Bidirektionale ADX-Handelsstrategie

Überblick

Eine Zwei-Wege-ADX-Handelsstrategie ist eine quantitative Strategie, bei der die ADX-Indikatoren für den Zwei-Wege-Handel genutzt werden. Die Strategie berechnet die Differenz zwischen dem ADX-Indikator und den DIPlus- und DIMinus-Indikatoren, um zu beurteilen, ob ein Handelssignal erzeugt wird, um mehrere Leerköpfe zu handeln und Gewinne zu erzielen.

Strategieprinzip

- Berechnung der realen Bandbreite

- Berechnen Sie mehrere Richtungsbewegungen (Directional Movement Plus) und eine Leerlaufbewegung (Directional Movement Minus).

- Berechnung der Smoothed True Range

- Berechnung der glatten Mehrkopfbewegung ((Smoothed Directional Movement Plus) und der glatten Leerkopfbewegung ((Smoothed Directional Movement Minus)

- Berechnung der DIPlus-, DIMinus- und ADX-Indikatoren

- Berechnung der Differenz zwischen DIPlus und ADX, DIMinus und ADX

- Setzen Sie die Differenz zwischen mehrköpfigen und leeren Transaktionen

- Die Differenz ist größer als der Wertminderung, so dass ein Handelssignal erzeugt wird

- Entstehung von Kauf- und Verkaufsauftrag

Der Kern der Strategie besteht darin, die Richtung und Stärke des Trends anhand von dynamischen Indexindikatoren wie dem ADX zu bestimmen und in Kombination mit der Differenzwert-Bestimmungsregel die Schwellenwerte zu setzen, um automatisch zu handeln.

Analyse der Stärken

- Mit ADX können Sie Trends genau erfassen

- Die Differenz-Ermittlungs-Gesetze können falsche Signale wirksam filtern.

- Zwei-Wege-Trading, um mehrköpfige und leere Gelegenheiten zu nutzen

- Vollständig automatisierte Transaktionen ohne menschliche Intervention

- Die Strategie ist klar, leicht zu verstehen und zu ändern

Risikoanalyse

- Der ADX-Indikator ist zurückgeblieben und könnte einen Trendwendepunkt verpassen

- Zwei-Wege-Transaktionsrisiken erhöhen sich, Verluste können sich ausweiten

- Die falsche Einstellung der Parameter kann zu übermäßigen Transaktionen führen

- Die Rückmeldung ist nicht repräsentativ für den realen Markt, und die Risiken für den echten Markt bleiben bestehen.

Die Lösung:

- In Kombination mit anderen Indikatoren bestätigte Handelssignale

- Optimierung der Parameter und Kontrolle der Häufigkeit der Transaktionen

- Strenge Position Sizing für die Verwaltung von Positionen

Optimierungsrichtung

- Optimierung der ADX-Parameter und Verbesserung ihrer Sensitivität

- Hinzufügen von anderen Kennzahlen

- Optimierungsparameter für die Anwendung von Machine Learning-Algorithmen

- Verlustrisiken mit Hilfe von Advanced Stop Loss Strategies

- Kombination von Modellvorhersagen und besseren Handelssignalen

Zusammenfassen

Eine binäre ADX-Handelsstrategie ist insgesamt eine sehr praktische, quantitative Strategie. Sie nutzt die ADX-Indikatoren, um Trends zu beurteilen, um Handelschancen zu erfassen. Gleichzeitig wird die Differenzbeurteilung angewendet, um die Signalwirksamkeit zu gewährleisten. Die Strategie ist logisch klar und einfach zu modifizieren.

