A brilliant explanation for the alternative to stop loss

Author: The Little Dream, Created: 2017-01-03 11:58:38, Updated:A brilliant explanation for the alternative to stop loss

A person's life, many times, is unlocked, and this key on the body often determines your life. Try to refine this key on the body with your heart, so that it provides more support for your choices. The confused person, who buries wisdom deep in his heart, faces too complex world affairs, simple to be a person, simple to do things, to meet people without haste, to meet things, difficult to use confusingly to meet and greet, to brew life's thick broth.

Trends, big trades have a lot of money. In the past, I thought about big trades every day, and when I broke through, I thought the price was going to double, and when I broke through, I thought the market was going to collapse. In fact, there is no real market wave in one year. The system needs to be designed according to the worst case scenario, if you can beat the past, then you are qualified.

-

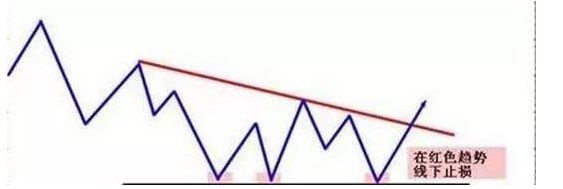

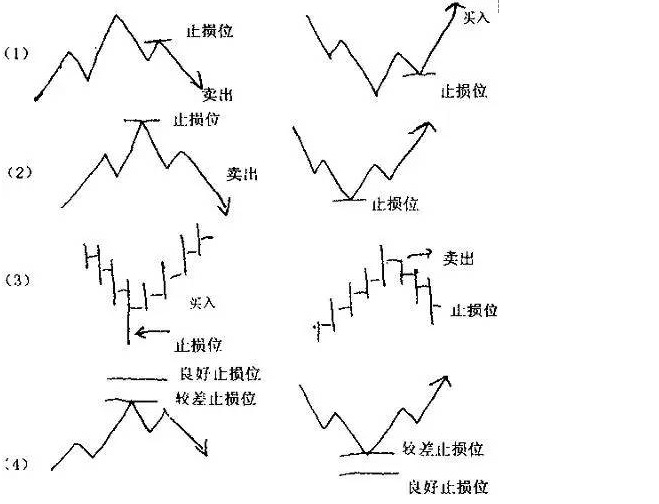

Stop the damage

The graph is more intuitive: Assume a small cycle to do more (the red dot is the right-hand trade point), 30 points of the blue line stop loss.-

1.入场后直接打止损,最坏的情况没话说。

-

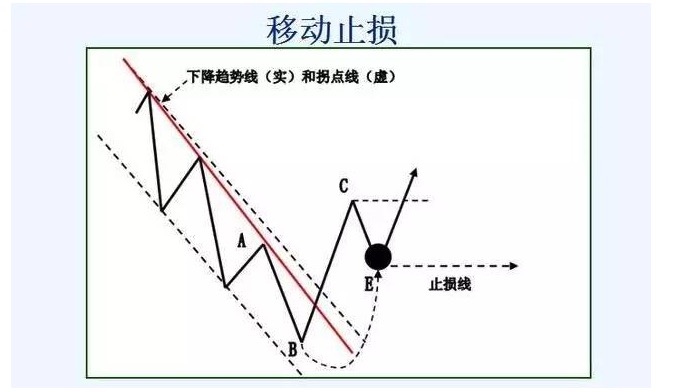

2. Floating profit 30 points after entry, profit and stop loss 1: 1, stop loss can be considered to cost.

-

3.入场后下一个调整继续上升,可以考虑止损移至成本或新的低点。

I would like to emphasize:

-

(1) Disorderly shocks can continuously put you out of business, the market doesn't respect us at all, so moving quickly to costs is very important.

-

(2) The design and optimization of the system must be based on the worst-case scenario, not on how much to win.

The author understands the shocks as follows: in the current cycle, say, the 4-hour cycle, there is a trend market and a shocker market, and the shocker market of the current cycle is the trend market of the small cycle. The shocker market of the 4-hour cycle may have a clear trend on the hourly chart and the 30-minute chart... We can turn our attention to the small cycle... Of course, the smaller cycle of 15 minutes, the 5-minute chart also has a trend, but this is too small for the 4-hour chart.

The following are some examples:

-

1st, the trading system daylight is sending out multiple signals

-

2 H1, wait for the right side to do more (H4, too, everyone's system is different), and set the loss.

-

3, After the market opens, stop-loss suspension costs.

-

4, return to the dayline bullish cycle exit. If the dayline is indeed trending up, move stop loss on the dayline (I am the lowest point of each dayline, you can also use 50% maximum profit or other methods, etc., as long as it is determined according to your habits and characteristics of the system, but it must be moved loss on the dayline).

-

5, With the continuous upward movement of the stop loss, the market finally ends the market with the end of the big cycle.

-

If the dayline is still judged to be an uptrend after hitting the loss, it can also be entered in multiple units in H1/H4. Until the dayline shift is judged, the next cycle.

Look at the support/resistance level of the large first-level cycle gradually followed by the protection, also the large-cycle transfer loss. Small-cycle transfer loss is for financial security, for less loss. While the large-cycle transfer loss is to respect the market, dare to win.

The odds of winning and losing are always a contradiction. For example, the daily cycle of entry, the H1/H4 cycle of entry, such a word guarantees the odds (i.e. the profit and loss ratio), while the odds of winning are also within an acceptable range (about 40% to 50%). But if the daily exit, and the 5 minute entry, the odds are guaranteed to be higher, but the success rate is greatly reduced, may be only 10% or even lower.

-

-

This is from Sina Blog.

- Bitcoin exchange network error GetOrders: parameter error

- The template of the listing system triggers the design outline of ten items

- The technical gist of the shark system trading rules

- Template 3.0: Draw line class library

- Peak and slope

- The most profitable economist, writing papers and leading economist, Tom Maynard Keynes

- Template 3.2: Digital currency trading class library (integrated Cash, futures support OKCoin futures/BitVC)

- I'm sorry, but Gauss did a small job.

- A Brief History of Risk (IV) Von Mover and the Curve of the Gods

- A short history of risk (5) Bayes, a man who lives only in his textbooks

- 2.13 Common error messages, exchange API error codes, various problems encountered by digital currency robots!

- OkCoin China API error code requested

- The real volatility applied to the market basis of thinking about shushupengli trading ideas with pen

- 2.12 _D (()) Function and Timestamp

- python: Please be careful in these places.

- A synergistic understanding of intuition

- The hidden Markov model

- Interested in understanding the simplicity of Bayes

- 2.11 API: Simple example of use of Chart function (graph function)

- Details of the currency pair