Estrategia de tendencia dinámica de medias móviles múltiples

Descripción general

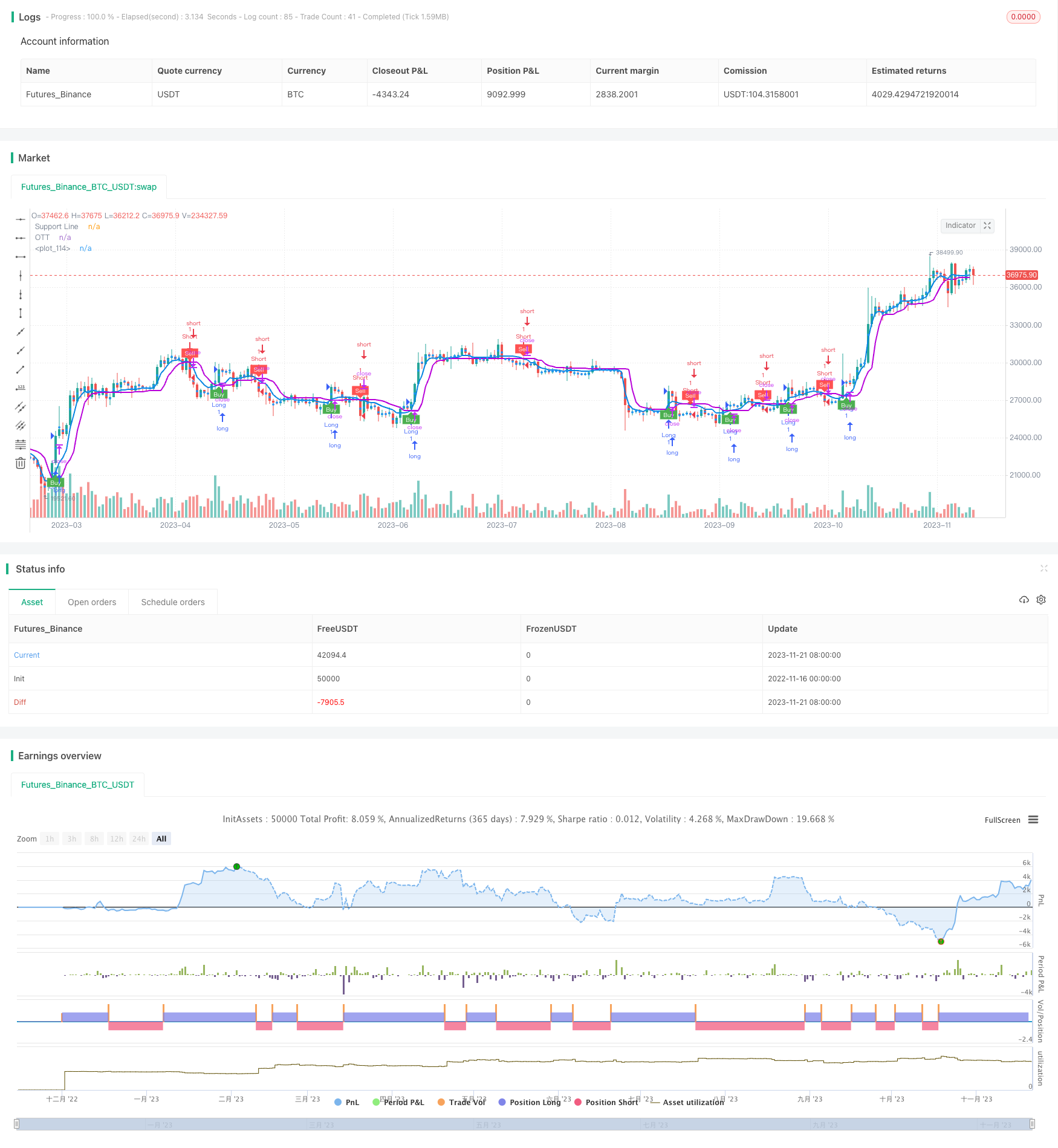

La estrategia de tendencias dinámicas de múltiples promedios móviles es una estrategia de negociación cuantitativa que utiliza varios indicadores de promedios móviles para determinar la dirección de la tendencia y ajustar dinámicamente la posición de la línea de parada. La estrategia combina diferentes tipos de promedios móviles para determinar la tendencia del mercado de manera más completa y precisa, lo que permite una negociación con altas probabilidades de éxito.