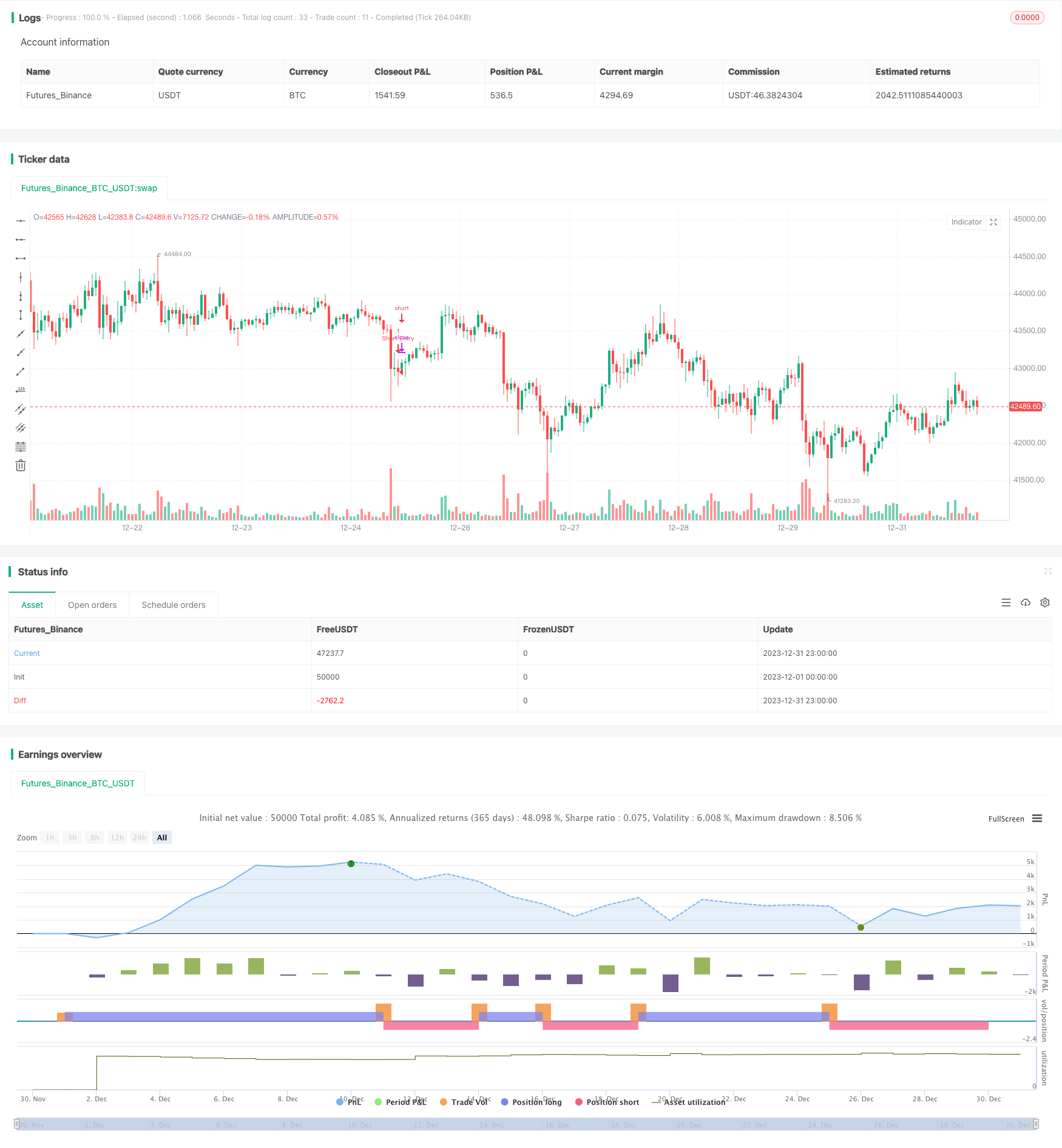

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © MAURYA_ALGO_TRADER

//@version=5

strategy("Monthly Performance", overlay=true)

len = input(14)

th = input(20)

TrueRange = math.max(math.max(high - low, math.abs(high - nz(close[1]))), math.abs(low - nz(close[1])))

DirectionalMovementPlus = high - nz(high[1]) > nz(low[1]) - low ? math.max(high - nz(high[1]), 0) : 0

DirectionalMovementMinus = nz(low[1]) - low > high - nz(high[1]) ? math.max(nz(low[1]) - low, 0) : 0

SmoothedTrueRange = 0.0

SmoothedTrueRange := nz(SmoothedTrueRange[1]) - nz(SmoothedTrueRange[1]) / len + TrueRange

SmoothedDirectionalMovementPlus = 0.0

SmoothedDirectionalMovementPlus := nz(SmoothedDirectionalMovementPlus[1]) - nz(SmoothedDirectionalMovementPlus[1]) / len + DirectionalMovementPlus

SmoothedDirectionalMovementMinus = 0.0

SmoothedDirectionalMovementMinus := nz(SmoothedDirectionalMovementMinus[1]) - nz(SmoothedDirectionalMovementMinus[1]) / len + DirectionalMovementMinus

DIPlus = SmoothedDirectionalMovementPlus / SmoothedTrueRange * 100

DIMinus = SmoothedDirectionalMovementMinus / SmoothedTrueRange * 100

DX = math.abs(DIPlus - DIMinus) / (DIPlus + DIMinus) * 100

ADX = ta.sma(DX, len)

// plot(DIPlus, color=color.new(color.green, 0), title='DI+')

// plot(DIMinus, color=color.new(color.red, 0), title='DI-')

// plot(ADX, color=color.new(color.white, 0), title='ADX')

// hline(th, color=color.black)

