Stratégie de tendance dynamique à moyennes mobiles multiples

Aperçu

La stratégie de tendance dynamique à multiples moyennes mobiles est une stratégie de trading quantitative qui utilise plusieurs indicateurs de moyennes mobiles pour déterminer la direction de la tendance et ajuster dynamiquement la position de la ligne de stop-loss. En combinant différents types de moyennes mobiles, la stratégie permet de juger plus complètement et avec plus de précision la tendance du marché et de réaliser des transactions à haut taux de victoire.

Principe de stratégie

La stratégie implémente principalement 8 types différents de moyennes mobiles via des fonctions personnalisées, y compris les moyennes mobiles simples (SMA), les moyennes mobiles indicielles (EMA), les moyennes mobiles pondérées (WMA), les moyennes mobiles triangulaires (TMA), les moyennes mobiles variables (VIDYA), les moyennes mobiles de Wilder (WWMA), les moyennes mobiles à retardement zéro (ZLEMA) et les moyennes mobiles de force réelle (TSF). La stratégie permet à l’utilisateur de choisir l’une de ces 8 moyennes mobiles comme indicateur principal de jugement.

La stratégie calcule d’abord la moyenne mobile du type sélectionné, puis calcule dynamiquement la position de la montée et de la descente des rails en fonction des paramètres de pourcentage définis. Elle sert de signal d’achat lorsque le prix atteint la montée et de signal de vente lorsqu’il atteint la descente. De plus, la stratégie suit la croisée de la moyenne mobile et du prix comme signal de jugement auxiliaire.

Dans le calcul, la stratégie détermine simultanément la direction de la tendance du marché, ce qui permet d’ajuster dynamiquement la position de la descente et de la descente. Plus précisément, lorsque la tendance est à la hausse, la descente augmente avec la hausse des prix, ce qui permet au stop-loss de suivre de manière optimale la hausse des prix.

Avantages stratégiques

- L’utilisation d’une combinaison de huit moyennes mobiles pour déterminer les tendances du marché est plus précise.

- Ajuster dynamiquement la position de la ligne de stop pour maximiser le profit et éviter le revers de stop;

- La croisée des moyennes mobiles et des prix comme signaux auxiliaires permet de filtrer les transactions erronées causées par les fausses percées.

- Les paramètres de la stratégie peuvent être personnalisés et optimisés pour différents environnements de marché.

Les risques et les solutions

- L’utilisation d’indicateurs multiples augmente la complexité de la stratégie et rend le débogage du code plus difficile.

- Certains types d’indicateurs de moyennes mobiles ne sont pas efficaces dans certaines conditions de marché;

- Le risque d’une transaction erronée est toujours présent.

La réponse:

- L’ajout de commentaires au code, l’amélioration de la lisibilité du code, la facilité de vérification et de débogage;

- Un module de sélection automatique peut également être ajouté pour sélectionner le type de moyenne mobile en fonction de la situation du marché.

- Optimisation des paramètres, combinée à des signaux de filtrage de plus d’indicateurs auxiliaires.

Orientation de l’optimisation de la stratégie

Il y a beaucoup de possibilités d’optimisation dans cette stratégie:

- Un module d’optimisation automatique des paramètres peut être ajouté pour ajuster automatiquement les paramètres en fonction de différents environnements de marché;

- Les modèles d’apprentissage automatique peuvent être ajoutés pour aider à déterminer la direction des tendances.

- Il est possible d’ajouter plus d’indicateurs auxiliaires de jugement, tels que l’indicateur émotionnel, pour améliorer la stabilité de la stratégie.

- L’optimisation des mécanismes d’arrêt des pertes pour un arrêt des pertes plus dynamique et plus précis;

- Les stratégies d’arbitrage peuvent être étendues à plusieurs variétés, en exploitant les différences de prix entre les variétés pour obtenir des opportunités d’arbitrage.

Résumer

La stratégie de tendance dynamique à multiples moyennes mobiles juge la tendance du marché en combinant plusieurs indicateurs de moyenne mobile et en émettant des instructions de négociation avec des signaux de rupture de prix, tout en ajustant dynamiquement la position de la ligne de stop-loss pour réaliser des gains efficaces. Cette stratégie intègre avec succès le suivi de la tendance, la rupture de la transaction et l’arrêt dynamique des trois principales stratégies de quantification.

