개요

이 거래 전략은 다중 이동 평균과 동력 지표가 결합된 방식으로 트렌드의 방향과 강도를 식별하고, 트렌드 초기 단계에서 포지션을 구축하고, 이동 스톱, 이동 스톱 등의 방법을 사용하여 수익 최적화 및 위험 통제를 수행합니다. 목표는 중장선 트렌드에서 큰 가격 움직임을 포착하는 것입니다.

전략 원칙

두 개의 다른 파라미터 설정을 사용하여 이동 평균 조합을 사용하여 빠른 라인 및 느린 라인을 구성합니다:

- 빠른 선은 5주기 지수 이동 평균과 25주기 중화 이동 평균으로 구성되어 단기 경향을 나타냅니다.

- 느린 선은 28주기 지수 이동 평균과 72주기 중화 이동 평균으로 구성되어 중·장기 추세를 나타냅니다.

빠른 선이 느린 선을 통과하면, 단기 트렌드가 중장기 트렌드보다 강해지기 시작한다는 것을 나타냅니다.

동력 지표 RSI와 결합하여, 가짜 돌파구를 필터링하기 위해 RSI 낮은 (구매 신호) 또는 RSI 높은 (판매 신호) 에서만 진입하십시오.

일단 입점한 후, 이동식 스톱로스를 사용하여 손실을 압축하고, 이동식 스톱로스를 사용하여 수익을 잠금합니다.

빠른 선이 느린 선을 통과하면, 트렌드가 역전되는 것을 알려줍니다. 이 때 스톱포드 또는 스톱이 탈퇴합니다.

우위 분석

- 이중 이동 평균은 음 필터링을 결합하여 트렌드 중반의 동작 방향과 강도를 식별합니다.

- 트렌드 초기에만 포지션을 설정하여 가짜 브레이크로 불필요한 손실을 피하십시오.

- 동력 지표는 필터링 엔트리를 결합하여 엔트리의 품질을 향상시킵니다.

- 이동 상쇄는 단편적 손실을 압축하고, 개별적 손실로 인한 손실을 줄인다.

- 이동식 제약은 수익을 높여주고, 상황이 좋아지면 추가로 수익을 올립니다.

위험 분석

- 이중 이동 평균은 트렌드 전환점에 지연되어 역전 기회를 놓칠 수 있다.

- 이동 평균 주기를 적절히 줄여서 더 민감하게 만들 수 있다.

- 허위 침입으로 인해 불필요한 입장이 발생했다.

- 더 많은 필터링 표시를 추가할 수 있습니다.

- 정지 또는 정지 거리는 최적화되지 않았으며, 너무 느슨하거나 너무 단단할 수 있다.

- 최적화 파라미터를 재검토하여 최적의 스톱 스톱 거리를 찾을 수 있다.

- 동향적인 전략, 동향적인 시장에만 적합하다.

- 이 전략의 사용 여부는 대박 상황에 따라 선택할 수 있습니다.

최적화 방향

- 이동 평균 변수를 최적화하여 트렌드의 표현에 대한 최적의 변수 조합을 찾습니다.

- 트렌드 필터 지표, 예를 들어 ATR 동적 정지, 에너지 유조 지표 등이 추가된다.

- 스톱패드 파라미터를 최적화하여 최적의 파라미터 조합을 찾습니다.

- 이 전략에 대해 더 많은 판단을 할 수 있고, 이 전략을 사용할지 여부를 선택할 수 있습니다.

- 다중 시기의 종합적인 판단을 증가시키고, 더 큰 수준의 트렌드 방향을 사용하여 단기 시기의 전략 방향을 안내한다.

요약하다

이 전략은 이동 평균과 동력 지표를 통합하고, 트렌드 s를 식별하는 것을 목표로 하며, 신속한 중지 및 중단으로 위험과 수익을 관리합니다. 더 넓은 시장 상황에 적응하기 위해 변수 및 규칙의 최적화가 여전히 필요하지만, 중장선 트렌드를 포착하는 기본 프레임 워크와 방향이 있습니다. 지속적인 최적화를 통해 이 전략은 안정적이고 효율적인 트렌드 추적 전략으로 성장할 것입니다.

