ダイナミックトレーリングストップロス戦略

概要

この戦略は,急速な移動平均と遅い移動平均の交差を計算してトレンドを判断し,高速な移動平均の上で遅い移動平均を横切るときに多めに行い,動的に追跡されるストップ・ローンを設定して利益をロックし,価格の変化の一定比率でストップ・ロスを退出する.

戦略原則

この戦略は,多頭トレンドの開始を判断するために,高速移動平均と遅い移動平均の金叉を使用する.具体的には,特定の周期内の閉店価格の単純な移動平均を計算し,高速移動平均と遅い移動平均の値を比較し,高速移動平均の上で遅い移動平均を横断すると,多頭トレンドの開始と判断し,この時点でポジションを多にする.

ポジションを多めに開いた後,戦略は固定ストップを設定するのではなく,動的に追跡されたストップラインを使用して利益をロックします.このストップラインの設定方法は:最高価格*(1- 設定されたストップ・損失のパーセント) ⇒ ストップ・損失線が価格上昇に伴い上昇し,一定の割合で下落するとストップ・損失が退出する.

この方法の利点は,無限の追及が可能であり,利益が一定のレベルに達した後に,ストップ・ロスを通して利益をロックすることができることである.

優位分析

ストップ・ローズ・ストラテジーの主な利点は,

無限の追及が可能で,大きな取引を逃さない.固定ストップを使用すると,大きな取引の開始後に簡単に損失が止まります.

止損率を設定して利益をロックする. 止損率を設定して利益をロックする. 止損率を設定して利益をロックする.

固定ストップよりも柔軟である. 固定ストップは1つの価格しか設定できないが,ここでのストップは最高価格に応じて変化する.

撤回リスクは小さい。固定ストップを使用すると,ストップ価格は最高価格から大きいので,通常のリコールではストップされる可能性がある。ここでのストップは最高価格から近いので,通常のリコールではストップされない。

リスク分析

この戦略にはいくつかのリスクがあります.

入口信号の指標が不安定で,誤信号が生じる可能性がある.

市場が急激に大きく変化して,戦略が失敗する可能性がある.

止損制限なし,止損に依存する.止損が効かなければ,大きな損失を引き起こす可能性がある.

データ設定は最適化が必要である.移動平均周期などのパラメータは最適化が必要である.

最適化の方向

この戦略は,以下の点で最適化できます.

また,入場確認の指標を追加し,誤った信号を回避します.

止まる設定を追加する. 利益の一定比率に達すると止まる.

市場異常が発生したときにストップ距離を大幅に調整する.

取引品種,取引時間などに最適化調整を行う.異なる品種と取引時間のパラメータに調整が必要である.

機械学習を追加してパラメータを動的に調整する.モデルが判断指数とストップダスの幅を自動的に最適化できるようにする.

要約する

この戦略の全体的な考え方は明確で合理的であり,快慢平均線判断トレンドを使用することはより古典的な方法であり,ダイナミック・トラッキング・ストップ・ロスを採用することで,利益を効果的にロックし,リスクを低減することができる.しかし,これらの指標およびパラメータは,戦略を安定して収益性のあるものにするために,継続的にテストおよび最適化する必要がある.同時に,市場の大きな変化が戦略に影響を防ぐことも必要です.これは,全体的な考え方と枠組みを完善し,セキュリティメカニズムを増やすことによって実現する必要があります.