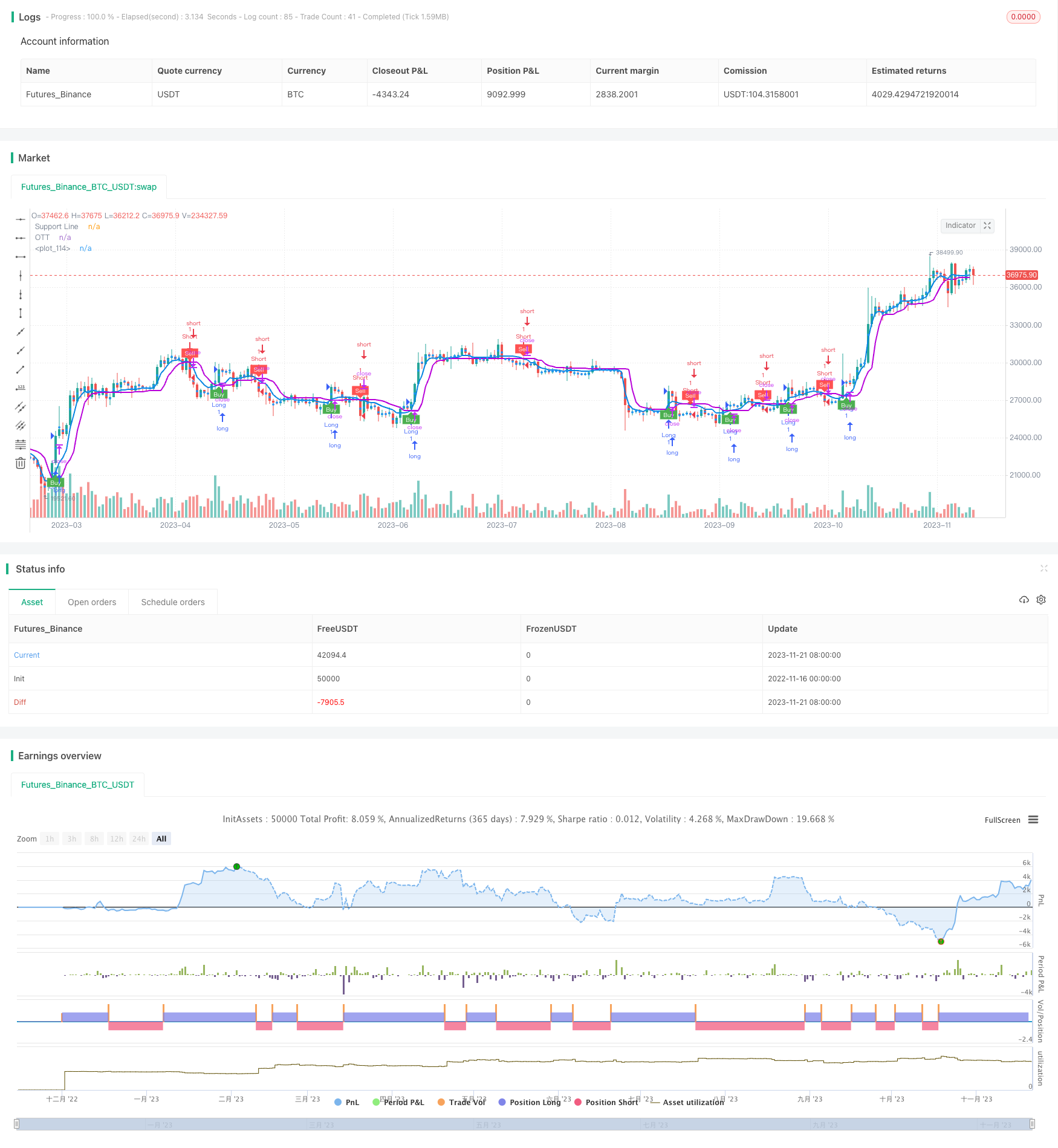

/*backtest

start: 2022-11-16 00:00:00

end: 2023-11-22 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © KivancOzbilgic

