RSIとSuperTrendに基づく双方向取引戦略

概要

これは,RSI指標とSuperTrend指標を統合した二方向の取引戦略である. この戦略は,市場の強みや弱みを識別し,トレンドの方向が変化したときに,より高い利益を得るために適切なタイミングでポジションを変更することを目的としています.

戦略原則

この戦略は以下の原則に基づいています.

RSI指標を使用して,現在の市場の強弱を判断する.RSIが50を超えると強い市場であり,50を下ると弱い市場である.

超トレンド指標をトレンドフィルターとして使用します. 価格が超トレンドを突破した場合のみ,取引シグナルを発信します.

RSIが強気な信号を発しているとき,価格が上線を突破した場合,多めに;価格が下線を突破した場合,平仓.

RSI指標が弱気信号を発したときに,価格が下線を突破した場合,空白する.価格が上線を突破した場合,平仓する.

RSI指数の多空変換により,トレンドの変化点を捕捉し,タイミングでポジション変更を行う.

具体的には

RSIは,長さ14で,強さと弱さを判断する境界線として50で計算します.

長さは10で,乗数は2である.

RSIが50を超え,価格がスーパートレンドを突破すると,多めにします. RSIが50を下回ると,価格がスーパートレンドを突破すると,空いてください.

過剰な時,RSIが弱くなり,価格がスーパートレンドの上線を突破した場合,平仓する.空白の時,RSIが強くなって,価格がスーパートレンドの下線を突破した場合,平仓する.

設定は”多”か”空”に設定できます

戦略的優位性

この戦略は,トレンド追跡と超買超売の判断を組み合わせて,以下の利点があります.

市場が変化するにつれて,市場が変化するにつれて,市場が変化するにつれて,市場が変化するにつれて,

RSIは,市場が転換する前,高を追いかけるのを避けるために,超買いと超売りの領域を効果的に判断します.

SuperTrendは,市場からの騒音を排除し,中長線トレンドを追跡する.

RSIとSuperTrendの2つの指標を組み合わせると,戦略の安定性を高めることができます.

この策略のパラメータは最適化スペースがあり,異なる品種と周期に応じて調整することができる.

“多作業”または”空き作業”のモードがサポートされ,さまざまな状況に柔軟に対応できます.

戦略リスク

この戦略にはいくつかのリスクがあります.

RSI指標は偽の信号を生成しやすいため,価格の実体検証が必要である.

SuperTrend指標のパラメータを誤って設定すると,漏れ点や追高殺低が発生する可能性があります.

双指標組合せには散布リスクがあり,最適のマッチングにパラメータを調整する必要があります.

状況が急激に変化する時,ストップダストは秒出され,合理的なストップダスト位置の設定が必要である.

重要なサポート・レジスタンス領域の近くでの反転開設は避けましょう.

戦略の最適化

この戦略は,以下の点で最適化できます.

RSIパラメータを調整し,偽信号をフィルターするために最適な長さを探します.

SuperTrendのパラメータを最適化し,トレンドの追跡効果を向上させる.

異なる種の異なる周期のパラメータの組み合わせをテストし,最適なパラメータを探します.

MACD,KDJなどの他の指標のフィルタを追加して,信号の正確性を向上させる.

重要なサポートのレジスタンス位,ブリンライン,運動平均などの判断,定性戦略信号を追加する.

ストップ・ロスの戦略を最適化し,ストップ・ロスの有効性を保証する前提で,ストップ・ロスが秒出される確率を最小限に抑える.

要約する

この戦略は,RSIとSuperTrendの2つの指標の優位性を統合し,市場の中期トレンドの変化を効果的に識別し,熊市と牛市の間に切替操作を行う.パラメータを最適化することで,より広範な市場状況に適応することができる.しかし,偽信号,パラメータセットなど,いくつかの一般的な問題にも注意する必要があります.全体的に,この戦略は,明確な考え,実行しやすい,強力な実用性を持っています.

