Estratégia de negociação de volume liderada por MA múltipla

Visão geral

Esta estratégia de negociação utiliza uma combinação de múltiplos movimentos médios e indicadores de movimento para identificar a direção e a intensidade da tendência, para estabelecer posições no início da tendência e, em seguida, para otimizar os lucros e controlar o risco usando paradas móveis e paradas móveis, com o objetivo de capturar grandes movimentos de preços em tendências de linha média e longa.

Princípio da estratégia

A combinação de médias móveis é construída usando dois conjuntos diferentes de configurações de parâmetros:

- A linha rápida é composta por uma média móvel de 5 períodos e uma média móvel ponderada de 25 períodos, representando tendências de curto prazo

- A linha lenta é composta por uma média móvel de 28 ciclos e uma média móvel ponderada de 72 ciclos, representando tendências de médio e longo prazo

Quando a linha rápida atravessa a linha lenta, indica que a tendência de curto prazo começa a ser mais forte do que a tendência de médio e longo prazo, como sinal de entrada.

Combinado com o indicador de momentum RSI, só entra em jogo quando o RSI está baixo (sinal de compra) ou o RSI está alto (sinal de venda), para filtrar brechas falsas.

Após a entrada, o stop loss móvel é usado para comprimir os prejuízos, e o stop loss móvel é usado para bloquear os lucros.

Quando a linha rápida atravessa a linha lenta, indica a reversão da tendência, na qual o stop loss ou o stop stop exit.

Análise de vantagens

- As médias móveis duplas combinam filtros de ruído para identificar a direção e a intensidade do segmento médio da tendência.

- Estabeleça posições apenas no início da tendência, evitando perdas desnecessárias com falsas rupturas.

- O índice de força, combinado com o filtro de entradas, aumenta a qualidade das entradas.

- O Stop Loss móvel comprime perdas individuais e reduz os prejuízos causados por perdas individuais.

- O que é que a empresa está a fazer para que o seu negócio seja mais lucrativo?

Análise de Riscos

- As médias móveis duplas são atrasadas nos pontos de mudança de tendência e podem perder a oportunidade de reverter.

- O ciclo da média móvel pode ser apropriadamente reduzido para torná-la mais sensível.

- Falso arrombamento de entrada desnecessária.

- Mais indicadores podem ser adicionados.

- A distância entre o travão e o travão não é otimizada, podendo ser muito flexível ou muito compacta.

- A melhor distância de parada de perda pode ser encontrada por meio de parâmetros de otimização de retrospectiva.

- A estratégia é direcionada, apenas para mercados de tendência.

- A estratégia pode ser escolhida de acordo com a situação do jogo.

Direção de otimização

- Optimizar os parâmetros da média móvel para encontrar a melhor combinação de parâmetros para representações de tendências.

- Aumentar os indicadores de filtragem de tendências, como o ATR Dynamic Stop Loss, o Energy Tide Indicator, etc.

- Optimizar os parâmetros de stop loss para encontrar a melhor combinação de parâmetros.

- Aumentar o julgamento sobre o cenário geral e escolher se a estratégia deve ser ativada.

- Aumentar a compreensão de vários períodos de tempo, usando um maior nível de direção de tendências para orientar a direção da estratégia de curto prazo.

Resumir

Esta estratégia integra as médias móveis e os indicadores de dinâmica, com o objetivo de identificar entradas precoces durante as tendências emergentes e gerenciar o risco e os lucros com paradas e paradas em tempo hábil. Embora os parâmetros e as regras ainda precisem ser otimizados para se adaptar às condições mais amplas do mercado, a estratégia possui o quadro e a direção básicos para capturar as tendências de média e longa distância.