//created by: @Anil_Ozeksi

//developer: ANIL ÖZEKŞİ

//author: @kivancozbilgic

strategy("Optimized Trend Tracker","OTTEx", overlay=true)

src = input(close, title="Source")

length=input(2, "OTT Period", minval=1)

percent=input(1.4, "OTT Percent", type=input.float, step=0.1, minval=0)

showsupport = input(title="Show Support Line?", type=input.bool, defval=true)

showsignalsk = input(title="Show Support Line Crossing Signals?", type=input.bool, defval=true)

showsignalsc = input(title="Show Price/OTT Crossing Signals?", type=input.bool, defval=false)

highlight = input(title="Show OTT Color Changes?", type=input.bool, defval=false)

showsignalsr = input(title="Show OTT Color Change Signals?", type=input.bool, defval=false)

highlighting = input(title="Highlighter On/Off ?", type=input.bool, defval=true)

mav = input(title="Moving Average Type", defval="VAR", options=["SMA", "EMA", "WMA", "TMA", "VAR", "WWMA", "ZLEMA", "TSF"])

Var_Func(src,length)=>

valpha=2/(length+1)

vud1=src>src[1] ? src-src[1] : 0

vdd1=src<src[1] ? src[1]-src : 0

vUD=sum(vud1,9)

vDD=sum(vdd1,9)

vCMO=nz((vUD-vDD)/(vUD+vDD))

VAR=0.0

VAR:=nz(valpha*abs(vCMO)*src)+(1-valpha*abs(vCMO))*nz(VAR[1])

VAR=Var_Func(src,length)

Wwma_Func(src,length)=>

wwalpha = 1/ length

WWMA = 0.0

WWMA := wwalpha*src + (1-wwalpha)*nz(WWMA[1])

WWMA=Wwma_Func(src,length)

Zlema_Func(src,length)=>

zxLag = length/2==round(length/2) ? length/2 : (length - 1) / 2

zxEMAData = (src + (src - src[zxLag]))

ZLEMA = ema(zxEMAData, length)

ZLEMA=Zlema_Func(src,length)

Tsf_Func(src,length)=>

lrc = linreg(src, length, 0)

lrc1 = linreg(src,length,1)

lrs = (lrc-lrc1)

TSF = linreg(src, length, 0)+lrs

TSF=Tsf_Func(src,length)

getMA(src, length) =>

ma = 0.0

if mav == "SMA"

ma := sma(src, length)

ma

if mav == "EMA"

ma := ema(src, length)

ma

if mav == "WMA"

ma := wma(src, length)

ma

if mav == "TMA"

ma := sma(sma(src, ceil(length / 2)), floor(length / 2) + 1)

ma

if mav == "VAR"

ma := VAR

ma

if mav == "WWMA"

ma := WWMA

ma

if mav == "ZLEMA"

ma := ZLEMA

ma

if mav == "TSF"

ma := TSF

ma

ma

MAvg=getMA(src, length)

fark=MAvg*percent*0.01

longStop = MAvg - fark

longStopPrev = nz(longStop[1], longStop)

longStop := MAvg > longStopPrev ? max(longStop, longStopPrev) : longStop

shortStop = MAvg + fark

shortStopPrev = nz(shortStop[1], shortStop)

shortStop := MAvg < shortStopPrev ? min(shortStop, shortStopPrev) : shortStop

dir = 1

dir := nz(dir[1], dir)

dir := dir == -1 and MAvg > shortStopPrev ? 1 : dir == 1 and MAvg < longStopPrev ? -1 : dir

MT = dir==1 ? longStop: shortStop

OTT=MAvg>MT ? MT*(200+percent)/200 : MT*(200-percent)/200

plot(showsupport ? MAvg : na, color=#0585E1, linewidth=2, title="Support Line")

OTTC = highlight ? OTT[2] > OTT[3] ? color.green : color.red : #B800D9

pALL=plot(nz(OTT[2]), color=OTTC, linewidth=2, title="OTT", transp=0)

alertcondition(cross(OTT[2], OTT[3]), title="Color ALARM", message="OTT Has Changed Color!")

alertcondition(crossover(OTT[2], OTT[3]), title="GREEN ALERT", message="OTT GREEN BUY SIGNAL!")

alertcondition(crossunder(OTT[2], OTT[3]), title="RED ALERT", message="OTT RED SELL SIGNAL!")

alertcondition(cross(MAvg, OTT[2]), title="Cross Alert", message="OTT - Support Line Crossing!")