Principio de estrategia

La estrategia permite a los usuarios elegir uno de estos ocho tipos de promedios móviles como su principal indicador de juicio. La estrategia permite a los usuarios elegir uno de estos ocho tipos de promedios móviles como su principal indicador de juicio.

La estrategia primero calcula los promedios móviles de los tipos seleccionados, y luego calcula la posición de las subidas y bajadas de las vías según los parámetros de porcentaje establecidos. Cuando el precio se rompe en la subida, es una señal de compra, y cuando se rompe en la bajada, es una señal de venta. Además, la estrategia también sigue el cruce de las medias móviles y los precios como una señal de juicio auxiliar.

En el proceso de cálculo, la estrategia determina simultáneamente la dirección de la tendencia del mercado, lo que permite ajustar dinámicamente la posición de la subida y bajada. En concreto, cuando se determina que la tendencia es ascendente, la línea descendente se ajusta con el aumento de los precios, lo que permite que la línea de stop loss pueda seguir de manera óptima el aumento de los precios; cuando se determina que la tendencia es descendente, la línea ascendente se ajusta con la caída de los precios, reduciendo el punto de parada para reducir las pérdidas.

Ventajas estratégicas

- La combinación de 8 indicadores de medias móviles para determinar las tendencias del mercado con mayor precisión;

- Ajuste dinámico de la posición de la línea de parada para maximizar el bloqueo de ganancias y evitar el reverso de la parada.

- La intersección de las medias móviles y los precios sirve como señal auxiliar para filtrar las transacciones erróneas provocadas por brechas falsas.

- Los parámetros de la estrategia se pueden personalizar y optimizar para diferentes entornos de mercado.

Riesgos y soluciones

- La combinación de múltiples indicadores aumenta la complejidad de la estrategia y la dificultad de la desinstalación del código.

- Algunos tipos de indicadores de medias móviles son ineficaces en determinadas condiciones de mercado.

- El riesgo de una transacción errónea con una brecha falsa sigue existiendo.

Resolución de las mismas:

- Aumentar el número de comentarios en el código, mejorar la legibilidad del código y facilitar su revisión y depuración.

- También se puede agregar un módulo de selección automática para seleccionar el tipo de promedio móvil en función de la situación del mercado.

- Optimización de la configuración de los parámetros, junto con más indicadores auxiliares para filtrar las señales.

Dirección de optimización de la estrategia

La estrategia también tiene un gran margen de mejora:

- Se puede agregar un módulo de optimización automática de parámetros para ajustar automáticamente los parámetros según los diferentes entornos del mercado;

- En la actualidad, los modelos de aprendizaje automático pueden ser usados para ayudar a determinar la dirección de las tendencias.

- Se pueden agregar más indicadores auxiliares de juicio, como los indicadores emocionales, para mejorar la estabilidad de la estrategia.

- Optimizar los mecanismos de detención de pérdidas para lograr una detención más dinámica y precisa;

- La estrategia de arbitraje puede extenderse a varias variedades, aprovechando las diferencias de precios entre variedades para obtener oportunidades de arbitraje.

Resumir

La estrategia de tendencia dinámica de múltiples medias móviles determina la tendencia del mercado mediante la combinación de varios indicadores de medias móviles y emite instrucciones de negociación complementadas con señales de ruptura de precios, al mismo tiempo que ajusta dinámicamente la posición de la línea de parada para lograr una ganancia eficiente. La estrategia integra con éxito el seguimiento de la tendencia, la ruptura de la operación y el deterioro dinámico de los tres principales estrategias de cuantificación. La estabilidad y la rentabilidad son fuertes.