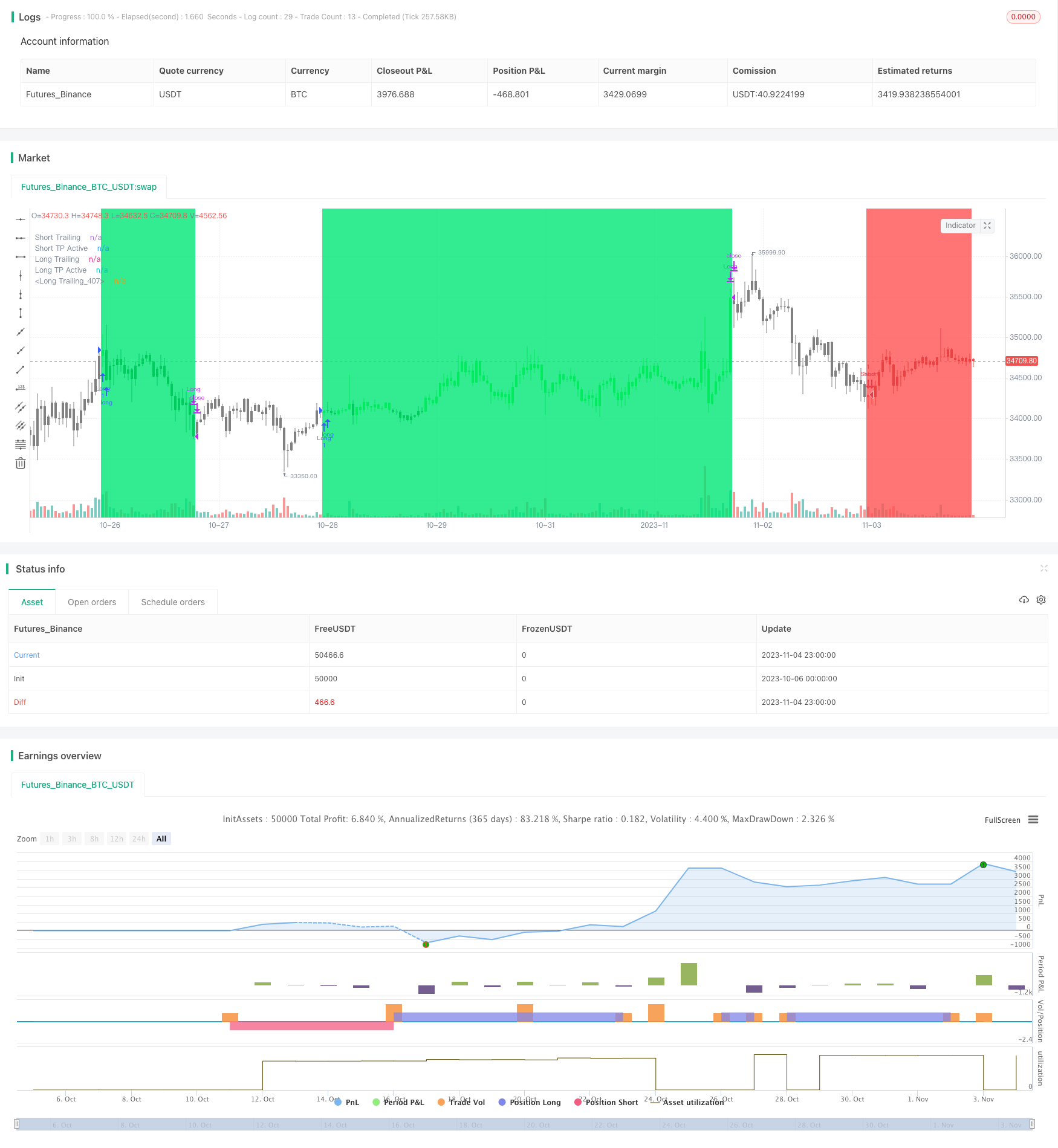

/*backtest

start: 2023-10-06 00:00:00

end: 2023-11-05 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

strategy(title="[WAI GUA]", shorttitle="[EOS] 1.0", overlay=true)

//study(title="[WAI GUA]", shorttitle="[EOS] 1.0", overlay=true)

//

// Use Alternate Anchor TF for MAs

uRenko = input(true, title="IS This a RENKO Chart")

//

anchor = input(0,minval=0,maxval=1440,title="Alternate TimeFrame Multiplier (0=none)")

//

src = close //input(close, title="EMA Source")

showRibbons = input(false,title="Show Coloured MA Ribbons")

showAvgs = input(false,title="Show Ribbon Median MA Lines")