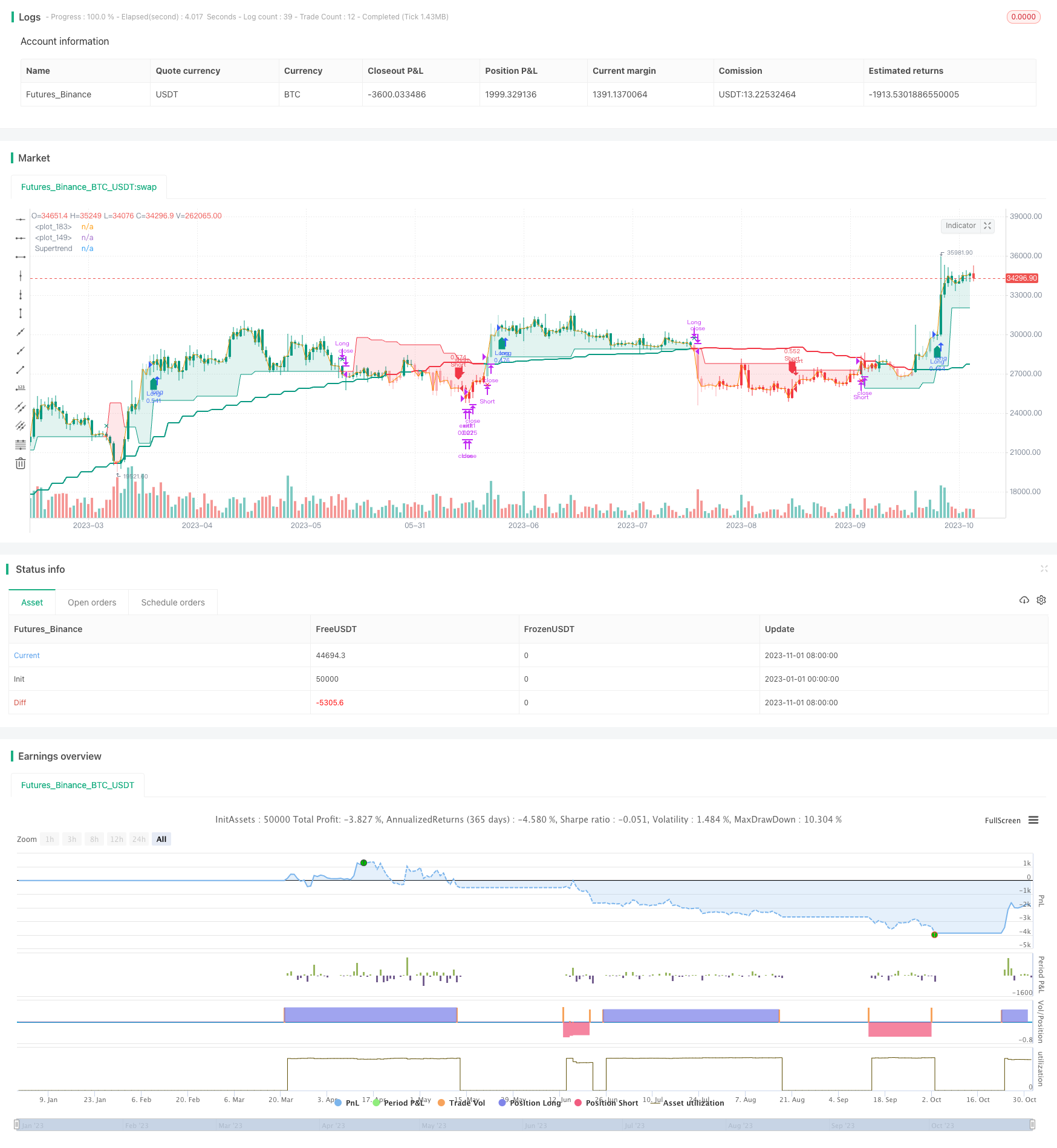

/*backtest

start: 2023-01-01 00:00:00

end: 2023-11-02 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

//@version=5

//Created by @CITIAlgo

// —————————————————————————————————————————————————————————————————————————————————————————————————————————

strategy('CITI Trends A with RSI Candles', shorttitle = "CITI Trends A" , overlay = true ,

initial_capital = 10000,

commission_value = 0.025,

default_qty_value = 25,

slippage = 1,

pyramiding = 0,

max_lines_count = 500,

max_labels_count = 500,

currency = currency.USD,

default_qty_type = strategy.percent_of_equity)

bullColor1 = #089981

bearColor1 = #f23645

bullColor2 = #3873e3

bearColor2 = #630ef5

neutralColor1 = #d5d5d5

//Base Settings

groupBase = "Base Settings ---------------------------------------"

