스윙 하위/하위 및 촛불 패턴

저자:차오장, 날짜: 2022-05-07 21:12:40태그:상승성추락

이 스크립트는 스윙 최고와 스윙 최하위뿐만 아니라 그 정확한 지점에서 발생한 촛불 패턴을 표시합니다. 스크립트는 다음 6 개의 촛불 패턴을 감지 할 수 있습니다. 망치, 역 망치, 올림 삼키기, 매달린 사람, 별 타기 및 하락 삼키기.

표지판에 표시된 HH, HL, LH, LL는 다음과 같이 정의됩니다.

HH: 높은 높은 HL: 높은 낮은 LH: 낮고 높다 LL: 낮은 낮은

설정

길이: 낮은 값이 짧은 기간 가격 변동의 최대/최저값을 반환하는 변동 높은/낮은 감지의 민감성

사용 및 세부 사항

상단 또는 하단이 특정 촛불 패턴과 연관되어 있는지 보는 것이 흥미롭을 수 있습니다. 이것은 이러한 패턴의 역전을 나타내는 잠재력을 연구 할 수 있습니다. 특정 패턴을 가진 라벨을 누르면 자세한 내용을 볼 수 있습니다.

표지판이 오프셋되어 있으며 나중에 실시간으로 표시 될 것이라는 점에 유의하십시오. 따라서 이 지표는 실시간으로 윗부분/아랫부분을 감지하는 것이 아닙니다.

더 높은 길이 값은 오류를 반환할 수 있습니다.