//

// Fast Ribbon MAs

// Lower MA - type, length

typeF1 = input(defval="EMA", title="FAST MA Ribbon Type: ", options=["SMA", "EMA", "WMA", "VWMA", "SMMA", "DEMA", "TEMA", "LAGMA", "HullMA", "ZEMA", "TMA", "SSMA"])

lenF1 = input(defval=5, title="FAST Ribbon Lower MA Length", minval=1)

gammaF1 = 0.33 //input(defval=0.33,title="Fast MA - Gamma for LAGMA")

// Upper MA - type, length

typeF11 = typeF1 //input(defval="WMA", title="FAST Ribbon Upper MA Type: ", options=["SMA", "EMA", "WMA", "VWMA", "SMMA", "DEMA", "TEMA", "LAGMA", "HullMA", "ZEMA", "TMA", "SSMA"])

lenF11 = input(defval=25, title="FAST Ribbon Upper Length", minval=2)

gammaF11 = 0.77 //input(defval=0.77,title="Slow MA - Gamma for LAGMA")

// Slow Ribbon MAs

// Lower MA - type, length

typeS1 = input(defval="EMA", title="SLOW MA Ribbon Type: ", options=["SMA", "EMA", "WMA", "VWMA", "SMMA", "DEMA", "TEMA", "LAGMA", "HullMA", "ZEMA", "TMA", "SSMA"])

lenS1 = input(defval=28, title="SLOW Ribbon Lower MA Length", minval=1)

gammaS1 = 0.33 //input(defval=0.33,title="Fast MA - Gamma for LAGMA")

// Upper MA - type, length

typeS16 = typeS1 //input(defval="WMA", title="SLOW Ribbon Upper MA Type: ", options=["SMA", "EMA", "WMA", "VWMA", "SMMA", "DEMA", "TEMA", "LAGMA", "HullMA", "ZEMA", "TMA", "SSMA"])

lenS16 = input(defval=72, title="SLOW Ribbon Upper Length", minval=2)

gammaS16 = 0.77 //input(defval=0.77,title="Slow MA - Gamma for LAGMA")

// - Constants

gold = #FFD700

// - FUNCTIONS

// - variant(type, src, len, gamma)

// 返回MA输入选择变量,默认为SMA,如果空白或键入。

// SuperSmoother filter

variant_supersmoother(src,len) =>

a1 = exp(-1.414*3.14159 / len)

b1 = 2*a1*cos(1.414*3.14159 / len)

c2 = b1

c3 = (-a1)*a1

c1 = 1 - c2 - c3

v9 = 0.0

v9 := c1*(src + nz(src[1])) / 2 + c2*nz(v9[1]) + c3*nz(v9[2])

v9

variant_smoothed(src,len) =>

v5 = 0.0

v5 := na(v5[1]) ? sma(src, len) : (v5[1] * (len - 1) + src) / len

v5

variant_zerolagema(src,len) =>

ema1 = ema(src, len)

ema2 = ema(ema1, len)

v10 = ema1+(ema1-ema2)

v10

variant_doubleema(src,len) =>

v2 = ema(src, len)

v6 = 2 * v2 - ema(v2, len)

v6

variant_tripleema(src,len) =>

v2 = ema(src, len)

v7 = 3 * (v2 - ema(v2, len)) + ema(ema(v2, len), len) // Triple Exponential

v7

//calc Laguerre

variant_lag(p,g) =>

L0 = 0.0

L1 = 0.0

L2 = 0.0

L3 = 0.0

L0 := (1 - g)*p+g*nz(L0[1])

L1 := -g*L0+nz(L0[1])+g*nz(L1[1])

L2 := -g*L1+nz(L1[1])+g*nz(L2[1])

L3 := -g*L2+nz(L2[1])+g*nz(L3[1])

f = (L0 + 2*L1 + 2*L2 + L3)/6

f

// return variant, defaults to SMA

variant(type, src, len, g) =>

type=="EMA" ? ema(src,len) :

type=="WMA" ? wma(src,len):

type=="VWMA" ? vwma(src,len) :

type=="SMMA" ? variant_smoothed(src,len) :

type=="DEMA" ? variant_doubleema(src,len):

type=="TEMA" ? variant_tripleema(src,len):

type=="LAGMA" ? variant_lag(src,g) :

type=="HullMA"? wma(2 * wma(src, len / 2) - wma(src, len), round(sqrt(len))) :

type=="SSMA" ? variant_supersmoother(src,len) :

type=="ZEMA" ? variant_zerolagema(src,len) :

type=="TMA" ? sma(sma(src,len),len) :

sma(src,len)

// - /variant

// If have anchor specified, calculate the base multiplier.

