概述

本策略运用假设检验的方法判断ATR是否偏离均值,结合对价格走势的预测,实现了一个基于ATR的均值回复交易策略。当ATR出现显著偏离时,表明市场可能存在反常波动。此时,如果价格走势预测为看涨,则可以建立做多头寸。

策略原理

假设检验

快速ATR周期(参数atr_fast)与慢速ATR周期(参数atr_slow)进行两样本t检验。假设检验的零假设H0为两样本均值无显著差异。

如果检验统计量高于阈值(参数reliability_factor指定的置信区间),则拒绝原假设,即认为快速ATR已明显偏离慢速ATR。

价格走势预测

计算对数收益率的移动平均作为预期漂移率(参数drift)。

如果漂移率上升,则判断目前为看涨趋势。

入场及止损退出

当快慢ATR差异显著且趋势看涨时,做多入场。

随后利用ATR计算持续调整止损线。当价格跌破止损线时止损退出。

优势分析

利用假设检验判断ATR异常偏离更科学、参数自适应。

结合价格趋势预测,避免了仅凭ATR偏离做出错误交易。

持续调整止损,降低亏损风险。

风险分析

价格出现断崖式下跌时,无法止损。

趋势判断存在错误,可能买入最高点。

参数设置不当,将错过正确的交易时点或者增加不必要的交易。

优化建议

可考虑加入其它指标进行多因子确认,避免单一指标造成错误交易。

可以测试不同的ATR参数组合,找到更稳定的参数。

增加对突破关键价格关口的判断,避免买入假突破。

总结

本策略总体思路清晰,利用假设检验判断反常波动的思路可取。但ATR偏离并不能完全判断趋势,需增加判断依据提高准确性。止损规则可靠,但无法应对断崖式下跌。未来可从入场条件、参数选择、止损优化等方面进行改进。

