Strategi Aliran Dinamik Purata Pergerakan Berbilang

Gambaran keseluruhan

Strategi Trend Dinamik Purata Bergerak Berganda (Multiple Moving Average Dynamic Trend Strategy) adalah strategi perdagangan kuantitatif yang menggunakan pelbagai petunjuk purata bergerak untuk menentukan arah trend dan secara dinamik menyesuaikan kedudukan garis hentian. Strategi ini, dengan menggabungkan pelbagai jenis purata bergerak, dapat menilai tren pasaran dengan lebih menyeluruh dan tepat, untuk mencapai kadar kemenangan yang tinggi.

Prinsip Strategi

Strategi ini terutamanya menggunakan fungsi tersuai untuk mewujudkan 8 jenis purata bergerak yang berbeza, termasuk purata bergerak sederhana (SMA), purata bergerak indeks (EMA), purata bergerak bertimbangan (WMA), purata bergerak segitiga (TMA), purata bergerak indeks berubah (VIDYA), purata bergerak Wilder (WWMA), purata bergerak indeks yang tertinggal sifar (ZLEMA) dan purata bergerak kekuatan sebenar (TSF). Strategi ini membolehkan pengguna memilih salah satu daripada lapan purata bergerak sebagai penunjuk utama.

Strategi pertama mengira purata bergerak jenis yang dipilih, dan kemudian secara dinamik mengira kedudukan atas dan bawah landasan berdasarkan parameter peratusan yang ditetapkan. Ia berfungsi sebagai isyarat beli apabila harga menembusi atas landasan, dan sebagai isyarat jual apabila ia menembusi bawah landasan. Selain itu, strategi juga mengesan persilangan purata bergerak dan harga sebagai isyarat penilaian tambahan.

Dalam proses pengiraan, strategi pada masa yang sama menilai arah trend pasaran, sehingga secara dinamik menyesuaikan kedudukan di atas dan di bawah landasan. Khususnya, apabila menilai sebagai trend menaik, garis bawah akan naik dengan kenaikan harga, sehingga garis stop loss dapat mengesan kenaikan harga dengan optimum; apabila menilai sebagai trend menurun, garis atas akan turun dengan penurunan harga, menurunkan titik berhenti untuk mengurangkan kerugian.

Kelebihan Strategik

- Menggunakan 8 penunjuk purata bergerak untuk menilai trend pasaran dengan lebih tepat;

- Mengubah kedudukan garis hentian secara dinamik untuk mengunci keuntungan dan mengelakkan hentian terbalik;

- Dengan menggunakan persilangan purata bergerak dan harga sebagai isyarat tambahan, anda boleh menyaring perdagangan yang salah yang disebabkan oleh penembusan palsu;

- Parameter strategi boleh disesuaikan dan dioptimumkan untuk persekitaran pasaran yang berbeza.

Risiko dan Penyelesaian

- Penggunaan pelbagai indikator dalam kombinasi meningkatkan kerumitan strategi dan kesukaran untuk melakukan debug kod;

- Sesetengah jenis penunjuk purata bergerak tidak berfungsi dengan baik dalam keadaan pasaran tertentu;

- Namun, risiko kesalahan transaksi yang disebabkan oleh penembusan palsu masih wujud.

Penyelesaian:

- Menambah kod komen, meningkatkan kebolehbacaan kod, dan memudahkan pemeriksaan dan debugging;

- Jenis purata bergerak yang dipilih mengikut keadaan pasaran boleh ditambah dengan modul pilihan automatik;

- Pengaturan parameter yang dioptimumkan, digabungkan dengan lebih banyak penapis petunjuk tambahan.

Arah pengoptimuman strategi

Strategi ini juga mempunyai ruang untuk pengoptimuman yang besar:

- Modul pengoptimuman parameter automatik boleh ditambah, menyesuaikan parameter secara automatik mengikut keadaan pasaran yang berbeza;

- Model pembelajaran mesin boleh dimasukkan untuk membantu menentukan arah trend.

