概述

本策略利用RSI指标识别股票超买超卖的市场状态,在超买区形成死叉做空,在超卖区形成金叉做多,属于基于指标的反转交易策略。该策略结合趋势跟踪止损、固定止盈止损,可以有效控制交易风险。

策略原理

该策略的交易信号是基于RSI指标的金叉死叉产生的。RSI指标一般以30作为超卖线,70作为超买线。当RSI指标上穿超卖线时,产生买入信号;当RSI指标下穿超买线时,产生卖出信号。根据这个原理,策略判断超买超卖区域的形成,并相应的产生做多做空信号。

在进场后,策略采用百分比追踪止损方式,通过持续刷新最高价或最低价,并离开一定百分比作为止损位。同时也采用了固定的止盈止损距离,当达到目标利润或最大亏损时止损。这种组合可以很好地控制交易风险。

优势分析

该策略具有以下优势:

利用RSI指标判断超买超卖区域,这是比较成熟的交易技巧,可以较准确地捕捉到市场反转点。

采用金叉死叉方式,可以过滤掉部分噪音交易信号,使交易更加可靠。

结合趋势跟踪止损,可以最大限度锁定盈利,同时也可以快速止损,降低单笔损失。

固定止盈止损距离,也可以有效控制单笔交易风险。

整体来说,该策略规则清晰,易于理解和实现,适合量化交易初学者学习。

风险分析

该策略也存在以下风险:

RSI指标容易产生错误信号,技术形态破裂的概率较大,可能导致止损被触发。

固定止盈止损距离,不能根据市场波动程度做调整,可能会过早止盈或扩大止损。

百分比跟踪止损只跟踪价格最高点或最低点,可能会过于激进,使盈利不足。

回测数据拟合风险。该策略的参数可能是针对历史数据进行优化的,在实际应用中表现可能会逊色。

交易频率可能过高,增加交易费用和滑点风险。

优化方向

该策略可以从以下几个方向进行优化:

优化RSI参数,寻找最佳指标参数组合,提高信号质量。

增加其他指标过滤,形成多指标共振,提高信号准确率。

采用自适应止盈止损机制,根据市场波动自动调整止损止盈位。

增加交易频率控制模块,降低交易次数,减少交易费用。

增加资金管理模块,控制单笔交易规模,降低单笔损失。

在更长时间周期内进行回测,检验参数稳定性。

总结

本策略整体是一个典型的反转交易策略,利用RSI指标判定超买超卖区域,采取金叉死叉方式产生交易信号。并使用趋势跟踪止损和固定止盈止损来控制风险。该策略逻辑清晰,容易实现,适合量化交易初学者学习和实践。但也存在一定的假信号风险和参数优化风险,需要继续对策略进行验证和优化,才能实际投入使用。