전략 소스 코드

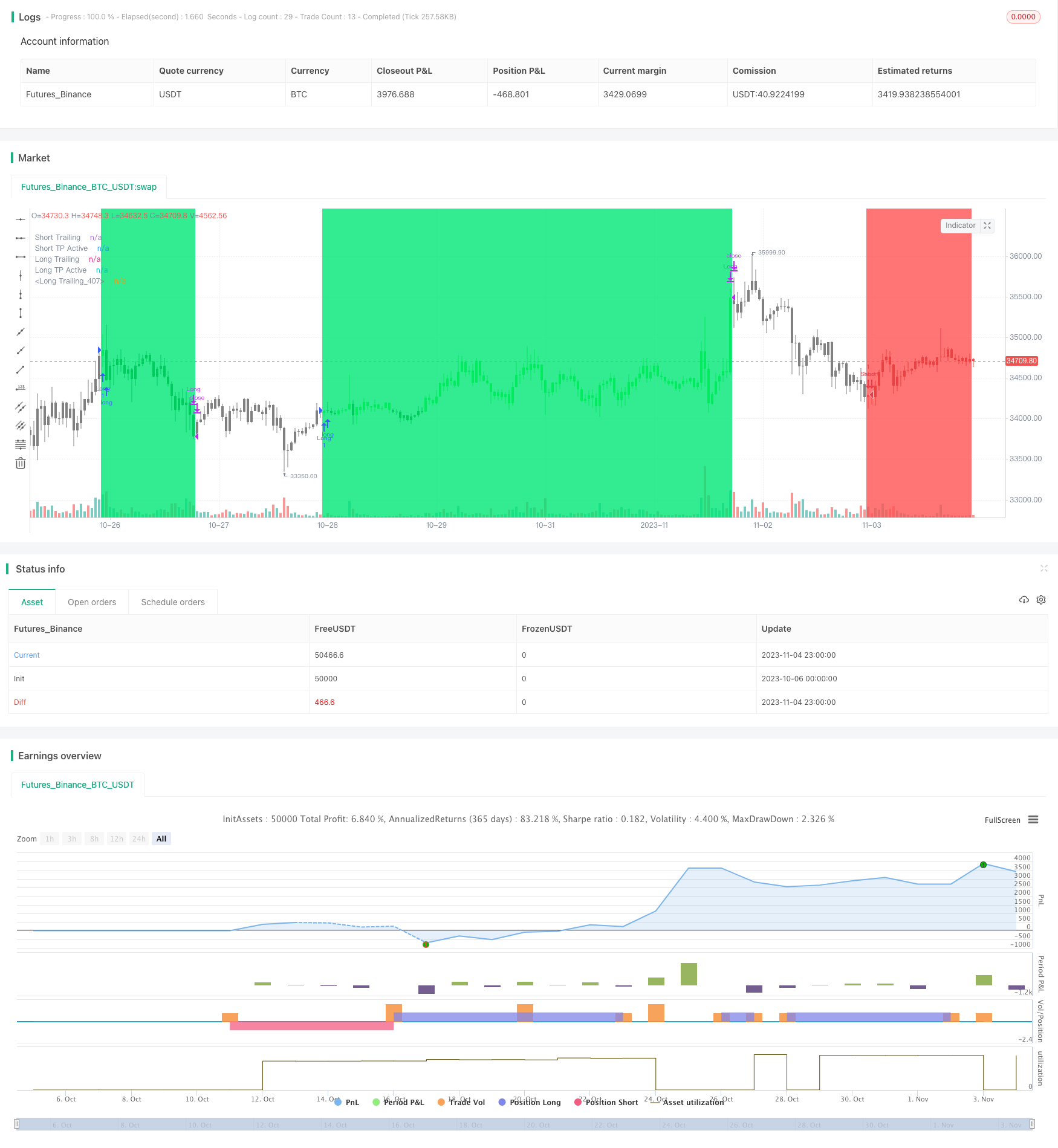

/*backtest

start: 2023-10-06 00:00:00

end: 2023-11-05 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

strategy(title="[WAI GUA]", shorttitle="[EOS] 1.0", overlay=true)

//study(title="[WAI GUA]", shorttitle="[EOS] 1.0", overlay=true)

//

// Use Alternate Anchor TF for MAs

uRenko = input(true, title="IS This a RENKO Chart")