- Lebih banyak penambahbaikan dalam penilaian, seperti penambahbaikan emosi, dapat meningkatkan kestabilan strategi;

- Memperbaiki mekanisme penangguhan kerugian untuk penangguhan kerugian yang lebih dinamik dan tepat;

- Anda boleh meluaskan kepada pelbagai jenis, menggunakan perbezaan harga antara jenis untuk mendapatkan peluang.

ringkaskan

Strategi trend dinamik pelbagai purata bergerak menilai trend pasaran dengan menggabungkan pelbagai indikator purata bergerak, dan dibantu dengan isyarat harga untuk memecahkan perintah perdagangan, dan secara dinamik menyesuaikan kedudukan garis hentian, untuk mencapai keuntungan yang cekap. Strategi ini berjaya menggabungkan trend mengikuti, memecahkan perdagangan dan tiga strategi kuantitatif dinamik hentian utama. Pemikiran, kestabilan dan keuntungan yang kuat. Dengan pengenalan teknologi seperti parameter pengoptimuman, pengenalan corak, dan lain-lain, kesan strategi mempunyai ruang untuk meningkatkan lagi, adalah strategi kuantitatif yang tinggi yang patut diteliti dan digunakan.

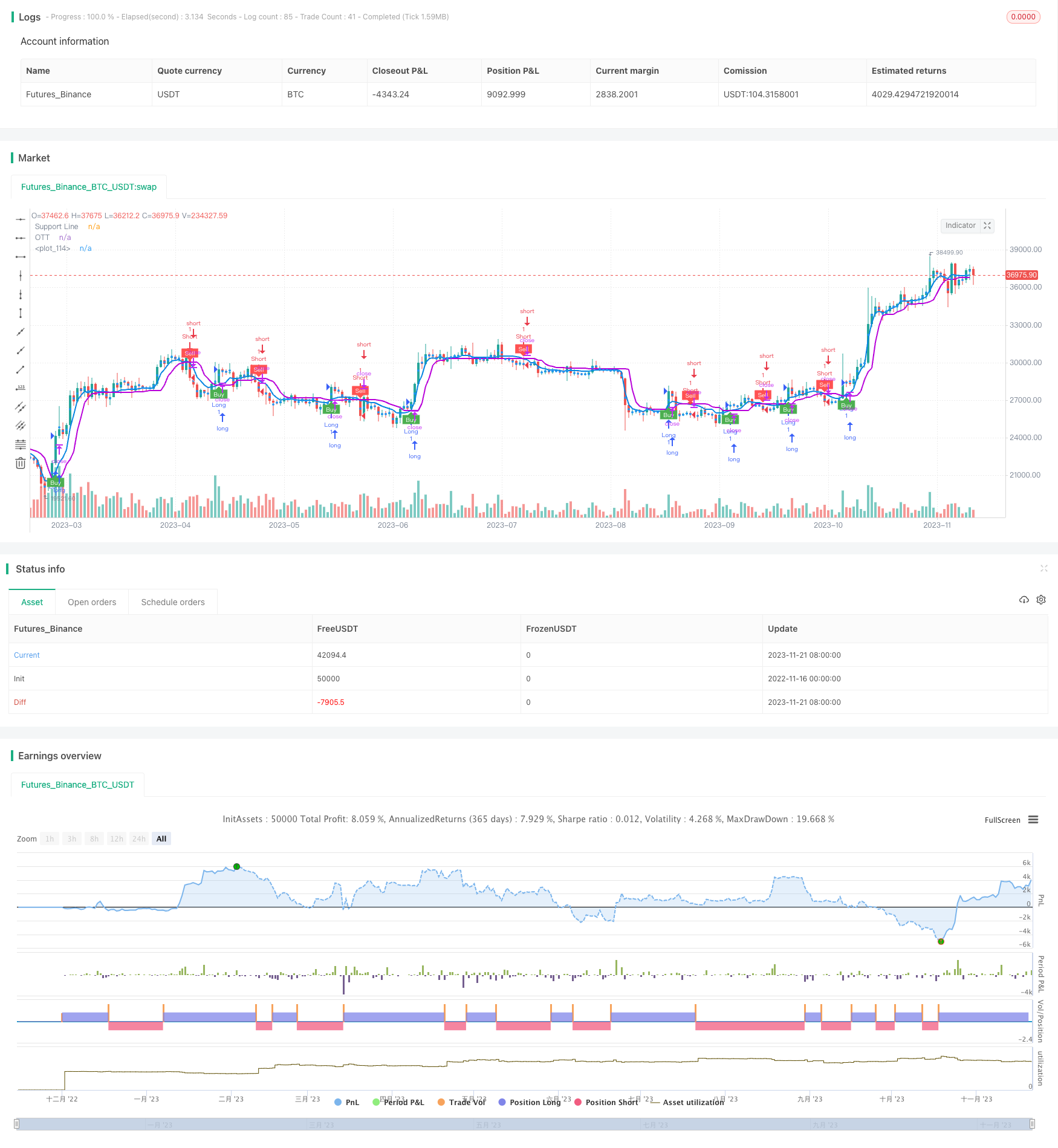

/*backtest

start: 2022-11-16 00:00:00

end: 2023-11-22 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © KivancOzbilgic

//created by: @Anil_Ozeksi

//developer: ANIL ÖZEKŞİ

//author: @kivancozbilgic

strategy("Optimized Trend Tracker","OTTEx", overlay=true)

src = input(close, title="Source")

length=input(2, "OTT Period", minval=1)

