Estratégia de tendência dinâmica de média móvel múltipla

Visão geral

A estratégia de tendência dinâmica de média móvel múltipla é uma estratégia de negociação quantitativa que usa vários indicadores de média móvel para determinar a direção da tendência e ajustar dinamicamente a posição da linha de parada. A estratégia, combinando diferentes tipos de médias móveis, pode determinar a tendência do mercado de forma mais abrangente e precisa, permitindo uma negociação de alta taxa de vitória.

Princípio da estratégia

A estratégia permite que o usuário escolha um dos oito tipos de médias móveis como principal indicador de julgamento. A estratégia permite que o usuário escolha um dos oito tipos de médias móveis como principal indicador de julgamento.

A estratégia primeiro calcula a média móvel do tipo selecionado, e depois calcula dinamicamente a posição da subida e da descida, de acordo com o parâmetro percentual definido. Quando o preço se move para cima, é um sinal de compra, e quando ele se move para baixo, é um sinal de venda. Além disso, a estratégia também acompanha o cruzamento entre a média móvel e o preço como um sinal de julgamento auxiliar.

No processo de cálculo, a estratégia simultaneamente julga a direção da tendência do mercado e, assim, ajusta dinamicamente a posição do traçado ascendente e descendente. Concretamente, quando julgado como tendência ascendente, a linha descendente sobe com o aumento do preço, permitindo que a linha de parada de perda possa acompanhar de forma ideal o aumento do preço. Quando julgado como tendência descendente, a linha ascendente baixa com a queda do preço, reduzindo o ponto de parada para reduzir os prejuízos.

Vantagens estratégicas

- A combinação de oito indicadores de médias móveis permite uma maior precisão nas tendências do mercado.

- Ajustar dinamicamente a posição da linha de stop para maximizar o lucro e evitar o reverso do stop loss;

- O cruzamento de médias móveis e preços, como sinais auxiliares, pode filtrar transações errôneas causadas por brechas falsas;

- Os parâmetros da estratégia podem ser customizados e otimizados para diferentes cenários de mercado.

Riscos e soluções

- A combinação de vários indicadores aumenta a complexidade da estratégia e dificulta a desativação do código;

- Alguns tipos de indicadores de médias móveis não são eficazes em determinadas circunstâncias de mercado;

- O risco de transações equivocadas por invasões falsas permanece.

Resolução:

- Adicionar comentários ao código, melhorar a legibilidade do código e facilitar a verificação e a depuração;

- O módulo de preferência automática também pode ser adicionado para escolher o tipo de média móvel em função da situação do mercado.

- Optimizar a configuração dos parâmetros, combinando com mais indicadores auxiliares para filtrar os sinais.

Direção de otimização da estratégia

A estratégia também tem muito espaço para otimização:

- Pode ser adicionado um módulo de otimização de parâmetros automáticos, que ajusta automaticamente os parâmetros de acordo com diferentes condições de mercado;

- A partir de agora, os modelos de aprendizado de máquina podem ser incorporados para ajudar a determinar a direção das tendências.

- A inclusão de mais indicadores auxiliares de julgamento, como os indicadores emocionais, pode aumentar a estabilidade da estratégia;

- Otimizar os mecanismos de suspensão de perdas para obter uma suspensão de perdas mais dinâmica e mais precisa;

- A estratégia de arbitragem pode ser estendida a várias variedades, aproveitando as diferenças de preço entre as variedades para obter oportunidades de arbitragem.

Resumir

A estratégia de tendência dinâmica de múltiplas médias móveis determina a tendência do mercado através da combinação de vários indicadores de médias móveis e é auxiliada por sinais de ruptura de preços para emitir instruções de negociação, ao mesmo tempo em que ajusta dinamicamente a posição da linha de parada para obter ganhos eficientes. A estratégia combina com sucesso a tendência, a ruptura de negociação e a interrupção dinâmica de três principais estratégias de quantificação de pensamento, estabilidade e capacidade de lucratividade. Com a introdução de tecnologias como a otimização de parâmetros, a identificação de padrões, a eficácia da estratégia tem espaço para melhorar ainda mais, e é uma estratégia de quantificação avançada que vale a pena estudar e aplicar.