//mult = isintraday ? anchor==0 or interval<=0 or interval>=anchor or anchor>1440? 1 : round(anchor/interval) : 1

//mult := isdwm? 1 : mult // Only available Daily or less

mult = anchor>0 ? anchor : 1

//

high_ = uRenko? max(close,open) : high

low_ = uRenko? min(close,open) : low

//用锚乘器调整MA长度

//Fast MA Ribbon

emaF1 = variant(typeF1, src, lenF1*mult, gammaF1)

emaF11 = variant(typeF11, src, lenF11*mult,gammaF11)

emafast = (emaF1+emaF11)/2 // Average of Upper and Lower MAs

//

//Slow MA Ribbon

emaS1 = variant(typeS1,src, lenS1*mult,gammaS1)

emaS16 = variant(typeS16, src, lenS16*mult, gammaS16)

emaslow = (emaS1+emaS16)/2 // Average of Upper and Lower MAs

//

// Count crossover candles

xup = 0

xdn = 0

fup = 0

fdn = 0

sup = 0

sdn = 0

//

xup := (emafast-emaslow)>0 and (emafast-emaslow)>(emafast[1]-emaslow[1]) ? nz(xup[1])+1 : 0

xdn := (emafast-emaslow)<0 and (emafast-emaslow)<(emafast[1]-emaslow[1]) ? nz(xdn[1])+1 : 0

fup := (emaF1-emaF11)>0 and (emaF1-emaF11)>(emaF1[1]-emaF11[1]) ? nz(fup[1])+1 : 0

fdn := (emaF1-emaF11)<0 and (emaF1-emaF11)<(emaF1[1]-emaF11[1]) ? nz(fdn[1])+1 : 0

sup := (emaS1-emaS16)>0 and (emaS1-emaS16)>(emaS1[1]-emaS16[1]) ? nz(sup[1])+1 : 0

sdn := (emaS1-emaS16)<0 and (emaS1-emaS16)<(emaS1[1]-emaS16[1]) ? nz(sdn[1])+1 : 0

//Fast EMA Final Color Rules

colFinal = fup>=2 ? aqua : fdn>=2 ? blue : gray

//Slow EMA Final Color Rules

colFinal2 = sup>=2 ? lime : sdn>=2 ? red : gray

//Fast EMA Plots

p1=plot(showRibbons?emaF1:na, title="Fast Ribbon Lower MA", style=line, linewidth=1, color=colFinal,transp=10)

p2=plot(showRibbons?emaF11:na, title="Fast Ribbon Upper MA", style=line, linewidth=1, color=colFinal,transp=10)

plot(showAvgs?emafast:na, title="Fast Ribbon Avg MA", style=circles,join=true, linewidth=1, color=gold,transp=10)

//

//fill(p1,p2,color=colFinal, transp=90)

//Slow EMA Plots

p3=plot(showRibbons?emaS1:na, title="Slow Ribbon Lower MA", style=line, linewidth=1, color=colFinal2,transp=10)

p4=plot(showRibbons?emaS16:na, title="Slow Ribbon Upper MA", style=line, linewidth=1, color=colFinal2,transp=10)

plot(showAvgs?emaslow:na, title="Slow Ribbon Avg MA", style=circles,join=true, linewidth=1, color=fuchsia,transp=10)

//

//fill(p3,p4, color=colFinal2, transp=90)