percent=input(1.4, "OTT Percent", type=input.float, step=0.1, minval=0)

showsupport = input(title="Show Support Line?", type=input.bool, defval=true)

showsignalsk = input(title="Show Support Line Crossing Signals?", type=input.bool, defval=true)

showsignalsc = input(title="Show Price/OTT Crossing Signals?", type=input.bool, defval=false)

highlight = input(title="Show OTT Color Changes?", type=input.bool, defval=false)

showsignalsr = input(title="Show OTT Color Change Signals?", type=input.bool, defval=false)

highlighting = input(title="Highlighter On/Off ?", type=input.bool, defval=true)

mav = input(title="Moving Average Type", defval="VAR", options=["SMA", "EMA", "WMA", "TMA", "VAR", "WWMA", "ZLEMA", "TSF"])

Var_Func(src,length)=>

valpha=2/(length+1)

vud1=src>src[1] ? src-src[1] : 0

vdd1=src<src[1] ? src[1]-src : 0

vUD=sum(vud1,9)

vDD=sum(vdd1,9)

vCMO=nz((vUD-vDD)/(vUD+vDD))

VAR=0.0

VAR:=nz(valpha*abs(vCMO)*src)+(1-valpha*abs(vCMO))*nz(VAR[1])

VAR=Var_Func(src,length)

Wwma_Func(src,length)=>

wwalpha = 1/ length

WWMA = 0.0

WWMA := wwalpha*src + (1-wwalpha)*nz(WWMA[1])

WWMA=Wwma_Func(src,length)

Zlema_Func(src,length)=>

zxLag = length/2==round(length/2) ? length/2 : (length - 1) / 2

zxEMAData = (src + (src - src[zxLag]))

ZLEMA = ema(zxEMAData, length)

ZLEMA=Zlema_Func(src,length)

Tsf_Func(src,length)=>

lrc = linreg(src, length, 0)

lrc1 = linreg(src,length,1)

lrs = (lrc-lrc1)