Repaint_type = input.string('Non-Repainting', "Allow Repainting ?", options = ['Non-Repainting', 'Repainting'], inline ='repaint' , group = groupBase , tooltip = 'The default value is Non-Repainting. To learn more visit https://www.tradingview.com/pine-script-docs/en/v5/concepts/Repainting.html')

//Configure trade direction

tradeDirection = input.string("Both", title="Trade Direction", options=["Long", "Short", "Both"] , group=groupBase , inline = 'Type' )

longOK = tradeDirection == "Long" or tradeDirection == "Both"

shortOK = tradeDirection == "Short" or tradeDirection == "Both"

var bool PlotEntries = input.bool (true, "Show Entries" ,group=groupBase , inline = 'Signals' )

var bool PlotExits = input.bool (true, "Show Exits" , group=groupBase, inline = 'Signals' )

//Display Settings

groupDisplay = "Display Settings ------------------------------------"

MomBars = input.bool( true , title="Apply Bar Colors", inline = 'candles' , group=groupDisplay)

cbullColor = input.color( bullColor1 , 'Candle Colors' , inline = 'candles1a',group=groupDisplay)

cbearColor = input.color( bearColor1 , '' , inline = 'candles1a',group=groupDisplay)

//Candle & label Colors

Bullish_Bars = color.new( cbullColor , 0)

WBullish_Bars = color.new( cbullColor , 60)

Bearish_Bars = color.new( cbearColor , 0)

WBearish_Bars = color.new( cbearColor , 60)

lbullColor = input.color( bullColor1 , 'Long/Short Labels' , group=groupDisplay, inline = 'Signals1' )

lbearColor = input.color( bearColor1 , '' , group=groupDisplay, inline = 'Signals1' )

st_status = input.bool( true , title="Show Supertrend", inline = 'st' , group=groupDisplay)

st_bullColor = input.color( bullColor1 , '' , group=groupDisplay, inline = 'st' )

st_bearColor = input.color( bearColor1 , '' , group=groupDisplay, inline = 'st' )

//Build Your Signals Settings

groupEntry = " Trend & Signal Settings---------------------"

Entry1a = input.bool(true, title= "Entry", inline='entry1a', group=groupEntry)

Exit1a = input.bool(false, title= "Exit | Strong/Weak Momentum", inline='entry1a', group=groupEntry)

Entry1b = input.bool(false, title= 'Entry' , inline='entry1b', group=groupEntry)

Exit1b = input.bool(false, title= 'Exit | Bull/Bear Momentum' , inline='entry1b', group=groupEntry)

Entry3a = input.bool(false, title= "Filter", inline='entry3a', group=groupEntry)

Exit3a = input.bool(false, title= "Exit | MA ", inline='entry3a', group=groupEntry)

Entry4a = input.bool(false, title= "Filter | Disable RSI Ranges ", inline='entry4a', group=groupEntry)

Entry4b = input.bool(true, title= "Filter", inline='entry4b', group=groupEntry)

Exit4b = input.bool(true, title= "Exit | Supertrend ", inline='entry4b', group=groupEntry)

Entry4c = input.bool(true, title= "Filter | Disable Supertrend Ranges ", inline='entry4c', group=groupEntry)

// —————————————————————————————————————MTF FUNCTIONS

// —————————— PineCoders MTF Selection Framework functions

// ————— Converts current "timeframe.multiplier" plus the TF into minutes of type float.

f_resInMinutes() =>

_resInMinutes = timeframe.multiplier * (timeframe.isseconds ? 1. / 60. : timeframe.isminutes ? 1. : timeframe.isdaily ? 1440. : timeframe.isweekly ? 10080. : timeframe.ismonthly ? 43800. : na)

_resInMinutes

// Get current resolution in float minutes.

var ResInMinutes = f_resInMinutes()

// ————— Returns resolution of _resolution period in minutes.

f_tfResInMinutes(_res) =>

// _res: resolution of any TF (in "timeframe.period" string format).

request.security(syminfo.tickerid, _res, f_resInMinutes())

// ————— Returns a multiple of current resolution as a string in "timeframe.period" format usable with "security()".

f_multipleOfRes(_res, _mult) =>

// _res: current resolution in minutes, in the fractional format supplied by f_resInMinutes() companion function.

// _mult: Multiple of current TF to be calculated.

// Convert current float TF in minutes to target string TF in "timeframe.period" format.

_targetResInMin = _res * math.max(_mult, 1)

// Find best string to express the resolution.