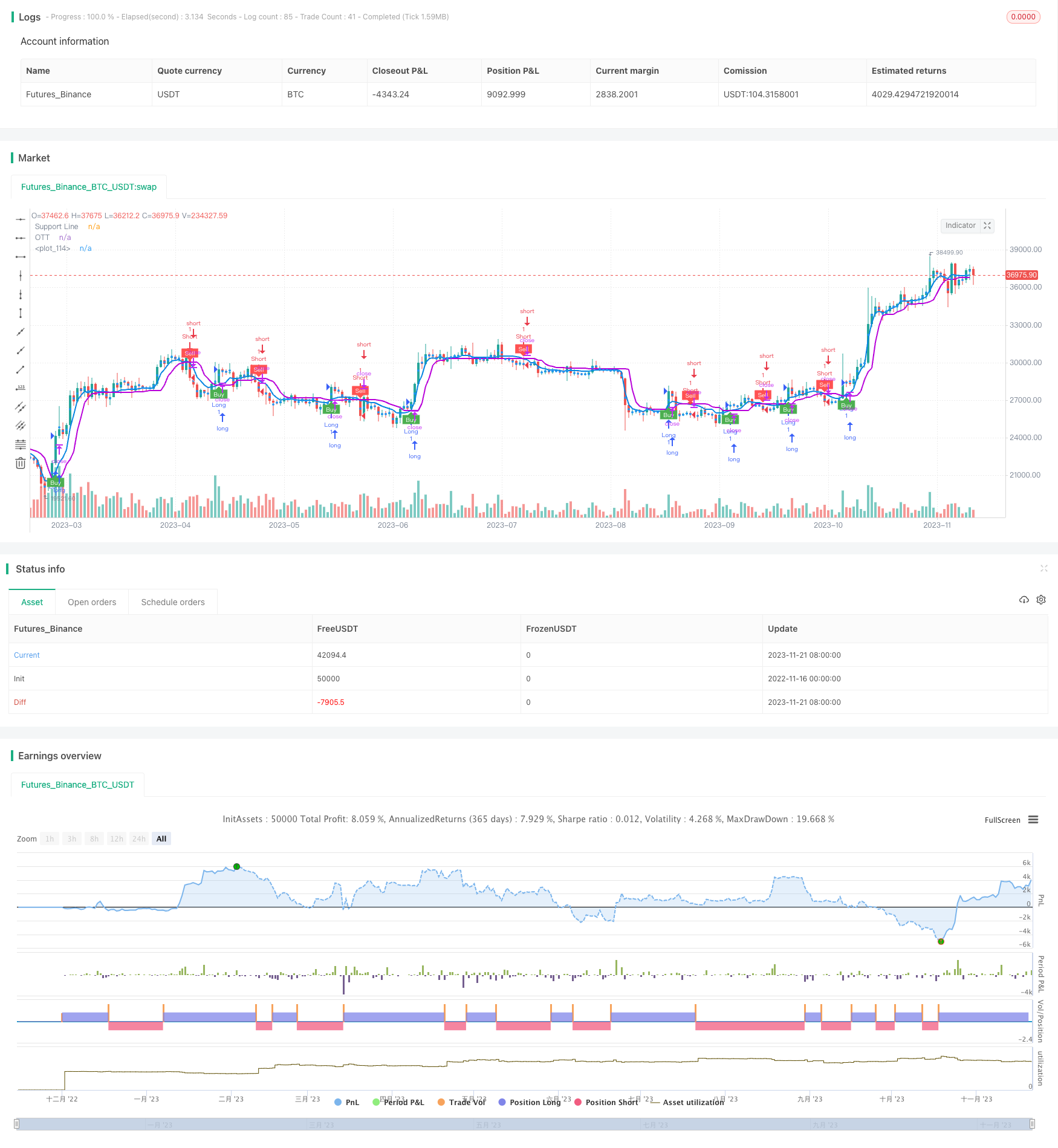

/*backtest

start: 2022-11-16 00:00:00

end: 2023-11-22 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © KivancOzbilgic