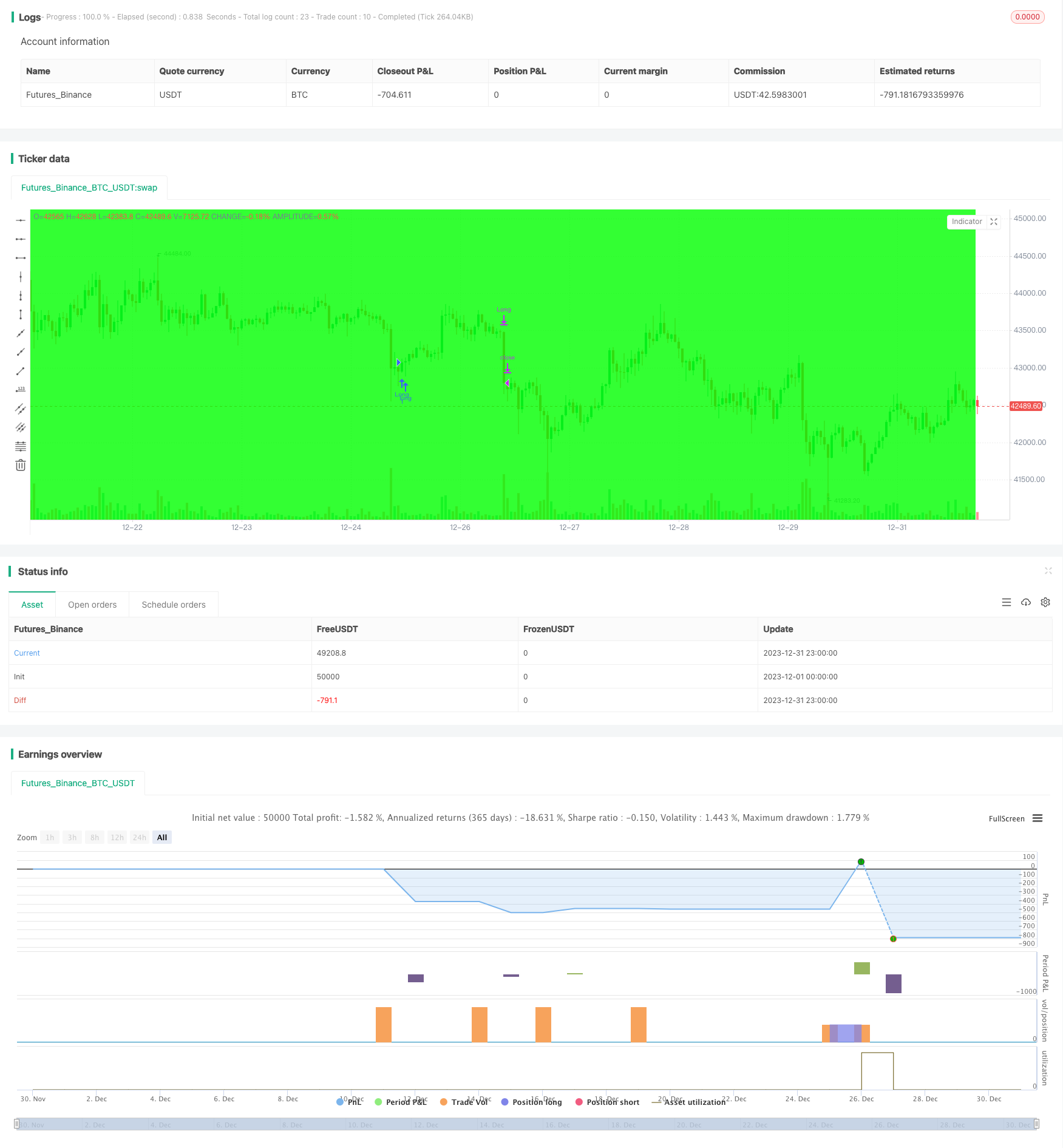

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// LOVE JOY PEACE PATIENCE KINDNESS GOODNESS FAITHFULNESS GENTLENESS SELF-CONTROL

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// Author: © JoshuaMcGowan

// Taken from https://www.tradingview.com/script/GbZGYi6l-Adding-some-essential-components-to-a-prebuilt-RSI-strategy/

// Just updated to compile in version 4.

//@version=4

strategy("Adding some essential components to a prebuilt RSI strategy", overlay=true)

/////////////// Component Code Start ///////////////

testStartYear = input(2011, "Backtest Start Year")

testStartMonth = input(8, "Backtest Start Month")

testStartDay = input(1, "Backtest Start Day")

testPeriodStart = timestamp(testStartYear,testStartMonth,testStartDay,0,0)

testStopYear = input(2100, "Backtest Stop Year")

testStopMonth = input(9, "Backtest Stop Month")

testStopDay = input(29, "Backtest Stop Day")

// testStopDay = testStartDay + 1

testPeriodStop = timestamp(testStopYear,testStopMonth,testStopDay,0,0)

// A switch to control background coloring of the test period

testPeriodBackground = input(title="Color Background?", type=input.bool, defval=true)

testPeriodBackgroundColor = testPeriodBackground and (time >= testPeriodStart) and (time <= testPeriodStop) ? #00FF00 : na

bgcolor(testPeriodBackgroundColor, transp=97)

testPeriod() => true

/////////////// Component Code Stop ///////////////

// Replace RSI Component, Long/Short, and Long Signal/Short Signal conditions with your trade setup components.

///////////// RSI component /////////////

length = input( 14 )

overSold = input( 30 )

overBought = input( 70 )

price = close

vrsi = rsi(price, length)

notna = not na(vrsi)

/////////////// STRATEGY ///////////////

ts = input(99999, "Trailing Stop") / 100

tp = input(99999, "Take Profit") / 100

sl = input(99999, "Stop Loss") / 100

// Update this with your setup.

long = notna and crossover(vrsi, overSold)

short = notna and crossunder(vrsi, overBought)

last_long = 0

last_short = 0

last_long := long ? time : nz(last_long[1])

last_short := short ? time : nz(last_short[1])

// Update this to reflect your setup.

long_signal = crossover(last_long, last_short)

short_signal = crossover(last_short, last_long)

float last_open_long_signal = 0

float last_open_short_signal = 0

last_open_long_signal := long_signal ? open : nz(last_open_long_signal[1])

last_open_short_signal := short_signal ? open : nz(last_open_short_signal[1])

last_long_signal = 0

last_short_signal = 0

last_long_signal := long_signal ? time : nz(last_long_signal[1])

last_short_signal := short_signal ? time : nz(last_short_signal[1])

in_long_signal = last_long_signal > last_short_signal

in_short_signal = last_short_signal > last_long_signal

float last_high = 0

float last_low = 0

last_high := not in_long_signal ? na : in_long_signal and (na(last_high[1]) or high > nz(last_high[1])) ? high : nz(last_high[1])

last_low := not in_short_signal ? na : in_short_signal and (na(last_low[1]) or low < nz(last_low[1])) ? low : nz(last_low[1])

long_ts = not na(last_high) and high <= (last_high - ts) //and high >= last_open_long_signal

short_ts = not na(last_low) and low >= (last_low + ts) //and low <= last_open_short_signal

long_tp = high >= (last_open_long_signal + tp)

short_tp = low <= (last_open_short_signal - tp)

long_sl = low <= (last_open_long_signal - sl)

short_sl = high >= (last_open_short_signal + sl)

leverage = input(200, "Leverage")

long_call = last_open_long_signal - (0.8 + 0.2 * (1/leverage)) / leverage * last_open_long_signal

short_call = last_open_short_signal + (0.78 + 0.2 * (1/leverage)) / leverage * last_open_short_signal

long_call_signal = low <= long_call

short_call_signal = high >= short_call

if testPeriod()

strategy.entry("Long", strategy.long, when=long_signal)

strategy.entry("Short", strategy.short, when=short_signal)

// plot(long_call, color=color.red)

// plot(short_call, color=color.green)

strategy.close("Long", when=long_call_signal)

strategy.close("Short", when=short_call_signal)

strategy.close("Long", when=long_tp)

strategy.close("Short", when=short_tp)

strategy.close("Long", when=long_sl)

strategy.close("Short", when=short_sl)

strategy.close("Long", when=long_ts)

strategy.close("Short", when=short_ts)