_targetResInMin <= 0.083 ? '5S' : _targetResInMin <= 0.251 ? '15S' : _targetResInMin <= 0.501 ? '30S' : _targetResInMin <= 1440 ? str.tostring(math.round(_targetResInMin)) : _targetResInMin <= 43800 ? str.tostring(math.round(math.min(_targetResInMin / 1440, 365))) + 'D' : str.tostring(math.round(math.min(_targetResInMin / 43800, 12))) + 'M'

// ————— Converts current resolution

f_resInString(_res) =>

// _res: resolution of any TF (in "timeframe.period" string format).

_res == "1" ? "1m" :

_res == "3" ? "3m" :

_res == "5" ? "5m" :

_res == "15" ? "15m" :

_res == "30" ? "30m" :

_res == "45" ? "45m" :

_res == "60" ? "1h" :

_res == "120" ? "2h" :

_res == "180" ? "3h" :

_res == "240" ? "4h" :

_res == "1D" ? "D" :

_res == "1W" ? "W" :

_res == "1M" ? "M" : _res

//Set repaint security function

repaint_sw = Repaint_type == 'Non-Repainting' ? false : true

f_security(_symbol, _res, _src, _repaint) => request.security(_symbol, _res, _src[_repaint ? 0 : barstate.isrealtime ? 1 : 0] , barmerge.gaps_off, barmerge.lookahead_on)[_repaint ? 0 : barstate.isrealtime ? 0 : 1]

f_source(_res , source) => f_security(syminfo.tickerid , _res , source , repaint_sw )

Type1 = 'Auto Multiplied TF'

Type2 = 'Fixed TF'

//---------------------------------------------------------------------------

//RSI Settings // INPUTS

groupRange = "RSI Settings ----------------------------------"

TF1type = input.string( Type1, 'TF' , options=[Type1,Type2] , inline ='tf1' , group=groupRange)

setHTF1a = input.int( 4 , '' , inline ='tf1', group=groupRange)

setHTF1b = input.timeframe( 'D' , '' , inline ='tf1', group=groupRange)

// Get HTF from user-defined mode.

var TF1 = TF1type == Type1 ? f_multipleOfRes(ResInMinutes, setHTF1a) : setHTF1b

mLength = input.int( 14 , "RSI Length" ,inline='lines', group=groupRange)

BullLevel = input.int( 50 , "Bullish Level | Above 50 ",inline='lines1a', group=groupRange)

BearLevel = input.int( 50 , "Bearish Level | Below 50 ",inline='lines1b', group=groupRange)

ma_length = input.int( 21 , "MA Length" ,inline='ma', group=groupRange)

ma_status = input.bool( true , "Show MA" ,inline='ma1', group=groupRange)

ma_bullColor = input.color( bullColor1 , '' , inline='ma1', group=groupRange)

ma_bearColor = input.color( bearColor1 , '' , inline='ma1', group=groupRange)

//--------------------------------------------------------------------------

//Momentum Calculations

f_momTF( _tf ) =>

_isShow = f_tfResInMinutes(_tf) >= f_resInMinutes()

close_ = f_source(_tf , close)

rsi_ = _isShow ? f_security(syminfo.tickerid , _tf, ta.rsi( close_, mLength) , repaint_sw) : na

ma = _isShow ? f_security(syminfo.tickerid , _tf, ta.vwma( hlc3 , ma_length ) , repaint_sw) : na

[rsi_ , ma]

[ rsi , ma ] = f_momTF(TF1)

ma_color = close > ma ? ma_bullColor : ma_bearColor

plot( ma_status ? ma : na , color = ma_color , linewidth = 2 , style = plot.style_line)

//---------------------------------------------------------------------------

//Supertrend Settings // INPUTS

groupST = "Supertrend Settings ----------------------------------"

TF2type = input.string( Type1, 'TF' , options=[Type1,Type2] , inline ='tf2' , group=groupST)

setHTF2a = input.int( 4 , '' , inline ='tf2', group=groupST)

setHTF2b = input.timeframe( 'D' , '' , inline ='tf2', group=groupST)

// Get HTF from user-defined mode.