TSF = linreg(src, length, 0)+lrs

TSF=Tsf_Func(src,length)

getMA(src, length) =>

ma = 0.0

if mav == "SMA"

ma := sma(src, length)

ma

if mav == "EMA"

ma := ema(src, length)

ma

if mav == "WMA"

ma := wma(src, length)

ma

if mav == "TMA"

ma := sma(sma(src, ceil(length / 2)), floor(length / 2) + 1)

ma

if mav == "VAR"

ma := VAR

ma

if mav == "WWMA"

ma := WWMA

ma

if mav == "ZLEMA"

ma := ZLEMA

ma

if mav == "TSF"

ma := TSF

ma

ma

MAvg=getMA(src, length)

fark=MAvg*percent*0.01

longStop = MAvg - fark

longStopPrev = nz(longStop[1], longStop)

longStop := MAvg > longStopPrev ? max(longStop, longStopPrev) : longStop

shortStop = MAvg + fark

shortStopPrev = nz(shortStop[1], shortStop)

shortStop := MAvg < shortStopPrev ? min(shortStop, shortStopPrev) : shortStop

dir = 1

dir := nz(dir[1], dir)

dir := dir == -1 and MAvg > shortStopPrev ? 1 : dir == 1 and MAvg < longStopPrev ? -1 : dir

MT = dir==1 ? longStop: shortStop

OTT=MAvg>MT ? MT*(200+percent)/200 : MT*(200-percent)/200

plot(showsupport ? MAvg : na, color=#0585E1, linewidth=2, title="Support Line")

OTTC = highlight ? OTT[2] > OTT[3] ? color.green : color.red : #B800D9

pALL=plot(nz(OTT[2]), color=OTTC, linewidth=2, title="OTT", transp=0)

alertcondition(cross(OTT[2], OTT[3]), title="Color ALARM", message="OTT Has Changed Color!")

alertcondition(crossover(OTT[2], OTT[3]), title="GREEN ALERT", message="OTT GREEN BUY SIGNAL!")

alertcondition(crossunder(OTT[2], OTT[3]), title="RED ALERT", message="OTT RED SELL SIGNAL!")

alertcondition(cross(MAvg, OTT[2]), title="Cross Alert", message="OTT - Support Line Crossing!")

alertcondition(crossover(MAvg, OTT[2]), title="Crossover Alarm", message="Support Line BUY SIGNAL!")

alertcondition(crossunder(MAvg, OTT[2]), title="Crossunder Alarm", message="Support Line SELL SIGNAL!")

alertcondition(cross(src, OTT[2]), title="Price Cross Alert", message="OTT - Price Crossing!")

alertcondition(crossover(src, OTT[2]), title="Price Crossover Alarm", message="PRICE OVER OTT - BUY SIGNAL!")

alertcondition(crossunder(src, OTT[2]), title="Price Crossunder Alarm", message="PRICE UNDER OTT - SELL SIGNAL!")

buySignalk = crossover(MAvg, OTT[2])

plotshape(buySignalk and showsignalsk ? OTT*0.995 : na, title="Buy", text="Buy", location=location.absolute, style=shape.labelup, size=size.tiny, color=color.green, textcolor=color.white, transp=0)

sellSignallk = crossunder(MAvg, OTT[2])

plotshape(sellSignallk and showsignalsk ? OTT*1.005 : na, title="Sell", text="Sell", location=location.absolute, style=shape.labeldown, size=size.tiny, color=color.red, textcolor=color.white, transp=0)

buySignalc = crossover(src, OTT[2])

plotshape(buySignalc and showsignalsc ? OTT*0.995 : na, title="Buy", text="Buy", location=location.absolute, style=shape.labelup, size=size.tiny, color=color.green, textcolor=color.white, transp=0)

sellSignallc = crossunder(src, OTT[2])

plotshape(sellSignallc and showsignalsc ? OTT*1.005 : na, title="Sell", text="Sell", location=location.absolute, style=shape.labeldown, size=size.tiny, color=color.red, textcolor=color.white, transp=0)