//created by: @Anil_Ozeksi

//developer: ANIL ÖZEKŞİ

//author: @kivancozbilgic

strategy("Optimized Trend Tracker","OTTEx", overlay=true)

src = input(close, title="Source")

length=input(2, "OTT Period", minval=1)

percent=input(1.4, "OTT Percent", type=input.float, step=0.1, minval=0)

showsupport = input(title="Show Support Line?", type=input.bool, defval=true)

showsignalsk = input(title="Show Support Line Crossing Signals?", type=input.bool, defval=true)

showsignalsc = input(title="Show Price/OTT Crossing Signals?", type=input.bool, defval=false)

highlight = input(title="Show OTT Color Changes?", type=input.bool, defval=false)

showsignalsr = input(title="Show OTT Color Change Signals?", type=input.bool, defval=false)

highlighting = input(title="Highlighter On/Off ?", type=input.bool, defval=true)

mav = input(title="Moving Average Type", defval="VAR", options=["SMA", "EMA", "WMA", "TMA", "VAR", "WWMA", "ZLEMA", "TSF"])

Var_Func(src,length)=>

valpha=2/(length+1)

vud1=src>src[1] ? src-src[1] : 0

vdd1=src<src[1] ? src[1]-src : 0

vUD=sum(vud1,9)

vDD=sum(vdd1,9)

vCMO=nz((vUD-vDD)/(vUD+vDD))

VAR=0.0

VAR:=nz(valpha*abs(vCMO)*src)+(1-valpha*abs(vCMO))*nz(VAR[1])

VAR=Var_Func(src,length)

Wwma_Func(src,length)=>

wwalpha = 1/ length

WWMA = 0.0

WWMA := wwalpha*src + (1-wwalpha)*nz(WWMA[1])

WWMA=Wwma_Func(src,length)

Zlema_Func(src,length)=>

zxLag = length/2==round(length/2) ? length/2 : (length - 1) / 2

zxEMAData = (src + (src - src[zxLag]))

ZLEMA = ema(zxEMAData, length)

ZLEMA=Zlema_Func(src,length)

Tsf_Func(src,length)=>

lrc = linreg(src, length, 0)

lrc1 = linreg(src,length,1)

lrs = (lrc-lrc1)

TSF = linreg(src, length, 0)+lrs

TSF=Tsf_Func(src,length)

getMA(src, length) =>

ma = 0.0

if mav == "SMA"

ma := sma(src, length)

ma

if mav == "EMA"

ma := ema(src, length)

ma

if mav == "WMA"

ma := wma(src, length)

ma

if mav == "TMA"

ma := sma(sma(src, ceil(length / 2)), floor(length / 2) + 1)

ma

if mav == "VAR"

ma := VAR

ma

if mav == "WWMA"

ma := WWMA

ma

if mav == "ZLEMA"

ma := ZLEMA

ma

if mav == "TSF"

ma := TSF

ma

ma

MAvg=getMA(src, length)

fark=MAvg*percent*0.01

longStop = MAvg - fark

longStopPrev = nz(longStop[1], longStop)

longStop := MAvg > longStopPrev ? max(longStop, longStopPrev) : longStop

shortStop = MAvg + fark

shortStopPrev = nz(shortStop[1], shortStop)

shortStop := MAvg < shortStopPrev ? min(shortStop, shortStopPrev) : shortStop

dir = 1

dir := nz(dir[1], dir)

dir := dir == -1 and MAvg > shortStopPrev ? 1 : dir == 1 and MAvg < longStopPrev ? -1 : dir

MT = dir==1 ? longStop: shortStop

OTT=MAvg>MT ? MT*(200+percent)/200 : MT*(200-percent)/200

plot(showsupport ? MAvg : na, color=#0585E1, linewidth=2, title="Support Line")

OTTC = highlight ? OTT[2] > OTT[3] ? color.green : color.red : #B800D9

pALL=plot(nz(OTT[2]), color=OTTC, linewidth=2, title="OTT", transp=0)

alertcondition(cross(OTT[2], OTT[3]), title="Color ALARM", message="OTT Has Changed Color!")

alertcondition(crossover(OTT[2], OTT[3]), title="GREEN ALERT", message="OTT GREEN BUY SIGNAL!")

alertcondition(crossunder(OTT[2], OTT[3]), title="RED ALERT", message="OTT RED SELL SIGNAL!")

alertcondition(cross(MAvg, OTT[2]), title="Cross Alert", message="OTT - Support Line Crossing!")

alertcondition(crossover(MAvg, OTT[2]), title="Crossover Alarm", message="Support Line BUY SIGNAL!")