백테스트

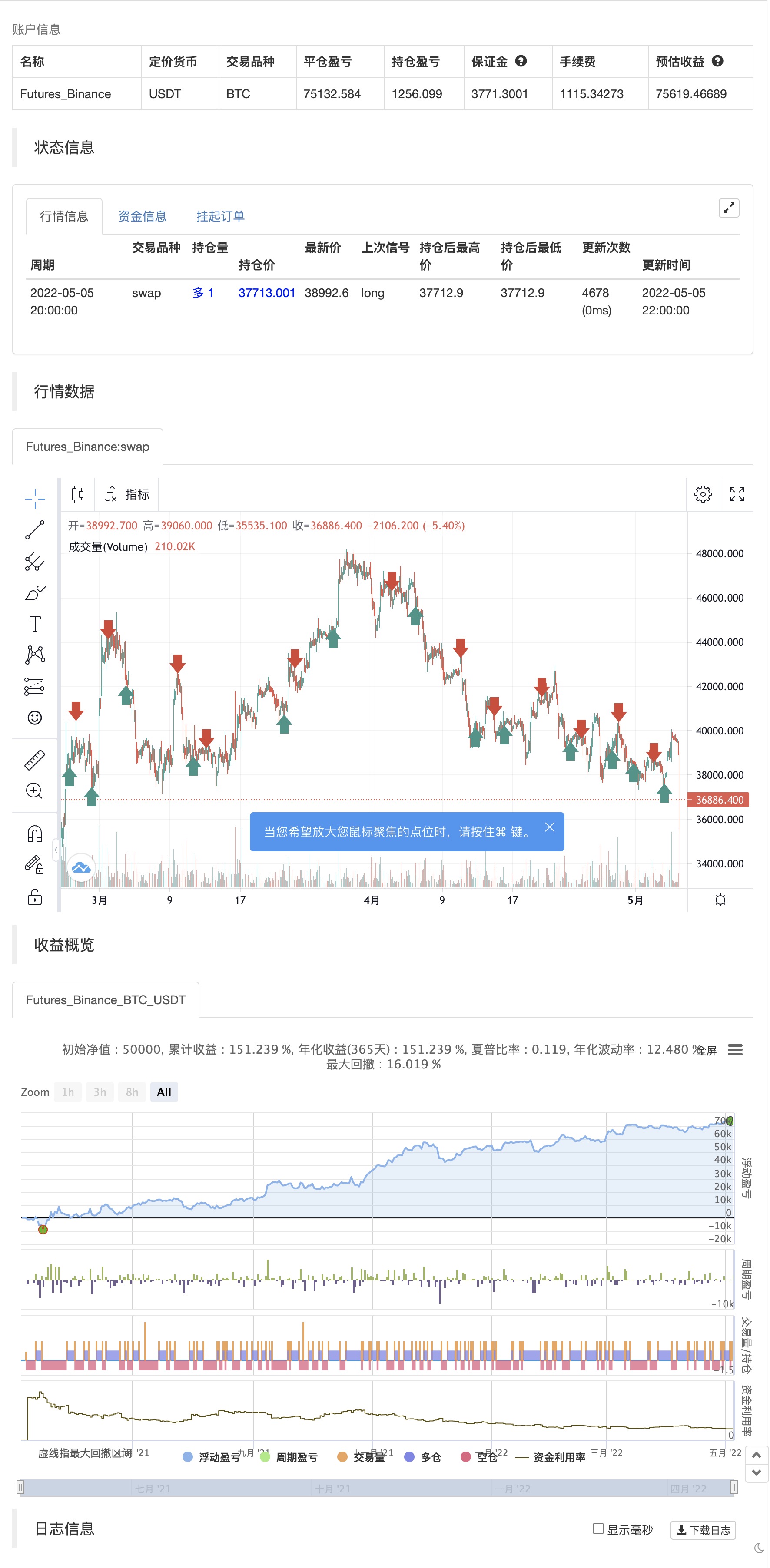

/*backtest

start: 2021-05-06 00:00:00

end: 2022-05-05 23:59:00

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This work is licensed under a Attribution-NonCommercial-ShareAlike 4.0 International (CC BY-NC-SA 4.0) https://creativecommons.org/licenses/by-nc-sa/4.0/

// © LuxAlgo

//@version=4

study("Swing Highs/Lows & Candle Patterns",overlay=true)

length = input(21)

//------------------------------------------------------------------------------

o = open[length],h = high[length]

l = low[length],c = close[length]

//------------------------------------------------------------------------------

ph = pivothigh(close,length,length)

pl = pivotlow(open,length,length)

valH = valuewhen(ph,c,0)

valL = valuewhen(pl,c,0)

valpH = valuewhen(ph,c,1)

valpL = valuewhen(pl,c,1)

//------------------------------------------------------------------------------

d = abs(c - o)

hammer = pl and min(o,c) - l > d and h - max(c,o) < d

ihammer = pl and h - max(c,o) > d and min(c,o) - l < d

bulleng = c > o and c[1] < o[1] and c > o[1] and o < c[1]

hanging = ph and min(c,o) - l > d and h - max(o,c) < d

shooting = ph and h - max(o,c) > d and min(c,o) - l < d

beareng = c > o and c[1] < o[1] and c > o[1] and o < c[1]

//------------------------------------------------------------------------------

//Descriptions

//------------------------------------------------------------------------------

hammer_ = "The hammer candlestick pattern is formed of a short body with a long lower wick, and is found at the bottom of a downward trend."

+ "\n" + "\n A hammer shows that although there were selling pressures during the day, ultimately a strong buying pressure drove the price back up."

ihammer_ = "The inverted hammer is a similar pattern than the hammer pattern. The only difference being that the upper wick is long, while the lower wick is short."

+ "\n" + "\n It indicates a buying pressure, followed by a selling pressure that was not strong enough to drive the market price down. The inverse hammer suggests that buyers will soon have control of the market."

bulleng_ = "The bullish engulfing pattern is formed of two candlesticks. The first candle is a short red body that is completely engulfed by a larger green candle"

+ "\n" + "\n Though the second day opens lower than the first, the bullish market pushes the price up, culminating in an obvious win for buyers"

hanging_ = "The hanging man is the bearish equivalent of a hammer; it has the same shape but forms at the end of an uptrend."

+ "\n" + "It indicates that there was a significant sell-off during the day, but that buyers were able to push the price up again. The large sell-off is often seen as an indication that the bulls are losing control of the market."

shotting_ = "The shooting star is the same shape as the inverted hammer, but is formed in an uptrend: it has a small lower body, and a long upper wick."

+ "\n" + "Usually, the market will gap slightly higher on opening and rally to an intra-day high before closing at a price just above the open – like a star falling to the ground."

beareng_ = "A bearish engulfing pattern occurs at the end of an uptrend. The first candle has a small green body that is engulfed by a subsequent long red candle."

+ "\n" + "It signifies a peak or slowdown of price movement, and is a sign of an impending market downturn. The lower the second candle goes, the more significant the trend is likely to be."

//------------------------------------------------------------------------------

n = bar_index

label lbl = na

H = valH > valpH ? "HH" : valH < valpH ? "LH" : na

L = valL < valpL ? "LL" : valL > valpL ? "HL" : na

txt = hammer ? "Hammer" : ihammer ? "Inverse Hammer" :

bulleng ? "Bullish Engulfing" : hanging ? "Hanging Man" :

shooting ? "Shooting Star" : beareng ? "Bearish Engulfing" : "None"

des = hammer ? hammer_ : ihammer ? ihammer_ :

bulleng ? bulleng_ : hanging ? hanging_ :

shooting ? shotting_ : beareng ? beareng_ : ""

//------------------------------------------------------------------------------

if ph

strategy.entry("Enter Long", strategy.long)

else if pl

strategy.entry("Enter Short", strategy.short)

관련

- 깨진 프랙탈: 누군가의 깨진 꿈은 당신의 이익입니다!

- ZigZag PA 전략 V4.1

- 디마크 설정 표시기

을 삼키는 것 - 지원-저항 파업

- MTF RSI & STOCH 전략

- jma + dwma 다 곡물

- 이동 평균 색상 EMA/SMA

- 다중 시간 프레임 거래

- zdmre의 RSI

더 많은