mPlot = plot(ohlc4, title="", style=plot.style_circles, linewidth=0,display=display.none)

longFillColor = highlighting ? (MAvg>OTT ? color.green : na) : na

shortFillColor = highlighting ? (MAvg<OTT ? color.red : na) : na

fill(mPlot, pALL, title="UpTrend Highligter", color=longFillColor)

fill(mPlot, pALL, title="DownTrend Highligter", color=shortFillColor)

buySignalr = crossover(OTT[2], OTT[3])

plotshape(buySignalr and showsignalsr ? OTT*0.995 : na, title="Buy", text="Buy", location=location.absolute, style=shape.labelup, size=size.tiny, color=color.green, textcolor=color.white, transp=0)

sellSignallr = crossunder(OTT[2], OTT[3])

plotshape(sellSignallr and showsignalsr ? OTT*1.005 : na, title="Sell", text="Sell", location=location.absolute, style=shape.labeldown, size=size.tiny, color=color.red, textcolor=color.white, transp=0)

showscr = input(true, title="Show Screener Label")

posX_scr = input(20, title="Pos. Label x-axis")

posY_scr = input(1, title="Pos. Size Label y-axis")

colinput = input(title="Label Color", defval="Blue", options=["White", "Black", "Red", "Green", "Yellow", "Blue"])

col = color.gray

if colinput=="White"

col:=color.white

if colinput=="Black"

col:=color.black

if colinput=="Red"

col:=color.red

if colinput=="Green"

col:=color.green

if colinput=="Yellow"

col:=color.yellow

if colinput=="Blue"

col:=color.blue

dummy0 = input(true, title = "=Backtest Inputs=")

FromDay = input(defval = 1, title = "From Day", minval = 1, maxval = 31)

FromMonth = input(defval = 1, title = "From Month", minval = 1, maxval = 12)

FromYear = input(defval = 2005, title = "From Year", minval = 2005)

ToDay = input(defval = 1, title = "To Day", minval = 1, maxval = 31)

ToMonth = input(defval = 1, title = "To Month", minval = 1, maxval = 12)

ToYear = input(defval = 9999, title = "To Year", minval = 2006)

Start = timestamp(FromYear, FromMonth, FromDay, 00, 00)

Finish = timestamp(ToYear, ToMonth, ToDay, 23, 59)

Timerange() => true

if buySignalk

strategy.entry("Long", strategy.long,when=Timerange())

if sellSignallk

strategy.entry("Short", strategy.short,when=Timerange())

// t1=input('EURUSD', title='Symbol 01',type=input.symbol)

// t2=input('XAUUSD', title='Symbol 02',type=input.symbol)

// t3=input('AMZN', title='Symbol 03',type=input.symbol)

// t4=input('TSLA', title='Symbol 04',type=input.symbol)

// t5=input('BTCUSDT', title='Symbol 05',type=input.symbol)

// t6=input('ETHBTC', title='Symbol 06',type=input.symbol)

// t7=input('XBTUSD', title='Symbol 07',type=input.symbol)

// t8=input('XRPBTC', title='Symbol 08',type=input.symbol)

// t9=input('THYAO', title='Symbol 09',type=input.symbol)

// t10=input('GARAN', title='Symbol 10',type=input.symbol)

// t11=input('', title='Symbol 11',type=input.symbol)

// t12=input('', title='Symbol 12',type=input.symbol)

// t13=input('', title='Symbol 13',type=input.symbol)

// t14=input('', title='Symbol 14',type=input.symbol)

// t15=input('', title='Symbol 15',type=input.symbol)

// t16=input('', title='Symbol 16',type=input.symbol)

// t17=input('', title='Symbol 17',type=input.symbol)

// t18=input('', title='Symbol 18',type=input.symbol)

// t19=input('', title='Symbol 19',type=input.symbol)