策略源码

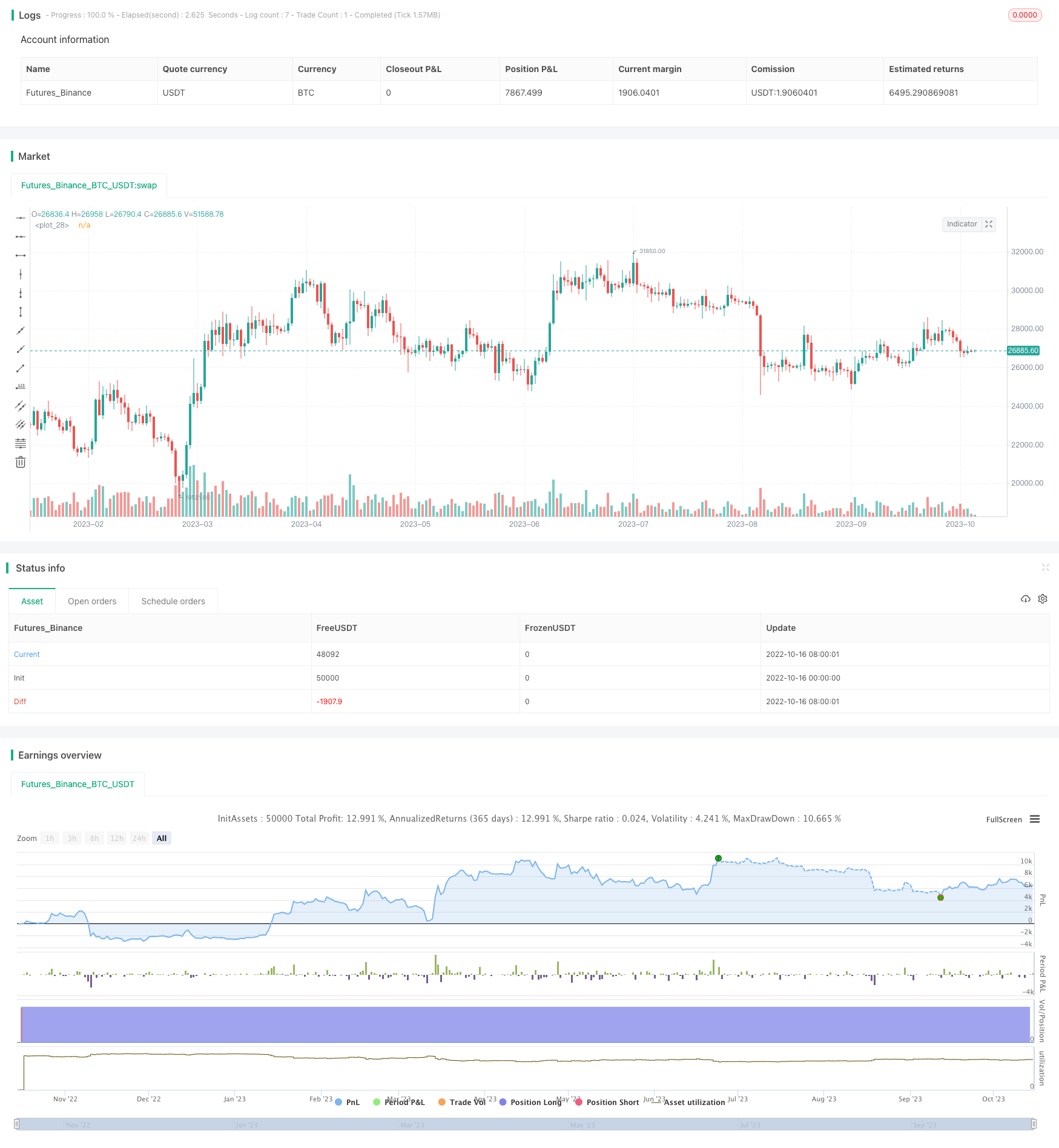

/*backtest

start: 2022-10-16 00:00:00

end: 2023-10-16 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © DojiEmoji

//@version=5

strategy("Mean Reversion (ATR) Strategy v2 [KL] ", overlay=true, pyramiding=1)

var string ENUM_LONG = "Long"

var string GROUP_TEST = "Hypothesis testing"

var string GROUP_TSL = "Stop loss"

var string GROUP_TREND = "Trend prediction"

backtest_timeframe_start = input(defval=timestamp("01 Apr 2000 13:30 +0000"), title="Backtest Start Time")

within_timeframe = true

// TSL: calculate the stop loss price. {

ATR_TSL = ta.atr(input(14, title="Length of ATR for trailing stop loss", group=GROUP_TSL)) * input(2.0, title="ATR Multiplier for trailing stop loss", group=GROUP_TSL)

TSL_source = low

TSL_line_color = color.green

TSL_transp = 100

var stop_loss_price = float(0)

if strategy.position_size == 0 or not within_timeframe

TSL_line_color := color.black

stop_loss_price := TSL_source - ATR_TSL

else if strategy.position_size > 0

stop_loss_price := math.max(stop_loss_price, TSL_source - ATR_TSL)

TSL_transp := 0

plot(stop_loss_price, color=color.new(TSL_line_color, TSL_transp))

// } end of "TSL" block

// Entry variables {

// ATR diversion test via Hypothesis testing (2-tailed):

// H0 : atr_fast equals atr_slow

// Ha : reject H0 if z_stat is above critical value, say reliability factor of 1.96 for a 95% confidence interval

len_fast = input(14,title="Length of ATR (fast) for diversion test", group=GROUP_TEST)

atr_fast = ta.atr(len_fast)

std_error = ta.stdev(ta.tr, len_fast) / math.pow(len_fast, 0.5) // Standard Error (SE) = std / sq root(sample size)

atr_slow = ta.atr(input(28,title="Length of ATR (slow) for diversion test", group=GROUP_TEST))

test_stat = (atr_fast - atr_slow) / std_error

reject_H0 = math.abs(test_stat) > input.float(1.645,title="Reliability factor", tooltip="Strategy uses 2-tailed test; Confidence Interval = Point Estimate (avg ATR) +/- Reliability Factor x Standard Error; i.e use 1.645 for a 90% confidence interval", group=GROUP_TEST)

// main entry signal, subject to confirmation(s), gets passed onto the next bar

var _signal_diverted_ATR = false

if not _signal_diverted_ATR

_signal_diverted_ATR := reject_H0

// confirmation: trend prediction; based on expected lognormal returns

_prcntge_chng = math.log(close / close[1])

// Expected return (drift) = average percentage change + half variance over the lookback period

len_drift = input(14, title="Length of drift", group=GROUP_TREND)

_drift = ta.sma(_prcntge_chng, len_drift) - math.pow(ta.stdev(_prcntge_chng, len_drift), 2) * 0.5

_signal_uptrend = _drift > _drift[1]

entry_signal_all = _signal_diverted_ATR and _signal_uptrend // main signal + confirmations

// } end of "Entry variables" block

// MAIN {

// Update the stop limit if strategy holds a position

if strategy.position_size > 0 and ta.change(stop_loss_price)

strategy.exit(ENUM_LONG, comment="sl", stop=stop_loss_price)

// Entry

if within_timeframe and entry_signal_all

strategy.entry(ENUM_LONG, strategy.long, comment=strategy.position_size > 0 ? "adding" : "initial")

// Alerts

_atr = ta.atr(14)

alert_helper(msg) =>

prefix = "[" + syminfo.root + "] "

suffix = "(P=" + str.tostring(close, "#.##") + "; atr=" + str.tostring(_atr, "#.##") + ")"

alert(str.tostring(prefix) + str.tostring(msg) + str.tostring(suffix), alert.freq_once_per_bar)

if strategy.position_size > 0 and ta.change(strategy.position_size)

if strategy.position_size > strategy.position_size[1]

alert_helper("BUY")

else if strategy.position_size < strategy.position_size[1]

alert_helper("SELL")

// Clean up - set the variables back to default values once no longer in use

if strategy.position_size == 0

stop_loss_price := float(0)

if ta.change(strategy.position_size)

_signal_diverted_ATR := false

// } end of MAIN block