Strategi mengikuti tren osilator pembalikan ganda

Ringkasan

Strategi pelacakan tren dengan kombinasi sinyal reversal ganda dan indikator bands reversal. Strategi ini pertama-tama menggunakan sistem 123 reversal untuk menghasilkan sinyal reversal, dan kemudian menggabungkan indikator Fractal Chaos Bands untuk memfilter sinyal, untuk melakukan pelacakan tren. Strategi ini dapat mengidentifikasi peluang reversal dan melacak tren, merupakan strategi perdagangan yang sangat komprehensif.

Prinsip Strategi

123 sistem reversal

123 Reverse System berasal dari Ulf Jensen’s How I Get Three-Fold Income in the Futures Market pada halaman 183. Sinyal tradingnya adalah:

Ketika harga penutupan 2 hari berturut-turut lebih tinggi dari harga penutupan hari sebelumnya, dan pada hari ke-9 garis Slow K lebih rendah dari 50, lakukan over; ketika harga penutupan 2 hari berturut-turut lebih rendah dari harga penutupan hari sebelumnya, dan pada hari ke-9 garis Fast K lebih tinggi dari 50, lakukan over.

Bagian ini terutama menggunakan indikator Stochastic oscillator untuk menghasilkan sinyal di area overbought dan oversold. Strategi bullish diambil ketika saham terus naik tetapi indikator Stochastic oscillator menunjukkan masih ada lebih banyak ruang untuk naik. Strategi bearish diambil ketika saham terus turun tetapi indikator Stochastic oscillator menunjukkan masih ada lebih banyak ruang untuk turun.

Indikator Fractal Chaos Bands

Indikator Fractal Chaos Bands menilai tren pasar dengan memetakan titik tertinggi dan terendah dari harga saham, membentuk lintasan atas dan bawah. Aturan spesifik adalah:

Ketika harga naik, lakukan lebih banyak; ketika harga turun, lakukan lebih sedikit.

Bagian ini terutama digunakan sebagai filter tren, yang digunakan dalam kombinasi dengan 123 sinyal pembalikan. Posisi dibuka hanya jika kedua sinyal sesuai.

Keunggulan Strategis

- Mengambil Kesempatan dari Perpindahan dan Tren

Strategi pelacakan tren dual reverse oscillating band dapat menangkap peluang reversal dan dapat melacak tren, sangat komprehensif. Anda dapat memperoleh sinyal perdagangan terlepas dari apakah pasar berada dalam keadaan goyah atau tren.

- Mengurangi sinyal palsu, meningkatkan peluang menang

Dibandingkan dengan indikator tunggal, strategi ini dapat mengurangi sinyal palsu secara signifikan dengan kombinasi penyaringan dari indikator ganda, meningkatkan kemenangan dan tingkat keuntungan dari perdagangan yang sebenarnya.

- Fleksibel dan Adaptif dalam Pengaturan Parameter

Parameter strategi pelacakan tren zona getaran reversal ganda dipahami dengan baik, pengguna dapat menyesuaikan sesuai dengan kebutuhan mereka sendiri dan lingkungan pasar, sangat fleksibel. Baik pasar getaran atau pasar tren, dapat disesuaikan dengan parameter.

Risiko dan optimasi

- Tidak bisa beradaptasi dengan tren besar

Strategi itu sendiri lebih bergantung pada peluang perdagangan dalam garis pendek. Dalam tren pasar yang besar, strategi ini mungkin menghasilkan terlalu banyak sinyal reversal dan menghentikan kerugian. Ini dapat dioptimalkan dengan penyesuaian parameter.

- Membutuhkan Dukungan Keuangan Marginal

Strategi pelacakan tren zona reversal oscillator ganda adalah jenis perdagangan yang sering terjadi, yang membutuhkan cukup margin untuk mendukung kebutuhan untuk membuka sekuritas. Untuk pengguna yang tidak memiliki cukup dana, mungkin perlu mengurangi posisi dengan tepat.

- Filter untuk lebih banyak indikator

Strategi ini dapat di atas dasar yang ada, memperkenalkan lebih banyak jenis indikator untuk memperkaya sumber sinyal dan meningkatkan stabilitas strategi. Sebagai tambahan indikator energi kuantitatif, indikator volatilitas dan lain-lain untuk memeriksa sinyal reversal dan tren.