//

anchor = input(0,minval=0,maxval=1440,title="Alternate TimeFrame Multiplier (0=none)")

//

src = close //input(close, title="EMA Source")

showRibbons = input(false,title="Show Coloured MA Ribbons")

showAvgs = input(false,title="Show Ribbon Median MA Lines")

//

// Fast Ribbon MAs

// Lower MA - type, length

typeF1 = input(defval="EMA", title="FAST MA Ribbon Type: ", options=["SMA", "EMA", "WMA", "VWMA", "SMMA", "DEMA", "TEMA", "LAGMA", "HullMA", "ZEMA", "TMA", "SSMA"])

lenF1 = input(defval=5, title="FAST Ribbon Lower MA Length", minval=1)

gammaF1 = 0.33 //input(defval=0.33,title="Fast MA - Gamma for LAGMA")

// Upper MA - type, length

typeF11 = typeF1 //input(defval="WMA", title="FAST Ribbon Upper MA Type: ", options=["SMA", "EMA", "WMA", "VWMA", "SMMA", "DEMA", "TEMA", "LAGMA", "HullMA", "ZEMA", "TMA", "SSMA"])

lenF11 = input(defval=25, title="FAST Ribbon Upper Length", minval=2)

gammaF11 = 0.77 //input(defval=0.77,title="Slow MA - Gamma for LAGMA")

// Slow Ribbon MAs

// Lower MA - type, length

typeS1 = input(defval="EMA", title="SLOW MA Ribbon Type: ", options=["SMA", "EMA", "WMA", "VWMA", "SMMA", "DEMA", "TEMA", "LAGMA", "HullMA", "ZEMA", "TMA", "SSMA"])

lenS1 = input(defval=28, title="SLOW Ribbon Lower MA Length", minval=1)

gammaS1 = 0.33 //input(defval=0.33,title="Fast MA - Gamma for LAGMA")

// Upper MA - type, length

typeS16 = typeS1 //input(defval="WMA", title="SLOW Ribbon Upper MA Type: ", options=["SMA", "EMA", "WMA", "VWMA", "SMMA", "DEMA", "TEMA", "LAGMA", "HullMA", "ZEMA", "TMA", "SSMA"])

lenS16 = input(defval=72, title="SLOW Ribbon Upper Length", minval=2)

gammaS16 = 0.77 //input(defval=0.77,title="Slow MA - Gamma for LAGMA")

// - Constants

gold = #FFD700

// - FUNCTIONS

// - variant(type, src, len, gamma)

// 返回MA输入选择变量,默认为SMA,如果空白或键入。

// SuperSmoother filter

variant_supersmoother(src,len) =>

a1 = exp(-1.414*3.14159 / len)

b1 = 2*a1*cos(1.414*3.14159 / len)

c2 = b1

c3 = (-a1)*a1

c1 = 1 - c2 - c3

v9 = 0.0

v9 := c1*(src + nz(src[1])) / 2 + c2*nz(v9[1]) + c3*nz(v9[2])

v9

variant_smoothed(src,len) =>

v5 = 0.0

v5 := na(v5[1]) ? sma(src, len) : (v5[1] * (len - 1) + src) / len

v5

variant_zerolagema(src,len) =>

ema1 = ema(src, len)

ema2 = ema(ema1, len)

v10 = ema1+(ema1-ema2)

v10

variant_doubleema(src,len) =>

v2 = ema(src, len)

v6 = 2 * v2 - ema(v2, len)

v6

variant_tripleema(src,len) =>

v2 = ema(src, len)

v7 = 3 * (v2 - ema(v2, len)) + ema(ema(v2, len), len) // Triple Exponential

v7

//calc Laguerre

variant_lag(p,g) =>

L0 = 0.0

L1 = 0.0

L2 = 0.0

L3 = 0.0

L0 := (1 - g)*p+g*nz(L0[1])

L1 := -g*L0+nz(L0[1])+g*nz(L1[1])

L2 := -g*L1+nz(L1[1])+g*nz(L2[1])