var TF2 = TF2type == Type1 ? f_multipleOfRes(ResInMinutes, setHTF2a) : setHTF2b

stLength = input.int( 10 , "Supertrend Length" ,inline='lines', group=groupST)

stmult = input.int( 2 , "Mult" ,inline='lines', group=groupST)

stHighlights = input.bool( true , "Highlights",inline='lines1a', group=groupST)

f_st( _tf) =>

_isShow = f_tfResInMinutes(_tf) >= f_resInMinutes()

close_ = f_source(_tf , close)

atr= f_security(syminfo.tickerid , _tf, ta.atr(stLength) , repaint_sw)

Up=close_ -(stmult*atr)

Dn=close_ +(stmult*atr)

TrendUp = 0.0

TrendUp := close_[1]>TrendUp[1] ? math.max(Up,TrendUp[1]) : Up

TrendDown = 0.0

TrendDown := close_[1]<TrendDown[1]? math.min(Dn,TrendDown[1]) : Dn

Trend = 0.0

Trend := close_ > TrendDown[1] ? 1: close_< TrendUp[1]? -1: nz(Trend[1],1)

stLine = Trend==1? TrendUp: TrendDown

[Trend, stLine]

[Trend, stLine] = f_st( TF2 )

stTrend = close > stLine ? 1:-1

stplot = plot( st_status? stLine : na , color= stTrend ==1 ? st_bullColor : st_bearColor , linewidth=1 ,title ="Supertrend")

priceLineP = plot( close , color= na , linewidth=1 , display = display.none)

fill(priceLineP , stplot , color = stHighlights ? stTrend ==1 ? color.new(st_bullColor , 85) : color.new( st_bearColor , 85 ) : na )

//---------------------------------------------------------------------------

//Momentum BarColors

mom2a = rsi > BullLevel ? Bullish_Bars : WBullish_Bars

mom2b = rsi < BearLevel ? Bearish_Bars : WBearish_Bars

mom2_color = close > ma ? mom2a : mom2b

mom_color = MomBars ? mom2_color : na

barcolor(mom_color)

//-------------------------------------------------

//Momentum Strength & Values

momVal2a = rsi > BullLevel ? 2 : 1

momVal2b = rsi < BearLevel ? -2 : -1

momVal2 = close > ma ? momVal2a : momVal2b

momVal = momVal2

///==============================================================================================================

//Long Trend Conditions

Entry1aL = Entry1a ? momVal == 2 : true

Entry1bL = Entry1b ? momVal == 1 or momVal == 2 : true

Entry3aL = Entry3a ? close > ma : true

Entry4aL = Entry4a ? rsi > BullLevel : true

Entry4bL = Entry4b ? close > stLine : true

Entry4cL = Entry4c ? stLine > stLine[1] : true

//------

noEntry = Entry1a == false and Entry1b == false and Entry3a == false and Entry4a == false and Entry4b == false and Entry4c == false ? false : true

noExit = Exit1a == false and Exit1b == false and Exit3a == false and Exit4b == false ? false : true

//------

EntryL = noEntry and Entry1aL and Entry1bL and Entry3aL and Entry4aL and Entry4bL and Entry4cL

Exit1aL = Exit1a ? momVal == 1 and momVal[1] == 2 : true

Exit1bL = Exit1b ? momVal == -1 or momVal == -2 : true

Exit3aL = Exit3a ? close < ma : true

Exit4bL = Exit4b ? close < stLine : true

ExitL = noExit and Exit1aL and Exit3aL and Exit1bL and Exit4bL

//Short Trend Conditions

Entry1aS = Entry1a ? momVal == -2 : true

Entry1bS = Entry1b ? momVal == -1 or momVal == -2 : true

Entry3aS = Entry3a ? close < ma : true

Entry4aS = Entry4a ? rsi < BearLevel : true

Entry4bS = Entry4b ? close < stLine : true

Entry4cS = Entry4c ? stLine < stLine[1] : true

EntryS = noEntry and Entry1aS and Entry1bS and Entry3aS and Entry4aS and Entry4bS and Entry4cS

Exit1aS = Exit1a ? momVal == -1 and momVal[1] == -2 : true

Exit1bS = Exit1b ? momVal == 1 or momVal == 2 : true

Exit3aS = Exit3a ? close > ma : true

Exit4bS = Exit4b ? close > stLine : true

ExitS = noExit and Exit1aS and Exit3aS and Exit1bS and Exit4bS

///==============================================================================================================

