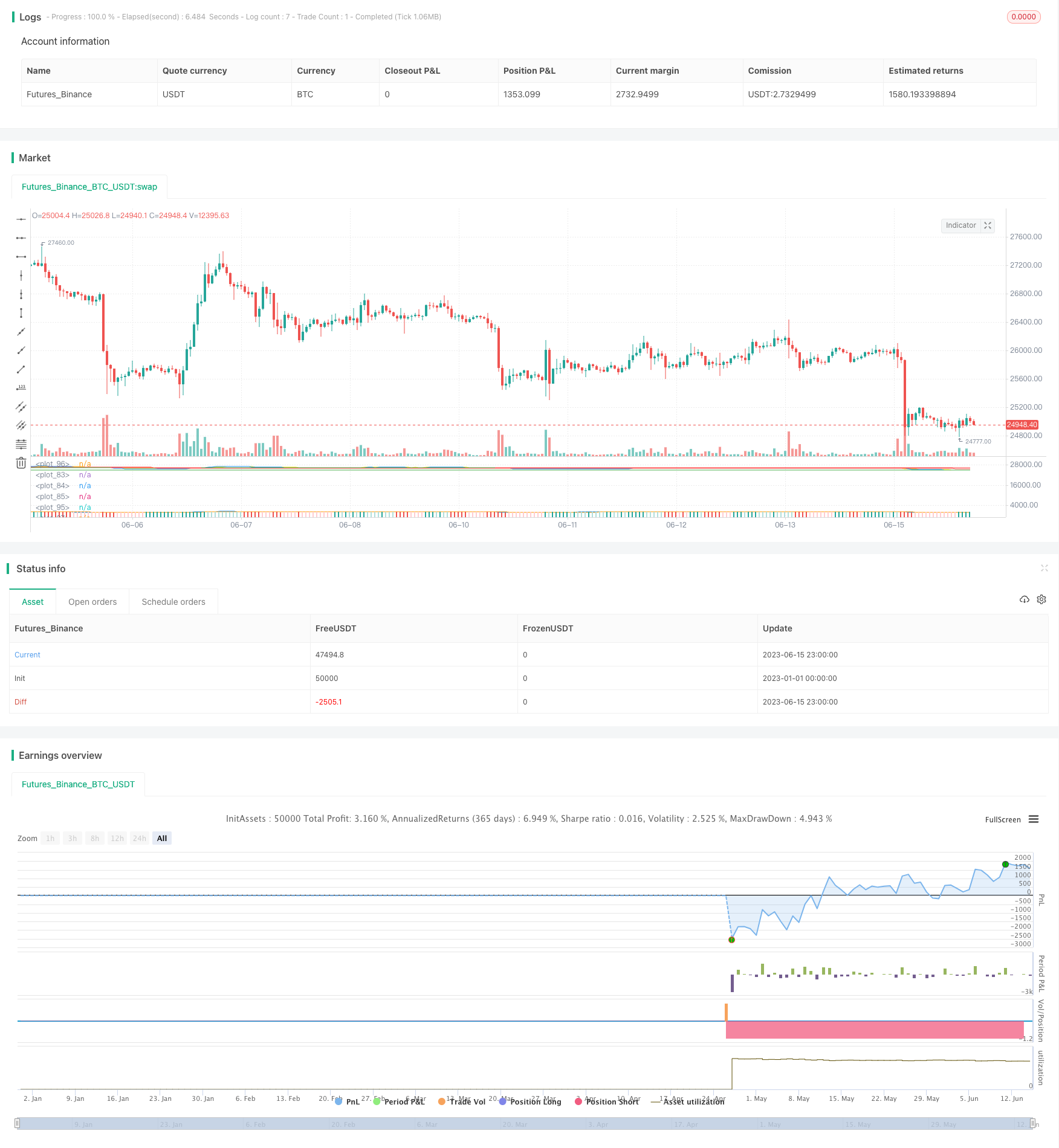

/*backtest

start: 2023-01-01 00:00:00

end: 2023-06-16 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © maxits

//@version=4

// MACD Divergence + Multi Time Frame EMA

// This Strategy uses 3 indicators: the Macd and two emas in different time frames

// The configuration of the strategy is:

// Macd standar configuration (12, 26, 9) in 1H resolution

// 10 periods ema, in 1H resolution

// 5 periods ema, in 15 minutes resolution

// We use the two emas to filter for long and short positions.