//diff_1 = math.abs(DIPlus - DIMinus)

diff_2 = math.abs(DIPlus-ADX)

diff_3 = math.abs(DIMinus - ADX)

long_diff = input(10, "Long Difference")

short_diff = input(10, "Short Difference")

buy_condition = diff_2 >=long_diff and diff_3 >=long_diff and (ADX < DIPlus and ADX > DIMinus)

sell_condition = diff_2 >=short_diff and diff_3 >=short_diff and (ADX > DIPlus and ADX < DIMinus)

if buy_condition

strategy.entry("Long Entry", strategy.long, comment = "Long")

if sell_condition

strategy.entry("Short Entry", strategy.short, comment = "Short")

// Copy below code to end of the desired strategy script

///////////////////////////////////////////////////////////////////////////////////////////////////////////////////////

// monthly pnl performance by Dr. Maurya @MAURYA_ALGO_TRADER //

///////////////////////////////////////////////////////////////////////////////////////////////////////////////////////

show_performance = input.bool(true, 'Show Monthly Monthly Performance ?', group='Monthly Performance')

dash_loc_mp = input("Bottom Right","Location" ,options=["Top Right","Bottom Right","Top Left","Bottom Left", "Middle Right","Bottom Center"] ,group='Monthly Performance', inline = "performance")

text_size_mp = input('Small',"Size" ,options=["Tiny","Small","Normal","Large"] ,group='Monthly Performance', inline = "performance")

bg_c = input.color( color.rgb(7, 226, 242, 38), "Background Color", group='Monthly Performance')

text_head_color = input.color( color.rgb(0,0,0), "Month/Year Heading Color", group='Monthly Performance')

tab_month_c = input.color( color.white, "Month PnL Data Color", group='Monthly Performance')

tab_year_c = input.color( color.rgb(0,0,0), "Year PnL Data Color", group='Monthly Performance')

border_c = input.color( color.white, "Table Border Color", group='Monthly Performance')

var table_position_mp = dash_loc_mp == 'Top Left' ? position.top_left :

dash_loc_mp == 'Bottom Left' ? position.bottom_left :

dash_loc_mp == 'Middle Right' ? position.middle_right :

dash_loc_mp == 'Bottom Center' ? position.bottom_center :

dash_loc_mp == 'Top Right' ? position.top_right : position.bottom_right

var table_text_size_mp = text_size_mp == 'Tiny' ? size.tiny :

text_size_mp == 'Small' ? size.small :

text_size_mp == 'Normal' ? size.normal : size.large

/////////////////

strategy.initial_capital = 50000

/////////////////////////////////////////////

// var bool new_month = na

new_month = ta.change(month) //> 0 ? true : false

newest_month = new_month and strategy.closedtrades >= 1

// profit

only_profit = strategy.netprofit

initial_balance = strategy.initial_capital

// month number

var int month_number = na

month_number := (ta.valuewhen(newest_month, month(time), 0)) //and month(time) > 1 ? (ta.valuewhen(newest_month, month(time), 0) - 1) : 12 //1 to 12

//month_year

var int month_time = na

month_time := ta.valuewhen(newest_month, time, 0) - 2419200000

var int m_counter = 0

if newest_month

m_counter += 1

// current month values

var bool new_year = na

new_year := ta.change(year)

curr_m_pnl = only_profit - nz(ta.valuewhen(newest_month, only_profit, 0), 0)

curr_m_number = newest_month ? ta.valuewhen(newest_month, month(time), 0) : month(time)

curr_y_pnl = (only_profit - nz(ta.valuewhen(new_year, only_profit, 0),0))

var float [] net_profit_array = array.new_float()

var int [] month_array = array.new_int()

var int [] month_time_array = array.new_int()

if newest_month

array.push(net_profit_array, only_profit)

array.push(month_array, month_number)

array.push(month_time_array, month_time)

var float [] y_pnl_array = array.new_float()

var int [] y_number_array = array.new_int()

var int [] y_time_array = array.new_int()

newest_year = ta.change(year) and strategy.closedtrades >= 1

get_yearly_pnl = nz(ta.valuewhen(newest_year, strategy.netprofit, 0) - nz(ta.valuewhen(newest_year, strategy.netprofit, 1), 0), 0)

get_m_year = ta.valuewhen(newest_year, year(time), 1)

get_y_time = ta.valuewhen(newest_year, time, 0)

if newest_year

array.push(y_pnl_array, get_yearly_pnl)

array.push(y_number_array, get_m_year)

array.push(y_time_array, get_y_time)

var float monthly_profit = na

var int column_month_number = na

var int row_month_time = na

var testTable = table.new(position = table_position_mp, columns = 14, rows = 40, bgcolor = bg_c, border_color = border_c, border_width = 1)

if barstate.islastconfirmedhistory and show_performance

table.cell(table_id = testTable, column = 0, row = 0, text = "YEAR", text_color = text_head_color, text_size=table_text_size_mp)

table.cell(table_id = testTable, column = 1, row = 0, text = "JAN", text_color = text_head_color, text_size=table_text_size_mp)