L3 := -g*L2+nz(L2[1])+g*nz(L3[1])

f = (L0 + 2*L1 + 2*L2 + L3)/6

f

// return variant, defaults to SMA

variant(type, src, len, g) =>

type=="EMA" ? ema(src,len) :

type=="WMA" ? wma(src,len):

type=="VWMA" ? vwma(src,len) :

type=="SMMA" ? variant_smoothed(src,len) :

type=="DEMA" ? variant_doubleema(src,len):

type=="TEMA" ? variant_tripleema(src,len):

type=="LAGMA" ? variant_lag(src,g) :

type=="HullMA"? wma(2 * wma(src, len / 2) - wma(src, len), round(sqrt(len))) :

type=="SSMA" ? variant_supersmoother(src,len) :

type=="ZEMA" ? variant_zerolagema(src,len) :

type=="TMA" ? sma(sma(src,len),len) :

sma(src,len)

// - /variant

// If have anchor specified, calculate the base multiplier.

//mult = isintraday ? anchor==0 or interval<=0 or interval>=anchor or anchor>1440? 1 : round(anchor/interval) : 1

//mult := isdwm? 1 : mult // Only available Daily or less

mult = anchor>0 ? anchor : 1

//

high_ = uRenko? max(close,open) : high

low_ = uRenko? min(close,open) : low

//用锚乘器调整MA长度

//Fast MA Ribbon

emaF1 = variant(typeF1, src, lenF1*mult, gammaF1)

emaF11 = variant(typeF11, src, lenF11*mult,gammaF11)

emafast = (emaF1+emaF11)/2 // Average of Upper and Lower MAs

//

//Slow MA Ribbon

emaS1 = variant(typeS1,src, lenS1*mult,gammaS1)

emaS16 = variant(typeS16, src, lenS16*mult, gammaS16)

emaslow = (emaS1+emaS16)/2 // Average of Upper and Lower MAs

//

// Count crossover candles

xup = 0

xdn = 0

fup = 0

fdn = 0

sup = 0

sdn = 0

//

xup := (emafast-emaslow)>0 and (emafast-emaslow)>(emafast[1]-emaslow[1]) ? nz(xup[1])+1 : 0

xdn := (emafast-emaslow)<0 and (emafast-emaslow)<(emafast[1]-emaslow[1]) ? nz(xdn[1])+1 : 0

fup := (emaF1-emaF11)>0 and (emaF1-emaF11)>(emaF1[1]-emaF11[1]) ? nz(fup[1])+1 : 0

fdn := (emaF1-emaF11)<0 and (emaF1-emaF11)<(emaF1[1]-emaF11[1]) ? nz(fdn[1])+1 : 0

sup := (emaS1-emaS16)>0 and (emaS1-emaS16)>(emaS1[1]-emaS16[1]) ? nz(sup[1])+1 : 0

sdn := (emaS1-emaS16)<0 and (emaS1-emaS16)<(emaS1[1]-emaS16[1]) ? nz(sdn[1])+1 : 0

//Fast EMA Final Color Rules

colFinal = fup>=2 ? aqua : fdn>=2 ? blue : gray

//Slow EMA Final Color Rules

colFinal2 = sup>=2 ? lime : sdn>=2 ? red : gray

//Fast EMA Plots

p1=plot(showRibbons?emaF1:na, title="Fast Ribbon Lower MA", style=line, linewidth=1, color=colFinal,transp=10)

p2=plot(showRibbons?emaF11:na, title="Fast Ribbon Upper MA", style=line, linewidth=1, color=colFinal,transp=10)

plot(showAvgs?emafast:na, title="Fast Ribbon Avg MA", style=circles,join=true, linewidth=1, color=gold,transp=10)

//

//fill(p1,p2,color=colFinal, transp=90)

//Slow EMA Plots

p3=plot(showRibbons?emaS1:na, title="Slow Ribbon Lower MA", style=line, linewidth=1, color=colFinal2,transp=10)

p4=plot(showRibbons?emaS16:na, title="Slow Ribbon Upper MA", style=line, linewidth=1, color=colFinal2,transp=10)

plot(showAvgs?emaslow:na, title="Slow Ribbon Avg MA", style=circles,join=true, linewidth=1, color=fuchsia,transp=10)

//

//fill(p3,p4, color=colFinal2, transp=90)

