MTF RSI & Strategi STOCH

Penulis:ChaoZhang, Tarikh: 2022-05-10 10:41:43Tag:SMA

Perkongsian ini adalah penunjuk di mana anda boleh melihat purata jangka masa yang berbeza.

RSI adalah garis biru Saham adalah garis kuning

Anda boleh mengurus jangka masa dalam parameter.

Strategi adalah untuk mengambil kedudukan apabila kedua-dua garis mendapat overbought atau oversold dan menutup apabila stok dan RSI pergi ke tengah.

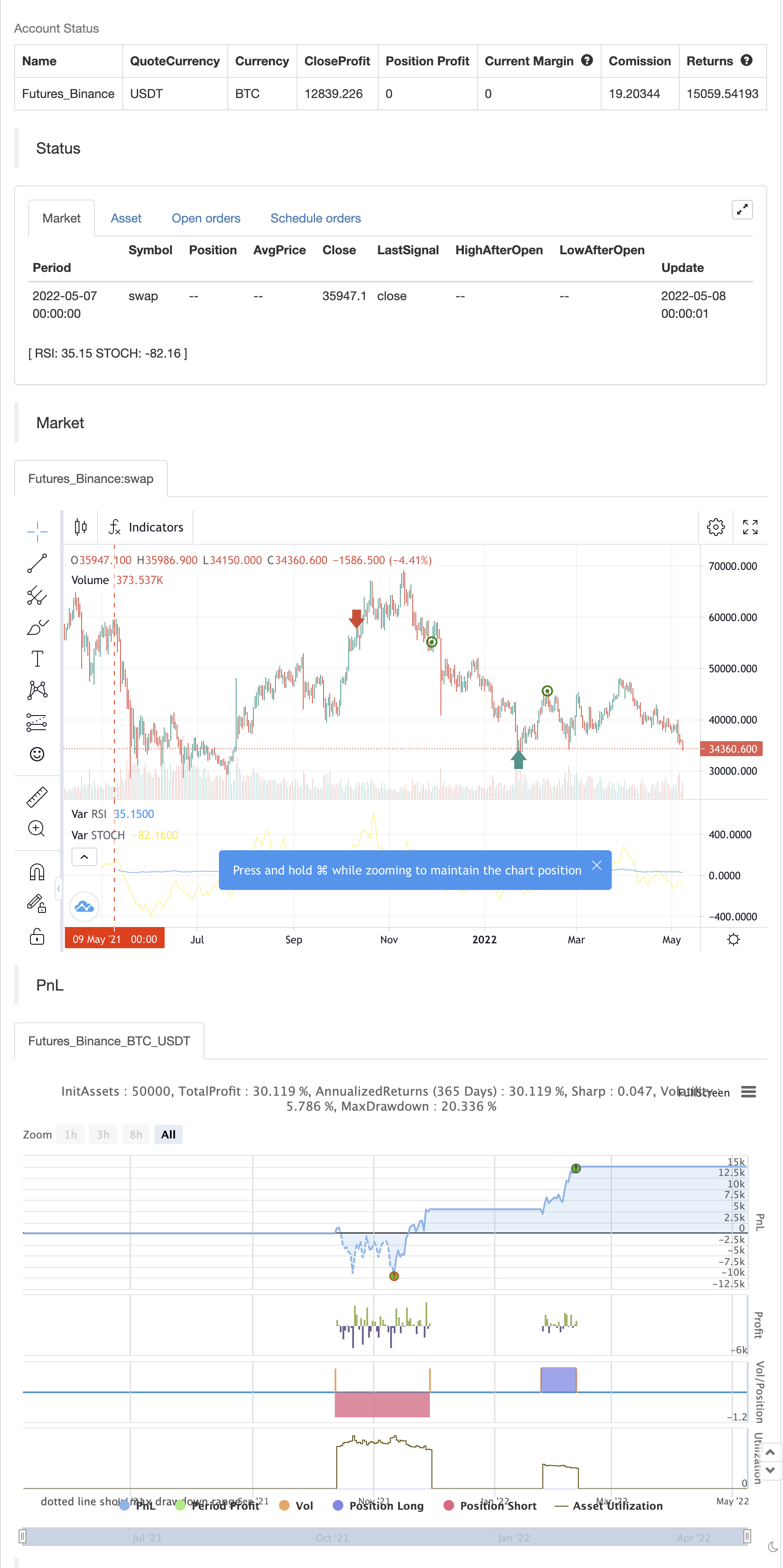

Ujian belakang

/*backtest

start: 2021-05-09 00:00:00

end: 2022-05-08 23:59:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

////////////////////////////////////////// MTF Stochastic & RSI Strategy ©️ bykzis /////////////////////////////////////////

//

// *** Inspired by "Binance CHOP Dashboard" from @Cazimiro and "RSI MTF Table" from @mobester16 *** and LOT OF COPY of Indicator-Jones MTF Scanner

//

////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////

//@version=5

//strategy('MTF RSI & STOCH Strategy', overlay=false,initial_capital=100, currency=currency.USD, commission_value=0.01, commission_type=strategy.commission.percent)

// Pair list

var string GRP1 = '══════════ General ══════════'

overbought = input.int(80, 'Overbought Level', minval=1, group=GRP1)

oversold = input.int(20, 'Oversold Level', minval=1, group=GRP1)

/// Timeframes

var string GRP2 = '══════════ Timeframes ══════════'

timeframe1 = input.timeframe(title="Timeframe 1", defval="W", group=GRP2)

timeframe2 = input.timeframe(title="Timeframe 2", defval="D", group=GRP2)

timeframe3 = input.timeframe(title="Timeframe 3", defval="240", group=GRP2)

timeframe4 = input.timeframe(title="Timeframe 4", defval="60", group=GRP2)