// If 15 minutes ema is above 1H ema, we look for long positions

// If 15 minutes ema is below 1H ema, we look for short positions

// We can use an aditional filter using a 100 days ema, so when the 15' and 1H emas are above the daily ema we take long positions

// Using this filter improves the strategy

// We wait for Macd indicator to form a divergence between histogram and price

// If we have a bullish divergence, and 15 minutes ema is above 1H ema, we wait for macd line to cross above signal line and we open a long position

// If we have a bearish divergence, and 15 minutes ema is below 1H ema, we wait for macd line to cross below signal line and we open a short position

// We close both position after a cross in the oposite direction of macd line and signal line

// Also we can configure a Take profit parameter and a trailing stop loss

// strategy("Macd + MTF EMA",

// overlay=true,

// initial_capital=1000,

// default_qty_value=20,

// default_qty_type=strategy.percent_of_equity,

// commission_value=0.1,

// pyramiding=0)

// User Inputs

i_time = input(defval = timestamp("01 Apr 2018 13:30 +0000"), title = "Start Time", type = input.time) // Starting time for backtest

f_time = input(defval = timestamp("30 Sep 2021 13:30 +0000"), title = "Finish Time", type = input.time) // Finishing time for backtest

long_pos = input(title="Show Long Positions", defval=true, type=input.bool) // Enable Long Positions

short_pos = input(title="Show Short Positions", defval=true, type=input.bool) // Enable Short Positions

src = input(close, title="Source") // Price value to calculate indicators

emas_properties = input(title="============ EMAS Properties ============", defval=false, type=input.bool) // Properties

mtf_15 = input(title="Fast EMA", type=input.resolution, defval="15") // Resolucion para MTF EMA 15 minutes

ma_15_length = input(5, title = "Fast EMA Period") // MTF EMA 15 minutes Length

mtf_60 = input(title="Slow EMA", type=input.resolution, defval="60") // Resolucion para MTF EMA 60 minutes

ma_60_length = input(10, title = "Slow EMA Period") // MTF EMA 60 minutes Length

e_new_filter = input(title="Enable a Third Ema filter?", defval=true, type=input.bool)

slowest_ema_len = input(100, title = "Fast EMA Period")

slowest_ema_res = input(title="Slowest EMA", type=input.resolution, defval="D")

macd_res = input(title="MACD TimeFrame", type=input.resolution, defval="") // MACD Time Frame

macd_properties = input(title="============ MACD Properties ============", defval="") // Properties

fast_len = input(title="Fast Length", type=input.integer, defval=12) // Fast MA Length

slow_len = input(title="Sign Length", type=input.integer, defval=26) // Sign MA Length

sign_len = input(title="Sign Length", type=input.integer, defval=9)

syst_properties = input(title="============ System Properties ============", defval="") // Properties

lookback = input(title="Lookback period", type=input.integer, defval=14, minval=1) // Candles to lookback for swing high or low

multiplier = input(title="Profit Multiplier based on Stop Loss", type=input.float, defval=6.0, minval=0.1) // Profit multiplier based on stop loss

shortStopPer = input(title="Short Stop Loss Percentage", type=input.float, defval=1.0, minval=0.0)/100

longStopPer = input(title="Long Stop Loss Percentage", type=input.float, defval=2.0, minval=0.0)/100

// Indicators

[macd, signal, hist] = security(syminfo.tickerid, macd_res, macd(src, fast_len, slow_len, sign_len))

ma_15 = security(syminfo.tickerid, mtf_15, ema(src, ma_15_length))

ma_60 = security(syminfo.tickerid, mtf_60, ema(src, ma_60_length))

ma_slo = security(syminfo.tickerid, slowest_ema_res, ema(src, slowest_ema_len))

// Macd Plot

col_grow_above = #26A69A

col_grow_below = #FFCDD2

col_fall_above = #B2DFDB

col_fall_below = #EF5350

plot(macd, color=color.new(color.blue, 0)) // Solo para visualizar que se plotea correctamente

plot(signal, color=color.new(color.orange, 0))

plot(hist, style=plot.style_columns,

color=(hist >= 0 ? (hist[1] < hist ? col_grow_above : col_fall_above) :

(hist[1] < hist ? col_grow_below : col_fall_below)))

// MTF EMA Plot

bullish_filter = e_new_filter ? ma_15 > ma_60 and ma_60 > ma_slo : ma_15 > ma_60

bearish_filter = e_new_filter ? ma_15 < ma_60 and ma_60 < ma_slo : ma_15 < ma_60

plot(ma_15, color=color.new(color.blue, 0))

plot(ma_60, color=color.new(color.yellow, 0))

plot(e_new_filter ? ma_slo : na, color = ma_60 > ma_slo ? color.new(color.green, 0) : color.new(color.red, 0))

////////////////////////////////////////////// Logic For Divergence

zero_cross = false

zero_cross := crossover(hist,0) or crossunder(hist,0) //Cruce del Histograma a la linea 0

// plot(zero_cross ? 1 : na)