// Generate Buy Sell signals,

buy = 0

sell=0

//

buy := xup>=2 and sup>=2 and fup>=2 ? nz(buy[1])>0?buy[1]+1 :1 : 0

sell := xdn>=2 and sdn>=2 and fdn>=2 ? nz(sell[1])>0?sell[1]+1 :1 : 0

////////////////////////

//* 反测试周期选择器 *//

////////////////////////

testStartYear = input(2018, "Backtest Start Year",minval=1980)

testStartMonth = input(1, "Backtest Start Month",minval=1,maxval=12)

testStartDay = input(1, "Backtest Start Day",minval=1,maxval=31)

testPeriodStart = timestamp(testStartYear,testStartMonth,testStartDay,0,0)

testStopYear = 9999 //input(9999, "Backtest Stop Year",minval=1980)

testStopMonth = 12 // input(12, "Backtest Stop Month",minval=1,maxval=12)

testStopDay = 31 //input(31, "Backtest Stop Day",minval=1,maxval=31)

testPeriodStop = timestamp(testStopYear,testStopMonth,testStopDay,0,0)

testPeriod() => time >= testPeriodStart and time <= testPeriodStop ? true : false

///////////////

//* RSI策略 *//

///////////////

//指示器 1

lowerpc = lowest(low, 21)

upperpc = highest(high, 21)

midpc = avg(upperpc, lowerpc)

//指示器 2

ma = sma(close, 50)

petd = ema(close,13)

rangema = ema(tr, 50)

upperkc = ma + rangema * 0.25

lowerkc = ma - rangema * 0.25

//指示器 3

up = rma(max(change(close), 0), 5)

down = rma(-min(change(close), 0), 5)

rsi = down == 0 ? 100 : up == 0 ? 0 : 100 - (100 / (1 + up / down))

// PET-D

petdcolor = close > petd ? green : red

barcolor (petdcolor)

//Slope

SlopeL = midpc > midpc[5]

SlopeS = midpc < midpc[5]

//条件

CL = SlopeL == 1 and close > lowerkc and close < midpc and rsi < 35

CS = SlopeS == 1 and close < upperkc and close > midpc and rsi > 65

//Setup

RsiSL = CL == 1 and CL[1] != 1

RsiSS = CS == 1 and CS[1] != 1

/////////////////////

//* RSA抛物线指标 *//

/////////////////////

start = input(0.02)

increment = input(0.02)

maximum = input(0.2)

psar = sar(start, increment, maximum)

RSALE = false

RSASE = false

if (psar > high)

RSALE = true

else

RSALE = false

if (psar < low)

RSASE = true

else

RSASE = false

////////////////

//* 策略组件 *//

////////////////

AQUA = #00FFFFFF

BLUE = #0000FFFF

RED = #FF0000FF

LIME = #00FF00FF

GRAY = #808080FF

DARKRED = #8B0000FF

DARKGREEN = #006400FF

//

fastExit = input(false,title="Use Opposite Trade as a Close Signal")

clrBars = input(true,title="Colour Candles to Trade Order state")

orderType = input("Longs+Shorts",title="What type of Orders", options=["Longs+Shorts","LongsOnly","ShortsOnly","Flip"])

//

isLong = (orderType != "ShortsOnly")

isShort = (orderType != "LongsOnly")

//////////////////////////

//* 贸易状态引擎 *//

//////////////////////////

// 追踪当前贸易状态

longClose = false, longClose := nz(longClose[1],false)

shortClose = false, shortClose := nz(shortClose[1],false)

tradeState = 0, tradeState := nz(tradeState[1])

tradeState := tradeState==0 ? buy==1 and (barstate.isconfirmed or barstate.ishistory) and isLong and not longClose and not shortClose? 1 :

sell==1 and (barstate.isconfirmed or barstate.ishistory) and isShort and not longClose and not shortClose? -1 :

tradeState : tradeState

////////////////////////////////////

//* 在这里设置入口和特殊出口条件 *//

////////////////////////////////////

//进入状态,当状态改变方向时。

longCondition = false

shortCondition = false

//longCondition := longCondition != true ? change(tradeState) and tradeState==1 : true