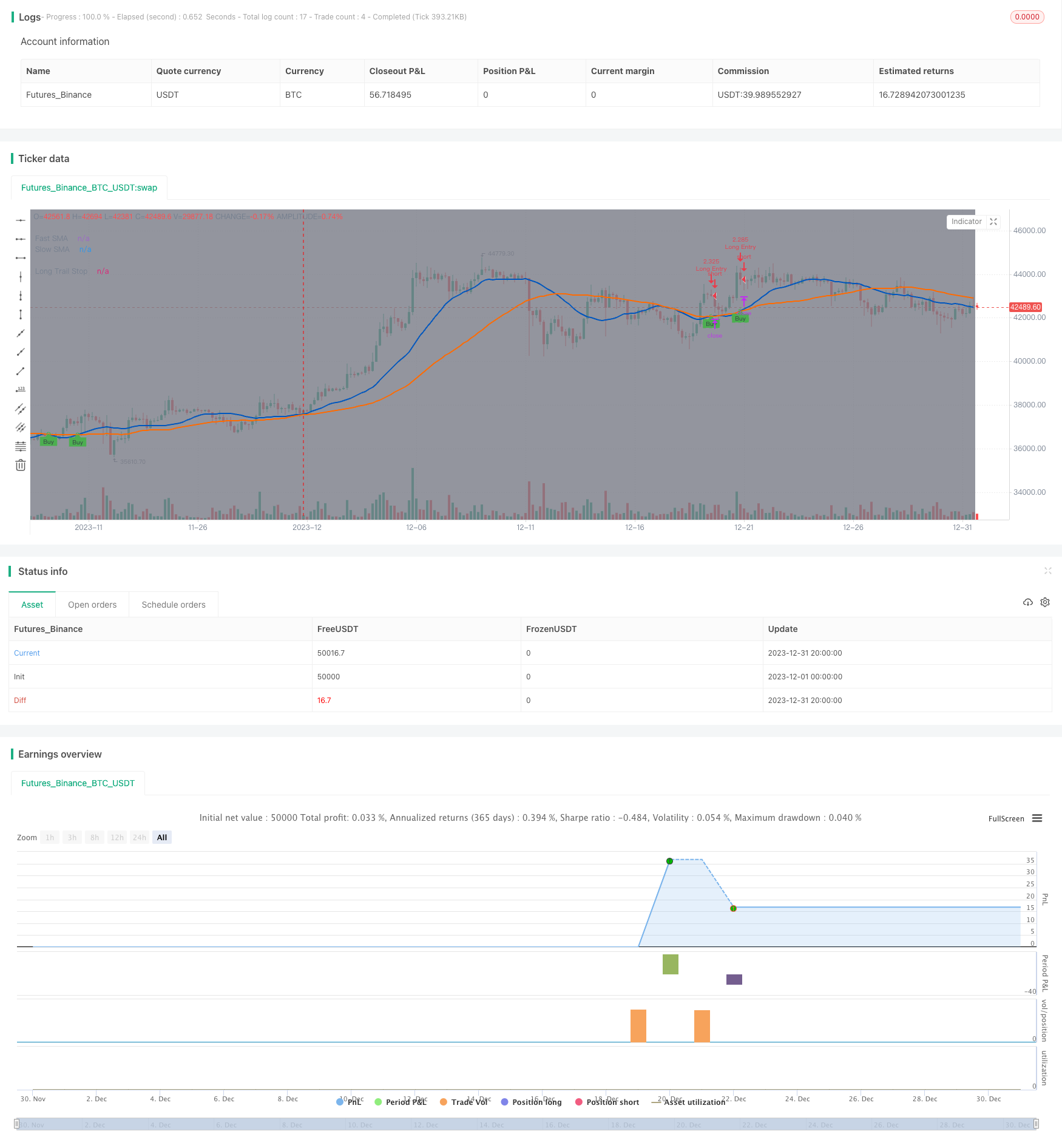

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 4h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

//

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒

// -----------------------------------------------------------------------------

// Copyright 2021 Iason Nikolas | jason5480

// Trainiling Take Profit Trailing Stop Loss script may be freely distributed under the MIT license.

//

// Permission is hereby granted, free of charge,

// to any person obtaining a copy of this software and associated documentation files (the "Software"),

// to deal in the Software without restriction, including without limitation the rights to use, copy, modify, merge,

// publish, distribute, sublicense, and/or sell copies of the Software, and to permit persons to whom the Software is furnished to do so,

// subject to the following conditions:

//

// The above copyright notice and this permission notice shall be included in all copies or substantial portions of the Software.

//

// THE SOFTWARE IS PROVIDED "AS IS", WITHOUT WARRANTY OF ANY KIND,

// EXPRESS OR IMPLIED, INCLUDING BUT NOT LIMITED TO THE WARRANTIES OF MERCHANTABILITY,

// FITNESS FOR A PARTICULAR PURPOSE AND NONINFRINGEMENT. IN NO EVENT SHALL THE AUTHORS OR COPYRIGHT HOLDERS BE LIABLE FOR ANY CLAIM,

// DAMAGES OR OTHER LIABILITY, WHETHER IN AN ACTION OF CONTRACT, TORT OR OTHERWISE, ARISING FROM,

// OUT OF OR IN CONNECTION WITH THE SOFTWARE OR THE USE OR OTHER DEALINGS IN THE SOFTWARE.

//

// -----------------------------------------------------------------------------

//

// Authors: @jason5480

// Revision: v1.0.0

// Date: 05-May-2021

//

// Description

// =============================================================================

// This strategy will go long if fast MA crosses over slow MA.

// The strategy will exit from long position when the price increases by a fixed percentage.

// If the trailing take profit is checked then the strategy instead of setting a limit order in a predefined price (based on the percentage)

// it will follow the price with small steps (percentagewise)

// If the price drops by this percentage then the exit order will be executed

//

// The strategy has the following parameters:

//

// Fast SMA Length - How many candles back to calculte the fast SMA.

// Slow SMA Length - How many candles back to calculte the slow SMA.

// Enable Trailing - Enable or disable the trailing.

// Stop Loss % - The percentage of the price decrease to set the stop loss price target for long positions.

//

// -----------------------------------------------------------------------------

// Disclaimer:

// 1. I am not licensed financial advisors or broker dealer. I do not tell you

// when or what to buy or sell. I developed this software which enables you

// execute manual or automated trades using TradingView. The

// software allows you to set the criteria you want for entering and exiting

// trades.

// 2. Do not trade with money you cannot afford to lose.

// 3. I do not guarantee consistent profits or that anyone can make money with no

// effort. And I am not selling the holy grail.

// 4. Every system can have winning and losing streaks.