alertcondition(crossover(MAvg, OTT[2]), title="Crossover Alarm", message="Support Line BUY SIGNAL!")

alertcondition(crossunder(MAvg, OTT[2]), title="Crossunder Alarm", message="Support Line SELL SIGNAL!")

alertcondition(cross(src, OTT[2]), title="Price Cross Alert", message="OTT - Price Crossing!")

alertcondition(crossover(src, OTT[2]), title="Price Crossover Alarm", message="PRICE OVER OTT - BUY SIGNAL!")

alertcondition(crossunder(src, OTT[2]), title="Price Crossunder Alarm", message="PRICE UNDER OTT - SELL SIGNAL!")

buySignalk = crossover(MAvg, OTT[2])

plotshape(buySignalk and showsignalsk ? OTT*0.995 : na, title="Buy", text="Buy", location=location.absolute, style=shape.labelup, size=size.tiny, color=color.green, textcolor=color.white, transp=0)

sellSignallk = crossunder(MAvg, OTT[2])

plotshape(sellSignallk and showsignalsk ? OTT*1.005 : na, title="Sell", text="Sell", location=location.absolute, style=shape.labeldown, size=size.tiny, color=color.red, textcolor=color.white, transp=0)

buySignalc = crossover(src, OTT[2])

plotshape(buySignalc and showsignalsc ? OTT*0.995 : na, title="Buy", text="Buy", location=location.absolute, style=shape.labelup, size=size.tiny, color=color.green, textcolor=color.white, transp=0)

sellSignallc = crossunder(src, OTT[2])

plotshape(sellSignallc and showsignalsc ? OTT*1.005 : na, title="Sell", text="Sell", location=location.absolute, style=shape.labeldown, size=size.tiny, color=color.red, textcolor=color.white, transp=0)

mPlot = plot(ohlc4, title="", style=plot.style_circles, linewidth=0,display=display.none)

longFillColor = highlighting ? (MAvg>OTT ? color.green : na) : na

shortFillColor = highlighting ? (MAvg<OTT ? color.red : na) : na

fill(mPlot, pALL, title="UpTrend Highligter", color=longFillColor)

fill(mPlot, pALL, title="DownTrend Highligter", color=shortFillColor)

buySignalr = crossover(OTT[2], OTT[3])

plotshape(buySignalr and showsignalsr ? OTT*0.995 : na, title="Buy", text="Buy", location=location.absolute, style=shape.labelup, size=size.tiny, color=color.green, textcolor=color.white, transp=0)

sellSignallr = crossunder(OTT[2], OTT[3])

plotshape(sellSignallr and showsignalsr ? OTT*1.005 : na, title="Sell", text="Sell", location=location.absolute, style=shape.labeldown, size=size.tiny, color=color.red, textcolor=color.white, transp=0)

showscr = input(true, title="Show Screener Label")

posX_scr = input(20, title="Pos. Label x-axis")

posY_scr = input(1, title="Pos. Size Label y-axis")

colinput = input(title="Label Color", defval="Blue", options=["White", "Black", "Red", "Green", "Yellow", "Blue"])

col = color.gray

if colinput=="White"

col:=color.white

if colinput=="Black"

col:=color.black

if colinput=="Red"

col:=color.red

if colinput=="Green"

col:=color.green

if colinput=="Yellow"

col:=color.yellow

if colinput=="Blue"

col:=color.blue

dummy0 = input(true, title = "=Backtest Inputs=")

FromDay = input(defval = 1, title = "From Day", minval = 1, maxval = 31)

FromMonth = input(defval = 1, title = "From Month", minval = 1, maxval = 12)

FromYear = input(defval = 2005, title = "From Year", minval = 2005)

ToDay = input(defval = 1, title = "To Day", minval = 1, maxval = 31)

ToMonth = input(defval = 1, title = "To Month", minval = 1, maxval = 12)

ToYear = input(defval = 9999, title = "To Year", minval = 2006)

Start = timestamp(FromYear, FromMonth, FromDay, 00, 00)

Finish = timestamp(ToYear, ToMonth, ToDay, 23, 59)

Timerange() => true

if buySignalk

strategy.entry("Long", strategy.long,when=Timerange())

if sellSignallk

strategy.entry("Short", strategy.short,when=Timerange())

// t1=input('EURUSD', title='Symbol 01',type=input.symbol)