// Generate Buy Sell signals,

buy = 0

sell=0

//

buy := xup>=2 and sup>=2 and fup>=2 ? nz(buy[1])>0?buy[1]+1 :1 : 0

sell := xdn>=2 and sdn>=2 and fdn>=2 ? nz(sell[1])>0?sell[1]+1 :1 : 0

////////////////////////

//* 反测试周期选择器 *//

////////////////////////

testStartYear = input(2018, "Backtest Start Year",minval=1980)

testStartMonth = input(1, "Backtest Start Month",minval=1,maxval=12)

testStartDay = input(1, "Backtest Start Day",minval=1,maxval=31)

testPeriodStart = timestamp(testStartYear,testStartMonth,testStartDay,0,0)

testStopYear = 9999 //input(9999, "Backtest Stop Year",minval=1980)

testStopMonth = 12 // input(12, "Backtest Stop Month",minval=1,maxval=12)

testStopDay = 31 //input(31, "Backtest Stop Day",minval=1,maxval=31)

testPeriodStop = timestamp(testStopYear,testStopMonth,testStopDay,0,0)

testPeriod() => time >= testPeriodStart and time <= testPeriodStop ? true : false

///////////////

//* RSI策略 *//

///////////////

//指示器 1

lowerpc = lowest(low, 21)

upperpc = highest(high, 21)

midpc = avg(upperpc, lowerpc)

//指示器 2

ma = sma(close, 50)

petd = ema(close,13)

rangema = ema(tr, 50)

upperkc = ma + rangema * 0.25

lowerkc = ma - rangema * 0.25

//指示器 3

up = rma(max(change(close), 0), 5)

down = rma(-min(change(close), 0), 5)

rsi = down == 0 ? 100 : up == 0 ? 0 : 100 - (100 / (1 + up / down))

// PET-D

petdcolor = close > petd ? green : red

barcolor (petdcolor)

//Slope

SlopeL = midpc > midpc[5]

SlopeS = midpc < midpc[5]

//条件

CL = SlopeL == 1 and close > lowerkc and close < midpc and rsi < 35

CS = SlopeS == 1 and close < upperkc and close > midpc and rsi > 65

//Setup

RsiSL = CL == 1 and CL[1] != 1

RsiSS = CS == 1 and CS[1] != 1

/////////////////////

//* RSA抛物线指标 *//

/////////////////////

start = input(0.02)

increment = input(0.02)

maximum = input(0.2)

psar = sar(start, increment, maximum)

RSALE = false

RSASE = false

if (psar > high)

RSALE = true

else

RSALE = false

if (psar < low)

RSASE = true

else

RSASE = false

////////////////

//* 策略组件 *//

////////////////

AQUA = #00FFFFFF

BLUE = #0000FFFF

RED = #FF0000FF

LIME = #00FF00FF

GRAY = #808080FF

DARKRED = #8B0000FF

DARKGREEN = #006400FF

//

fastExit = input(false,title="Use Opposite Trade as a Close Signal")

clrBars = input(true,title="Colour Candles to Trade Order state")

orderType = input("Longs+Shorts",title="What type of Orders", options=["Longs+Shorts","LongsOnly","ShortsOnly","Flip"])

//

isLong = (orderType != "ShortsOnly")

isShort = (orderType != "LongsOnly")

//////////////////////////

//* 贸易状态引擎 *//

//////////////////////////

// 追踪当前贸易状态

longClose = false, longClose := nz(longClose[1],false)

shortClose = false, shortClose := nz(shortClose[1],false)

tradeState = 0, tradeState := nz(tradeState[1])

tradeState := tradeState==0 ? buy==1 and (barstate.isconfirmed or barstate.ishistory) and isLong and not longClose and not shortClose? 1 :

sell==1 and (barstate.isconfirmed or barstate.ishistory) and isShort and not longClose and not shortClose? -1 :

tradeState : tradeState

////////////////////////////////////

//* 在这里设置入口和特殊出口条件 *//

////////////////////////////////////

//进入状态,当状态改变方向时。

longCondition = false

shortCondition = false

//longCondition := longCondition != true ? change(tradeState) and tradeState==1 : true