alertcondition(crossunder(MAvg, OTT[2]), title="Crossunder Alarm", message="Support Line SELL SIGNAL!")

alertcondition(cross(src, OTT[2]), title="Price Cross Alert", message="OTT - Price Crossing!")

alertcondition(crossover(src, OTT[2]), title="Price Crossover Alarm", message="PRICE OVER OTT - BUY SIGNAL!")

alertcondition(crossunder(src, OTT[2]), title="Price Crossunder Alarm", message="PRICE UNDER OTT - SELL SIGNAL!")

buySignalk = crossover(MAvg, OTT[2])

plotshape(buySignalk and showsignalsk ? OTT*0.995 : na, title="Buy", text="Buy", location=location.absolute, style=shape.labelup, size=size.tiny, color=color.green, textcolor=color.white, transp=0)

sellSignallk = crossunder(MAvg, OTT[2])

plotshape(sellSignallk and showsignalsk ? OTT*1.005 : na, title="Sell", text="Sell", location=location.absolute, style=shape.labeldown, size=size.tiny, color=color.red, textcolor=color.white, transp=0)

buySignalc = crossover(src, OTT[2])

plotshape(buySignalc and showsignalsc ? OTT*0.995 : na, title="Buy", text="Buy", location=location.absolute, style=shape.labelup, size=size.tiny, color=color.green, textcolor=color.white, transp=0)

sellSignallc = crossunder(src, OTT[2])

plotshape(sellSignallc and showsignalsc ? OTT*1.005 : na, title="Sell", text="Sell", location=location.absolute, style=shape.labeldown, size=size.tiny, color=color.red, textcolor=color.white, transp=0)

mPlot = plot(ohlc4, title="", style=plot.style_circles, linewidth=0,display=display.none)

longFillColor = highlighting ? (MAvg>OTT ? color.green : na) : na

shortFillColor = highlighting ? (MAvg<OTT ? color.red : na) : na

fill(mPlot, pALL, title="UpTrend Highligter", color=longFillColor)

fill(mPlot, pALL, title="DownTrend Highligter", color=shortFillColor)

buySignalr = crossover(OTT[2], OTT[3])

plotshape(buySignalr and showsignalsr ? OTT*0.995 : na, title="Buy", text="Buy", location=location.absolute, style=shape.labelup, size=size.tiny, color=color.green, textcolor=color.white, transp=0)

sellSignallr = crossunder(OTT[2], OTT[3])

plotshape(sellSignallr and showsignalsr ? OTT*1.005 : na, title="Sell", text="Sell", location=location.absolute, style=shape.labeldown, size=size.tiny, color=color.red, textcolor=color.white, transp=0)

showscr = input(true, title="Show Screener Label")

posX_scr = input(20, title="Pos. Label x-axis")

posY_scr = input(1, title="Pos. Size Label y-axis")

colinput = input(title="Label Color", defval="Blue", options=["White", "Black", "Red", "Green", "Yellow", "Blue"])

col = color.gray

if colinput=="White"

col:=color.white

if colinput=="Black"

col:=color.black

if colinput=="Red"

col:=color.red

if colinput=="Green"

col:=color.green

if colinput=="Yellow"

col:=color.yellow

if colinput=="Blue"

col:=color.blue

dummy0 = input(true, title = "=Backtest Inputs=")

FromDay = input(defval = 1, title = "From Day", minval = 1, maxval = 31)

FromMonth = input(defval = 1, title = "From Month", minval = 1, maxval = 12)

FromYear = input(defval = 2005, title = "From Year", minval = 2005)

ToDay = input(defval = 1, title = "To Day", minval = 1, maxval = 31)

ToMonth = input(defval = 1, title = "To Month", minval = 1, maxval = 12)

ToYear = input(defval = 9999, title = "To Year", minval = 2006)

Start = timestamp(FromYear, FromMonth, FromDay, 00, 00)

Finish = timestamp(ToYear, ToMonth, ToDay, 23, 59)

Timerange() => true

if buySignalk

strategy.entry("Long", strategy.long,when=Timerange())

if sellSignallk

strategy.entry("Short", strategy.short,when=Timerange())

// t1=input('EURUSD', title='Symbol 01',type=input.symbol)

// t2=input('XAUUSD', title='Symbol 02',type=input.symbol)