// t20=input('', title='Symbol 20',type=input.symbol)

// OTTs(percent, length) =>

// Up=MAvg-MAvg*percent*0.01

// Dn=MAvg+MAvg*percent*0.01

// TrendUp = 0.0

// TrendUp := MAvg[1]>TrendUp[1] ? max(Up,TrendUp[1]) : Up

// TrendDown = 0.0

// TrendDown := MAvg[1]<TrendDown[1]? min(Dn,TrendDown[1]) : Dn

// Trend = 0.0

// Trend := MAvg > TrendDown[1] ? 1: MAvg< TrendUp[1]? -1: nz(Trend[1],1)

// Tsl = Trend==1? TrendUp: TrendDown

// S_Buy = Trend == 1 ? 1 : 0

// S_Sell = Trend != 1 ? 1 : 0

// [Trend, Tsl]

// [Trend, Tsl] = OTTs(percent, length)

// TrendReversal = Trend != Trend[1]

// [t01, s01] = security(t1, timeframe.period, OTTs(percent, length))

// [t02, s02] = security(t2, timeframe.period, OTTs(percent, length))

// [t03, s03] = security(t3, timeframe.period, OTTs(percent, length))

// [t04, s04] = security(t4, timeframe.period, OTTs(percent, length))

// [t05, s05] = security(t5, timeframe.period, OTTs(percent, length))

// [t06, s06] = security(t6, timeframe.period, OTTs(percent, length))

// [t07, s07] = security(t7, timeframe.period, OTTs(percent, length))

// [t08, s08] = security(t8, timeframe.period, OTTs(percent, length))

// [t09, s09] = security(t9, timeframe.period, OTTs(percent, length))

// [t010, s010] = security(t10, timeframe.period, OTTs(percent, length))

// [t011, s011] = security(t11, timeframe.period, OTTs(percent, length))

// [t012, s012] = security(t12, timeframe.period, OTTs(percent, length))

// [t013, s013] = security(t13, timeframe.period, OTTs(percent, length))

// [t014, s014] = security(t14, timeframe.period, OTTs(percent, length))

// [t015, s015] = security(t15, timeframe.period, OTTs(percent, length))

// [t016, s016] = security(t16, timeframe.period, OTTs(percent, length))

// [t017, s017] = security(t17, timeframe.period, OTTs(percent, length))

// [t018, s018] = security(t18, timeframe.period, OTTs(percent, length))

// [t019, s019] = security(t19, timeframe.period, OTTs(percent, length))

// [t020, s020] = security(t20, timeframe.period, OTTs(percent, length))