//shortCondition := shortCondition != true ? change(tradeState) and tradeState==-1 : true

longCondition := change(tradeState) and tradeState==1

shortCondition := change(tradeState) and tradeState==-1

if orderType=="Flip"

temp = longCondition

longCondition := shortCondition

shortCondition := temp

//end if

// 卖出信号退出

longExitC = (emafast[1]<emaslow[1] and open<emaslow[1]) ? 1 : 0

shortExitC = (emafast[1]>emaslow[1] and open>emaslow[1]) ? 1 : 0

// change退出条件。

longExit = change(longExitC) and longExitC==1 and tradeState==1

shortExit = change(shortExitC) and shortExitC==1 and tradeState==-1

// -- debugs

//plotchar(tradeState,"tradeState at Event",location=location.bottom, color=#FF0000FF)

//plotchar(longCondition, title="longCondition",color=#FF0000FF)

//plotchar(shortCondition, title="shortCondition",color=#FF0000FF)

//plotchar(tradeState, title="tradeState",color=#006400FF)

// -- /debugs

////////////////////////////////

//======[ 交易入门价格 ]======//

////////////////////////////////

last_open_longCondition = na

last_open_shortCondition = na

last_open_longCondition := longCondition ? close : nz(last_open_longCondition[1])

last_open_shortCondition := shortCondition ? close : nz(last_open_shortCondition[1])

////////////////////////////

//======[ 位置状态 ]======//

////////////////////////////

in_longCondition = tradeState == 1

in_shortCondition = tradeState == -1

////////////////////////

//======[ 尾停 ]======//

////////////////////////

isTS = input(true, "Trailing Stop")

ts = input(3.0, "Trailing Stop (%)", minval=0,step=0.1, type=float) /100

last_high = na

last_low = na

last_high_short = na

last_low_long = na

last_high := not in_longCondition ? na : in_longCondition and (na(last_high[1]) or high_ > nz(last_high[1])) ? high_ : nz(last_high[1])

last_high_short := not in_shortCondition ? na : in_shortCondition and (na(last_high[1]) or high_ > nz(last_high[1])) ? high_ : nz(last_high[1])

last_low := not in_shortCondition ? na : in_shortCondition and (na(last_low[1]) or low_ < nz(last_low[1])) ? low_ : nz(last_low[1])

last_low_long := not in_longCondition ? na : in_longCondition and (na(last_low[1]) or low_ < nz(last_low[1])) ? low_ : nz(last_low[1])

long_ts = isTS and in_longCondition and not na(last_high) and (low_ <= last_high - last_high * ts) //and (last_high >= last_open_longCondition + last_open_longCondition * tsi)

short_ts = isTS and in_shortCondition and not na(last_low) and (high_ >= last_low + last_low * ts) //and (last_low <= last_open_shortCondition - last_open_shortCondition * tsi)

////////////////////////

//======[ 获利 ]======//

////////////////////////

isTP = input(true, "Take Profit")

tp = input(3.0, "Take Profit (%)",minval=0,step=0.1,type=float) / 100

ttp = input(1.0, "Trailing Profit (%)",minval=0,step=0.1,type=float) / 100

ttp := ttp>tp ? tp : ttp

long_tp = isTP and in_longCondition and (last_high >= last_open_longCondition + last_open_longCondition * tp) and (low_ <= last_high - last_high * ttp)

short_tp = isTP and in_shortCondition and (last_low <= last_open_shortCondition - last_open_shortCondition * tp) and (high_ >= last_low + last_low * ttp)

////////////////////////////

//======[ 停止损耗 ]======//

////////////////////////////

isSL = input(false, "Stop Loss")

sl = input(3.0, "Stop Loss (%)", minval=0,step=0.1, type=float) / 100

long_sl = isSL and in_longCondition and (low_ <= last_open_longCondition - last_open_longCondition * sl)

short_sl = isSL and in_shortCondition and (high_ >= last_open_shortCondition + last_open_shortCondition * sl)

////////////////////////

//======[ 对峙 ]======//

////////////////////////

//注:短出口信号不重漆,无需用力,如果锥体继续进行。

long_sos = (fastExit or (not isTS and not isSL)) and longExit and in_longCondition

short_sos = (fastExit or (not isTS and not isSL)) and shortExit and in_shortCondition

////////////////////////////

//======[ 关闭信号 ]======//

////////////////////////////

// 为所有不同的关闭条件创建一个单独的关闭,这里的所有条件都不重漆。

longClose := isLong and (long_tp or long_sl or long_ts or long_sos) and not longCondition

shortClose := isShort and (short_tp or short_sl or short_ts or short_sos) and not shortCondition