//shortCondition := shortCondition != true ? change(tradeState) and tradeState==-1 : true

longCondition := change(tradeState) and tradeState==1

shortCondition := change(tradeState) and tradeState==-1

if orderType=="Flip"

temp = longCondition

longCondition := shortCondition

shortCondition := temp

//end if

// 卖出信号退出

longExitC = (emafast[1]<emaslow[1] and open<emaslow[1]) ? 1 : 0

shortExitC = (emafast[1]>emaslow[1] and open>emaslow[1]) ? 1 : 0

// change退出条件。

longExit = change(longExitC) and longExitC==1 and tradeState==1

shortExit = change(shortExitC) and shortExitC==1 and tradeState==-1

// -- debugs

//plotchar(tradeState,"tradeState at Event",location=location.bottom, color=#FF0000FF)

//plotchar(longCondition, title="longCondition",color=#FF0000FF)

//plotchar(shortCondition, title="shortCondition",color=#FF0000FF)

//plotchar(tradeState, title="tradeState",color=#006400FF)

// -- /debugs

////////////////////////////////

//======[ 交易入门价格 ]======//

////////////////////////////////

last_open_longCondition = na

last_open_shortCondition = na

last_open_longCondition := longCondition ? close : nz(last_open_longCondition[1])

last_open_shortCondition := shortCondition ? close : nz(last_open_shortCondition[1])

////////////////////////////

//======[ 位置状态 ]======//

////////////////////////////

in_longCondition = tradeState == 1

in_shortCondition = tradeState == -1

////////////////////////

//======[ 尾停 ]======//

////////////////////////

isTS = input(true, "Trailing Stop")

ts = input(3.0, "Trailing Stop (%)", minval=0,step=0.1, type=float) /100

last_high = na

last_low = na

last_high_short = na

last_low_long = na

last_high := not in_longCondition ? na : in_longCondition and (na(last_high[1]) or high_ > nz(last_high[1])) ? high_ : nz(last_high[1])

last_high_short := not in_shortCondition ? na : in_shortCondition and (na(last_high[1]) or high_ > nz(last_high[1])) ? high_ : nz(last_high[1])

last_low := not in_shortCondition ? na : in_shortCondition and (na(last_low[1]) or low_ < nz(last_low[1])) ? low_ : nz(last_low[1])

last_low_long := not in_longCondition ? na : in_longCondition and (na(last_low[1]) or low_ < nz(last_low[1])) ? low_ : nz(last_low[1])

long_ts = isTS and in_longCondition and not na(last_high) and (low_ <= last_high - last_high * ts) //and (last_high >= last_open_longCondition + last_open_longCondition * tsi)

short_ts = isTS and in_shortCondition and not na(last_low) and (high_ >= last_low + last_low * ts) //and (last_low <= last_open_shortCondition - last_open_shortCondition * tsi)

////////////////////////

//======[ 获利 ]======//

////////////////////////

isTP = input(true, "Take Profit")

tp = input(3.0, "Take Profit (%)",minval=0,step=0.1,type=float) / 100

ttp = input(1.0, "Trailing Profit (%)",minval=0,step=0.1,type=float) / 100

ttp := ttp>tp ? tp : ttp

long_tp = isTP and in_longCondition and (last_high >= last_open_longCondition + last_open_longCondition * tp) and (low_ <= last_high - last_high * ttp)

short_tp = isTP and in_shortCondition and (last_low <= last_open_shortCondition - last_open_shortCondition * tp) and (high_ >= last_low + last_low * ttp)

////////////////////////////

//======[ 停止损耗 ]======//

////////////////////////////

isSL = input(false, "Stop Loss")

sl = input(3.0, "Stop Loss (%)", minval=0,step=0.1, type=float) / 100

long_sl = isSL and in_longCondition and (low_ <= last_open_longCondition - last_open_longCondition * sl)

short_sl = isSL and in_shortCondition and (high_ >= last_open_shortCondition + last_open_shortCondition * sl)

////////////////////////

//======[ 对峙 ]======//

////////////////////////

//注:短出口信号不重漆,无需用力,如果锥体继续进行。

long_sos = (fastExit or (not isTS and not isSL)) and longExit and in_longCondition

short_sos = (fastExit or (not isTS and not isSL)) and shortExit and in_shortCondition