/*backtest

start: 2022-11-16 00:00:00

end: 2023-11-22 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © KivancOzbilgic

//created by: @Anil_Ozeksi

//developer: ANIL ÖZEKŞİ

//author: @kivancozbilgic

strategy("Optimized Trend Tracker","OTTEx", overlay=true)

src = input(close, title="Source")

length=input(2, "OTT Period", minval=1)

percent=input(1.4, "OTT Percent", type=input.float, step=0.1, minval=0)

showsupport = input(title="Show Support Line?", type=input.bool, defval=true)

showsignalsk = input(title="Show Support Line Crossing Signals?", type=input.bool, defval=true)

showsignalsc = input(title="Show Price/OTT Crossing Signals?", type=input.bool, defval=false)

highlight = input(title="Show OTT Color Changes?", type=input.bool, defval=false)

showsignalsr = input(title="Show OTT Color Change Signals?", type=input.bool, defval=false)

highlighting = input(title="Highlighter On/Off ?", type=input.bool, defval=true)

mav = input(title="Moving Average Type", defval="VAR", options=["SMA", "EMA", "WMA", "TMA", "VAR", "WWMA", "ZLEMA", "TSF"])

Var_Func(src,length)=>

valpha=2/(length+1)

vud1=src>src[1] ? src-src[1] : 0

vdd1=src<src[1] ? src[1]-src : 0

vUD=sum(vud1,9)

vDD=sum(vdd1,9)

vCMO=nz((vUD-vDD)/(vUD+vDD))

VAR=0.0

VAR:=nz(valpha*abs(vCMO)*src)+(1-valpha*abs(vCMO))*nz(VAR[1])

VAR=Var_Func(src,length)

Wwma_Func(src,length)=>

wwalpha = 1/ length

WWMA = 0.0

WWMA := wwalpha*src + (1-wwalpha)*nz(WWMA[1])

WWMA=Wwma_Func(src,length)

Zlema_Func(src,length)=>

zxLag = length/2==round(length/2) ? length/2 : (length - 1) / 2

zxEMAData = (src + (src - src[zxLag]))

ZLEMA = ema(zxEMAData, length)

ZLEMA=Zlema_Func(src,length)

Tsf_Func(src,length)=>

lrc = linreg(src, length, 0)

lrc1 = linreg(src,length,1)

lrs = (lrc-lrc1)

TSF = linreg(src, length, 0)+lrs

TSF=Tsf_Func(src,length)

getMA(src, length) =>

ma = 0.0

if mav == "SMA"

ma := sma(src, length)

ma

if mav == "EMA"

ma := ema(src, length)

ma

if mav == "WMA"

ma := wma(src, length)

ma

if mav == "TMA"

ma := sma(sma(src, ceil(length / 2)), floor(length / 2) + 1)

ma

if mav == "VAR"

ma := VAR

ma

if mav == "WWMA"

ma := WWMA

ma

if mav == "ZLEMA"

ma := ZLEMA

ma

if mav == "TSF"

ma := TSF

ma

ma

MAvg=getMA(src, length)

fark=MAvg*percent*0.01

longStop = MAvg - fark

longStopPrev = nz(longStop[1], longStop)

longStop := MAvg > longStopPrev ? max(longStop, longStopPrev) : longStop

shortStop = MAvg + fark

shortStopPrev = nz(shortStop[1], shortStop)

shortStop := MAvg < shortStopPrev ? min(shortStop, shortStopPrev) : shortStop

dir = 1

dir := nz(dir[1], dir)

dir := dir == -1 and MAvg > shortStopPrev ? 1 : dir == 1 and MAvg < longStopPrev ? -1 : dir

MT = dir==1 ? longStop: shortStop

OTT=MAvg>MT ? MT*(200+percent)/200 : MT*(200-percent)/200

plot(showsupport ? MAvg : na, color=#0585E1, linewidth=2, title="Support Line")

OTTC = highlight ? OTT[2] > OTT[3] ? color.green : color.red : #B800D9

pALL=plot(nz(OTT[2]), color=OTTC, linewidth=2, title="OTT", transp=0)

alertcondition(cross(OTT[2], OTT[3]), title="Color ALARM", message="OTT Has Changed Color!")

alertcondition(crossover(OTT[2], OTT[3]), title="GREEN ALERT", message="OTT GREEN BUY SIGNAL!")

alertcondition(crossunder(OTT[2], OTT[3]), title="RED ALERT", message="OTT RED SELL SIGNAL!")

alertcondition(cross(MAvg, OTT[2]), title="Cross Alert", message="OTT - Support Line Crossing!")

alertcondition(crossover(MAvg, OTT[2]), title="Crossover Alarm", message="Support Line BUY SIGNAL!")