// t2=input('XAUUSD', title='Symbol 02',type=input.symbol)

// t3=input('AMZN', title='Symbol 03',type=input.symbol)

// t4=input('TSLA', title='Symbol 04',type=input.symbol)

// t5=input('BTCUSDT', title='Symbol 05',type=input.symbol)

// t6=input('ETHBTC', title='Symbol 06',type=input.symbol)

// t7=input('XBTUSD', title='Symbol 07',type=input.symbol)

// t8=input('XRPBTC', title='Symbol 08',type=input.symbol)

// t9=input('THYAO', title='Symbol 09',type=input.symbol)

// t10=input('GARAN', title='Symbol 10',type=input.symbol)

// t11=input('', title='Symbol 11',type=input.symbol)

// t12=input('', title='Symbol 12',type=input.symbol)

// t13=input('', title='Symbol 13',type=input.symbol)

// t14=input('', title='Symbol 14',type=input.symbol)

// t15=input('', title='Symbol 15',type=input.symbol)

// t16=input('', title='Symbol 16',type=input.symbol)

// t17=input('', title='Symbol 17',type=input.symbol)

// t18=input('', title='Symbol 18',type=input.symbol)

// t19=input('', title='Symbol 19',type=input.symbol)

// t20=input('', title='Symbol 20',type=input.symbol)

// OTTs(percent, length) =>

// Up=MAvg-MAvg*percent*0.01

// Dn=MAvg+MAvg*percent*0.01

// TrendUp = 0.0

// TrendUp := MAvg[1]>TrendUp[1] ? max(Up,TrendUp[1]) : Up

// TrendDown = 0.0

// TrendDown := MAvg[1]<TrendDown[1]? min(Dn,TrendDown[1]) : Dn

// Trend = 0.0

// Trend := MAvg > TrendDown[1] ? 1: MAvg< TrendUp[1]? -1: nz(Trend[1],1)

// Tsl = Trend==1? TrendUp: TrendDown

// S_Buy = Trend == 1 ? 1 : 0

// S_Sell = Trend != 1 ? 1 : 0

// [Trend, Tsl]

// [Trend, Tsl] = OTTs(percent, length)

// TrendReversal = Trend != Trend[1]

// [t01, s01] = security(t1, timeframe.period, OTTs(percent, length))

// [t02, s02] = security(t2, timeframe.period, OTTs(percent, length))

// [t03, s03] = security(t3, timeframe.period, OTTs(percent, length))

// [t04, s04] = security(t4, timeframe.period, OTTs(percent, length))

// [t05, s05] = security(t5, timeframe.period, OTTs(percent, length))

// [t06, s06] = security(t6, timeframe.period, OTTs(percent, length))

// [t07, s07] = security(t7, timeframe.period, OTTs(percent, length))

// [t08, s08] = security(t8, timeframe.period, OTTs(percent, length))

// [t09, s09] = security(t9, timeframe.period, OTTs(percent, length))

// [t010, s010] = security(t10, timeframe.period, OTTs(percent, length))

// [t011, s011] = security(t11, timeframe.period, OTTs(percent, length))

// [t012, s012] = security(t12, timeframe.period, OTTs(percent, length))

// [t013, s013] = security(t13, timeframe.period, OTTs(percent, length))

// [t014, s014] = security(t14, timeframe.period, OTTs(percent, length))

// [t015, s015] = security(t15, timeframe.period, OTTs(percent, length))

// [t016, s016] = security(t16, timeframe.period, OTTs(percent, length))

// [t017, s017] = security(t17, timeframe.period, OTTs(percent, length))

// [t018, s018] = security(t18, timeframe.period, OTTs(percent, length))

// [t019, s019] = security(t19, timeframe.period, OTTs(percent, length))

// [t020, s020] = security(t20, timeframe.period, OTTs(percent, length))