// MACD DIVERGENCE TOPS (Bearish Divergence)

highest_top = 0.0

highest_top := (zero_cross == true ? 0.0 : (hist > 0 and hist > highest_top[1] ? hist : highest_top[1]))

prior_top = 0.0

prior_top := (crossunder(hist,0) ? highest_top[1] : prior_top[1]) // Búsqueda del Maximo en MACD

// plot(highest_top)

// plot(prior_top)

highest_top_close = 0.0

highest_top_close := (zero_cross == true ? 0.0 : (hist > 0 and hist > highest_top[1] ? close : highest_top_close[1]))

prior_top_close = 0.0

prior_top_close := (crossunder(hist,0) ? highest_top_close[1] : prior_top_close[1]) // Búsqueda del Maximo en pRECIO

// plot(highest_top_close)

// plot(prior_top_close)

top = false

top := highest_top[1] < prior_top[1]

and highest_top_close[1] > prior_top_close[1]

and hist < hist[1]

and crossunder(hist,0) // Bearish Divergence: top == true

// MACD DIVERGENCE BOTTOMS (Bullish Divergence)

lowest_bottom = 0.0

lowest_bottom := (zero_cross == true ? 0.0 : (hist < 0 and hist < lowest_bottom[1] ? hist : lowest_bottom[1]))

prior_bottom = 0.0

prior_bottom := (crossover(hist,0) ? lowest_bottom[1] : prior_bottom[1])

lowest_bottom_close = 0.0

lowest_bottom_close := (zero_cross == true ? 0.0 : (hist < 0 and hist < lowest_bottom[1] ? close : lowest_bottom_close[1]))

prior_bottom_close = 0.0

prior_bottom_close := (crossover(hist,0) ? lowest_bottom_close[1] : prior_bottom_close[1])

bottom = false

bottom := lowest_bottom[1] > prior_bottom[1]

and lowest_bottom_close[1] < prior_bottom_close[1]

and hist > hist[1]

and crossover(hist,0) // Bullish Divergence: bottom == true

////////////////////////////////////////////// System Conditions //////////////////////////////////////////////

inTrade = strategy.position_size != 0 // In Trade

longTrade = strategy.position_size > 0 // Long position

shortTrade = strategy.position_size < 0 // Short position

notInTrade = strategy.position_size == 0 // No trade

entryPrice = strategy.position_avg_price // Position Entry Price

////////////////////////////////////////////// Long Conditions //////////////////////////////////////////////

sl = lowest(low, lookback) // Swing Low for Long Entry

longStopLoss = 0.0 // Trailing Stop Loss calculation

longStopLoss := if (longTrade)

astopValue = sl * (1 - longStopPer)

max(longStopLoss[1], astopValue)

else

0

longTakeProf = 0.0 // Profit calculation based on stop loss

longTakeProf := if (longTrade)

profitValue = entryPrice + (entryPrice - longStopLoss) * multiplier

max(longTakeProf[1], profitValue)

else

0

// Long Entry Conditions

if bottom and notInTrade and bullish_filter and long_pos

strategy.entry(id="Go Long", long=strategy.long, comment="Long Position")

// strategy.close(id="Go Long", when=zero_cross)

if longTrade

strategy.exit("Exit Long", "Go Long", limit = longTakeProf, stop = longStopLoss)

plot(longTrade and longStopLoss ? longStopLoss : na, title="Long Stop Loss", color=color.new(color.red, 0), style=plot.style_linebr)

plot(longTrade and longTakeProf ? longTakeProf : na, title="Long Take Prof", color=color.new(color.green, 0), style=plot.style_linebr)

////////////////////////////////////////////// Short Conditions //////////////////////////////////////////////

sh = highest(high, lookback) // Swing High for Short Entry

shortStopLoss = 0.0

shortStopLoss := if (shortTrade)

bstopValue = sh * (1 + shortStopPer)

min(shortStopLoss[1], bstopValue)

else

999999

shortTakeProf = 0.0

shortTakeProf := if (shortTrade)

SprofitValue = entryPrice - (shortStopLoss - entryPrice) * multiplier

min(SprofitValue, shortTakeProf[1])

else

999999

// Short Entry

if top and notInTrade and bearish_filter and short_pos

strategy.entry(id="Go Short", long=strategy.short, comment="Short Position")

// strategy.close(id="Go Short", when=zero_cross)

if shortTrade

strategy.exit("Exit Short", "Go Short", limit = shortTakeProf, stop = shortStopLoss)

plot(shortTrade and shortStopLoss ? shortStopLoss : na, title="Short Stop Loss", color=color.new(color.red, 0), style=plot.style_linebr)

plot(shortTrade and shortTakeProf ? shortTakeProf : na, title="Short Take Prof", color=color.new(color.green, 0), style=plot.style_linebr)