// tr01 = t01 != t01[1], up01 = t01 == 1, dn01 = t01 == -1

// tr02 = t02 != t02[1], up02 = t02 == 1, dn02 = t02 == -1

// tr03 = t03 != t03[1], up03 = t03 == 1, dn03 = t03 == -1

// tr04 = t04 != t04[1], up04 = t04 == 1, dn04 = t04 == -1

// tr05 = t05 != t05[1], up05 = t05 == 1, dn05 = t05 == -1

// tr06 = t06 != t06[1], up06 = t06 == 1, dn06 = t06 == -1

// tr07 = t07 != t07[1], up07 = t07 == 1, dn07 = t07 == -1

// tr08 = t08 != t08[1], up08 = t08 == 1, dn08 = t08 == -1

// tr09 = t09 != t09[1], up09 = t09 == 1, dn09 = t09 == -1

// tr010 = t010 != t010[1], up010 = t010 == 1, dn010 = t010 == -1

// tr011 = t011 != t011[1], up011 = t011 == 1, dn011 = t011 == -1

// tr012 = t012 != t012[1], up012 = t012 == 1, dn012 = t012 == -1

// tr013 = t013 != t013[1], up013 = t013 == 1, dn013 = t013 == -1

// tr014 = t014 != t014[1], up014 = t014 == 1, dn014 = t014 == -1

// tr015 = t015 != t015[1], up015 = t015 == 1, dn015 = t015 == -1

// tr016 = t016 != t016[1], up016 = t016 == 1, dn016 = t016 == -1

// tr017 = t017 != t017[1], up017 = t017 == 1, dn017 = t017 == -1

// tr018 = t018 != t018[1], up018 = t018 == 1, dn018 = t018 == -1

// tr019 = t019 != t019[1], up019 = t019 == 1, dn019 = t019 == -1

// tr020 = t020 != t020[1], up020 = t020 == 1, dn020 = t020 == -1

// pot_label = 'Potential Reversal: \n'

// pot_label := tr01 ? pot_label + t1 + '\n' : pot_label

// pot_label := tr02 ? pot_label + t2 + '\n' : pot_label

// pot_label := tr03 ? pot_label + t3 + '\n' : pot_label

// pot_label := tr04 ? pot_label + t4 + '\n' : pot_label

// pot_label := tr05 ? pot_label + t5 + '\n' : pot_label

// pot_label := tr06 ? pot_label + t6 + '\n' : pot_label

// pot_label := tr07 ? pot_label + t7 + '\n' : pot_label

// pot_label := tr08 ? pot_label + t8 + '\n' : pot_label

// pot_label := tr09 ? pot_label + t9 + '\n' : pot_label

// pot_label := tr010 ? pot_label + t10 + '\n' : pot_label

// pot_label := tr011 ? pot_label + t11 + '\n' : pot_label

// pot_label := tr012 ? pot_label + t12 + '\n' : pot_label

// pot_label := tr013 ? pot_label + t13 + '\n' : pot_label

// pot_label := tr014 ? pot_label + t14 + '\n' : pot_label

// pot_label := tr015 ? pot_label + t15 + '\n' : pot_label

// pot_label := tr016 ? pot_label + t16 + '\n' : pot_label

// pot_label := tr017 ? pot_label + t17 + '\n' : pot_label

// pot_label := tr018 ? pot_label + t18 + '\n' : pot_label

// pot_label := tr019 ? pot_label + t19 + '\n' : pot_label

// pot_label := tr020 ? pot_label + t20 + '\n' : pot_label

// scr_label = 'Confirmed Reversal: \n'

// scr_label := tr01[1] ? scr_label + t1 + '\n' : scr_label

// scr_label := tr02[1] ? scr_label + t2 + '\n' : scr_label

// scr_label := tr03[1] ? scr_label + t3 + '\n' : scr_label

// scr_label := tr04[1] ? scr_label + t4 + '\n' : scr_label

// scr_label := tr05[1] ? scr_label + t5 + '\n' : scr_label

// scr_label := tr06[1] ? scr_label + t6 + '\n' : scr_label

// scr_label := tr07[1] ? scr_label + t7 + '\n' : scr_label

// scr_label := tr08[1] ? scr_label + t8 + '\n' : scr_label

// scr_label := tr09[1] ? scr_label + t9 + '\n' : scr_label

// scr_label := tr010[1] ? scr_label + t10 + '\n' : scr_label

// scr_label := tr011[1] ? scr_label + t11 + '\n' : scr_label

// scr_label := tr012[1] ? scr_label + t12 + '\n' : scr_label

// scr_label := tr013[1] ? scr_label + t13 + '\n' : scr_label

// scr_label := tr014[1] ? scr_label + t14 + '\n' : scr_label

// scr_label := tr015[1] ? scr_label + t15 + '\n' : scr_label

// scr_label := tr016[1] ? scr_label + t16 + '\n' : scr_label

// scr_label := tr017[1] ? scr_label + t17 + '\n' : scr_label

// scr_label := tr018[1] ? scr_label + t18 + '\n' : scr_label

// scr_label := tr019[1] ? scr_label + t19 + '\n' : scr_label

// scr_label := tr020[1] ? scr_label + t20 + '\n' : scr_label

// up_label = 'Uptrend: \n'