// tr01 = t01 != t01[1], up01 = t01 == 1, dn01 = t01 == -1

// tr02 = t02 != t02[1], up02 = t02 == 1, dn02 = t02 == -1

// tr03 = t03 != t03[1], up03 = t03 == 1, dn03 = t03 == -1

// tr04 = t04 != t04[1], up04 = t04 == 1, dn04 = t04 == -1

// tr05 = t05 != t05[1], up05 = t05 == 1, dn05 = t05 == -1

// tr06 = t06 != t06[1], up06 = t06 == 1, dn06 = t06 == -1

// tr07 = t07 != t07[1], up07 = t07 == 1, dn07 = t07 == -1

// tr08 = t08 != t08[1], up08 = t08 == 1, dn08 = t08 == -1

// tr09 = t09 != t09[1], up09 = t09 == 1, dn09 = t09 == -1

// tr010 = t010 != t010[1], up010 = t010 == 1, dn010 = t010 == -1

// tr011 = t011 != t011[1], up011 = t011 == 1, dn011 = t011 == -1

// tr012 = t012 != t012[1], up012 = t012 == 1, dn012 = t012 == -1

// tr013 = t013 != t013[1], up013 = t013 == 1, dn013 = t013 == -1

// tr014 = t014 != t014[1], up014 = t014 == 1, dn014 = t014 == -1

// tr015 = t015 != t015[1], up015 = t015 == 1, dn015 = t015 == -1

// tr016 = t016 != t016[1], up016 = t016 == 1, dn016 = t016 == -1

// tr017 = t017 != t017[1], up017 = t017 == 1, dn017 = t017 == -1

// tr018 = t018 != t018[1], up018 = t018 == 1, dn018 = t018 == -1

// tr019 = t019 != t019[1], up019 = t019 == 1, dn019 = t019 == -1

// tr020 = t020 != t020[1], up020 = t020 == 1, dn020 = t020 == -1

// pot_label = 'Potential Reversal: \n'

// pot_label := tr01 ? pot_label + t1 + '\n' : pot_label

// pot_label := tr02 ? pot_label + t2 + '\n' : pot_label

// pot_label := tr03 ? pot_label + t3 + '\n' : pot_label

// pot_label := tr04 ? pot_label + t4 + '\n' : pot_label

// pot_label := tr05 ? pot_label + t5 + '\n' : pot_label

// pot_label := tr06 ? pot_label + t6 + '\n' : pot_label

// pot_label := tr07 ? pot_label + t7 + '\n' : pot_label

// pot_label := tr08 ? pot_label + t8 + '\n' : pot_label

// pot_label := tr09 ? pot_label + t9 + '\n' : pot_label

// pot_label := tr010 ? pot_label + t10 + '\n' : pot_label

// pot_label := tr011 ? pot_label + t11 + '\n' : pot_label

// pot_label := tr012 ? pot_label + t12 + '\n' : pot_label

// pot_label := tr013 ? pot_label + t13 + '\n' : pot_label

// pot_label := tr014 ? pot_label + t14 + '\n' : pot_label

// pot_label := tr015 ? pot_label + t15 + '\n' : pot_label

// pot_label := tr016 ? pot_label + t16 + '\n' : pot_label

// pot_label := tr017 ? pot_label + t17 + '\n' : pot_label

// pot_label := tr018 ? pot_label + t18 + '\n' : pot_label

// pot_label := tr019 ? pot_label + t19 + '\n' : pot_label

// pot_label := tr020 ? pot_label + t20 + '\n' : pot_label

// scr_label = 'Confirmed Reversal: \n'

// scr_label := tr01[1] ? scr_label + t1 + '\n' : scr_label

// scr_label := tr02[1] ? scr_label + t2 + '\n' : scr_label

// scr_label := tr03[1] ? scr_label + t3 + '\n' : scr_label

// scr_label := tr04[1] ? scr_label + t4 + '\n' : scr_label

// scr_label := tr05[1] ? scr_label + t5 + '\n' : scr_label

// scr_label := tr06[1] ? scr_label + t6 + '\n' : scr_label

// scr_label := tr07[1] ? scr_label + t7 + '\n' : scr_label

// scr_label := tr08[1] ? scr_label + t8 + '\n' : scr_label

// scr_label := tr09[1] ? scr_label + t9 + '\n' : scr_label

// scr_label := tr010[1] ? scr_label + t10 + '\n' : scr_label

// scr_label := tr011[1] ? scr_label + t11 + '\n' : scr_label

// scr_label := tr012[1] ? scr_label + t12 + '\n' : scr_label

// scr_label := tr013[1] ? scr_label + t13 + '\n' : scr_label

// scr_label := tr014[1] ? scr_label + t14 + '\n' : scr_label

// scr_label := tr015[1] ? scr_label + t15 + '\n' : scr_label

// scr_label := tr016[1] ? scr_label + t16 + '\n' : scr_label

// scr_label := tr017[1] ? scr_label + t17 + '\n' : scr_label

// scr_label := tr018[1] ? scr_label + t18 + '\n' : scr_label

// scr_label := tr019[1] ? scr_label + t19 + '\n' : scr_label

// scr_label := tr020[1] ? scr_label + t20 + '\n' : scr_label

// up_label = 'Uptrend: \n'