// t3=input('AMZN', title='Symbol 03',type=input.symbol)

// t4=input('TSLA', title='Symbol 04',type=input.symbol)

// t5=input('BTCUSDT', title='Symbol 05',type=input.symbol)

// t6=input('ETHBTC', title='Symbol 06',type=input.symbol)

// t7=input('XBTUSD', title='Symbol 07',type=input.symbol)

// t8=input('XRPBTC', title='Symbol 08',type=input.symbol)

// t9=input('THYAO', title='Symbol 09',type=input.symbol)

// t10=input('GARAN', title='Symbol 10',type=input.symbol)

// t11=input('', title='Symbol 11',type=input.symbol)

// t12=input('', title='Symbol 12',type=input.symbol)

// t13=input('', title='Symbol 13',type=input.symbol)

// t14=input('', title='Symbol 14',type=input.symbol)

// t15=input('', title='Symbol 15',type=input.symbol)

// t16=input('', title='Symbol 16',type=input.symbol)

// t17=input('', title='Symbol 17',type=input.symbol)

// t18=input('', title='Symbol 18',type=input.symbol)

// t19=input('', title='Symbol 19',type=input.symbol)

// t20=input('', title='Symbol 20',type=input.symbol)

// OTTs(percent, length) =>

// Up=MAvg-MAvg*percent*0.01

// Dn=MAvg+MAvg*percent*0.01

// TrendUp = 0.0

// TrendUp := MAvg[1]>TrendUp[1] ? max(Up,TrendUp[1]) : Up

// TrendDown = 0.0

// TrendDown := MAvg[1]<TrendDown[1]? min(Dn,TrendDown[1]) : Dn

// Trend = 0.0

// Trend := MAvg > TrendDown[1] ? 1: MAvg< TrendUp[1]? -1: nz(Trend[1],1)

// Tsl = Trend==1? TrendUp: TrendDown

// S_Buy = Trend == 1 ? 1 : 0

// S_Sell = Trend != 1 ? 1 : 0

// [Trend, Tsl]

// [Trend, Tsl] = OTTs(percent, length)

// TrendReversal = Trend != Trend[1]

// [t01, s01] = security(t1, timeframe.period, OTTs(percent, length))

// [t02, s02] = security(t2, timeframe.period, OTTs(percent, length))

// [t03, s03] = security(t3, timeframe.period, OTTs(percent, length))

// [t04, s04] = security(t4, timeframe.period, OTTs(percent, length))

// [t05, s05] = security(t5, timeframe.period, OTTs(percent, length))

// [t06, s06] = security(t6, timeframe.period, OTTs(percent, length))

// [t07, s07] = security(t7, timeframe.period, OTTs(percent, length))

// [t08, s08] = security(t8, timeframe.period, OTTs(percent, length))

// [t09, s09] = security(t9, timeframe.period, OTTs(percent, length))

// [t010, s010] = security(t10, timeframe.period, OTTs(percent, length))

// [t011, s011] = security(t11, timeframe.period, OTTs(percent, length))

// [t012, s012] = security(t12, timeframe.period, OTTs(percent, length))

// [t013, s013] = security(t13, timeframe.period, OTTs(percent, length))

// [t014, s014] = security(t14, timeframe.period, OTTs(percent, length))

// [t015, s015] = security(t15, timeframe.period, OTTs(percent, length))

// [t016, s016] = security(t16, timeframe.period, OTTs(percent, length))

// [t017, s017] = security(t17, timeframe.period, OTTs(percent, length))

// [t018, s018] = security(t18, timeframe.period, OTTs(percent, length))

// [t019, s019] = security(t19, timeframe.period, OTTs(percent, length))

// [t020, s020] = security(t20, timeframe.period, OTTs(percent, length))