Meringkaskan

Strategi pelacakan tren dual reverse oscillating band berhasil menggabungkan keunggulan perdagangan reverse dan pelacakan tren, dapat menangkap reverse dan mengikuti tren, sangat komprehensif dan efisien. Dibandingkan dengan indikator tunggal, ini dapat mengurangi sinyal palsu secara signifikan, meningkatkan tingkat kemenangan dan tingkat keuntungan dari perdagangan aktual. Selain itu, parameter strategi ini fleksibel untuk disesuaikan, dan pengguna dapat mengoptimalkannya sesuai dengan gaya dan lingkungan pasar mereka sendiri.

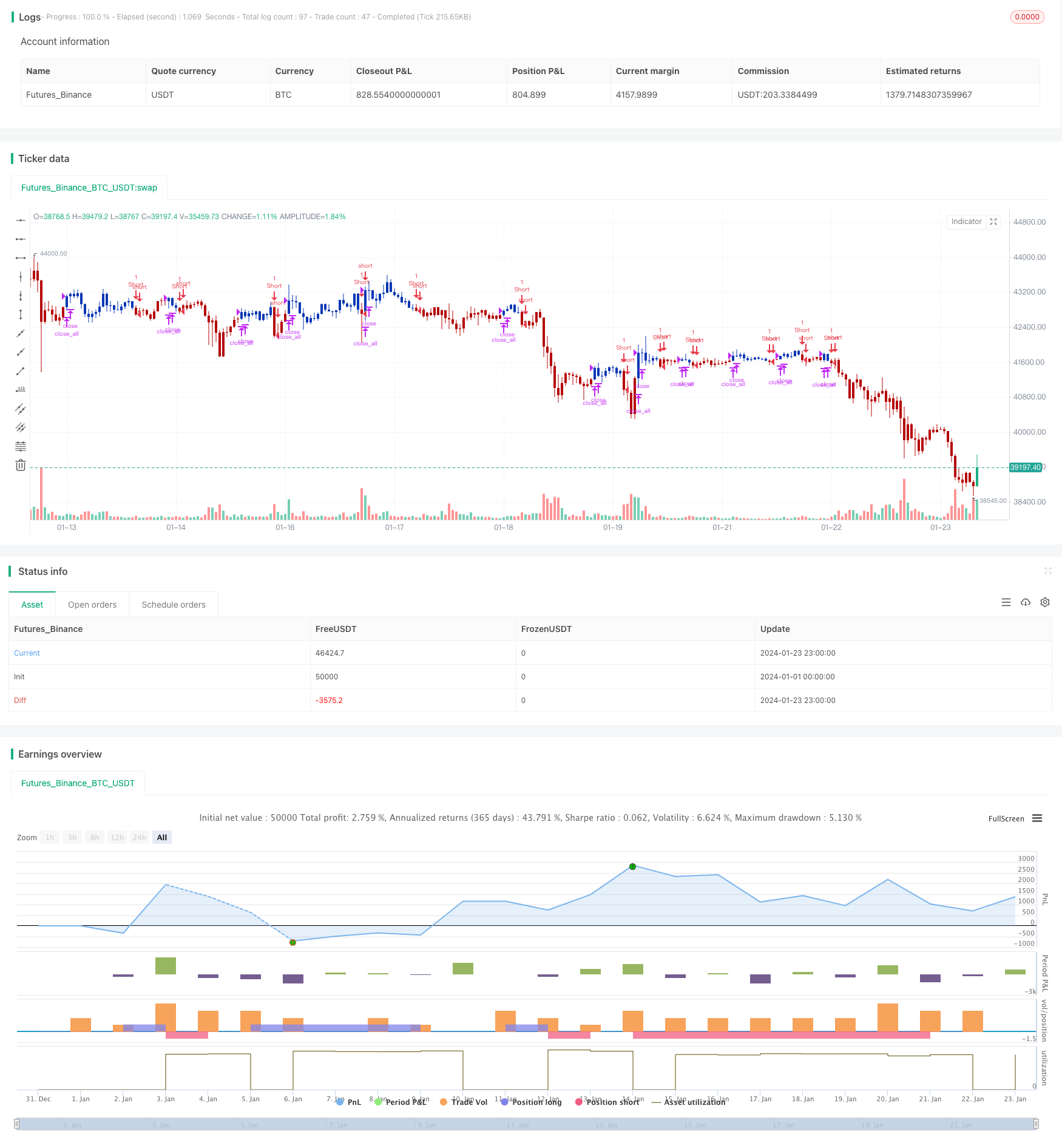

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-24 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 21/09/2020

// This is combo strategies for get a cumulative signal.