////////////////////////////

//======[ 关闭信号 ]======//

////////////////////////////

// 为所有不同的关闭条件创建一个单独的关闭,这里的所有条件都不重漆。

longClose := isLong and (long_tp or long_sl or long_ts or long_sos) and not longCondition

shortClose := isShort and (short_tp or short_sl or short_ts or short_sos) and not shortCondition

////////////////////////////

//======[ 情节色彩 ]======//

////////////////////////////

longCloseCol = na

shortCloseCol = na

longCloseCol := long_tp ? green : long_sl ? maroon : long_ts ? purple : long_sos ? orange :longCloseCol[1]

shortCloseCol := short_tp ? green : short_sl ? maroon : short_ts ? purple : short_sos ? orange : shortCloseCol[1]

//

tpColor = isTP and in_longCondition ? lime : isTP and in_shortCondition ? lime : na

slColor = isSL and in_longCondition ? red : isSL and in_shortCondition ? red : na

//////////////////////////////////

//======[ 策略图 ]======//

//////////////////////////////////

plot(isTS and in_longCondition?

last_high - last_high * ts : na, "Long Trailing", fuchsia, style=2, linewidth=2,offset=1)

plot(isTP and in_longCondition and last_high < last_open_longCondition + last_open_longCondition * tp ?

last_open_longCondition + last_open_longCondition * tp : na, "Long TP Active", tpColor, style=3,join=false, linewidth=2,offset=1)

plot(isTP and in_longCondition and last_high >= last_open_longCondition + last_open_longCondition * tp ?

last_high - last_high * ttp : na, "Long Trailing", black, style=2, linewidth=2,offset=1)

plot(isSL and in_longCondition and last_low_long > last_open_longCondition - last_open_longCondition * sl ?

last_open_longCondition - last_open_longCondition * sl : na, "Long SL", slColor, style=3,join=false, linewidth=2,offset=1)

plot(isTS and in_shortCondition?

last_low + last_low * ts : na, "Short Trailing", fuchsia, style=2, linewidth=2,offset=1)

plot(isTP and in_shortCondition and last_low > last_open_shortCondition - last_open_shortCondition * tp ?

last_open_shortCondition - last_open_shortCondition * tp : na, "Short TP Active", tpColor, style=3,join=false, linewidth=2,offset=1)

plot(isTP and in_shortCondition and last_low <= last_open_shortCondition - last_open_shortCondition * tp ?

last_low + last_low * ttp : na, "Short Trailing", black, style=2, linewidth=2,offset=1)

plot(isSL and in_shortCondition and last_high_short < last_open_shortCondition + last_open_shortCondition * sl ?

last_open_shortCondition + last_open_shortCondition * sl : na, "Short SL", slColor, style=3,join=false, linewidth=2,offset=1)

bclr = not clrBars ? na : tradeState==0 ? GRAY :

in_longCondition ? close<last_open_longCondition? DARKGREEN : LIME :

in_shortCondition ? close>last_open_shortCondition? DARKRED : RED : GRAY

barcolor(bclr,title="Trade State Bar Colouring")

//////////////////////////////////

//======[ 战略进入与退出 ]======//

//////////////////////////////////

if testPeriod() and isLong

strategy.entry("Long", 1, when=longCondition)

strategy.close("Long", when=longClose )

if testPeriod() and isShort

strategy.entry("Short", 0, when=shortCondition)

strategy.close("Short", when=shortClose )

// --- Debugs

//plotchar(longExit,title="longExit",location=location.bottom,color=na)

//plotchar(longCondition,title="longCondition",location=location.bottom,color=na)

//plotchar(in_longCondition,title="in_longCondition",location=location.bottom,color=na)

//plotchar(longClose,title="longClose",location=location.bottom,color=na,color=na)

//plotchar(buy,title="buy",location=location.bottom,color=na)

// --- /Debugs

//开单时改变背景

bgcolor( in_longCondition ? lime : na, transp=90)

bgcolor( in_shortCondition ? red : na, transp=90)

////////////////////////////

//======[ 重置变量 ]======//

////////////////////////////

if longClose or not in_longCondition

last_high := na

last_high_short := na

if shortClose or not in_shortCondition

last_low := na

last_low_long := na

if longClose or shortClose

tradeState := 0

in_longCondition := false

in_shortCondition := false

//plotchar(tradeState,"tradeState at EOF",location=location.bottom, color=na)

// EOF