// RSI settings

var string GRP3 = '══════════ RSI settings ══════════'

rsiLength = input.int(14, minval=1, title='RSI length', group=GRP3)

rsiSource = input(close, 'RSI Source', group=GRP3)

rsioverbought = input.int(70, 'RSI Overbought Level', minval=1, group=GRP3)

rsioversold = input.int(30, 'RSI Oversold Level', minval=1, group=GRP3)

/// Get RSI values of each timeframe /////////////////////////////////////////////////////

rsi = ta.rsi(rsiSource, rsiLength)

callRSI(id,timeframe) =>

rsiValue = request.security(id, str.tostring(timeframe), rsi, gaps=barmerge.gaps_off)

rsiValue

RSI_TF1 = callRSI(syminfo.tickerid, timeframe1)

RSI_TF2 = callRSI(syminfo.tickerid, timeframe2)

RSI_TF3 = callRSI(syminfo.tickerid, timeframe3)

RSI_TF4 = callRSI(syminfo.tickerid, timeframe4)

/////// Calculate Averages /////////////////////////////////////////////////////////////////

calcAVG(valueTF1, valueTF2, valueTF3, valueTF4) =>

math.round((valueTF1 + valueTF2 + valueTF3 + valueTF4) / 4, 2)

AVG=calcAVG(RSI_TF1, RSI_TF2, RSI_TF3, RSI_TF4)

// Stochastic settings

var string GRP4 = '══════════ Stochastic settings ══════════'

periodK = input.int(14, '%K length', minval=1, group=GRP4)

smoothK = input.int(3, 'Smooth K', minval=1, group=GRP4)

stochSource = input(close, 'Stochastic Source', group=GRP4)

stochoverbought = input.int(70, 'Stochastic Overbought Level', minval=1, group=GRP4)

stochoversold = input.int(30, 'Stochastic Oversold Level', minval=1, group=GRP4)

/// Get Stochastic values of each timeframe ////////////////////////////////////////////////

stoch = ta.sma(ta.stoch(stochSource, high, low, periodK), smoothK)

getStochastic(id,timeframe) =>

stochValue = request.security(id, str.tostring(timeframe), stoch, gaps=barmerge.gaps_off)

stochValue

Stoch_TF1 = getStochastic(syminfo.tickerid, timeframe1)

Stoch_TF2 = getStochastic(syminfo.tickerid, timeframe2)

Stoch_TF3 = getStochastic(syminfo.tickerid, timeframe3)

Stoch_TF4 = getStochastic(syminfo.tickerid, timeframe4)

AVG_STOCH=calcAVG(Stoch_TF1, Stoch_TF2, Stoch_TF3, Stoch_TF4)

plot(AVG, color = color.blue, title='RSI')

plot(AVG_STOCH, color = color.yellow,title='STOCH')

hline(rsioverbought,color=color.red)

hline(rsioversold, color=color.lime)

hline(50, color=color.white)

//============ signal Generator ==================================//

if AVG <= rsioversold and AVG_STOCH <=stochoversold

strategy.entry('Buy_Long', strategy.long)

strategy.close("Buy_Long",when=(AVG_STOCH >=70 and AVG >=50 and close >=strategy.position_avg_price),comment="Long_OK")

if AVG >=rsioverbought and AVG_STOCH >=stochoverbought

strategy.entry('Buy_Short', strategy.short)

strategy.close("Buy_Short",when=(AVG_STOCH <=30 and AVG <=50 and close <=strategy.position_avg_price),comment="Short_OK")

///////////////////////////////////////////////////////////////////////////////////////////

Berkaitan

- Strategi Perdagangan Trend Purata Bergerak Berbilang

- Trend Purata Bergerak Ganda Jangka Pendek-Tengah-panjang Mengikut Strategi

- Strategi Dagangan Ambil Keuntungan Dinamik dan Hentikan Kerugian Berdasarkan Tiga Lilin Bearish Berturut-turut dan Purata Bergerak

- MOST dan strategi silang purata bergerak berganda

- Strategi Bollinger Bands Stochastic Oscillator

- Strategi Pendaftaran Crossover Rata-rata Bergerak Berganda

- Strategi Crossover Purata Bergerak

- Strategi Penembusan Bollinger Bands

- Bollinger Bands Standard Deviation Breakout Strategi

- Bollinger Bands Penapisan Penyimpangan Standar Ganda Strategi Dagangan Kuantitatif 5 Minit

- Strategi Perdagangan Pullback Bitcoin, Coin Binance, dan Ethereum Berbilang Jangka Masa

Lebih lanjut

- Fractal yang lebih kecil (+ Ketelusan)

- Titik kemasukan BB-RSI-ADX

- Hull-4ema

- Sudut Serangan Ikuti Indikator Garis

- KijunSen Line Dengan Salib

- AMACD - Kesemua Rata-rata Bergerak Convergence Divergensi

- MA HYBRID BY RAJ

- Trend Berlian

- Nik Stoch

- stok supertrd atr 200ma

- EMA + AROON + ASH

- Momentum 2.0

- Strategi Julat EHMA

- Purata Bergerak Beli-Jual

- Midas Mk. II - Ultimate Crypto Swing

- TMA-Legacy

- Strategi TV Tinggi dan Rendah

- Strategi TradingView Terbaik

- Amaran Big Snapper R3.0 + Keadaan Volatiliti Chaiking + TP RSI

- Chande Kroll Hentikan