//

// First strategy

// This System was created from the Book "How I Tripled My Money In The

// Futures Market" by Ulf Jensen, Page 183. This is reverse type of strategies.

// The strategy buys at market, if close price is higher than the previous close

// during 2 days and the meaning of 9-days Stochastic Slow Oscillator is lower than 50.

// The strategy sells at market, if close price is lower than the previous close price

// during 2 days and the meaning of 9-days Stochastic Fast Oscillator is higher than 50.

//

// Second strategy

// Stock market moves in a highly chaotic way, but at a larger scale, the movements

// follow a certain pattern that can be applied to shorter or longer periods of time

// and we can use Fractal Chaos Bands Indicator to identify those patterns. Basically,

// the Fractal Chaos Bands Indicator helps us to identify whether the stock market is

// trending or not. When a market is trending, the bands will have a slope and if market

// is not trending the bands will flatten out. As the slope of the bands decreases, it

// signifies that the market is choppy, insecure and variable. As the graph becomes more

// and more abrupt, be it going up or down, the significance is that the market becomes

// trendy, or stable. Fractal Chaos Bands Indicator is used similarly to other bands-indicator

// (Bollinger bands for instance), offering trading opportunities when price moves above or

// under the fractal lines.

//

// The FCB indicator looks back in time depending on the number of time periods trader selected

// to plot the indicator. The upper fractal line is made by plotting stock price highs and the

// lower fractal line is made by plotting stock price lows. Essentially, the Fractal Chaos Bands

// show an overall panorama of the price movement, as they filter out the insignificant fluctuations

// of the stock price.

//

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

Reversal123(Length, KSmoothing, DLength, Level) =>

vFast = sma(stoch(close, high, low, Length), KSmoothing)

vSlow = sma(vFast, DLength)

pos = 0.0

pos := iff(close[2] < close[1] and close > close[1] and vFast < vSlow and vFast > Level, 1,

iff(close[2] > close[1] and close < close[1] and vFast > vSlow and vFast < Level, -1, nz(pos[1], 0)))

pos

fractalUp(pattern) =>

p = high[pattern+1]

okl = 1

okr = 1

res = 0.0

for i = pattern to 1

okl := iff(high[i] < high[i+1] and okl == 1 , 1, 0)

for i = pattern+2 to pattern*2+1

okr := iff(high[i] < high[i-1] and okr == 1, 1, 0)

res := iff(okl == 1 and okr == 1, p, res[1])

res

fractalDn(pattern) =>

p = low[pattern+1]

okl = 1

okr = 1

res =0.0

for i = pattern to 1

okl := iff(low[i] > low[i+1] and okl == 1 , 1, 0)

for i = pattern+2 to pattern*2+1

okr := iff(low[i] > low[i-1] and okr == 1, 1, 0)

res := iff(okl == 1 and okr == 1, p, res[1])

res

FCB(Pattern) =>

pos = 0.0

xUpper = fractalUp(Pattern)

xLower = fractalDn(Pattern)

pos := iff(close > xUpper, 1,

iff(close < xLower, -1, nz(pos[1], 0)))

pos

strategy(title="Combo Backtest 123 Reversal & Fractal Chaos Bands", shorttitle="Combo", overlay = true)

Length = input(15, minval=1)

KSmoothing = input(1, minval=1)

DLength = input(3, minval=1)

Level = input(50, minval=1)

//-------------------------

Pattern = input(1, minval=1)

reverse = input(false, title="Trade reverse")

posReversal123 = Reversal123(Length, KSmoothing, DLength, Level)

posFCB = FCB(Pattern)

pos = iff(posReversal123 == 1 and posFCB == 1 , 1,

iff(posReversal123 == -1 and posFCB == -1, -1, 0))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1 , 1, pos))

if (possig == 1)

strategy.entry("Long", strategy.long)

if (possig == -1)

strategy.entry("Short", strategy.short)

if (possig == 0)

strategy.close_all()

barcolor(possig == -1 ? #b50404: possig == 1 ? #079605 : #0536b3 )