//Entry & exit conditions

isLong = false

isLong := nz(isLong[1], false)

isShort = false

isShort := nz(isShort[1], false)

goLong = not isLong and EntryL and not ExitL and longOK and barstate.isconfirmed

goShort = not isShort and EntryS and not ExitS and shortOK and barstate.isconfirmed

longExit = isLong and ExitL and barstate.isconfirmed

shortExit = isShort and ExitS and barstate.isconfirmed

if (goLong)

isLong := true

isShort := false

if (goShort)

isLong := false

isShort := true

if (longExit)

isLong := false

if (shortExit)

isShort := false

//------------------------------------------------------------------------------

// ——Backtester

grouptime = 'Step 5 - 📆 Time Filter 📆-------------'

startTime = input (group=grouptime, title="Start Timeㅤㅤ", defval=timestamp('UTC 01 Jan 2020 00:00'), inline="Start")

endTime = input (group=grouptime, title="End Time ㅤ ㅤ", defval=timestamp('UTC 31 Dec 2025 23:45'), inline="End")

dateRange = true

//------------------------------------------------------------------------------

// Risk Managment

grouprisk = 'Step 6 - Risk Management-------------'

takeprofit = input.bool(true,title = "TP Price %",group=grouprisk, inline="profit")

tppercent = input.float(1, '', group=grouprisk, inline="profit") / 100

q1 = input.int (5 , "Quantity %",group=grouprisk , inline="profit")

stoploss = input.bool(false,title = "SL Price %",group=grouprisk, inline="loss")

stoppercent = input.float(5, '', group=grouprisk, inline="loss") / 100

// Determine where you've entered and in what direction

longtp = strategy.position_avg_price * (1 + tppercent)

longStop = strategy.position_avg_price * (1 - stoppercent)

shorttp = strategy.position_avg_price * (1 - tppercent)

shortStop = strategy.position_avg_price * (1 + stoppercent)

QTYMethod = input.string ('EQUITY', 'Order Size', group=grouprisk, inline=' ', options=['NONE', 'EQUITY', 'SIZE', 'CONTRACTS'])

useNetProfit = input.bool (true, 'Use Net Profit', group=grouprisk, inline=' ', tooltip='Use Net Profit- On/Off the use of profit in the following trades. *Only works if the type is EQUITY')

riskPerc = input.int (30, '🇪🇶🇺🇮🇹🇾 %', group=grouprisk, inline='.', minval=1, maxval=100)

riskSize = input.int (10000, '🇸🇮🇿🇪', group=grouprisk, inline='.', minval=1)

riskCntr = input.int (1, '🇨🇴🇳🇹🇷🇦🇨🇹🇸', group=grouprisk, inline='.', minval=1, tooltip='Order Size: \nNone- Use the default position size settings in Tab "Properties". \nEquity% - per trade from the initial capital. \nSize- Fixed size amount of trade. \nContracts- The fixed amount of the deal in contracts. \n')

// —————— Order Size

eqty = switch QTYMethod

'NONE' => na

'EQUITY' => riskPerc / close

'SIZE' => riskSize / close

'CONTRACTS' => riskCntr

//-----------------------------------------------------------------------------

// —————— Trade variables

entry = strategy.position_avg_price

sizePos = strategy.position_size

inLong = sizePos > 0

inShort = sizePos < 0

inTrade = inLong or inShort

inPos = (inLong and not inShort[1]) or (inShort and not inLong[1])

var ID = 'TradeID'

var tpPrice = float(na)

var slPrice = float(na)

///==============================================================================================================

// ALERTS

groupalerts = 'Step 7 - Alerts & Bot Trading Settings-------------'

broker = input.string('Binance', "Broker", options=['Binance', 'Alpaca', 'Kucoin', '3Commas'], group=groupalerts, tooltip = 'Choose which type you are using to send the correct Json Alert message for entry and exit alerts.')

my_sym = input("FTMM/USDT", "Ticker", group = 'Cloud Function Server', tooltip = 'Only used with Alerts to fix ticker ID in json message. Some exchanges use the forward slash and some do not.')

my_pass = input('Passphrase', "Passphrase" , group = 'Cloud Function Server', tooltip = 'Only enter your Passphrase and nothing else goes here. Only needed when using a Cloud Function Server.')

i_alert_3CID_txt = input('Bot ID', "Bot ID", group =groupalerts, tooltip = 'Only enter your 3Commas Bot ID and nothing else goes here.')

i_alert_3CET_txt = input('Bot Email Token', title = 'Bot Email Token', group =groupalerts , tooltip = 'Only enter your 3Commas Bot Email Token and nothing else goes here.')