alertcondition(crossunder(MAvg, OTT[2]), title="Crossunder Alarm", message="Support Line SELL SIGNAL!")

alertcondition(cross(src, OTT[2]), title="Price Cross Alert", message="OTT - Price Crossing!")

alertcondition(crossover(src, OTT[2]), title="Price Crossover Alarm", message="PRICE OVER OTT - BUY SIGNAL!")

alertcondition(crossunder(src, OTT[2]), title="Price Crossunder Alarm", message="PRICE UNDER OTT - SELL SIGNAL!")

buySignalk = crossover(MAvg, OTT[2])

plotshape(buySignalk and showsignalsk ? OTT*0.995 : na, title="Buy", text="Buy", location=location.absolute, style=shape.labelup, size=size.tiny, color=color.green, textcolor=color.white, transp=0)

sellSignallk = crossunder(MAvg, OTT[2])

plotshape(sellSignallk and showsignalsk ? OTT*1.005 : na, title="Sell", text="Sell", location=location.absolute, style=shape.labeldown, size=size.tiny, color=color.red, textcolor=color.white, transp=0)

buySignalc = crossover(src, OTT[2])

plotshape(buySignalc and showsignalsc ? OTT*0.995 : na, title="Buy", text="Buy", location=location.absolute, style=shape.labelup, size=size.tiny, color=color.green, textcolor=color.white, transp=0)

sellSignallc = crossunder(src, OTT[2])

plotshape(sellSignallc and showsignalsc ? OTT*1.005 : na, title="Sell", text="Sell", location=location.absolute, style=shape.labeldown, size=size.tiny, color=color.red, textcolor=color.white, transp=0)

mPlot = plot(ohlc4, title="", style=plot.style_circles, linewidth=0,display=display.none)

longFillColor = highlighting ? (MAvg>OTT ? color.green : na) : na

shortFillColor = highlighting ? (MAvg<OTT ? color.red : na) : na

fill(mPlot, pALL, title="UpTrend Highligter", color=longFillColor)

fill(mPlot, pALL, title="DownTrend Highligter", color=shortFillColor)

buySignalr = crossover(OTT[2], OTT[3])

plotshape(buySignalr and showsignalsr ? OTT*0.995 : na, title="Buy", text="Buy", location=location.absolute, style=shape.labelup, size=size.tiny, color=color.green, textcolor=color.white, transp=0)

sellSignallr = crossunder(OTT[2], OTT[3])

plotshape(sellSignallr and showsignalsr ? OTT*1.005 : na, title="Sell", text="Sell", location=location.absolute, style=shape.labeldown, size=size.tiny, color=color.red, textcolor=color.white, transp=0)

showscr = input(true, title="Show Screener Label")

posX_scr = input(20, title="Pos. Label x-axis")

posY_scr = input(1, title="Pos. Size Label y-axis")

colinput = input(title="Label Color", defval="Blue", options=["White", "Black", "Red", "Green", "Yellow", "Blue"])

col = color.gray

if colinput=="White"

col:=color.white

if colinput=="Black"

col:=color.black

if colinput=="Red"

col:=color.red

if colinput=="Green"

col:=color.green

if colinput=="Yellow"

col:=color.yellow

if colinput=="Blue"

col:=color.blue

dummy0 = input(true, title = "=Backtest Inputs=")

FromDay = input(defval = 1, title = "From Day", minval = 1, maxval = 31)

FromMonth = input(defval = 1, title = "From Month", minval = 1, maxval = 12)

FromYear = input(defval = 2005, title = "From Year", minval = 2005)

ToDay = input(defval = 1, title = "To Day", minval = 1, maxval = 31)

ToMonth = input(defval = 1, title = "To Month", minval = 1, maxval = 12)

ToYear = input(defval = 9999, title = "To Year", minval = 2006)

Start = timestamp(FromYear, FromMonth, FromDay, 00, 00)

Finish = timestamp(ToYear, ToMonth, ToDay, 23, 59)

Timerange() => true

if buySignalk

strategy.entry("Long", strategy.long,when=Timerange())

if sellSignallk

strategy.entry("Short", strategy.short,when=Timerange())

// t1=input('EURUSD', title='Symbol 01',type=input.symbol)

// t2=input('XAUUSD', title='Symbol 02',type=input.symbol)