// tr01 = t01 != t01[1], up01 = t01 == 1, dn01 = t01 == -1

// tr02 = t02 != t02[1], up02 = t02 == 1, dn02 = t02 == -1

// tr03 = t03 != t03[1], up03 = t03 == 1, dn03 = t03 == -1

// tr04 = t04 != t04[1], up04 = t04 == 1, dn04 = t04 == -1

// tr05 = t05 != t05[1], up05 = t05 == 1, dn05 = t05 == -1

// tr06 = t06 != t06[1], up06 = t06 == 1, dn06 = t06 == -1

// tr07 = t07 != t07[1], up07 = t07 == 1, dn07 = t07 == -1

// tr08 = t08 != t08[1], up08 = t08 == 1, dn08 = t08 == -1

// tr09 = t09 != t09[1], up09 = t09 == 1, dn09 = t09 == -1

// tr010 = t010 != t010[1], up010 = t010 == 1, dn010 = t010 == -1

// tr011 = t011 != t011[1], up011 = t011 == 1, dn011 = t011 == -1

// tr012 = t012 != t012[1], up012 = t012 == 1, dn012 = t012 == -1

// tr013 = t013 != t013[1], up013 = t013 == 1, dn013 = t013 == -1

// tr014 = t014 != t014[1], up014 = t014 == 1, dn014 = t014 == -1

// tr015 = t015 != t015[1], up015 = t015 == 1, dn015 = t015 == -1

// tr016 = t016 != t016[1], up016 = t016 == 1, dn016 = t016 == -1

// tr017 = t017 != t017[1], up017 = t017 == 1, dn017 = t017 == -1

// tr018 = t018 != t018[1], up018 = t018 == 1, dn018 = t018 == -1

// tr019 = t019 != t019[1], up019 = t019 == 1, dn019 = t019 == -1

// tr020 = t020 != t020[1], up020 = t020 == 1, dn020 = t020 == -1

// pot_label = 'Potential Reversal: \n'

// pot_label := tr01 ? pot_label + t1 + '\n' : pot_label

// pot_label := tr02 ? pot_label + t2 + '\n' : pot_label

// pot_label := tr03 ? pot_label + t3 + '\n' : pot_label

// pot_label := tr04 ? pot_label + t4 + '\n' : pot_label

// pot_label := tr05 ? pot_label + t5 + '\n' : pot_label

// pot_label := tr06 ? pot_label + t6 + '\n' : pot_label

// pot_label := tr07 ? pot_label + t7 + '\n' : pot_label

// pot_label := tr08 ? pot_label + t8 + '\n' : pot_label

// pot_label := tr09 ? pot_label + t9 + '\n' : pot_label

// pot_label := tr010 ? pot_label + t10 + '\n' : pot_label

// pot_label := tr011 ? pot_label + t11 + '\n' : pot_label

// pot_label := tr012 ? pot_label + t12 + '\n' : pot_label

// pot_label := tr013 ? pot_label + t13 + '\n' : pot_label

// pot_label := tr014 ? pot_label + t14 + '\n' : pot_label

// pot_label := tr015 ? pot_label + t15 + '\n' : pot_label

// pot_label := tr016 ? pot_label + t16 + '\n' : pot_label

// pot_label := tr017 ? pot_label + t17 + '\n' : pot_label

// pot_label := tr018 ? pot_label + t18 + '\n' : pot_label

// pot_label := tr019 ? pot_label + t19 + '\n' : pot_label

// pot_label := tr020 ? pot_label + t20 + '\n' : pot_label

// scr_label = 'Confirmed Reversal: \n'

// scr_label := tr01[1] ? scr_label + t1 + '\n' : scr_label

// scr_label := tr02[1] ? scr_label + t2 + '\n' : scr_label

// scr_label := tr03[1] ? scr_label + t3 + '\n' : scr_label

// scr_label := tr04[1] ? scr_label + t4 + '\n' : scr_label

// scr_label := tr05[1] ? scr_label + t5 + '\n' : scr_label

// scr_label := tr06[1] ? scr_label + t6 + '\n' : scr_label

// scr_label := tr07[1] ? scr_label + t7 + '\n' : scr_label

// scr_label := tr08[1] ? scr_label + t8 + '\n' : scr_label

// scr_label := tr09[1] ? scr_label + t9 + '\n' : scr_label

// scr_label := tr010[1] ? scr_label + t10 + '\n' : scr_label

// scr_label := tr011[1] ? scr_label + t11 + '\n' : scr_label

// scr_label := tr012[1] ? scr_label + t12 + '\n' : scr_label

// scr_label := tr013[1] ? scr_label + t13 + '\n' : scr_label

// scr_label := tr014[1] ? scr_label + t14 + '\n' : scr_label

// scr_label := tr015[1] ? scr_label + t15 + '\n' : scr_label

// scr_label := tr016[1] ? scr_label + t16 + '\n' : scr_label

// scr_label := tr017[1] ? scr_label + t17 + '\n' : scr_label

// scr_label := tr018[1] ? scr_label + t18 + '\n' : scr_label

// scr_label := tr019[1] ? scr_label + t19 + '\n' : scr_label

// scr_label := tr020[1] ? scr_label + t20 + '\n' : scr_label

// up_label = 'Uptrend: \n'