Alert='{"passphrase": "'+str.tostring(my_pass)+'","symbol": "'+ str.tostring(my_sym) +'","type":"market", "side":"{{strategy.order.action}}","amount":"{{strategy.order.contracts}}","price": "' + str.tostring(close) + '"}'

//---------------------------------------------------------------------------------

// JSON alert message used for 3Commas Bots

C3_EntryAlert ='{"message_type": "bot", "bot_id": ' + i_alert_3CID_txt + ', "email_token": "' + i_alert_3CET_txt + '", "delay_seconds": 0 }'

C3_ExitAlert ='{"action": "close_at_market_price_all", "message_type": "bot", "bot_id": ' + i_alert_3CID_txt + ', "email_token": "' + i_alert_3CET_txt + '", "delay_seconds": 0}'

//---------------------------------------------------------------------------------

// JSON alert message used for setting up a Google Cloud Function Server works when using Alpaca Exchange

Alert_Alpaca = '{"symbol": "{{ticker}}", "quantity": "{{strategy.order.contracts}}", "side": "{{strategy.order.action}}", "order_type": "market", "time_in_force": "gtc", "passphrase": "' + str.tostring(my_pass) + '"}'

entryAlert = broker == 'Binance' ? Alert : broker == 'Alpaca' ? Alert_Alpaca : broker == 'Kucoin' ? Alert : C3_EntryAlert

exitAlert = broker == 'Binance' ? Alert : broker == 'Alpaca' ? Alert_Alpaca : broker == 'Kucoin' ? Alert : C3_ExitAlert

strategy.initial_capital = 50000

// —————— Entry's

goLongEntry = goLong and dateRange and barstate.isconfirmed

goShortEntry = goShort and dateRange and barstate.isconfirmed

eqty(qty) => QTYMethod=='EQUITY' ? qty / 100 * (strategy.initial_capital + (useNetProfit ? strategy.netprofit : 0)) : QTYMethod=='SIZE' ? qty / syminfo.pointvalue : qty

if goLongEntry

ID := 'Long'

strategy.entry(ID, strategy.long, qty=eqty(eqty), comment=ID, alert_message = entryAlert)

if goShortEntry

ID := 'Short'

strategy.entry(ID, strategy.short, qty=eqty(eqty), comment=ID, alert_message = entryAlert)

// —————— Exit's

qty(perc) => math.abs(sizePos*perc/100)

if longExit

strategy.close("Long",comment='X', alert_message= exitAlert)

strategy.exit ("exit1", from_entry="Long", limit=takeprofit ? longtp : na, stop=stoploss ? longStop : na, comment_profit='TP', comment_loss='SL', qty_percent=q1)

strategy.exit ("exit2", from_entry="Long", stop=stoploss ? longStop : na, comment_loss='SL')

if shortExit

strategy.close("Short",comment='X', alert_message= exitAlert)

strategy.exit ("exit1", from_entry="Short", limit=takeprofit ? shorttp : na, stop=stoploss ? shortStop : na, comment_profit='TP', comment_loss='SL', qty_percent=q1)

strategy.exit ("exit2", from_entry="Short", stop=stoploss ? shortStop : na, comment_loss='SL')

///==============================================================================================================

//Style- Plots on Chart

posH = high + 2 * stLine

posL = low - 2 * stLine

plotshape( goLong and PlotEntries ? posL : na ,'Long Entry Signals' , text= '' , location=location.belowbar, style=shape.labelup , size=size.small , color=lbullColor , textcolor = color.white )

plotshape( longExit and PlotExits ? posH : na ,'Long Exit' , location=location.abovebar, style= shape.xcross , size=size.small, color=lbullColor )

plotshape( goShort and PlotEntries ? posH : na ,'Short Entry Signals' , text= '' , location=location.abovebar, style=shape.labeldown , size=size.small , color=lbearColor , textcolor = color.white )

plotshape( shortExit and PlotExits ? posL : na ,'Short Exit' , location=location.belowbar, style=shape.xcross , size=size.small , color=lbearColor )

///==============================================================================================================

// Alerts

alertcondition( goLong , 'Long Entry Alerts', 'Long Alerts')

alertcondition( goShort , 'Short Entry Alerts', 'Short Alerts')