////////////////////////////

//======[ 情节色彩 ]======//

////////////////////////////

longCloseCol = na

shortCloseCol = na

longCloseCol := long_tp ? green : long_sl ? maroon : long_ts ? purple : long_sos ? orange :longCloseCol[1]

shortCloseCol := short_tp ? green : short_sl ? maroon : short_ts ? purple : short_sos ? orange : shortCloseCol[1]

//

tpColor = isTP and in_longCondition ? lime : isTP and in_shortCondition ? lime : na

slColor = isSL and in_longCondition ? red : isSL and in_shortCondition ? red : na

//////////////////////////////////

//======[ 策略图 ]======//

//////////////////////////////////

plot(isTS and in_longCondition?

last_high - last_high * ts : na, "Long Trailing", fuchsia, style=2, linewidth=2,offset=1)

plot(isTP and in_longCondition and last_high < last_open_longCondition + last_open_longCondition * tp ?

last_open_longCondition + last_open_longCondition * tp : na, "Long TP Active", tpColor, style=3,join=false, linewidth=2,offset=1)

plot(isTP and in_longCondition and last_high >= last_open_longCondition + last_open_longCondition * tp ?

last_high - last_high * ttp : na, "Long Trailing", black, style=2, linewidth=2,offset=1)

plot(isSL and in_longCondition and last_low_long > last_open_longCondition - last_open_longCondition * sl ?

last_open_longCondition - last_open_longCondition * sl : na, "Long SL", slColor, style=3,join=false, linewidth=2,offset=1)

plot(isTS and in_shortCondition?

last_low + last_low * ts : na, "Short Trailing", fuchsia, style=2, linewidth=2,offset=1)

plot(isTP and in_shortCondition and last_low > last_open_shortCondition - last_open_shortCondition * tp ?

last_open_shortCondition - last_open_shortCondition * tp : na, "Short TP Active", tpColor, style=3,join=false, linewidth=2,offset=1)

plot(isTP and in_shortCondition and last_low <= last_open_shortCondition - last_open_shortCondition * tp ?

last_low + last_low * ttp : na, "Short Trailing", black, style=2, linewidth=2,offset=1)

plot(isSL and in_shortCondition and last_high_short < last_open_shortCondition + last_open_shortCondition * sl ?

last_open_shortCondition + last_open_shortCondition * sl : na, "Short SL", slColor, style=3,join=false, linewidth=2,offset=1)

bclr = not clrBars ? na : tradeState==0 ? GRAY :

in_longCondition ? close<last_open_longCondition? DARKGREEN : LIME :

in_shortCondition ? close>last_open_shortCondition? DARKRED : RED : GRAY

barcolor(bclr,title="Trade State Bar Colouring")

//////////////////////////////////

//======[ 战略进入与退出 ]======//

//////////////////////////////////

if testPeriod() and isLong

strategy.entry("Long", 1, when=longCondition)

strategy.close("Long", when=longClose )

if testPeriod() and isShort

strategy.entry("Short", 0, when=shortCondition)

strategy.close("Short", when=shortClose )

// --- Debugs

//plotchar(longExit,title="longExit",location=location.bottom,color=na)

//plotchar(longCondition,title="longCondition",location=location.bottom,color=na)

//plotchar(in_longCondition,title="in_longCondition",location=location.bottom,color=na)

//plotchar(longClose,title="longClose",location=location.bottom,color=na,color=na)

//plotchar(buy,title="buy",location=location.bottom,color=na)

// --- /Debugs

//开单时改变背景

bgcolor( in_longCondition ? lime : na, transp=90)

bgcolor( in_shortCondition ? red : na, transp=90)

////////////////////////////

//======[ 重置变量 ]======//

////////////////////////////

if longClose or not in_longCondition

last_high := na

last_high_short := na

if shortClose or not in_shortCondition

last_low := na

last_low_long := na

if longClose or shortClose

tradeState := 0

in_longCondition := false

in_shortCondition := false

//plotchar(tradeState,"tradeState at EOF",location=location.bottom, color=na)

// EOF