table.cell(table_id = testTable, column = 2, row = 0, text = "FEB", text_color = text_head_color, text_size=table_text_size_mp)

table.cell(table_id = testTable, column = 3, row = 0, text = "MAR", text_color = text_head_color, text_size=table_text_size_mp)

table.cell(table_id = testTable, column = 4, row = 0, text = "APR", text_color = text_head_color, text_size=table_text_size_mp)

table.cell(table_id = testTable, column = 5, row = 0, text = "MAY", text_color = text_head_color, text_size=table_text_size_mp)

table.cell(table_id = testTable, column = 6, row = 0, text = "JUN", text_color = text_head_color, text_size=table_text_size_mp)

table.cell(table_id = testTable, column = 7, row = 0, text = "JUL", text_color = text_head_color, text_size=table_text_size_mp)

table.cell(table_id = testTable, column = 8, row = 0, text = "AUG", text_color = text_head_color, text_size=table_text_size_mp)

table.cell(table_id = testTable, column = 9, row = 0, text = "SEP", text_color = text_head_color, text_size=table_text_size_mp)

table.cell(table_id = testTable, column = 10, row = 0, text = "OCT", text_color = text_head_color, text_size=table_text_size_mp)

table.cell(table_id = testTable, column = 11, row = 0, text = "NOV", text_color = text_head_color, text_size=table_text_size_mp)

table.cell(table_id = testTable, column = 12, row = 0, text = "DEC", text_color =text_head_color, text_size=table_text_size_mp)

table.cell(table_id = testTable, column = 13, row = 0, text = "YEAR P/L", text_color = text_head_color, text_size=table_text_size_mp)

for i = 0 to (array.size(y_number_array) == 0 ? na : array.size(y_number_array) - 1)

row_y = year(array.get(y_time_array, i)) - year(array.get(y_time_array, 0)) + 1

table.cell(table_id = testTable, column = 13, row = row_y, text = str.tostring(array.get(y_pnl_array , i), "##.##") + '\n' + '(' + str.tostring(array.get(y_pnl_array , i)*100/initial_balance, "##.##") + ' %)', bgcolor = array.get(y_pnl_array , i) > 0 ? color.green : array.get(y_pnl_array , i) < 0 ? color.red : color.gray, text_color = tab_year_c, text_size=table_text_size_mp)

curr_row_y = array.size(month_time_array) == 0 ? 1 : (year(array.get(month_time_array, array.size(month_time_array) - 1))) - (year(array.get(month_time_array, 0))) + 1

table.cell(table_id = testTable, column = 13, row = curr_row_y, text = str.tostring(curr_y_pnl, "##.##") + '\n' + '(' + str.tostring(curr_y_pnl*100/initial_balance, "##.##") + ' %)', bgcolor = curr_y_pnl > 0 ? color.green : curr_y_pnl < 0 ? color.red : color.gray, text_color = tab_year_c, text_size=table_text_size_mp)

for i = 0 to (array.size(net_profit_array) == 0 ? na : array.size(net_profit_array) - 1)

monthly_profit := i > 0 ? ( array.get(net_profit_array, i) - array.get(net_profit_array, i - 1) ) : array.get(net_profit_array, i)

column_month_number := month(array.get(month_time_array, i))

row_month_time :=((year(array.get(month_time_array, i))) - year(array.get(month_time_array, 0)) ) + 1

table.cell(table_id = testTable, column = column_month_number, row = row_month_time, text = str.tostring(monthly_profit, "##.##") + '\n' + '(' + str.tostring(monthly_profit*100/initial_balance, "##.##") + ' %)', bgcolor = monthly_profit > 0 ? color.green : monthly_profit < 0 ? color.red : color.gray, text_color = tab_month_c, text_size=table_text_size_mp)

table.cell(table_id = testTable, column = 0, row =row_month_time, text = str.tostring(year(array.get(month_time_array, i)), "##.##"), text_color = text_head_color, text_size=table_text_size_mp)

curr_row_m = array.size(month_time_array) == 0 ? 1 : (year(array.get(month_time_array, array.size(month_time_array) - 1))) - (year(array.get(month_time_array, 0))) + 1

table.cell(table_id = testTable, column = curr_m_number, row = curr_row_m, text = str.tostring(curr_m_pnl, "##.##") + '\n' + '(' + str.tostring(curr_m_pnl*100/initial_balance, "##.##") + ' %)', bgcolor = curr_m_pnl > 0 ? color.green : curr_m_pnl < 0 ? color.red : color.gray, text_color = tab_month_c, text_size=table_text_size_mp)

table.cell(table_id = testTable, column = 0, row =curr_row_m, text = str.tostring(year(time), "##.##"), text_color = text_head_color, text_size=table_text_size_mp)

//============================================================================================================================================================================