// t3=input('AMZN', title='Symbol 03',type=input.symbol)

// t4=input('TSLA', title='Symbol 04',type=input.symbol)

// t5=input('BTCUSDT', title='Symbol 05',type=input.symbol)

// t6=input('ETHBTC', title='Symbol 06',type=input.symbol)

// t7=input('XBTUSD', title='Symbol 07',type=input.symbol)

// t8=input('XRPBTC', title='Symbol 08',type=input.symbol)

// t9=input('THYAO', title='Symbol 09',type=input.symbol)

// t10=input('GARAN', title='Symbol 10',type=input.symbol)

// t11=input('', title='Symbol 11',type=input.symbol)

// t12=input('', title='Symbol 12',type=input.symbol)

// t13=input('', title='Symbol 13',type=input.symbol)

// t14=input('', title='Symbol 14',type=input.symbol)

// t15=input('', title='Symbol 15',type=input.symbol)

// t16=input('', title='Symbol 16',type=input.symbol)

// t17=input('', title='Symbol 17',type=input.symbol)

// t18=input('', title='Symbol 18',type=input.symbol)

// t19=input('', title='Symbol 19',type=input.symbol)

// t20=input('', title='Symbol 20',type=input.symbol)

// OTTs(percent, length) =>

// Up=MAvg-MAvg*percent*0.01

// Dn=MAvg+MAvg*percent*0.01

// TrendUp = 0.0

// TrendUp := MAvg[1]>TrendUp[1] ? max(Up,TrendUp[1]) : Up

// TrendDown = 0.0

// TrendDown := MAvg[1]<TrendDown[1]? min(Dn,TrendDown[1]) : Dn

// Trend = 0.0

// Trend := MAvg > TrendDown[1] ? 1: MAvg< TrendUp[1]? -1: nz(Trend[1],1)

// Tsl = Trend==1? TrendUp: TrendDown

// S_Buy = Trend == 1 ? 1 : 0

// S_Sell = Trend != 1 ? 1 : 0

// [Trend, Tsl]

// [Trend, Tsl] = OTTs(percent, length)

// TrendReversal = Trend != Trend[1]

// [t01, s01] = security(t1, timeframe.period, OTTs(percent, length))

// [t02, s02] = security(t2, timeframe.period, OTTs(percent, length))

// [t03, s03] = security(t3, timeframe.period, OTTs(percent, length))

// [t04, s04] = security(t4, timeframe.period, OTTs(percent, length))

// [t05, s05] = security(t5, timeframe.period, OTTs(percent, length))

// [t06, s06] = security(t6, timeframe.period, OTTs(percent, length))

// [t07, s07] = security(t7, timeframe.period, OTTs(percent, length))

// [t08, s08] = security(t8, timeframe.period, OTTs(percent, length))

// [t09, s09] = security(t9, timeframe.period, OTTs(percent, length))

// [t010, s010] = security(t10, timeframe.period, OTTs(percent, length))

// [t011, s011] = security(t11, timeframe.period, OTTs(percent, length))

// [t012, s012] = security(t12, timeframe.period, OTTs(percent, length))

// [t013, s013] = security(t13, timeframe.period, OTTs(percent, length))

// [t014, s014] = security(t14, timeframe.period, OTTs(percent, length))

// [t015, s015] = security(t15, timeframe.period, OTTs(percent, length))

// [t016, s016] = security(t16, timeframe.period, OTTs(percent, length))

// [t017, s017] = security(t17, timeframe.period, OTTs(percent, length))

// [t018, s018] = security(t18, timeframe.period, OTTs(percent, length))

// [t019, s019] = security(t19, timeframe.period, OTTs(percent, length))

// [t020, s020] = security(t20, timeframe.period, OTTs(percent, length))