// up_label := up01[1] ? up_label + t1 + '\n' : up_label

// up_label := up02[1] ? up_label + t2 + '\n' : up_label

// up_label := up03[1] ? up_label + t3 + '\n' : up_label

// up_label := up04[1] ? up_label + t4 + '\n' : up_label

// up_label := up05[1] ? up_label + t5 + '\n' : up_label

// up_label := up06[1] ? up_label + t6 + '\n' : up_label

// up_label := up07[1] ? up_label + t7 + '\n' : up_label

// up_label := up08[1] ? up_label + t8 + '\n' : up_label

// up_label := up09[1] ? up_label + t9 + '\n' : up_label

// up_label := up010[1] ? up_label + t10 + '\n' : up_label

// up_label := up011[1] ? up_label + t11 + '\n' : up_label

// up_label := up012[1] ? up_label + t12 + '\n' : up_label

// up_label := up013[1] ? up_label + t13 + '\n' : up_label

// up_label := up014[1] ? up_label + t14 + '\n' : up_label

// up_label := up015[1] ? up_label + t15 + '\n' : up_label

// up_label := up016[1] ? up_label + t16 + '\n' : up_label

// up_label := up017[1] ? up_label + t17 + '\n' : up_label

// up_label := up018[1] ? up_label + t18 + '\n' : up_label

// up_label := up019[1] ? up_label + t19 + '\n' : up_label

// up_label := up020[1] ? up_label + t20 + '\n' : up_label

// dn_label = 'Downtrend: \n'

// dn_label := dn01[1] ? dn_label + t1 + '\n' : dn_label

// dn_label := dn02[1] ? dn_label + t2 + '\n' : dn_label

// dn_label := dn03[1] ? dn_label + t3 + '\n' : dn_label

// dn_label := dn04[1] ? dn_label + t4 + '\n' : dn_label

// dn_label := dn05[1] ? dn_label + t5 + '\n' : dn_label

// dn_label := dn06[1] ? dn_label + t6 + '\n' : dn_label

// dn_label := dn07[1] ? dn_label + t7 + '\n' : dn_label

// dn_label := dn08[1] ? dn_label + t8 + '\n' : dn_label

// dn_label := dn09[1] ? dn_label + t9 + '\n' : dn_label

// dn_label := dn010[1] ? dn_label + t10 + '\n' : dn_label

// dn_label := dn011[1] ? dn_label + t11 + '\n' : dn_label

// dn_label := dn012[1] ? dn_label + t12 + '\n' : dn_label

// dn_label := dn013[1] ? dn_label + t13 + '\n' : dn_label

// dn_label := dn014[1] ? dn_label + t14 + '\n' : dn_label

// dn_label := dn015[1] ? dn_label + t15 + '\n' : dn_label

// dn_label := dn016[1] ? dn_label + t16 + '\n' : dn_label

// dn_label := dn017[1] ? dn_label + t17 + '\n' : dn_label

// dn_label := dn018[1] ? dn_label + t18 + '\n' : dn_label

// dn_label := dn019[1] ? dn_label + t19 + '\n' : dn_label

// dn_label := dn020[1] ? dn_label + t20 + '\n' : dn_label

// f_colorscr (_valscr ) =>

// _valscr ? #00000000 : na

// f_printscr (_txtscr ) =>

// var _lblscr = label(na),

// label.delete(_lblscr ),

// _lblscr := label.new(

// time + (time-time[1])*posX_scr ,

// ohlc4[posY_scr],

// _txtscr ,

// xloc.bar_time,

// yloc.price,

// f_colorscr ( showscr ),

// textcolor = showscr ? col : na,

// size = size.normal,

// style=label.style_label_center

// )

// f_printscr ( scr_label + '\n' + pot_label +'\n' + up_label + '\n' + dn_label)