// 5. Money management plays a large role in the results of your trading. For

// example: lot size, account size, broker leverage, and broker margin call

// rules all have an effect on results. Also, your Take Profit and Stop Loss

// settings for individual pair trades and for overall account equity have a

// major impact on results. If you are new to trading and do not understand

// these items, then I recommend you seek education materials to further your

// knowledge.

//

// YOU NEED TO FIND AND USE THE TRADING SYSTEM THAT WORKS BEST FOR YOU AND YOUR

// TRADING TOLERANCE.

//

// I HAVE PROVIDED NOTHING MORE THAN A TOOL WITH OPTIONS FOR YOU TO TRADE WITH THIS PROGRAM ON TRADINGVIEW.

//

// I accept suggestions to improve the script.

// If you encounter any problems I will be happy to share with me.

// -----------------------------------------------------------------------------

//

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒

// SETUP ============================================================================================================

strategy(title = "Trailing Stop Loss",

shorttitle = "TSL",

overlay = true,

pyramiding = 0,

calc_on_every_tick = true,

default_qty_type = strategy.cash,

default_qty_value = 100000,

initial_capital = 100000)

//

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒

// INPUTS ===========================================================================================================

// STRATEGY INPUT ===================================================================================================

fastMALen = input(defval = 21, title = "Fast SMA Length", type = input.integer, group = "Strategy", tooltip = "How many candles back to calculte the fast SMA.")

slowMALen = input(defval = 49, title = "Slow SMA Length", type = input.integer, group = "Strategy", tooltip = "How many candles back to calculte the slow SMA.")

enableStopLossTrailing = input(defval = true, title = "Enable Trailing", type = input.bool, group = "Strategy", tooltip = "Enable or disable the trailing for stop loss.")

longTrailingStopLossPerc = input(defval = 7.5, title = 'Long Stop Loss %', type = input.float, minval = 0.1, maxval = 100, step = 0.1, inline = "Trailing Stop Loss Perc", group = "Strategy") / 100

// BACKTEST PERIOD INPUT ============================================================================================

fromDate = input(defval = timestamp("01 Jan 2021 00:00 UTC"), title = "From Date", type = input.time, minval = timestamp("01 Jan 1970 00:00 UTC"), group = "Backtest Period") // backtest start date

toDate = input(defval = timestamp("31 Dec 2121 23:59 UTC"), title = "To Date", type = input.time, minval = timestamp("01 Jan 1970 00:00 UTC"), group = "Backtest Period") // backtest finish date

isWithinBacktestPeriod() => true

// SHOW PLOT INPUT ==================================================================================================

showDate = input(defval = true, title = "Show Backtest Range", type = input.bool, group = "Plot", tooltip = "Gray out the backround of the backtest period.")

//

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒

// STRATEGY LOGIC ===================================================================================================

fastMA = sma(close, fastMALen)

slowMA = sma(close, slowMALen)

bool startLongDeal = crossover(fastMA, slowMA)

bool longIsActive = startLongDeal or strategy.position_size > 0

// determine trailing stop loss price

float longTrailingStopLossPrice = na

longTrailingStopLossPrice := if (longIsActive)

stopValue = high * (1 - longTrailingStopLossPerc)

max(stopValue, nz(longTrailingStopLossPrice[1]))

else

na

//

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒

// STRATEGY EXECUTION ===============================================================================================

if (isWithinBacktestPeriod())

// getting into LONG position

strategy.entry(id = "Long Entry", long = strategy.long, when = startLongDeal, alert_message = "Long(" + syminfo.ticker + "): Started")

// submit exit orders for trailing stop loss price

strategy.exit(id = "Long Stop Loss", from_entry = "Long Entry", stop = longTrailingStopLossPrice, when = longIsActive, alert_message = "Long(" + syminfo.ticker + "): Stop Loss activated")

//

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒

// PLOT DATE POSITION MA AND TRAILING TAKE PROFIT STOP LOSS =========================================================

bgcolor(color = showDate and isWithinBacktestPeriod() ? color.gray : na, transp = 90)

plot(series = fastMA, title = "Fast SMA", color = #0056BD, linewidth = 2, style = plot.style_line)

plot(series = slowMA, title = "Slow SMA", color = #FF6A00, linewidth = 2, style = plot.style_line)

plotshape(series = isWithinBacktestPeriod() and startLongDeal and strategy.position_size <= 0 ? fastMA : na, title = "UpTrend Begins", style = shape.circle, location = location.absolute, color = color.green, transp = 0, size = size.tiny)

plotshape(series = isWithinBacktestPeriod() and startLongDeal and strategy.position_size <= 0 ? fastMA : na, title = "Buy", text = "Buy", style = shape.labelup, location = location.absolute, color = color.green, textcolor = color.black, transp = 0, size = size.tiny)

plot(series = strategy.position_avg_price, title = "Position", color = color.blue, linewidth = 2, style = plot.style_linebr, offset = 1)

plot(series = longTrailingStopLossPrice, title = "Long Trail Stop", color = color.fuchsia, linewidth = 2, style = plot.style_linebr, offset = 1)

// ==================================================================================================================