// tr01 = t01 != t01[1], up01 = t01 == 1, dn01 = t01 == -1

// tr02 = t02 != t02[1], up02 = t02 == 1, dn02 = t02 == -1

// tr03 = t03 != t03[1], up03 = t03 == 1, dn03 = t03 == -1

// tr04 = t04 != t04[1], up04 = t04 == 1, dn04 = t04 == -1

// tr05 = t05 != t05[1], up05 = t05 == 1, dn05 = t05 == -1

// tr06 = t06 != t06[1], up06 = t06 == 1, dn06 = t06 == -1

// tr07 = t07 != t07[1], up07 = t07 == 1, dn07 = t07 == -1

// tr08 = t08 != t08[1], up08 = t08 == 1, dn08 = t08 == -1

// tr09 = t09 != t09[1], up09 = t09 == 1, dn09 = t09 == -1

// tr010 = t010 != t010[1], up010 = t010 == 1, dn010 = t010 == -1

// tr011 = t011 != t011[1], up011 = t011 == 1, dn011 = t011 == -1

// tr012 = t012 != t012[1], up012 = t012 == 1, dn012 = t012 == -1

// tr013 = t013 != t013[1], up013 = t013 == 1, dn013 = t013 == -1

// tr014 = t014 != t014[1], up014 = t014 == 1, dn014 = t014 == -1

// tr015 = t015 != t015[1], up015 = t015 == 1, dn015 = t015 == -1

// tr016 = t016 != t016[1], up016 = t016 == 1, dn016 = t016 == -1

// tr017 = t017 != t017[1], up017 = t017 == 1, dn017 = t017 == -1

// tr018 = t018 != t018[1], up018 = t018 == 1, dn018 = t018 == -1

// tr019 = t019 != t019[1], up019 = t019 == 1, dn019 = t019 == -1

// tr020 = t020 != t020[1], up020 = t020 == 1, dn020 = t020 == -1

// pot_label = 'Potential Reversal: \n'

// pot_label := tr01 ? pot_label + t1 + '\n' : pot_label

// pot_label := tr02 ? pot_label + t2 + '\n' : pot_label

// pot_label := tr03 ? pot_label + t3 + '\n' : pot_label

// pot_label := tr04 ? pot_label + t4 + '\n' : pot_label

// pot_label := tr05 ? pot_label + t5 + '\n' : pot_label

// pot_label := tr06 ? pot_label + t6 + '\n' : pot_label

// pot_label := tr07 ? pot_label + t7 + '\n' : pot_label

// pot_label := tr08 ? pot_label + t8 + '\n' : pot_label

// pot_label := tr09 ? pot_label + t9 + '\n' : pot_label

// pot_label := tr010 ? pot_label + t10 + '\n' : pot_label

// pot_label := tr011 ? pot_label + t11 + '\n' : pot_label

// pot_label := tr012 ? pot_label + t12 + '\n' : pot_label

// pot_label := tr013 ? pot_label + t13 + '\n' : pot_label

// pot_label := tr014 ? pot_label + t14 + '\n' : pot_label

// pot_label := tr015 ? pot_label + t15 + '\n' : pot_label

// pot_label := tr016 ? pot_label + t16 + '\n' : pot_label

// pot_label := tr017 ? pot_label + t17 + '\n' : pot_label

// pot_label := tr018 ? pot_label + t18 + '\n' : pot_label

// pot_label := tr019 ? pot_label + t19 + '\n' : pot_label

// pot_label := tr020 ? pot_label + t20 + '\n' : pot_label

// scr_label = 'Confirmed Reversal: \n'

// scr_label := tr01[1] ? scr_label + t1 + '\n' : scr_label

// scr_label := tr02[1] ? scr_label + t2 + '\n' : scr_label

// scr_label := tr03[1] ? scr_label + t3 + '\n' : scr_label

// scr_label := tr04[1] ? scr_label + t4 + '\n' : scr_label

// scr_label := tr05[1] ? scr_label + t5 + '\n' : scr_label

// scr_label := tr06[1] ? scr_label + t6 + '\n' : scr_label

// scr_label := tr07[1] ? scr_label + t7 + '\n' : scr_label

// scr_label := tr08[1] ? scr_label + t8 + '\n' : scr_label

// scr_label := tr09[1] ? scr_label + t9 + '\n' : scr_label

// scr_label := tr010[1] ? scr_label + t10 + '\n' : scr_label

// scr_label := tr011[1] ? scr_label + t11 + '\n' : scr_label

// scr_label := tr012[1] ? scr_label + t12 + '\n' : scr_label

// scr_label := tr013[1] ? scr_label + t13 + '\n' : scr_label

// scr_label := tr014[1] ? scr_label + t14 + '\n' : scr_label

// scr_label := tr015[1] ? scr_label + t15 + '\n' : scr_label

// scr_label := tr016[1] ? scr_label + t16 + '\n' : scr_label

// scr_label := tr017[1] ? scr_label + t17 + '\n' : scr_label

// scr_label := tr018[1] ? scr_label + t18 + '\n' : scr_label

// scr_label := tr019[1] ? scr_label + t19 + '\n' : scr_label

// scr_label := tr020[1] ? scr_label + t20 + '\n' : scr_label

// up_label = 'Uptrend: \n'