// up_label := up01[1] ? up_label + t1 + '\n' : up_label

// up_label := up02[1] ? up_label + t2 + '\n' : up_label

// up_label := up03[1] ? up_label + t3 + '\n' : up_label

// up_label := up04[1] ? up_label + t4 + '\n' : up_label

// up_label := up05[1] ? up_label + t5 + '\n' : up_label

// up_label := up06[1] ? up_label + t6 + '\n' : up_label

// up_label := up07[1] ? up_label + t7 + '\n' : up_label

// up_label := up08[1] ? up_label + t8 + '\n' : up_label

// up_label := up09[1] ? up_label + t9 + '\n' : up_label

// up_label := up010[1] ? up_label + t10 + '\n' : up_label

// up_label := up011[1] ? up_label + t11 + '\n' : up_label

// up_label := up012[1] ? up_label + t12 + '\n' : up_label

// up_label := up013[1] ? up_label + t13 + '\n' : up_label

// up_label := up014[1] ? up_label + t14 + '\n' : up_label

// up_label := up015[1] ? up_label + t15 + '\n' : up_label

// up_label := up016[1] ? up_label + t16 + '\n' : up_label

// up_label := up017[1] ? up_label + t17 + '\n' : up_label

// up_label := up018[1] ? up_label + t18 + '\n' : up_label

// up_label := up019[1] ? up_label + t19 + '\n' : up_label

// up_label := up020[1] ? up_label + t20 + '\n' : up_label

// dn_label = 'Downtrend: \n'

// dn_label := dn01[1] ? dn_label + t1 + '\n' : dn_label

// dn_label := dn02[1] ? dn_label + t2 + '\n' : dn_label

// dn_label := dn03[1] ? dn_label + t3 + '\n' : dn_label

// dn_label := dn04[1] ? dn_label + t4 + '\n' : dn_label

// dn_label := dn05[1] ? dn_label + t5 + '\n' : dn_label

// dn_label := dn06[1] ? dn_label + t6 + '\n' : dn_label

// dn_label := dn07[1] ? dn_label + t7 + '\n' : dn_label

// dn_label := dn08[1] ? dn_label + t8 + '\n' : dn_label

// dn_label := dn09[1] ? dn_label + t9 + '\n' : dn_label

// dn_label := dn010[1] ? dn_label + t10 + '\n' : dn_label

// dn_label := dn011[1] ? dn_label + t11 + '\n' : dn_label

// dn_label := dn012[1] ? dn_label + t12 + '\n' : dn_label

// dn_label := dn013[1] ? dn_label + t13 + '\n' : dn_label

// dn_label := dn014[1] ? dn_label + t14 + '\n' : dn_label

// dn_label := dn015[1] ? dn_label + t15 + '\n' : dn_label

// dn_label := dn016[1] ? dn_label + t16 + '\n' : dn_label

// dn_label := dn017[1] ? dn_label + t17 + '\n' : dn_label

// dn_label := dn018[1] ? dn_label + t18 + '\n' : dn_label

// dn_label := dn019[1] ? dn_label + t19 + '\n' : dn_label

// dn_label := dn020[1] ? dn_label + t20 + '\n' : dn_label

// f_colorscr (_valscr ) =>

// _valscr ? #00000000 : na

// f_printscr (_txtscr ) =>

// var _lblscr = label(na),

// label.delete(_lblscr ),

// _lblscr := label.new(

// time + (time-time[1])*posX_scr ,

// ohlc4[posY_scr],

// _txtscr ,

// xloc.bar_time,

// yloc.price,

// f_colorscr ( showscr ),

// textcolor = showscr ? col : na,

// size = size.normal,

// style=label.style_label_center

// )

// f_printscr ( scr_label + '\n' + pot_label +'\n' + up_label + '\n' + dn_label)