// up_label := up01[1] ? up_label + t1 + '\n' : up_label

// up_label := up02[1] ? up_label + t2 + '\n' : up_label

// up_label := up03[1] ? up_label + t3 + '\n' : up_label

// up_label := up04[1] ? up_label + t4 + '\n' : up_label

// up_label := up05[1] ? up_label + t5 + '\n' : up_label

// up_label := up06[1] ? up_label + t6 + '\n' : up_label

// up_label := up07[1] ? up_label + t7 + '\n' : up_label

// up_label := up08[1] ? up_label + t8 + '\n' : up_label

// up_label := up09[1] ? up_label + t9 + '\n' : up_label

// up_label := up010[1] ? up_label + t10 + '\n' : up_label

// up_label := up011[1] ? up_label + t11 + '\n' : up_label

// up_label := up012[1] ? up_label + t12 + '\n' : up_label

// up_label := up013[1] ? up_label + t13 + '\n' : up_label

// up_label := up014[1] ? up_label + t14 + '\n' : up_label

// up_label := up015[1] ? up_label + t15 + '\n' : up_label

// up_label := up016[1] ? up_label + t16 + '\n' : up_label

// up_label := up017[1] ? up_label + t17 + '\n' : up_label

// up_label := up018[1] ? up_label + t18 + '\n' : up_label

// up_label := up019[1] ? up_label + t19 + '\n' : up_label

// up_label := up020[1] ? up_label + t20 + '\n' : up_label

// dn_label = 'Downtrend: \n'

// dn_label := dn01[1] ? dn_label + t1 + '\n' : dn_label

// dn_label := dn02[1] ? dn_label + t2 + '\n' : dn_label

// dn_label := dn03[1] ? dn_label + t3 + '\n' : dn_label

// dn_label := dn04[1] ? dn_label + t4 + '\n' : dn_label

// dn_label := dn05[1] ? dn_label + t5 + '\n' : dn_label

// dn_label := dn06[1] ? dn_label + t6 + '\n' : dn_label

// dn_label := dn07[1] ? dn_label + t7 + '\n' : dn_label

// dn_label := dn08[1] ? dn_label + t8 + '\n' : dn_label

// dn_label := dn09[1] ? dn_label + t9 + '\n' : dn_label

// dn_label := dn010[1] ? dn_label + t10 + '\n' : dn_label

// dn_label := dn011[1] ? dn_label + t11 + '\n' : dn_label

// dn_label := dn012[1] ? dn_label + t12 + '\n' : dn_label

// dn_label := dn013[1] ? dn_label + t13 + '\n' : dn_label

// dn_label := dn014[1] ? dn_label + t14 + '\n' : dn_label

// dn_label := dn015[1] ? dn_label + t15 + '\n' : dn_label

// dn_label := dn016[1] ? dn_label + t16 + '\n' : dn_label

// dn_label := dn017[1] ? dn_label + t17 + '\n' : dn_label

// dn_label := dn018[1] ? dn_label + t18 + '\n' : dn_label

// dn_label := dn019[1] ? dn_label + t19 + '\n' : dn_label

// dn_label := dn020[1] ? dn_label + t20 + '\n' : dn_label

// f_colorscr (_valscr ) =>

// _valscr ? #00000000 : na

// f_printscr (_txtscr ) =>

// var _lblscr = label(na),

// label.delete(_lblscr ),

// _lblscr := label.new(

// time + (time-time[1])*posX_scr ,

// ohlc4[posY_scr],

// _txtscr ,

// xloc.bar_time,

// yloc.price,

// f_colorscr ( showscr ),

// textcolor = showscr ? col : na,

// size = size.normal,

// style=label.style_label_center

// )

// f_printscr ( scr_label + '\n' + pot_label +'\n' + up_label + '\n' + dn_label)