// up_label := up01[1] ? up_label + t1 + '\n' : up_label

// up_label := up02[1] ? up_label + t2 + '\n' : up_label

// up_label := up03[1] ? up_label + t3 + '\n' : up_label

// up_label := up04[1] ? up_label + t4 + '\n' : up_label

// up_label := up05[1] ? up_label + t5 + '\n' : up_label

// up_label := up06[1] ? up_label + t6 + '\n' : up_label

// up_label := up07[1] ? up_label + t7 + '\n' : up_label

// up_label := up08[1] ? up_label + t8 + '\n' : up_label

// up_label := up09[1] ? up_label + t9 + '\n' : up_label

// up_label := up010[1] ? up_label + t10 + '\n' : up_label

// up_label := up011[1] ? up_label + t11 + '\n' : up_label

// up_label := up012[1] ? up_label + t12 + '\n' : up_label

// up_label := up013[1] ? up_label + t13 + '\n' : up_label

// up_label := up014[1] ? up_label + t14 + '\n' : up_label

// up_label := up015[1] ? up_label + t15 + '\n' : up_label

// up_label := up016[1] ? up_label + t16 + '\n' : up_label

// up_label := up017[1] ? up_label + t17 + '\n' : up_label

// up_label := up018[1] ? up_label + t18 + '\n' : up_label

// up_label := up019[1] ? up_label + t19 + '\n' : up_label

// up_label := up020[1] ? up_label + t20 + '\n' : up_label

// dn_label = 'Downtrend: \n'

// dn_label := dn01[1] ? dn_label + t1 + '\n' : dn_label

// dn_label := dn02[1] ? dn_label + t2 + '\n' : dn_label

// dn_label := dn03[1] ? dn_label + t3 + '\n' : dn_label

// dn_label := dn04[1] ? dn_label + t4 + '\n' : dn_label

// dn_label := dn05[1] ? dn_label + t5 + '\n' : dn_label

// dn_label := dn06[1] ? dn_label + t6 + '\n' : dn_label

// dn_label := dn07[1] ? dn_label + t7 + '\n' : dn_label

// dn_label := dn08[1] ? dn_label + t8 + '\n' : dn_label

// dn_label := dn09[1] ? dn_label + t9 + '\n' : dn_label

// dn_label := dn010[1] ? dn_label + t10 + '\n' : dn_label

// dn_label := dn011[1] ? dn_label + t11 + '\n' : dn_label

// dn_label := dn012[1] ? dn_label + t12 + '\n' : dn_label

// dn_label := dn013[1] ? dn_label + t13 + '\n' : dn_label

// dn_label := dn014[1] ? dn_label + t14 + '\n' : dn_label

// dn_label := dn015[1] ? dn_label + t15 + '\n' : dn_label

// dn_label := dn016[1] ? dn_label + t16 + '\n' : dn_label

// dn_label := dn017[1] ? dn_label + t17 + '\n' : dn_label

// dn_label := dn018[1] ? dn_label + t18 + '\n' : dn_label

// dn_label := dn019[1] ? dn_label + t19 + '\n' : dn_label

// dn_label := dn020[1] ? dn_label + t20 + '\n' : dn_label

// f_colorscr (_valscr ) =>

// _valscr ? #00000000 : na

// f_printscr (_txtscr ) =>

// var _lblscr = label(na),

// label.delete(_lblscr ),

// _lblscr := label.new(

// time + (time-time[1])*posX_scr ,

// ohlc4[posY_scr],

// _txtscr ,

// xloc.bar_time,

// yloc.price,

// f_colorscr ( showscr ),

// textcolor = showscr ? col : na,

// size = size.normal,

// style=label.style_label_center

// )

// f_printscr ( scr_label + '\n' + pot_label +'\n' + up_label + '\n' + dn_label)